Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

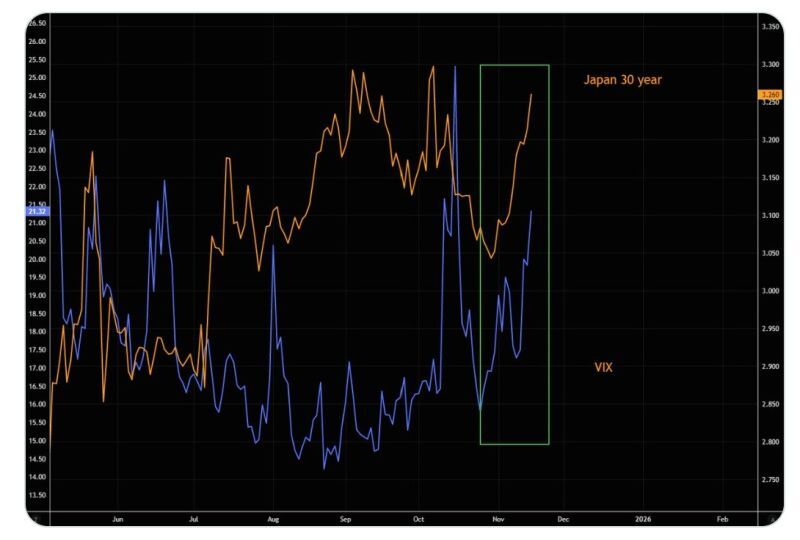

Why You Always Watch Japanese Rates.

Source: The Market Ear @themarketear

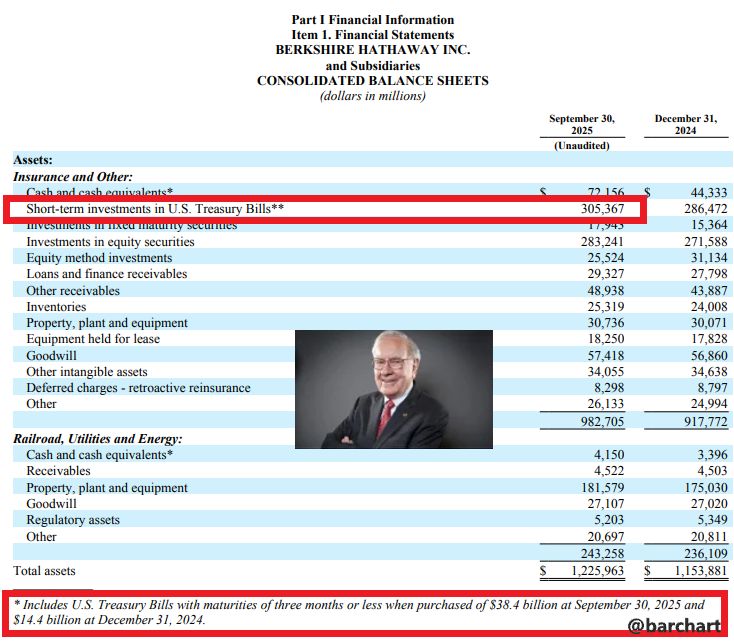

Warren Buffett now owns a staggering 5.6% of the entire U.S. Treasury Bill Market 🚨🚨🚨

Source: Barchart

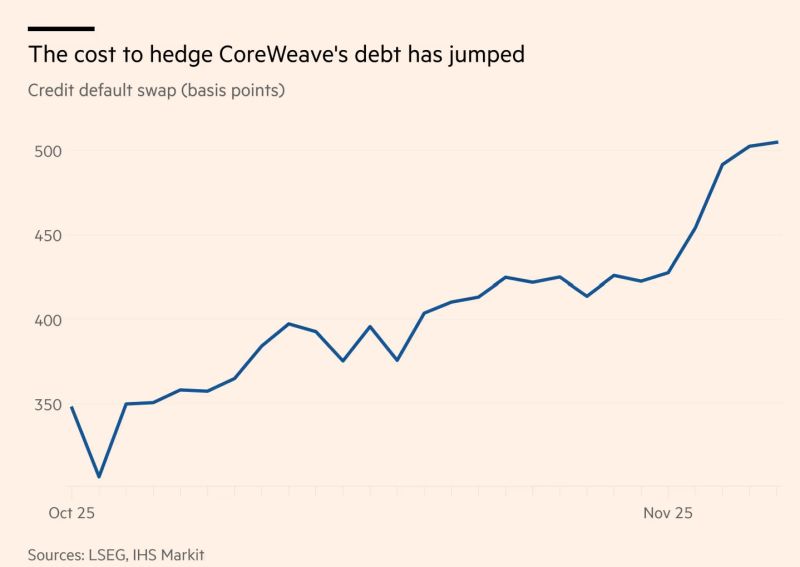

Data centre operator CoreWeave’s stock has fallen more than 20 per cent over the past two weeks, alongside the drop in bigger names.

On Tuesday, the company’s shares were down a further 16 per cent after it lowered its forecast for annual revenue as a result of expected data centre delays. The cost to protect against a default on CoreWeave’s debt has jumped as the equity price has fallen, with the group’s five-year credit default swaps trading at 505 basis points, from below 350bp at the start of October, according to LSEG data. Source: FT

The index is derived from state-level employment, wage, and unemployment data, capturing how many U.S. states experience significant labour-market deterioration at any given time.

About $1.5T may come from investment-grade bonds, plus $150B from leveraged finance and up to $40B a year in data-center securitizations. Even then, there’s still roughly a $1.4T funding gap likely filled by private credit and governments. Source: Wall St Engine

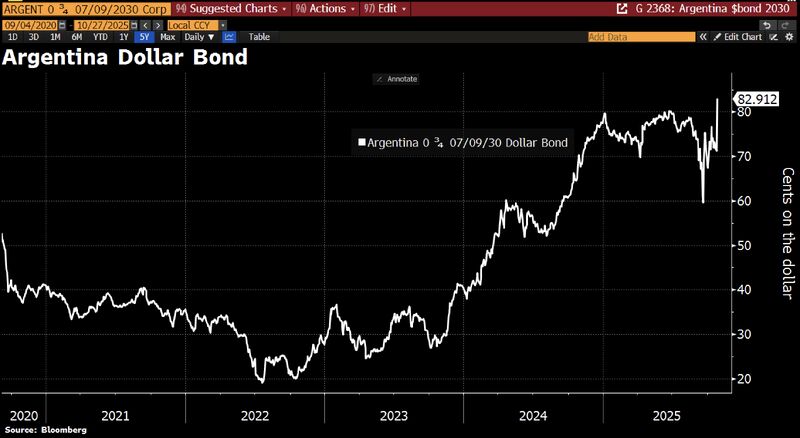

Argentina Dollar bonds jump after Milei's landslide midterm win.

Source: HolgerZ, Bloomberg

US Treasury yields are falling — but this time, it’s not about fear. It’s about confidence. 💡

The Trump–Bessent supply-side mix, tariff revenues, and AI-driven growth are reshaping the bond market story. 💵 Tariffs are turning out to be less inflationary than initially feared (at least for now) and deficit-friendly. 💰 Stablecoins now hold $180B+ in Treasuries, quietly anchoring the short end of the curve. 🚀 The U.S. productivity boom powered by AI is leaving others behind — while Europe unravels fiscally, Britain wrestles with debt, and China sinks deeper into deflation. As global credit stress rises, U.S. bonds are the safe haven again. The curve’s bull flattening isn’t a warning — it’s (almost) a vote of confidence. The U.S. is once again the "least worst" house in a bad neighborhood of indebted peers. Source: Bloomberg, James E. Thorne @DrJStrategy

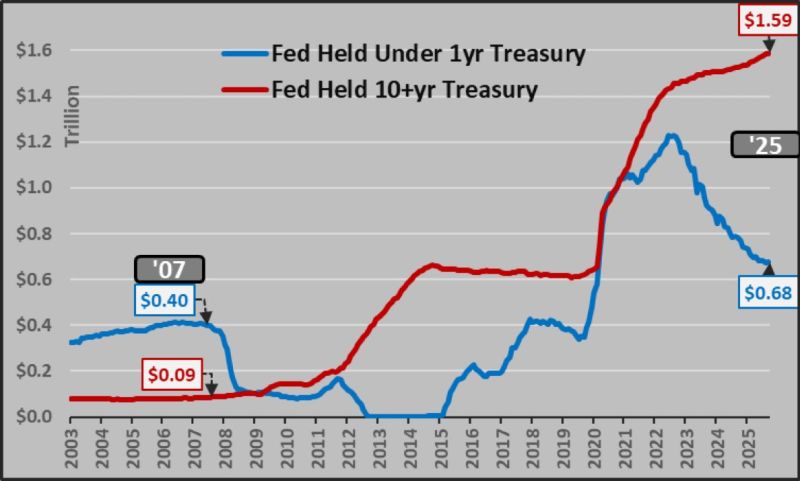

Really important chart from @Econimica

QT NEVER happened in 10+yr USTs post-2022. The Fed still holds a large amount of long-term debt. The QT mainly took place through short-term Treasuries (the blue line). As explained by StockMarket.news, over the last few years, the Fed has been draining some money out of the system but doing it in a very controlled way. It’s avoiding a big sell-off in long-term bonds because that could cause interest rates to spike and hurt the economy. So while it looks like the Fed is being tough with QT, the reality is softer the real tightening is happening with short-term bonds, while the long-term side still has a safety net. It’s a reminder that even when the Fed says it’s tightening, it’s still making sure the markets don’t fall apart.

Negative spread for corporates vs. US Treasuries can indeed happen

Source Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks