Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

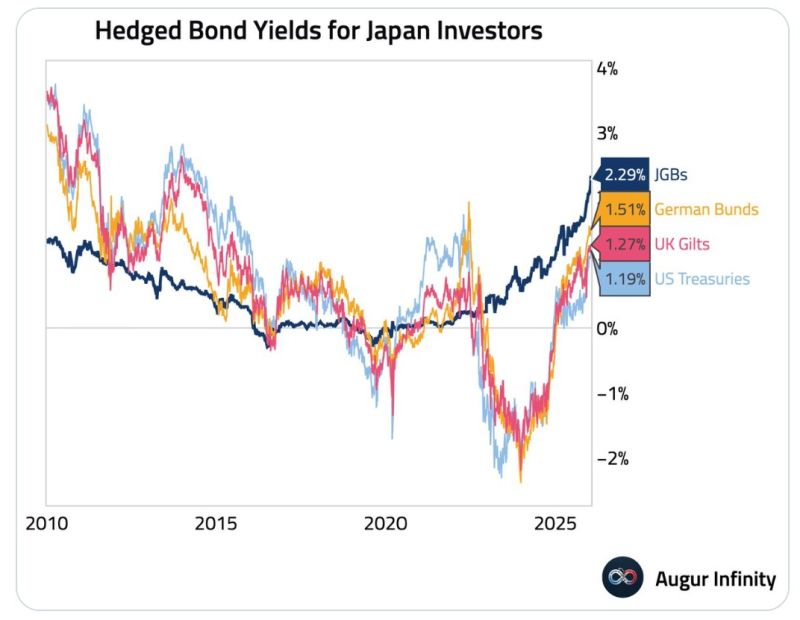

🇯🇵 For Japanese investors, domestic JGBs are now more attractive than hedged foreign bonds from a yield perspective.

Source: Augur Infinity @AugurInfinity on X

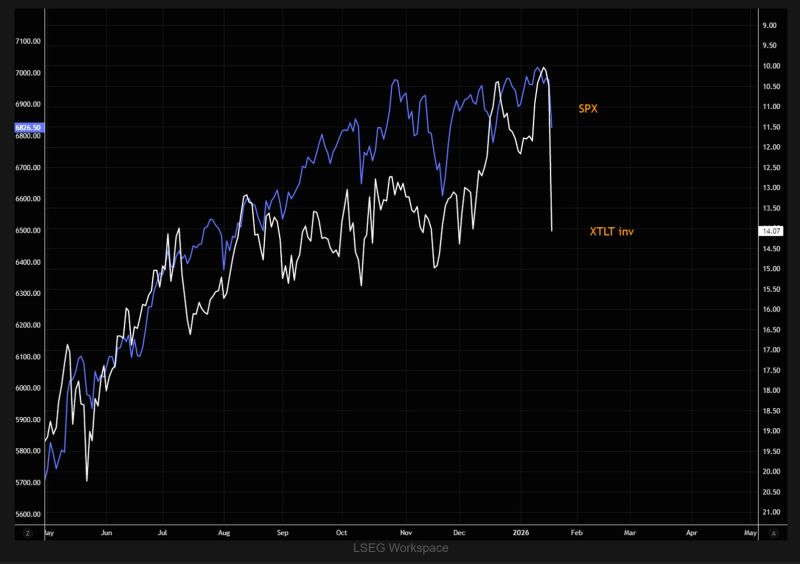

Bond vol matters

SPX vs VXTLT (inverted) needs little commenting. Source: TME

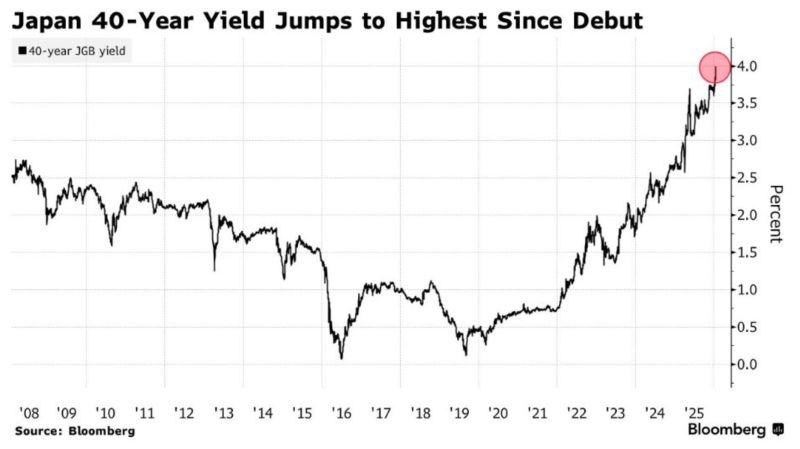

Japan's 40-year bond just hit 4% for the first time ever

Source: Joe Weisenthal @TheStalwart

U.S. Dollar Index $DXY plunging below its 200-day moving average

Source: Barchart

$7.8 Trillion is now sitting in Money Market Funds, a new all-time high

Source: Barchart

The Correlation Between Gold Prices and Japanese Bond Yields (2013–2025)

Gold (in organe) and 10-year JGB yields (in blue). Japan was always the endgame Source: www.zerohedge.com

U.S. Companies issued $95 Billion worth of bonds during the first week of the year, the highest weekly volume since Covid

Source: Barchart

Japan’s 30y govt bond yield jumped 10bps to 3.50%, its highest level since at least the 1990s.

The move comes amid growing speculation that PM Sanae Takaichi may dissolve parliament as early as next month, following reports in local media. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks