Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Countries joining Trump's peace board

Source: Rothmus @Rothmus on X

Excellent comments by German Chancellor Friedrich Merz in Davos today

Europeans have damaged their economies. They must fix it.

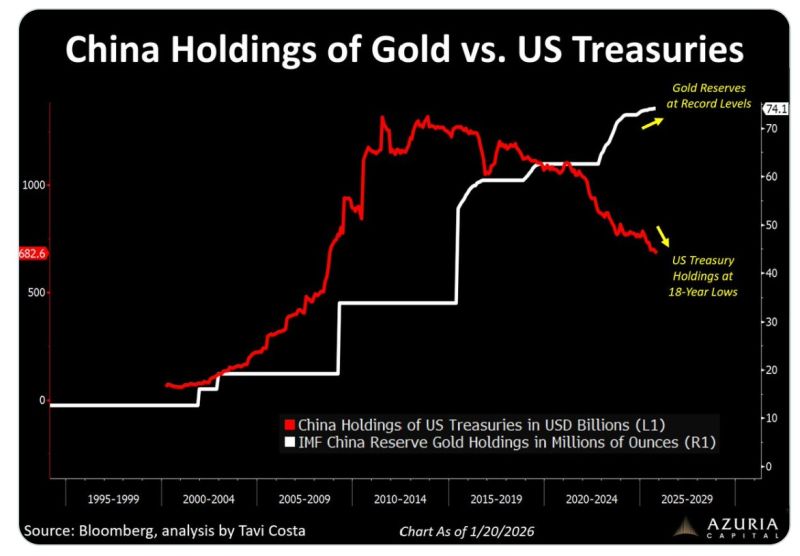

Gold is making new highs as a monetary realignment unfolds in real time

One chart says it all china’s Treasury holdings are at 18-year lows, while gold reserves are at all-time highs. Source: Tavi Costa, Bloomberg

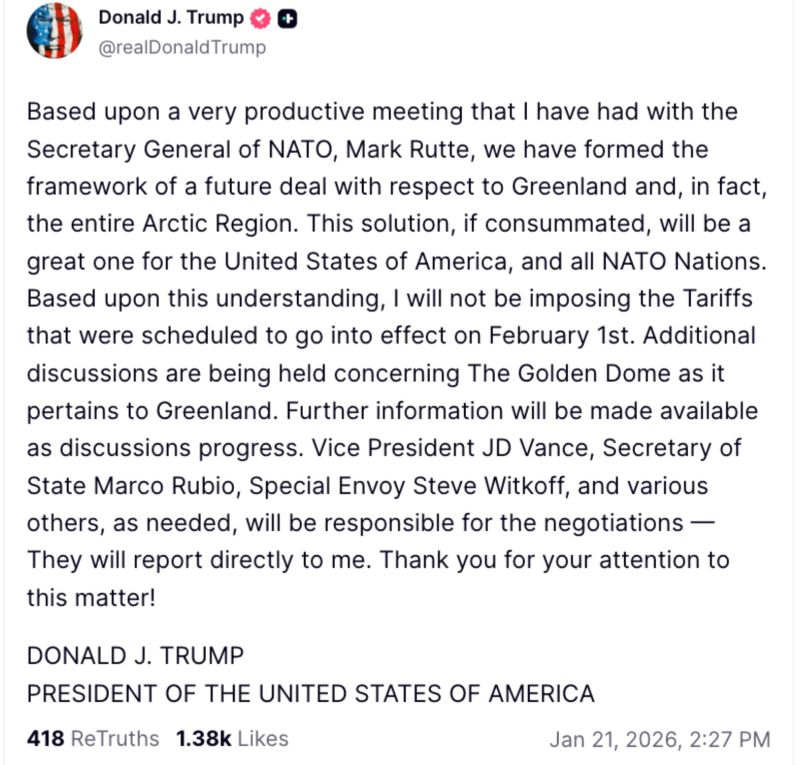

Trump says he reached Greenland deal ‘framework’ with NATO, backs off Europe tariffs

President Trump just said: "We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region" ... "Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st." Dow rallies 750 points. Dollar up. 10-year US Treasury yield down. Silver down. Cryptos up. Source: @realDonaldTrump

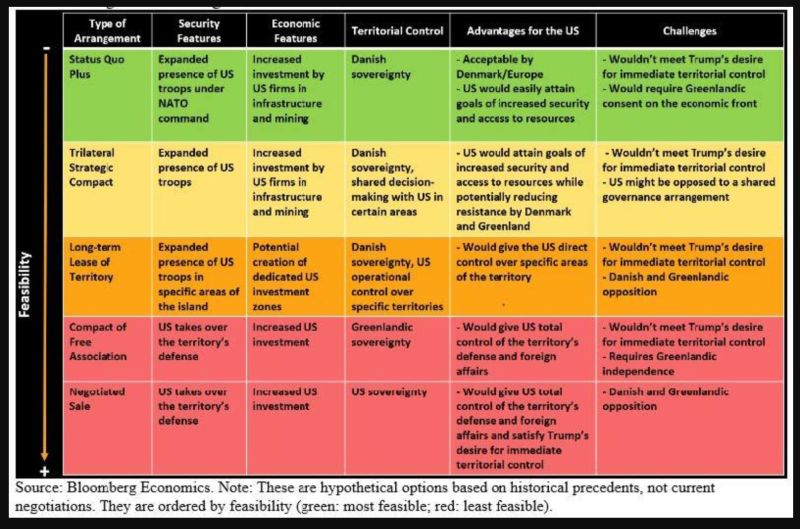

🚨 Why JPMorgan's Desk Thinks The Greenland Standoff Ends In A Bullish "Negotiated Arrangement" 🚨

The headlines are screaming "Trade War." JPMorgan’s desk is whispering "Opportunity." 📈 While the media focuses on the chaos, JPM’s International Market Intel team is looking at the scoreboard. Here is why they think the "Greenland Standoff" is actually a bullish signal for 2026: 1. It’s a Negotiation, Not an Invasion. 🤝 Federico Manicardi (JPM) calls it straight: This is classic Art of the Deal. Trump throws out a maximalist stance (10% EU tariffs / buying Greenland) to create leverage and urgency. The goal? A "Negotiated Arrangement," not a sale. 2. The "Bullish" Outcome. 🐂 JPM expects a deal where: ✅ Denmark keeps sovereignty. ✅ The US gets Arctic security & missile defense upgrades. ✅ Access to critical natural resources is secured. Result? Uncertainty clears, and the 2026 growth reboot stays on track. 3. The "Tail Risks" are Overblown. 🧊 An actual invasion? "Melts NATO faster than Arctic ice" and polls horribly. A sale? Unlikely and unnecessary. JPM sees the downside limited to a mid-single-digit (MSD) drop at worst before the rebound. 4. Eyes on Davos. 🏔️ With Trump addressing the World Economic Forum tomorrow, expect the rhetoric to shift from "threats" to "affordability and growth." The Bottom Line: Volatility is a gift if you understand the playbook. The market is anticipating a growth reboot, and JPM believes this "orange flag" is just noise on the path to a deal. Source: ZeroHedge

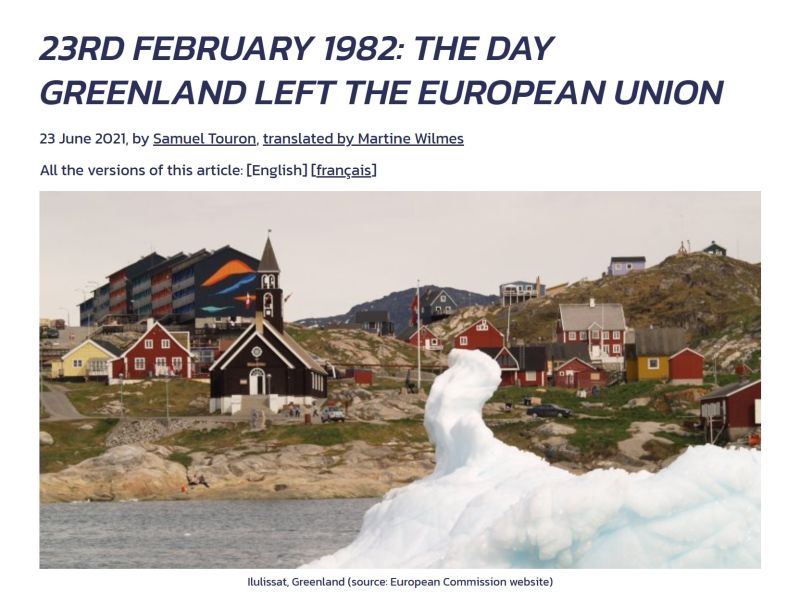

GREENLAND fact check #1: Greenland is NOT part of the European Union, despite being an autonomous territory within the Kingdom of Denmark, which is an EU member state.

Greenland has a unique history with the EU, being the only territory to ever leave it. Originally joining in 1973 as part of Denmark, Greenland’s population consistently opposed European integration. 1972 Referendum: 70% voted against joining the European Communities, but Greenland joined anyway as part of Denmark. 1982 Referendum: After gaining home rule in 1979, 52% voted to leave, driven by disputes over the Common Fisheries Policy, control of natural resources, and a sense that the EC ignored Greenland’s interests. Turnout was 74.9%. 1985 Withdrawal: Greenland formally left the EC on January 1, 1985, via the Greenland Treaty, becoming an Overseas Country and Territory (OCT) associated with the EU, maintaining some economic ties while regaining sovereignty over its fisheries.

GREENLAND FACT CHECK #2: The 1951 US Military Agreement

Greenland has a longstanding defense arrangement with the United States. On April 27, 1951, Denmark and the United States signed the Defense of Greenland Agreement, which remains in effect today. This treaty grants the United States significant military rights in Greenland: - The right to establish and operate military bases and “defense areas” in Greenland - Free movement of US ships, aircraft, and military vehicles across Greenland’s territory - The ability to construct facilities without paying rent or taxation to Denmark - Authorization to expand military presence if deemed necessary by NATO The most notable result of this agreement was the construction of Thule Air Base (now Pituffik Space Base) in northwest Greenland, which during the Cold War housed more than 10,000 US troops. Today, it remains the northernmost US Department of Defense installation, located 1,210 km north of the Arctic Circle. The agreement was updated in 2004 to recognize Greenland’s Home Rule government, but the fundamental military rights granted to the United States remain unchanged. The treaty continues in force as long as both countries remain NATO members.

Meloni warns Trump: NATO, not tariffs, is the answer in Greenland and the Arctic

"Imposing higher tariffs on countries that contribute to Greenland’s security is a mistake, and I do not agree with it. I share Trump’s focus on Greenland and the Arctic as a strategic region where hostile interference must be avoided. NATO is the proper framework to organize deterrence and collective security in the Arctic." Source: Mario Nawfal on X

Investing with intelligence

Our latest research, commentary and market outlooks