Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

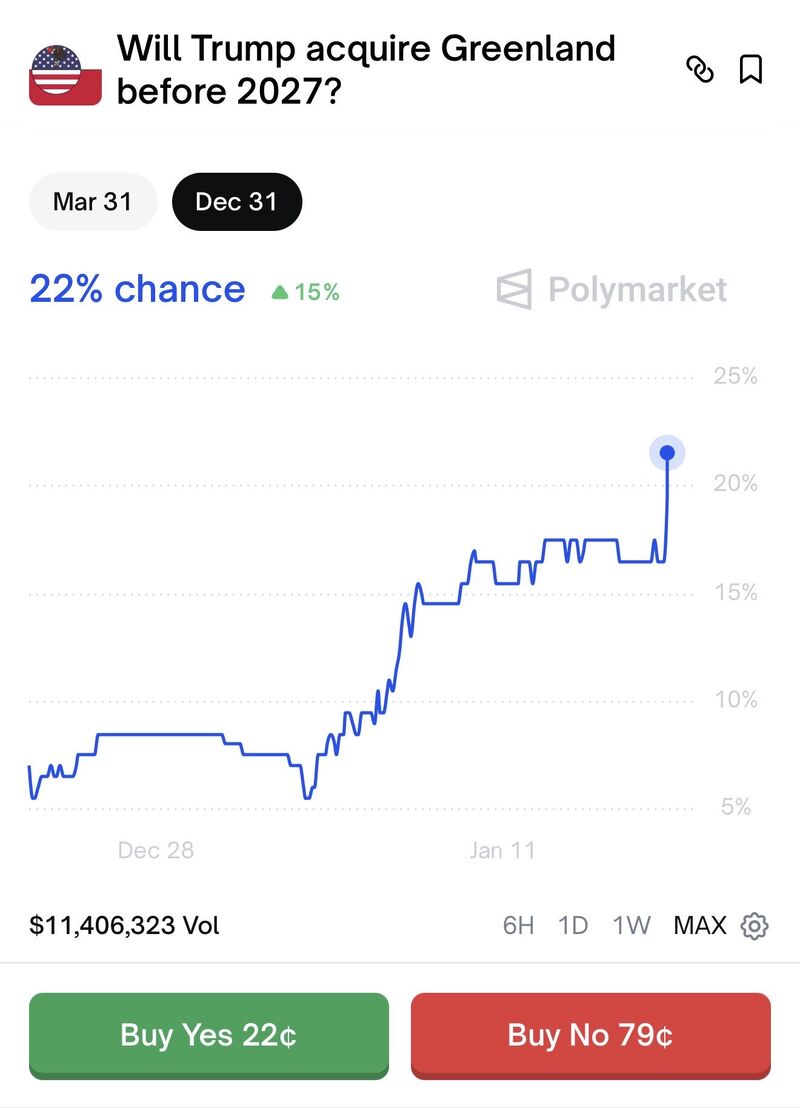

The probability of the United States acquiring Greenland reaches all-time highs. 22% chance.

Source: Polymarket

European Troop Commitments to Greenland

Number of European troops (by country) sent to Greenland to boost security... No, this is not a joke...

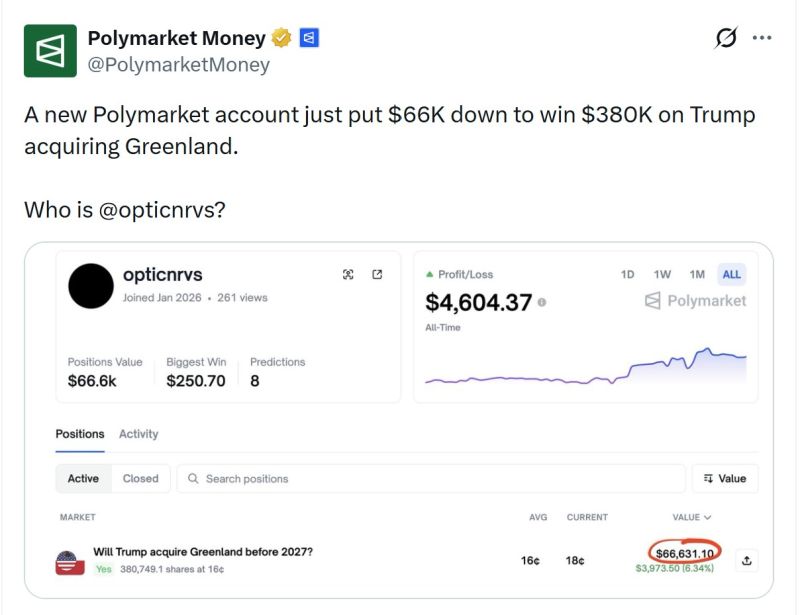

The Greenland Bet

Another insider trader? This account just dropped $66K on a Greenland acquisition and also mysteriously won on U.S. strike bets Iran, Venezuela, others! Source: Jacob King Polymarket

"Winner Winner": $CRML's Record-Breaking Day

Critical Metals $CRML, which controls one of the largest rare earth deposits in the world (also in Greenland), just soared more than 32% yesterday for one of its best days in history Source: Barchart

Germany's Merz admits: It was a serious strategic mistake to exit nuclear energy.

Friedrich Merz just plainly admitted: ditching nuclear was "a serious strategic mistake" and Germany's running the world's most expensive energy transition. "At least 3 years ago we had to leave the last remaining nuclear power plants in Germany on the grid so that we at least had the power generation capacities we had at that time. We have taken over something that we now have to correct. But we just don't have enough energy generation capacities." Source: Mario Nawfal on X

The $1.19 Trillion Elephant in the Room

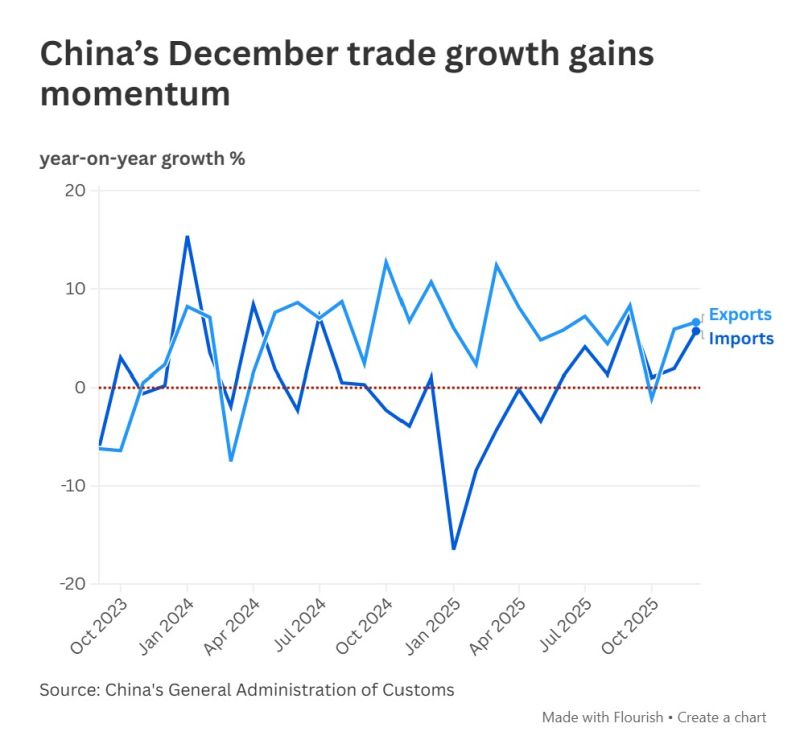

China’s December trade data just leaked, and it’s a masterclass in contradiction: ✅ The Good News: Exports beat expectations by 2x. Imports are at a 3-month high. The annual trade surplus hit a record high (up 20%). ❌ The Bad News: Trade with the U.S. is in freefall. Exports to the U.S. are down 30%. Imports from the U.S. are down 29%. What does this mean for 2026? - Diversification is king. China is filling the "U.S. gap" elsewhere. - Tariffs are working (but maybe not as intended). They are reducing bilateral trade, but China’s total global footprint is still growing. - Supply chains are shifting. Expect "China + 1" to move from a buzzword to a survival requirement. Source: CNBC

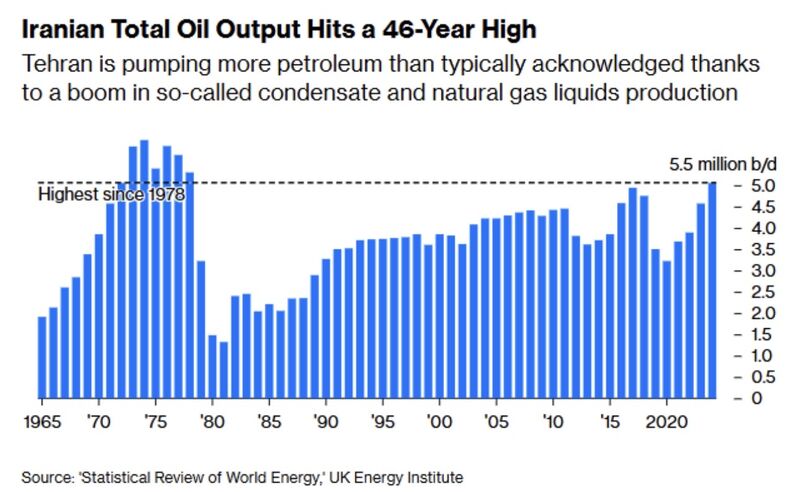

Iran’s Oil Output: A 46-Year Milestone You Might Have Missed

For the first time since 1978, Iran’s oil output has reached about 5.5 million barrels per day, marking a structural shift rather than a simple recovery. After years of volatility, production has surged since 2020, driven largely by growth in condensates and natural gas liquids (NGLs), which are less constrained by sanctions than conventional crude. Much of this supply is moving discreetly to China via shadow fleets, adding hidden liquidity to global markets and helping restrain oil prices despite geopolitical risks. Bottom line: Iran is re-emerging as a major energy player in a form that is harder to sanction, raising questions about how effective traditional oil sanctions remain in today’s market. Source: Jack Prandelli on X

Iran is now the #1 risk for global oil markets

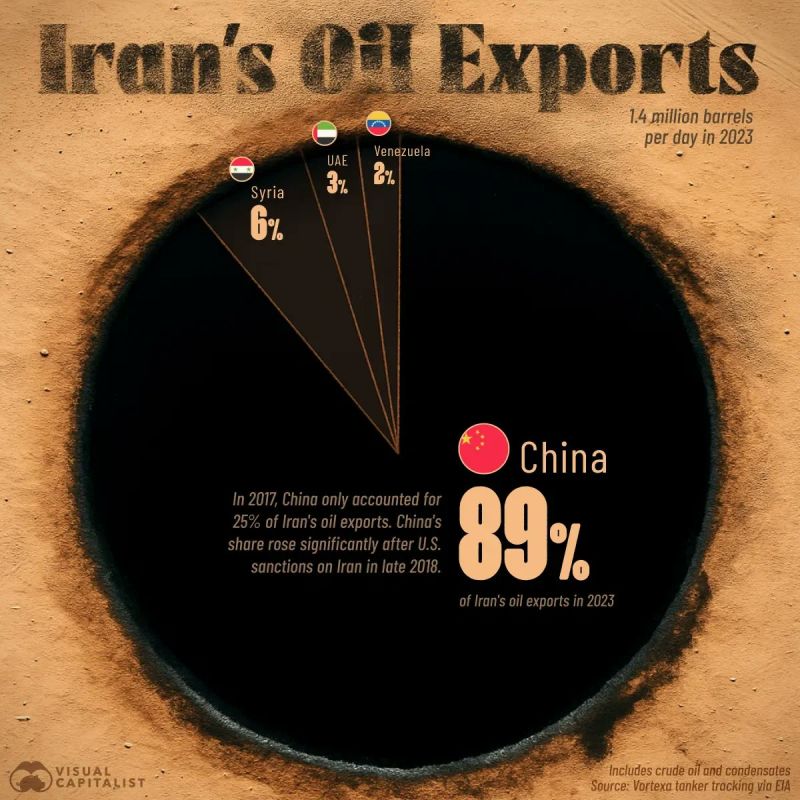

The global energy balance has shifted sharply as China now absorbs nearly 90% of Iran’s oil exports, up from 25% in 2017, creating a dangerous concentration of risk. Any disruption in Iran now directly threatens China’s energy security. The 2026 oil market is under pressure from rising political instability in Iran, already reflected in a $3–4/barrel geopolitical risk premium. Iranian oil stored offshore has reached record levels as buyers hesitate amid escalating sanctions and military risks. At the same time, the U.S. is threatening 25% tariffs on countries trading with Iran, extending the conflict from energy into global trade. With Iran increasingly reliant on Chinese “teapot” refiners, a break in this relationship could trigger severe economic fallout for Tehran and disrupt sanctioned oil flows globally. The system moving sanctioned oil is fragile, raising the risk of a supply shock for China and a major test of U.S. enforcement credibility. Source: Jack Prandelli in X, Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks