Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

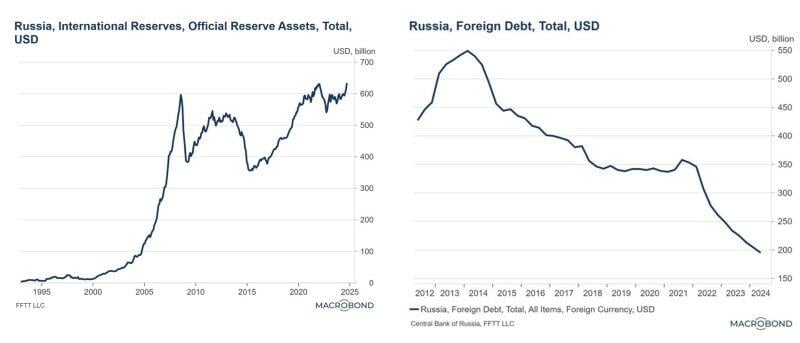

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

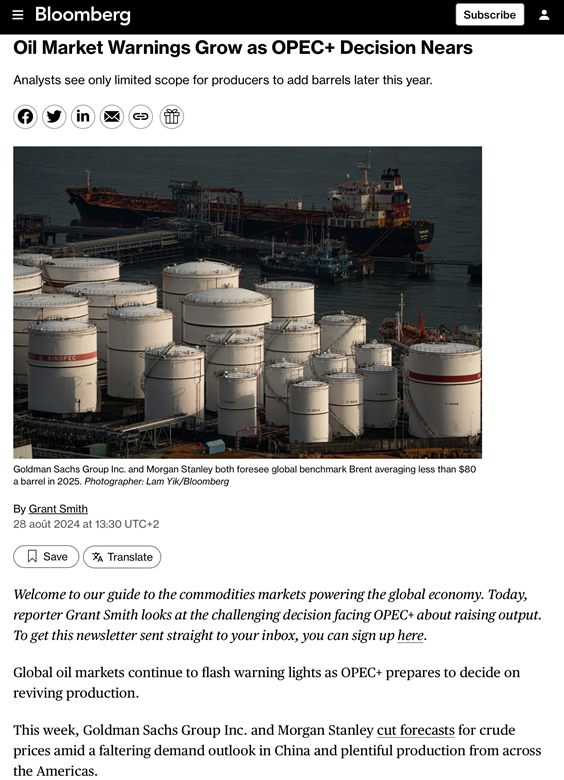

Washington Post: Israeli Prime Minister Benjamin Netanyahu has told the Biden administration he is willing to strike military rather than oil or nuclear facilities in Iran.

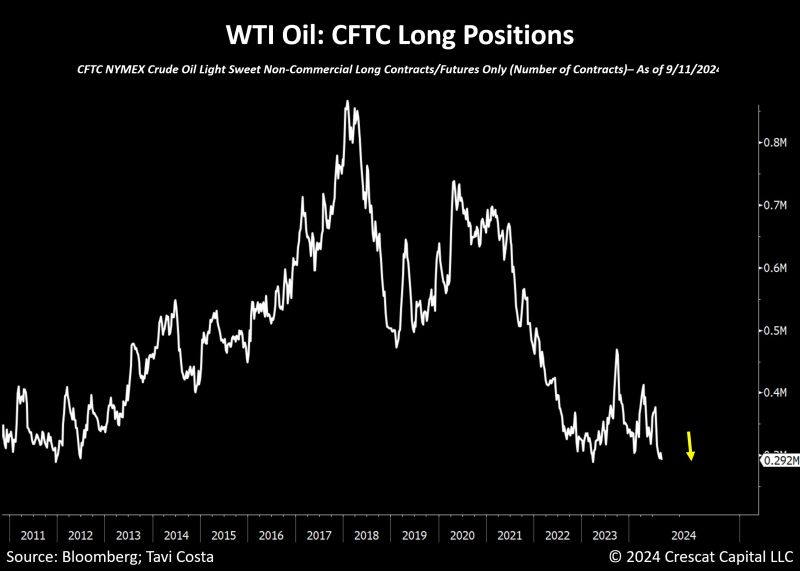

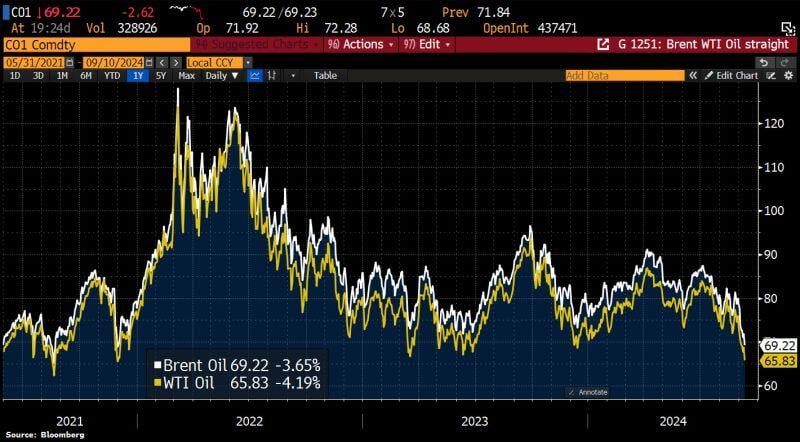

Oil gaps down on the new 👇 Source: Markets & Mayhem

BREAKING: Oil prices surge back above $70/barrel as investors begin pricing-in potential supply disruptions in the Middle East.

We now have a port strike, rising oil prices, aggressive Fed rate cuts and a china monetary + fiscal package. Could this combination trigger a second wave of inflation?

Investing with intelligence

Our latest research, commentary and market outlooks