Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

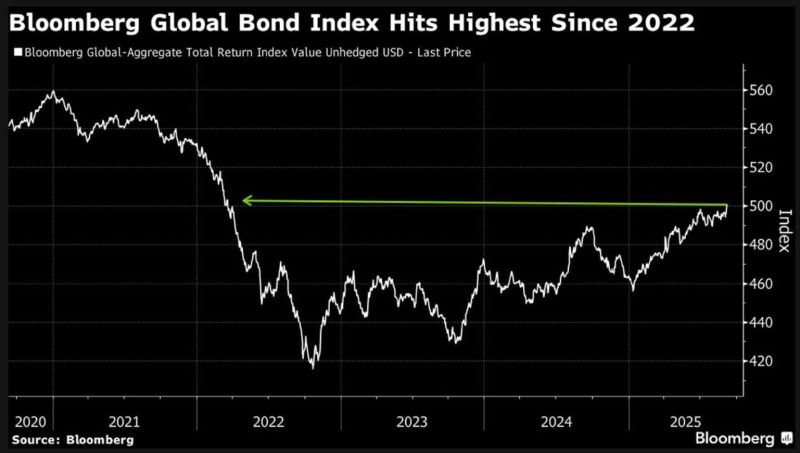

Bloomberg frames the latest bond rally (with yields falling) in a wider context:

“Three years after a surge in inflation pummeled fixed-income markets all around the world, global bonds have finally re-entered bull market territory. Bloomberg’s Global Aggregate Index, which tracks returns on sovereign and corporate debt across developed and emerging markets, has surged more than 20% from its 2022 trough to its highest level since March 2022 amid a broad fixed-income rally. The latest leg higher came as cooling US labor data fueled bets the Federal Reserve would step up policy easing.” Source: Bloomberg, Mo El Erian on X

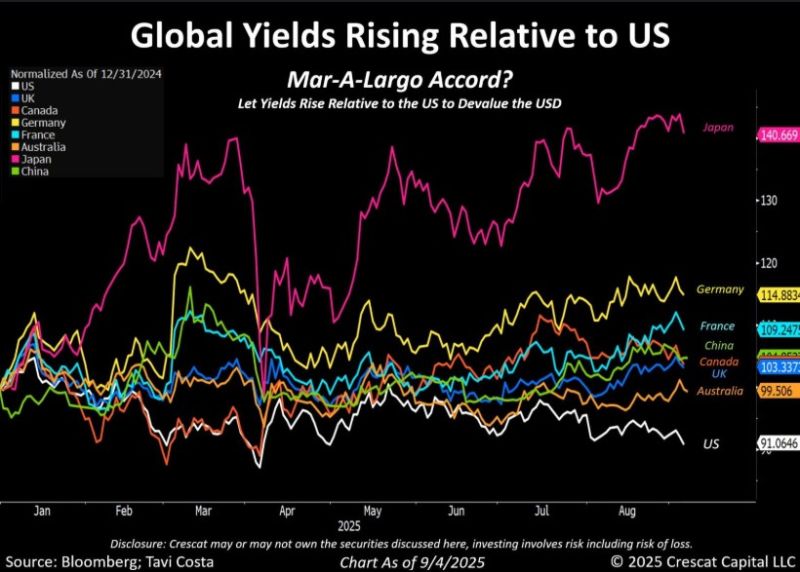

Interesting point of view by Otavio Costa on the rise of global yields relative to us yields

He sees it as a real-time “Mar-a-Lago Accord" (i.e dollar devaluation). Here's why: "The strategy of letting global yields rise relative to US yields is central to weakening the dollar. What some see as a market shift might be a policy, a clear move toward dollar devaluation. The implications extend further, especially for emerging markets, which stand to benefit significantly from this environment". Your view? Source: Crescat Capital, Bloomberg

$TLT jumps to highest price since April 📈📈📈 Ready to breakout?

Source: Barchart

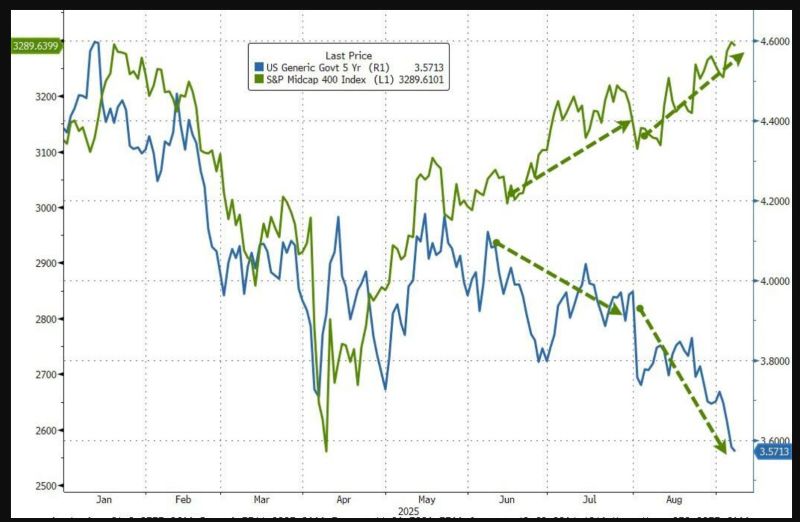

As Fed rate cuts odds increase, stocks and bonds continue to be bid together...

Source: www.zerohedge.com, Bloomberg

"The Ukraine war and the weaponization of the dollar was the straw that broke the camel's back"

Source: zerohedge

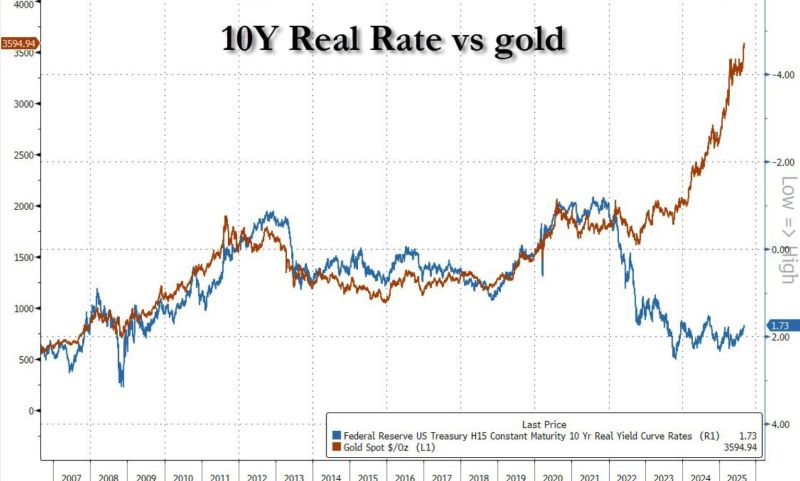

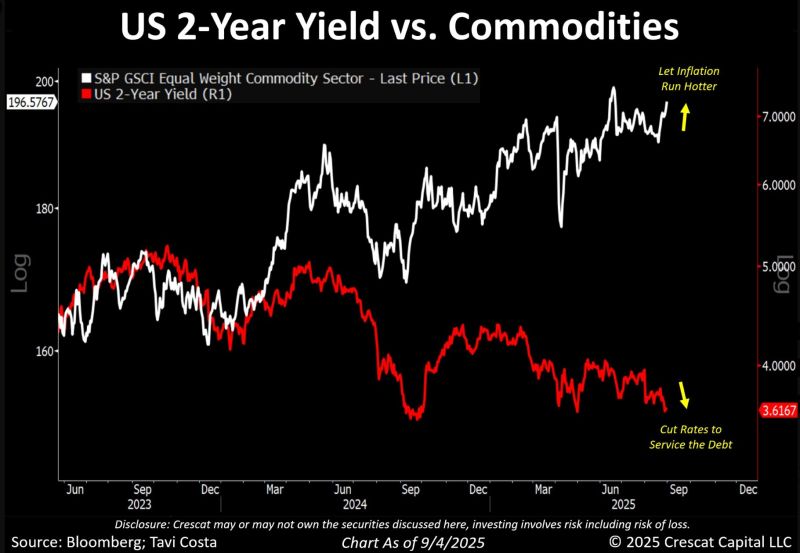

As highlighted by Otavio Costa, this is the environment we are in:

US 2-year yields approach multi year lows as commodities approach all time highs. The Fed is likely to cut rates to service debt. And the price to pay inflation expected to run hotter. Source: Tavi Costa, Bloomberg

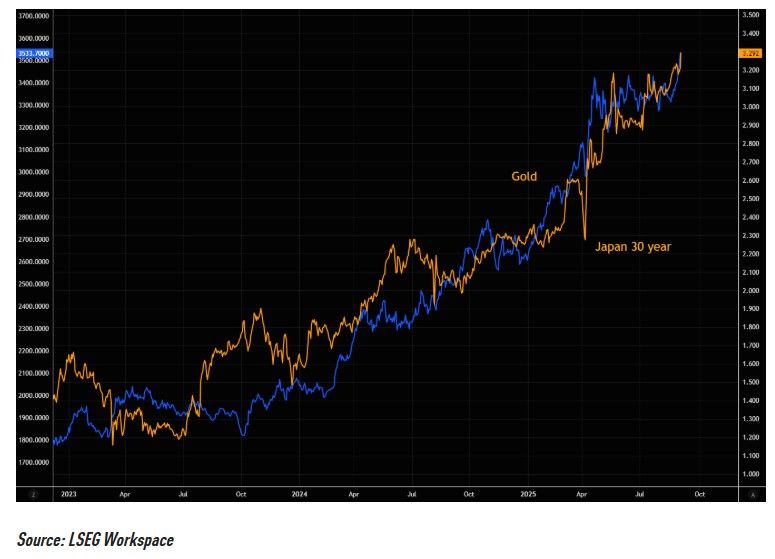

Gold knows

Gold is following the Japanese 30 year, pricing in "spillover" risks... Source: TME, LSEG workspace

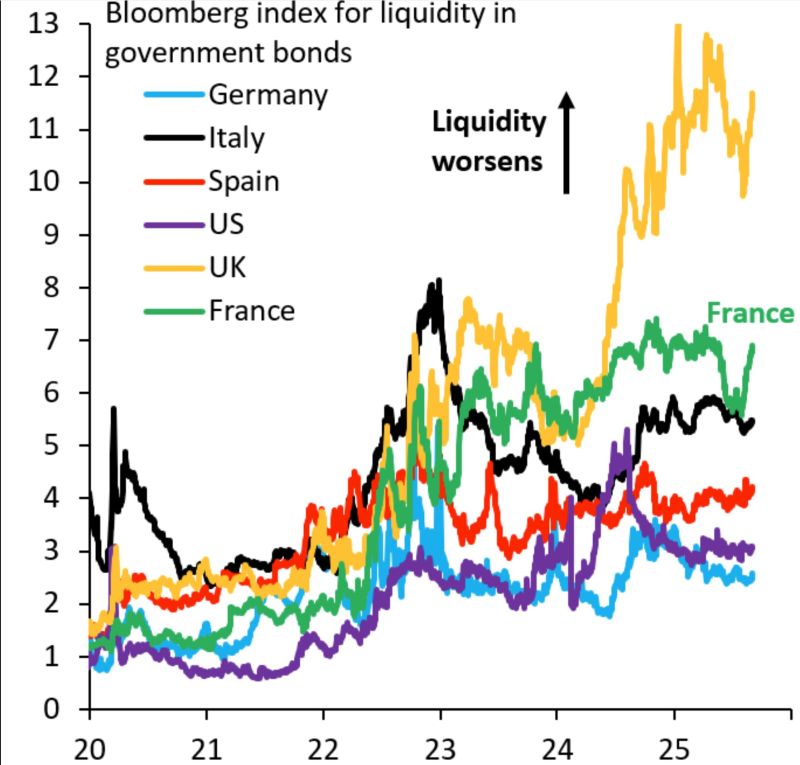

This is Bloomberg's measure of bond market liquidity, which compares actual yield curves to synthetic smooth yield curves for each country

The more kinks you have in the yield curve, the higher this index and the worse is liquidity. UK off the charts, France rising rapidly... Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks