Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Top 10 biggest companies in 2024 vs. 2009: What a difference 15 years can make...

Source: Stocktwits, Yahoo Finance

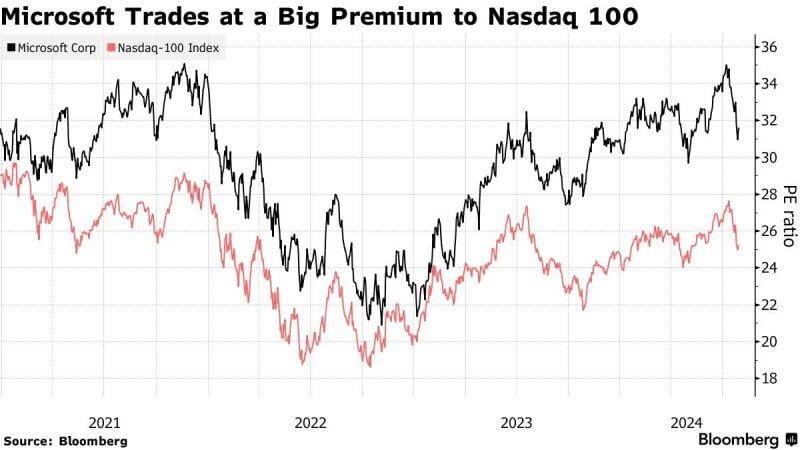

$MSFT trades at quite a large premium to the NASDAQ 100. Will the premium shrink after yesterday's earnings release?

Source: Bloomberg

A tough technical picture for Microsoft $MSFT. This is the first 200-Day SMA test since March 2023.

Source: Trendspider

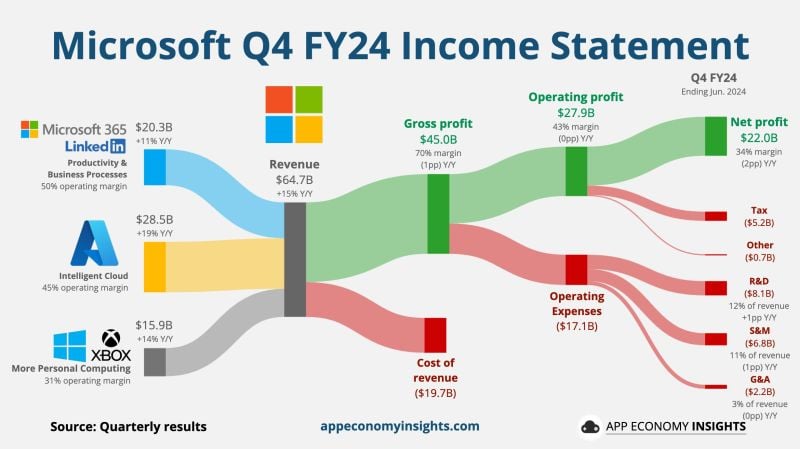

Microsoft shares fell 7% in extended trading on Tuesday as investors looked past better-than-expected earnings and revenue and focused instead on disappointing cloud results.

Here’s how the company did, compared with the LSEG consensus: -> Earnings per share: $2.95 vs. $2.93 expected -> Revenue: $64.73 billion vs. $64.39 billion expected Microsoft’s revenue increased 15% year over year in the fiscal fourth quarter, which ended on June 30, according to a statement. Net income, at $22.04 billion, was up from $20.08 billion, or $2.69 per share, in the year-ago quarter. The company’s top segment, Intelligent Cloud, generated $28.52 billion in revenue. It includes the Azure public cloud, Windows Server, Nuance and GitHub. The total was up about 19% and below the $28.68 billion consensus among analysts surveyed by StreetAccount. GitHub’s revenue is now at an annual run rate exceeding $2 billion, Microsoft CEO Satya Nadella said on a conference call with analysts. Revenue from Azure and other cloud services grew 29% during the quarter. Analysts polled by CNBC and StreetAccount had expected 31% growth. Microsoft’s Azure number hadn’t fallen short of consensus since 2022. Microsoft doesn’t disclose revenue from the category in dollars. In a nutshell: $MSFT Microsoft Q4 FY24 (ending in June): ☁️ Azure +30% Y/Y fx neutral (vs. 31% in Q3). • Revenue +15% Y/Y to $64.7B ($0.3B beat). • Gross margin 70% (-1pp Y/Y) • Operating margin 43% (flat Y/Y). • EPS $2.95 ($0.02 beat). Source: CNBC, App Economy Insights

Microsoft and Alphabet are now exactly on par since the launch of ChatGPT at the end of November 2022.

Source: HolgerZ, Bloomberg

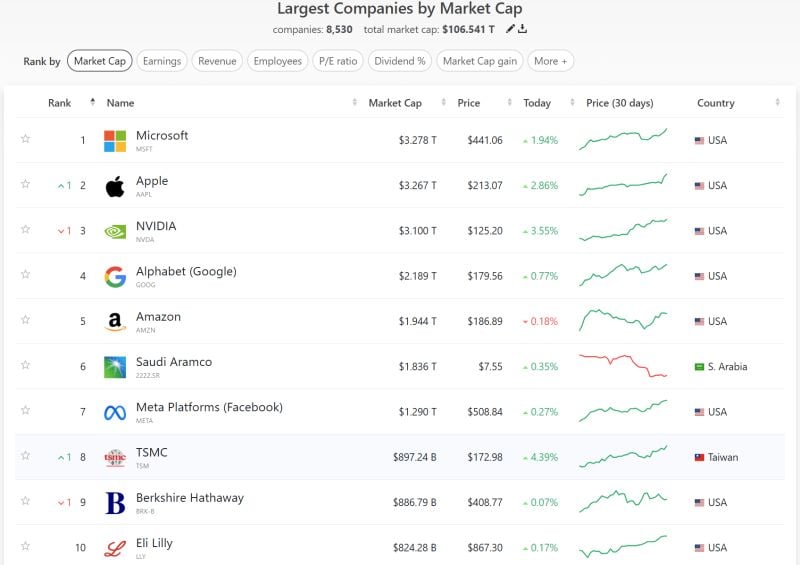

Apple almost overtook Microsoft as the largest market cap in the world.

Source: Companies Marketcap

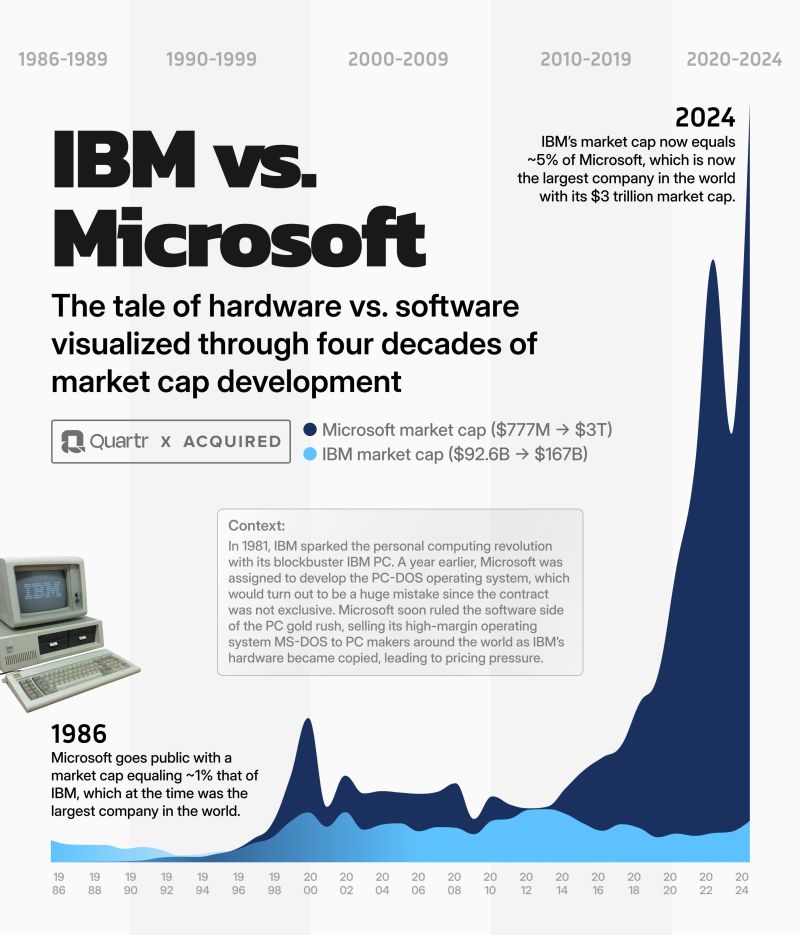

The tale of hardware vs. software visualized through four decades of market cap development by Quartr

Four intriguing facts: → In 1981, $IBM sparked the personal computing revolution with the release of its blockbuster IBM PC. → $MSFT was assigned to develop the operating system under a non-exclusive deal, instantly catapulting the company into a market-leading position in software. → In 1986, Microsoft went public with a market cap equaling 1% of IBM's, which at the time was the largest company in the world. → IBM's market cap now equals ~5% of Microsoft's, which now is the largest company in the world with a market cap exceeding $3 trillion.

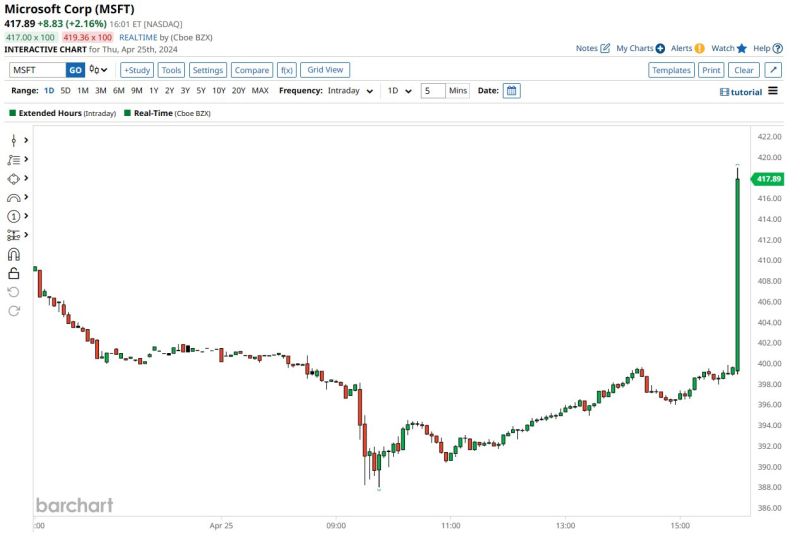

Microsoft shares rose as much as 5% in extended trading on Thursday after the software maker issued fiscal third-quarter results that outdid Wall Street’s expectations.

Here’s how the company did in comparison with the consensus from LSEG: Earnings per share: $2.94 vs. $2.82 expected Revenue: $61.86 vs. $60.80 billion expected Microsoft’s total revenue grew 17% year over year in the quarter, which ended on March 31, according to a statement. Net income, at $21.94 billion, or $2.94 per share, was up from $18.30 billion, or $2.45 per share in the year-ago quarter. The company’s Intelligent Cloud segment, including the Azure public cloud, Windows Server, Nuance and GitHub, produced $26.71 billion in revenue. That’s up about 21% and more than the $26.26 billion consensus among analysts surveyed by StreetAccount. Revenue from Azure and other cloud services grew 31%, compared with 30% in the previous quarter. Analysts polled by CNBC had expected 28.8%, while the StreetAccount consensus was 28.6%. In a nutshell: $MSFT Microsoft Q3 FY24 (ending in March): • Revenue +17% Y/Y to $61.9B ($1.0B beat). • Gross margin 70% (+0pp Y/Y) • Operating margin 44% (+2pp Y/Y). • EPS $2.94 ($0.11 beat). Azure +31% fx neutral. Source: Barchart, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks