Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

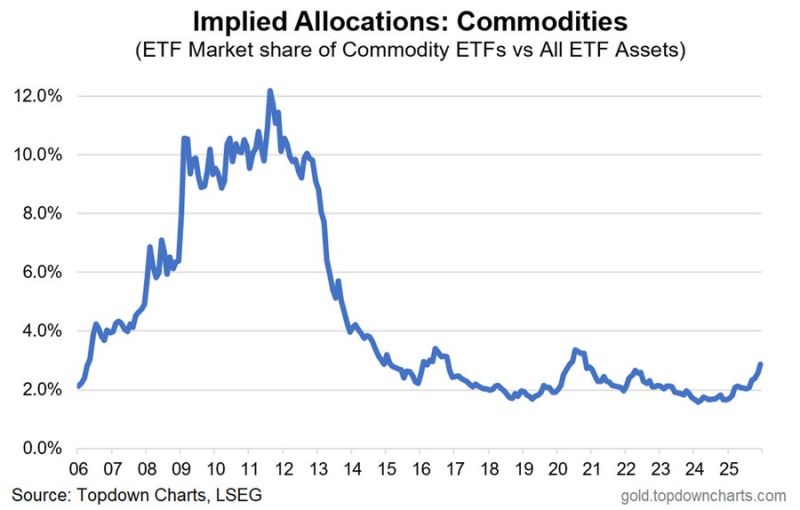

The commodity supercycle is back

The Sovereignty Trap: By offshoring industry to China for higher margins, the West traded its independence for cheap labor; China now controls the minerals essential for Defense, EVs, and tech. Resource vs. Currency: The ability to print money is irrelevant if China refuses to sell the raw materials required for survival and industry. The Great Rebuild: To regain independence, Western nations are aggressively reshoring industry, stockpiling minerals, and rebuilding infrastructure. The Irony of Tech: Building the "New Economy" (Silicon Valley, AI, Green Tech) is impossible without massive amounts of "Old Economy" materials like copper, lithium, and steel. Source: Topdown charts, LSEG, Lukas Ekwueme @ekwufinance

Powell has the highest approval rating of any “political leader” in the country.

Source: Joe Weisenthal @TheStalwart Gallup

📢 No Supreme court ruling on tariffs today.

The Supreme Court just kept the world guessing. 🏛️📉 Wall Street was holding its breath for a Friday ruling on the Trump administration’s broad tariffs. Instead? Silence. The Court released one unrelated opinion and adjourned, leaving the legality of billions in trade duties—and the fate of the U.S. fiscal deficit—hanging in the balance. Here is why this is the biggest "wait and see" in the market right now: ⚡ The $200 Billion Stakes At the heart of the case is the IEEPA (International Emergency Economic Powers Act). The Court has to decide: Legality: Can the President use emergency powers to bypass Congress and levy global tariffs? The Refund Bomb: If the tariffs are ruled illegal, will the U.S. have to pay back $150B–$200B to importers who already paid up? ⚖️ The "Mishmash" Theory Treasury Secretary Scott Bessent expects a "mishmash" ruling. The Court could grant limited powers or require only partial repayments. It’s rarely all-or-nothing at this level of government. 🔄 The "Workaround" Reality Even if the White House loses, don't expect a free-trade party. The "Plan B": The administration is already eyeing the 1962 Trade Act to keep tariffs at similar levels. The Impact: Analysts at Morgan Stanley see "significant room for nuance." The White House may pivot to a "lighter-touch" approach focused on affordability, but the tariffs aren't likely to vanish. 📉 The Economic Twist Despite the controversy, the data is defying the doomsayers: Inflation: Has remained surprisingly limited. Trade Deficit: October hit its lowest level since 2009. The Bottom Line: If the court blocks the tariffs, it’s a win for corporate earnings and input costs, but a massive headache for the national deficit and "onshoring" ambitions. Prediction markets only give a 28% chance that the tariffs are upheld exactly as they are.

Is it an "invasion" if the US captures a world leader, but doesn't stay to occupy the land? 🌎

On Polymarket, $10.5M is currently hanging on the definition of a single word. The drama unfolding right now in the prediction markets is a masterclass in Risk, Regulation, and the "Information Edge." 🧵 Here’s what’s happening: 1. The "Maduro Capture" Controversy US Special Forces extracted Nicolás Maduro from Caracas. Polymarket bettors who bet "YES" on an invasion thought they had hit the jackpot. But Polymarket says: Not so fast. The platform is refusing to settle the "Invasion" contract, arguing that a military raid isn't an "offensive to establish control over territory." 2. The $400k "Mystery Trader" While the crowd fights over definitions, one anonymous account is laughing all the way to the bank. Account created: Dec 26. Bets placed: Days before the raid. Outcome: Turned $32k into $400,000 by betting on Maduro’s removal when the market gave it only a 7% chance. Coincidence? Or the ultimate "information edge"? 🕵️♂️ 3. The Trust Gap in DeFi This highlights the massive hurdle for prediction markets. When the "Source of Truth" is subjective, the house becomes the judge, jury, and executioner. As one user (Skinner) put it: "Words are being redefined at will." The Big Takeaway: Prediction markets are the future of price discovery, but they are currently the "Wild West." Without clear definitions and insider trading protections, "betting on the news" is a dangerous game. Congress is already moving to ban insider trading on these platforms. The days of the "Mystery Trader" might be numbered. Source: FT

$1.5 TRILLION. 🚀 Donald Trump calls for 50% increase in US defence spending by 2027

Here is the breakdown of what this means for the US, the economy, and the defense industry: 1. The "Tariff-Fueled" Growth 💰 The President is pivotting away from traditional debt-funding. The plan? Use tariff revenue to bridge the gap from $901B to $1.5T. While skeptics point to CBO deficit warnings, the administration is betting big on trade levies to fund national security and even pay a "dividend" to the middle class. 2. A New Era for Defense Contractors 🛠️ The days of "business as usual" for the Big Defense are over. The President is demanding: - No more share buybacks or dividends if production speeds don't meet his standards. - Massive upfront investment in plants and equipment. - Executive pay tied to production, not short-term financial metrics. The message to giants like Raytheon is clear: Innovate or be sidelined. 3. "The Department of War" Mindset 🌎 With recent operations in the Atlantic and Venezuela—and Greenland back on the table—the military is being positioned as the primary tool for foreign policy. We are moving from a posture of deterrence to one of active assertion. The Bottom Line: We are witnessing a radical decoupling of defense spending from traditional fiscal constraints, fueled by a "Production First" mandate for the private sector. Is this the necessary evolution for "dangerous times," or a fiscal risk too far? Source: FT

The US Supreme Court might rule on the Trump tariffs this Friday. 🏛️

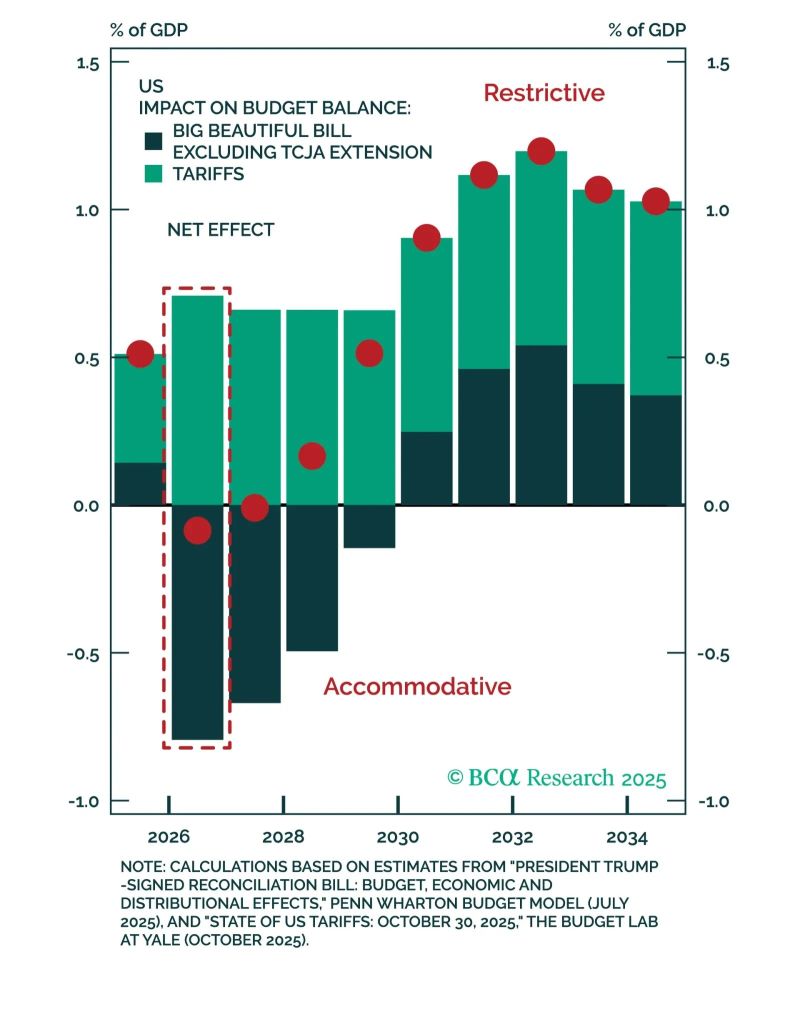

Investors are scrambling to figure out the "Day After" playbook. If the Court overturns them, we aren’t just looking at a policy shift—we’re looking at a complete market regime change. Here’s the bull vs. bear breakdown: ✅ The "Soft Landing" Bull Case Overturning tariffs = Instant Disinflation. Core goods inflation drops. Consumer purchasing power gets a massive boost. Short-term relief for the American wallet. ❌ The "Fiscal Nightmare" Bear Case It’s not all sunshine and roses. Fiscal Sustainability: Our deficit takes a direct hit (check the chart below 📉). Labor Heat: A boost in spending could supercharge labor demand, sparking structural inflation down the road. The "Wild Card" Factor 🃏 Don't expect the Administration to sit idly by. If the Court says "No," the White House will likely pivot to a raft of new legal avenues to keep protectionist measures alive. The $10 Trillion Question: How does the Fed react? If the Fed sees tariff removal as a green light for more rate cuts, we are looking at a "Risk On" environment. The Play: Long duration might be the winner. 📈 The Risk: If the term premium spikes because of fiscal concerns, that "Long" call could turn "Short" faster than you can hit 'sell.' Source: BCA, Jonathan LaBerge

Some inspiring thoughts by Ibrahim Majed on X And why this is not about Maduro. Not even about Venezuela. 🌎

We are witnessing the rollout of a global energy stranglehold. If you think the recent moves in South America are local politics, you’re missing the forest for the trees. This is a masterclass in Geopolitical Chess, and the target is much bigger. Here is why Venezuela is the "Patient Zero" for a new era of American dominance: 🔴 1. Cutting China’s Lifelines By taking control of Venezuela’s oil and aligning Nigeria under Western oversight, Washington is effectively pulling the plug on China’s access to cheap, reliable energy. Control the supply + control the transit = control the rival. 🚢 2. The Chokepoint Strategy Look at the map. From the Bab al-Mandab (Somaliland/Yemen) to the Strait of Hormuz, the U.S. is positioning itself to insulate its own economy while leaving China’s economy vulnerable to any disruption. 🛡️ 3. Neutralizing the Iran Factor Securing the world’s largest oil reserves in Venezuela provides a massive "buffer." If the Persian Gulf goes dark in a conflict with Iran, the U.S. won't flinch. Venezuela becomes the ultimate insurance policy, making military escalation in the Middle East "affordable." 💵 4. Defending the Petrodollar This is about ensuring the U.S. Dollar remains the undisputed king of energy markets. By restructuring sovereign states to align with U.S. interests, Washington is reinforcing the financial plumbing of the global economy. The Bottom Line: Venezuela is a strategic precedent. If this succeeds, it’s a blueprint for reasserting dominance over trade routes and energy flows for the next 50 years. But there’s a massive "IF." If the U.S. gets bogged down in a prolonged crisis in Caracas, it drains the very capital needed to project power in the Middle East and Asia. Is this a brilliant strategic realignment, or a high-stakes gamble that could overextend American power?

Investing with intelligence

Our latest research, commentary and market outlooks