Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Microsoft ($MSFT) announced its third quarter earnings after the bell on Wednesday, beating expectations on the top and bottom lines on the strength of its cloud performance.

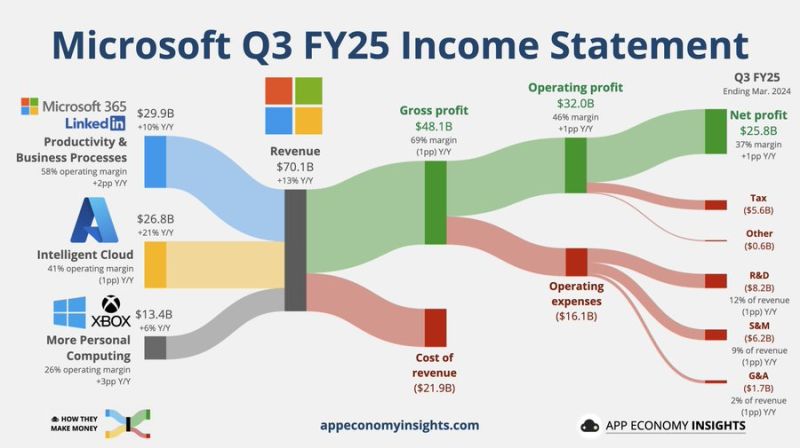

hares of Microsoft rose more than 6% on the news. $MSFT Microsoft Q3 FY25 (ending March): ☁️ Azure +35% Y/Y fx neutral (31% in Q2). 🤖 16% of Azure revenue attributed to AI. • Revenue +13% Y/Y to $70.1B ($1.6B beat). • Operating margin 46% (+1pp Y/Y). • EPS $3.46 ($0.24 beat). Source: App Economy Insights, www.zerohedge.com

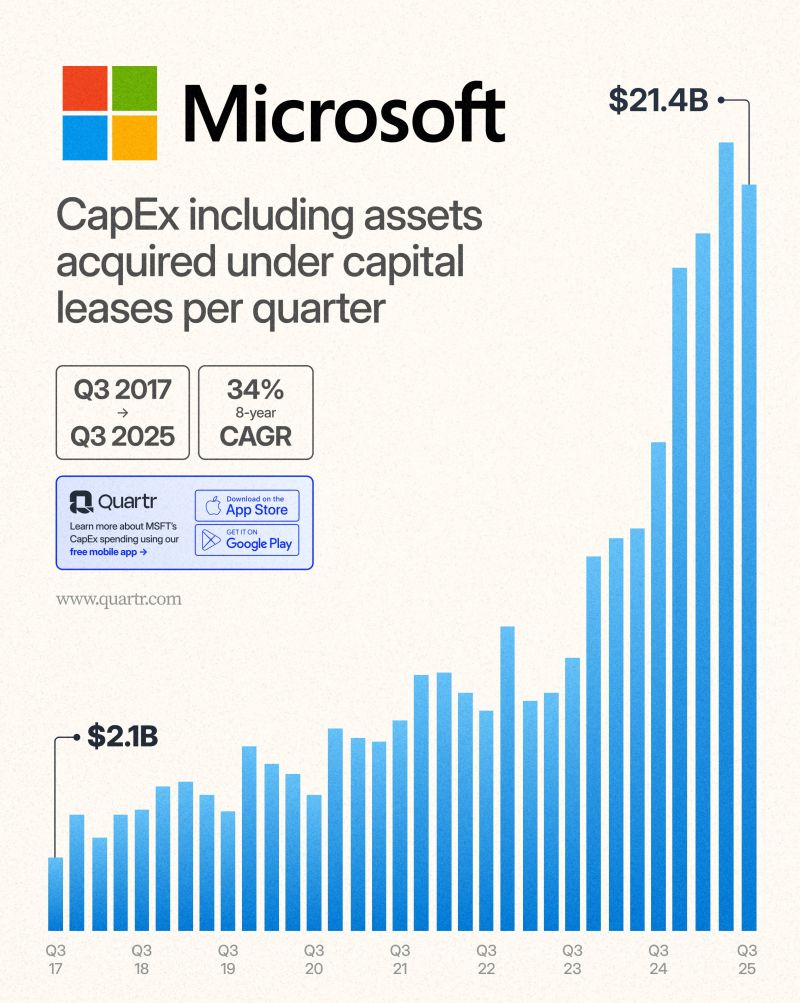

Microsoft $MSFT CapEx increased with 53% y/y in Q3'25

Source: Quartr

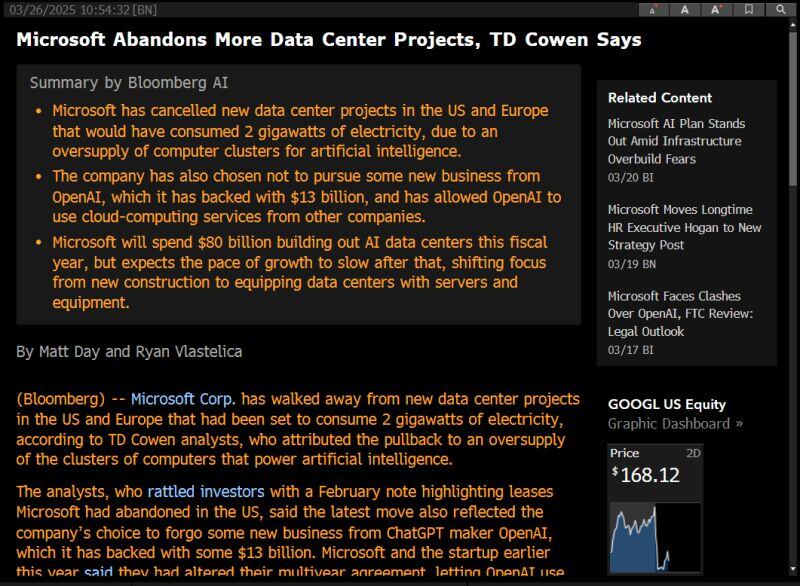

Is the AI bubble popping right before our eyes?

Microsoft Abandons More Data Center Projects, TD Cowen Says - Bloomberg Source: Bloomberg

Oups...

Microsoft will NOT participate in OpenAI Stargate project due to overestimation of demand

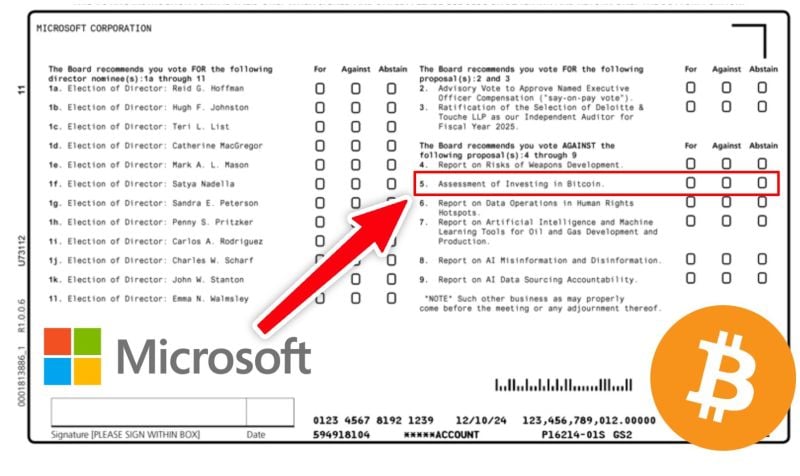

👉 JUST IN: Microsoft asks shareholders to vote on whether to consider investing in Bitcoin!

Source: Swan on X

Microsoft in a nuclear power deal with Constellation Energy for AI data centers

Source: Bloomberg

BlackRock is preparing to launch a more than $30bn artificial intelligence investment fund

With technology giant Microsoft to build data centres and energy projects to meet growing demands stemming from AI, people briefed about the matter said https://on.ft.com/3Bh2aGG Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks