Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

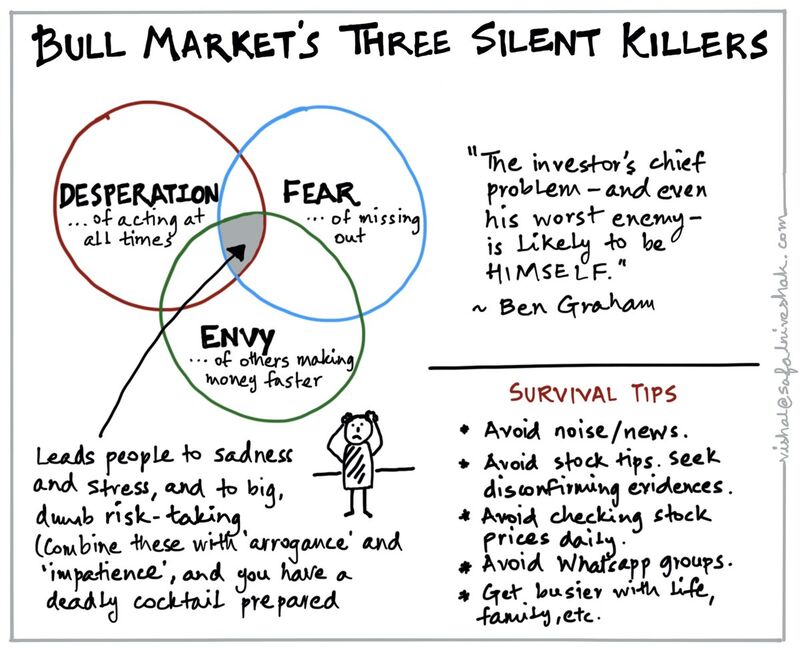

Three silent killers of bull markets.

"The investor's chief problem - and even his worst enemy - is likely to be HIMSELF" - Ben Graham Nice visual by @safalniveshak

Anthropic has raised $30bn from investors including GIC, Coatue, Founders Fund and Nvidia

reaching a $350bn pre-money valuation ahead of a potential IPO. Founded in 2021 by former OpenAI researchers, the company focuses on enterprise AI tools. About 80% of its $14bn revenue run rate comes from business clients. Its Claude Code product has gained strong adoption, with over 500 customers spending more than $1mn annually. Source: Financial Times

J.P. Morgan in 1912: "Gold is money. Everything else is credit."

Source: Barchart

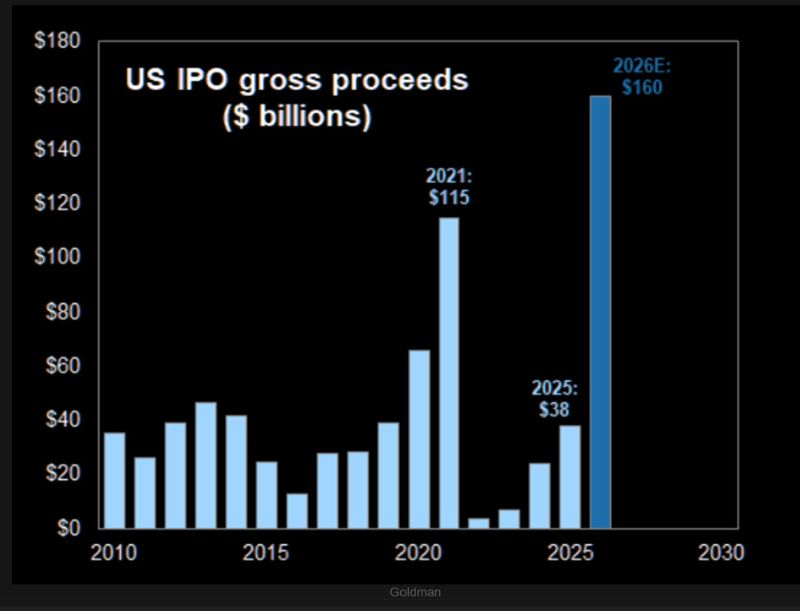

GS: "We forecast 120 IPOs this year and $160 billion in gross IPO proceeds in 2026".

Source: TME

The Swissfranc is holding its breakout to new all-time highs

Source: Sam Gatlin @sam_gatlin J-C Parets

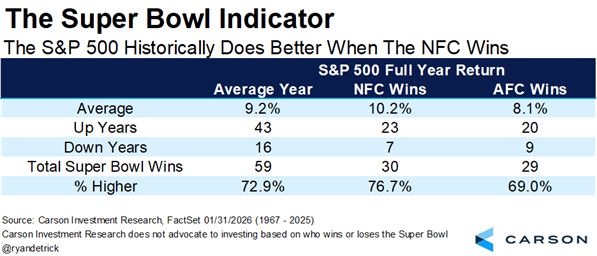

According to the Super Bowl Indicator

it should be noted, has no economic foundation—the Seahawks' win last night suggests that 2026 will be a bullish year for the markets Source: Sam Gatlin Source: Carson

US companies announced the largest number of job cuts for any January since the depths of the Great Recession in 2009

according to data from outplacement firm Challenger, Gray & Christmas Inc Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks