Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

From Bloomberg:

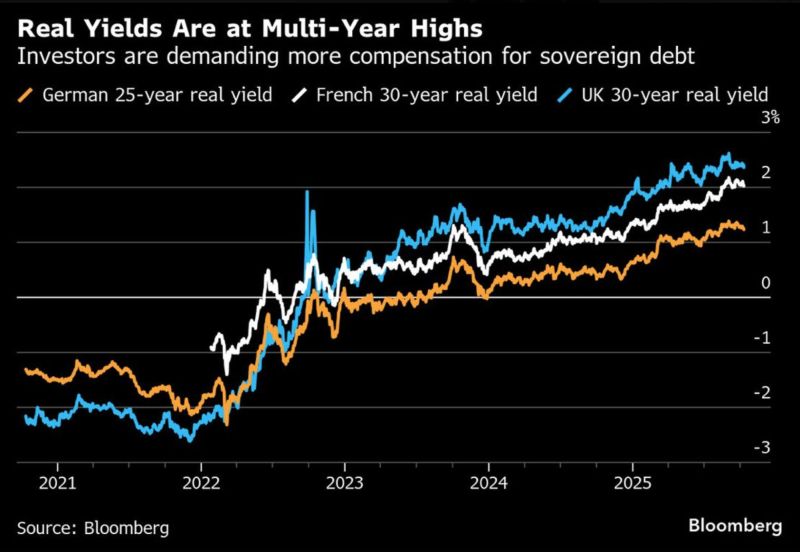

“Bond holders want an ever-higher premium to hold the debt of developed-nation governments as turmoil in France and Japan underscores how politics is eclipsing central bank policy globally as a key market driver.” Source: Mohamed A. El-Erian @elerianm

The U.S. just finalized a $20 billion currency swap deal with Argentina and is now directly buying Argentine pesos to help stabilize the collapsing currency.

This comes just a day after Argentina’s short-term yields exploded to 87% as President Milei burned through reserves to defend the peso before the October 26 elections. The new U.S. support marks a dramatic intervention aimed at restoring liquidity and easing pressure on Argentina’s financial system, which has been teetering on the edge after weeks of heavy dollar sales and record borrowing costs. Source: StockMarket.news

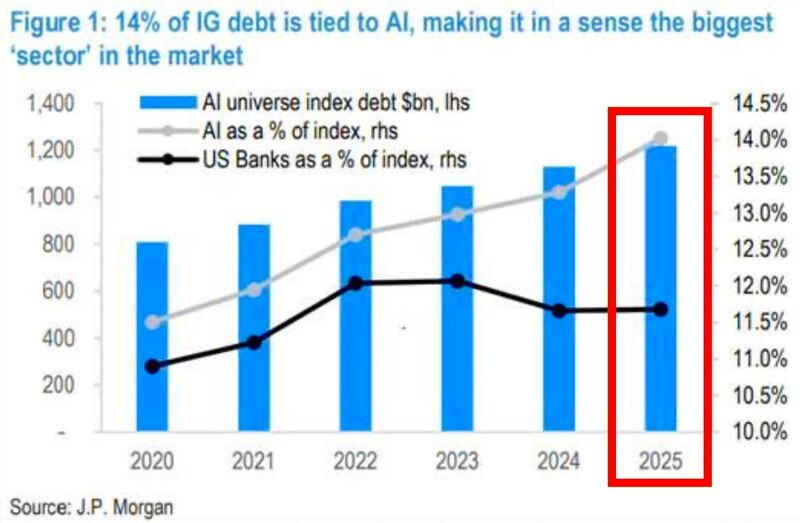

It's not just a stock bubble: AI is also now the largest sector in investment grade credit.

According to JP Morgan, AI-related companies now make up around 14% of the entire investment-grade debt market, with over $1.2 trillion in outstanding debt. It shows just how massive and expensive the AI buildout has become. These companies are financing data centers, semiconductor plants, and cloud infrastructure at a pace we haven’t seen in years. Much of the AI revolution is being funded by the debt markets. Every new data center, chip fab, and GPU cluster requires capital. It’s not just Big Tech spending cash reserves, the entire credit market is fueling AI growth. Source: JP Morgan, StockMarket.news

Japan 30-Year Bond Yield jumps to 3.29%, the highest level in history.

Source: Carl ₿ MENGER @CarlBMenger

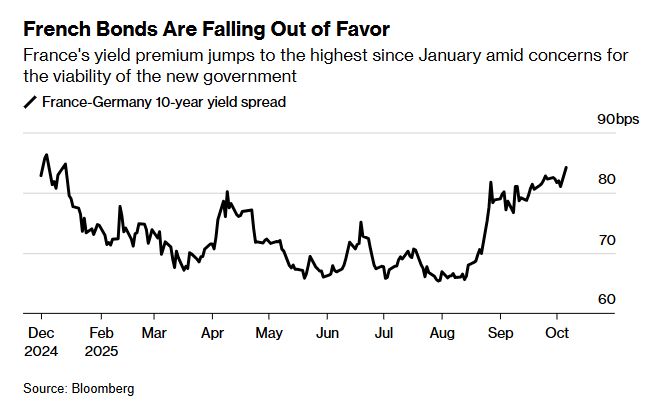

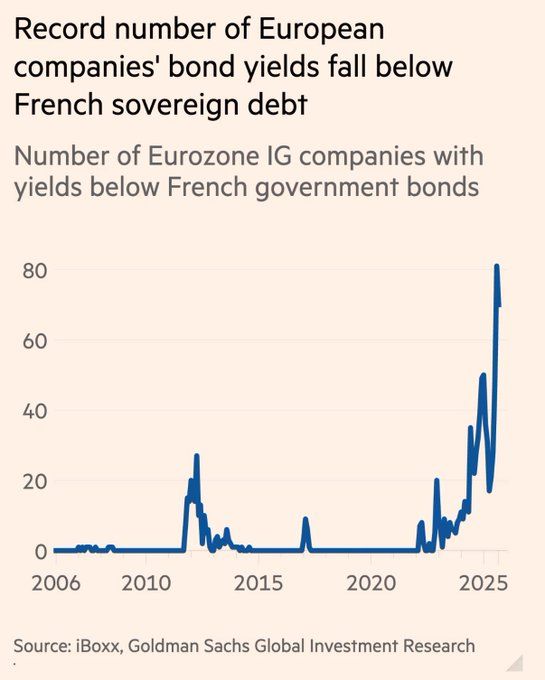

France bond risk hits Nine-Month high amid fears over government - Bloomberg

France’s new Prime Minister Sebastien Lecornu has resigned just weeks after his appointment, plunging the country into a fresh political crisis. Lecornu, France’s fifth PM in less than two years, had his work cut out to convince the country — and investors — that he could unite a fractious and divided parliament enough to get a 2026 budget over the line. With the prospect of a state budget being passed now in doubt, French markets reacted strongly to the news, with the yield on the 30-year government bond, or OAT, hitting a one-month high of 4.44% before retreating slightly. The yield on the benchmark 10-year bond rose to a 10-day high of 3.599%. Meanwhile, France’s CAC 40 index slumped 2.0% and the euro fell 0.7% against the dollar - CNBC

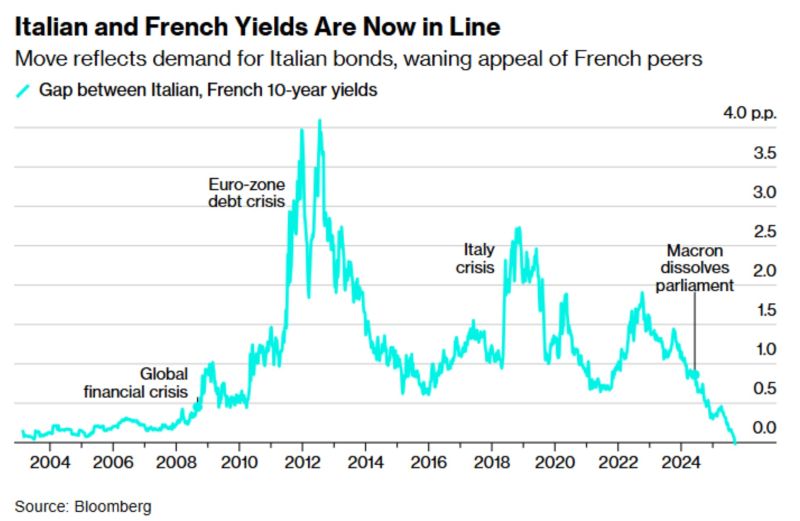

France is replacing Italy as Europe’s poster child of fiscal woe

Source: Bloomberg

The ECB has tentatively allowed a little bit of price discovery in the bond market

The French government wakes up to discover their cost of funding is higher than L'Oréal's. Source: Hanno Lustig, FT

Investing with intelligence

Our latest research, commentary and market outlooks