Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan 10 year - US 10 year: the big crocodile jaw

Japan might have to use yield curve control again to save its bond market Source chart: The Market Ear

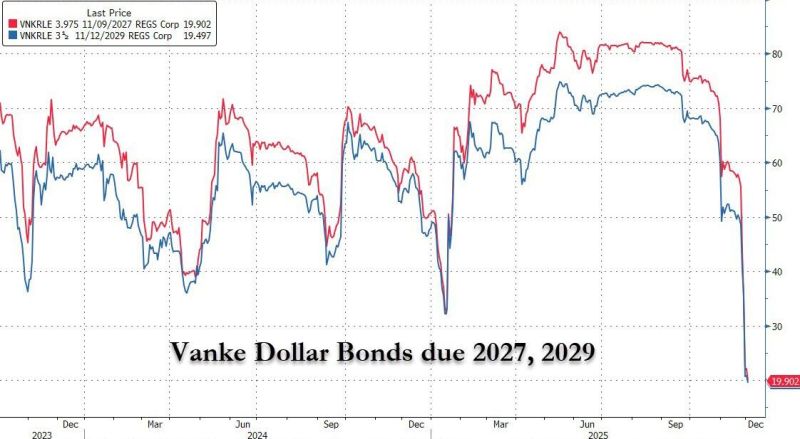

🔥 China’s Latest Property Shock: Vanke Just Broke the Last Illusion 🔥

Vanke, once viewed as China’s “safe” developer after Evergrande, just stunned markets. It’s asking for a 1-year delay on a ¥2B bond with zero upfront payment and even the interest pushed back a year. Creditors expected support. Instead, they got nothing. 📉 The fallout: ➡️ Bond crashed from near par to ¥27 ➡️USD notes collapsed to 20 cents ➡️Analysts warn this “shatters investor confidence” Vanke is now pledging core assets, being rejected for emergency loans, and facing warnings that its commitments are “unsustainable.” This isn’t one company’s problem — it’s the latest sign that China’s 5-year property downturn has no bottom. Home prices continue to fall, sales data is going missing, and global banks see years of decline ahead. And with China’s middle class holding most of its wealth in property, a deeper slump could be devastating. The crisis is no longer at the fringes. If Vanke is wobbling, the entire foundation is shaking. Source: zerohedge

Imagine buying a 100-year Austrian bond only to see it trade at about 25% of the value you bought it just a few years ago

🚨🚨 Ouch!! Source: FT

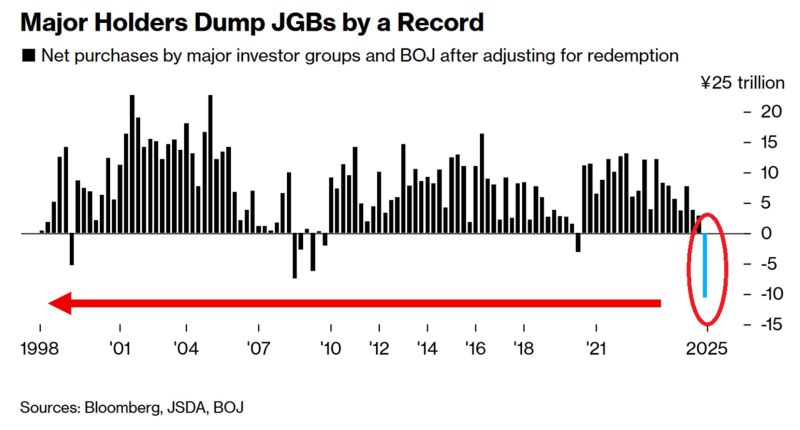

🚨 Major investors are DUMPING Japanese government bonds:

The Bank of Japan, domestic banks, insurers, and others have net sold -¥10.7 TRILLION in Japanese Government Bonds (JGBs) in September, the most EVER. Demand for Japanese debt is falling; no wonder yields are rising. Source: Global Market Investors, Bloomberg

The gap between UK borrowing costs and other advanced economies isn't just persisting, it’s widening:

A stark reminder of the "UK premium" currently baked into markets. The more this "UK premium" embeds itself in the public finances, the higher the risk of a self-feeding vicious cycle. Source: FT, Martin Wolf

In case you missed it... US 10-Year Treasury Yield back near its lowest level in the last 14 months 📉📉

Source: Barchart

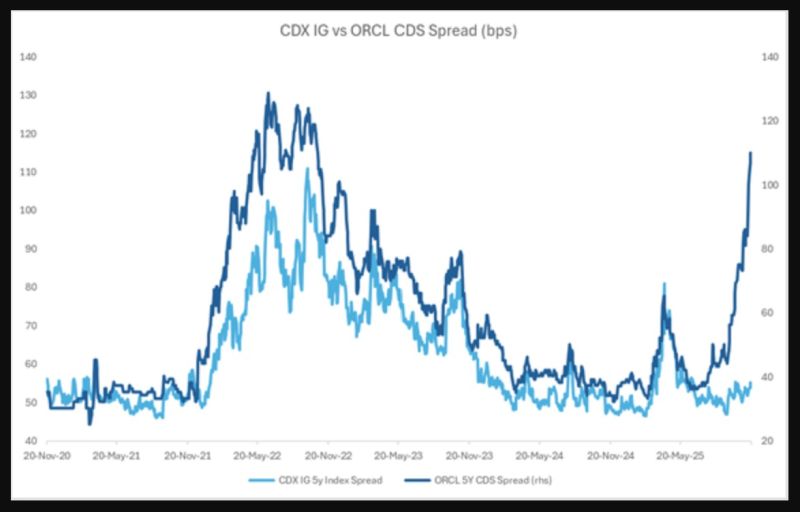

An important chart to watch: Investment grade credit default swaps are seeing a meaningful divergence from ORCL CDS

So no contagion at this stage Source: zerohedge

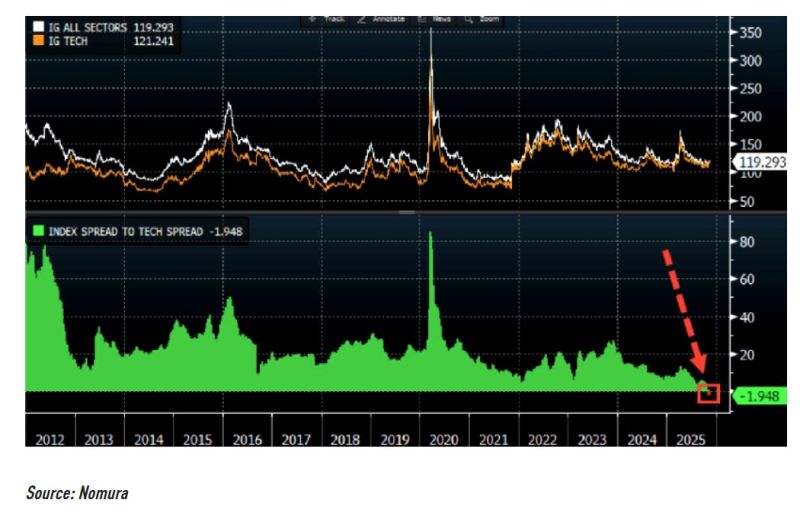

IG tech spreads are wider than the broad index for the first time since 2012...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks