Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The ratings agency kept the U.S. at AA+/A-1+ with a stable outlook.

“The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” S&P said in its statement. The firm pointed to broad economic resilience, policy continuity, and strong revenue streams, including what it described as “robust tariff income” - as offsets to fiscal slippage stemming from legislative changes. While acknowledging concerns that tariffs could dampen business confidence, growth, and hiring while spurring inflation, S&P said revenue gains would help balance the ledger, WSJ reports. The agency’s decision comes against the backdrop of a $5 trillion increase in the debt ceiling and projections that net general government debt will approach 100% of gross domestic product, driven by “structurally rising non-discretionary interest and aging-related expenditure.” S&P cited several strengths underpinning the rating, including the resilience of the U.S. economy, effective monetary policy, and a deficit trajectory that, while elevated, isn’t accelerating. Yet the firm also noted risks... “Bipartisan cooperation to strengthen the U.S. fiscal profile - namely to meaningfully lower deficits and tackle budgetary rigidities - remains elusive,” S&P said. Below is a chart of USA sovereign credit risk Source: zerohedge

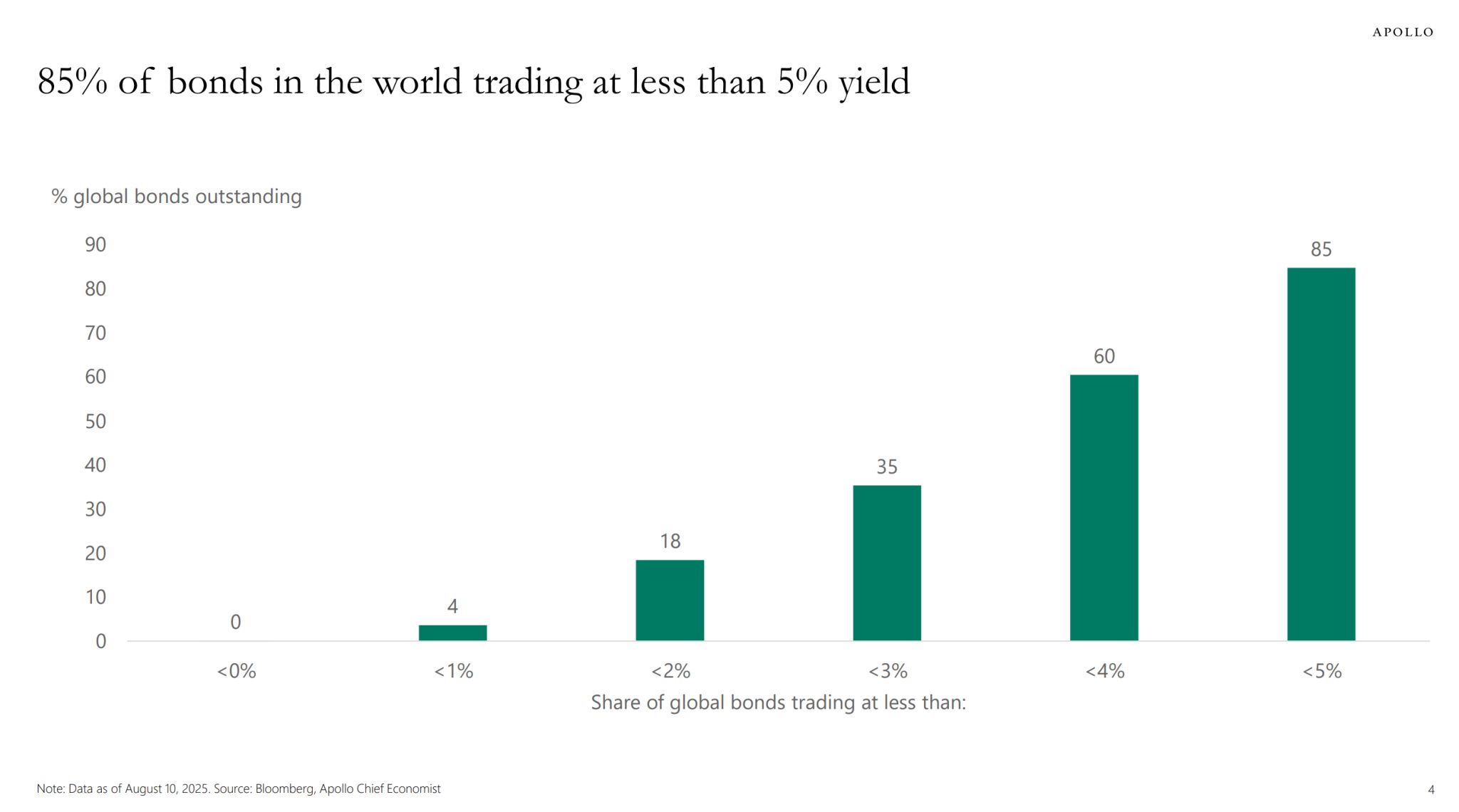

85% of bonds in the world are trading at less than 5% yield

Source: Apollo

German 30y bond yields climbed to 3.35%, the highest level since 2011.

Investors are demanding higher term premia as the surge in bond supply weighs on the market. Source: HolgerZ, Bloomberg

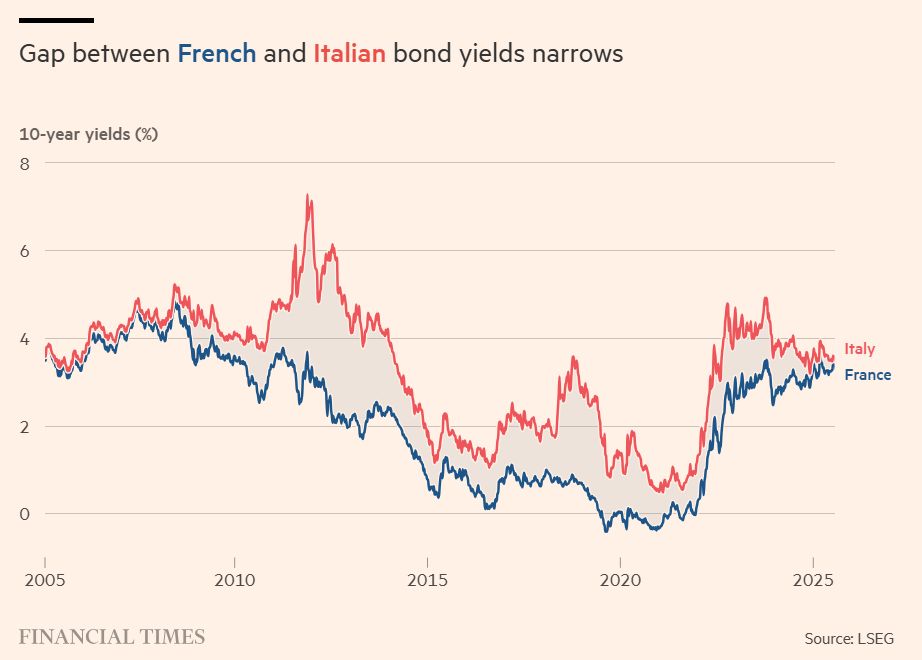

France’s long-term borrowing costs are converging with Italy’s for the first time since the global financial crisis.

Yields on 10-year French government bonds have jumped above 3 per cent over the past year, as months of political instability and concerns about the public finances take their toll. This has brought France’s benchmark borrowing costs to just 0.14 percentage points less than those of Italy, whose bond yields have been driven lower as a display of fiscal prudence from Giorgia Meloni’s administration has won over investors. The convergence has upended long-held views on France’s position as one of the region’s safest borrowers and Italy as one of its most risky, with a huge stock of public debt equal to about 140 per cent of GDP. Italy’s “spread” over France — the difference between their bond yields — ballooned to more than 4 percentage points during the Eurozone debt crisis of the 2010s. Source: FT

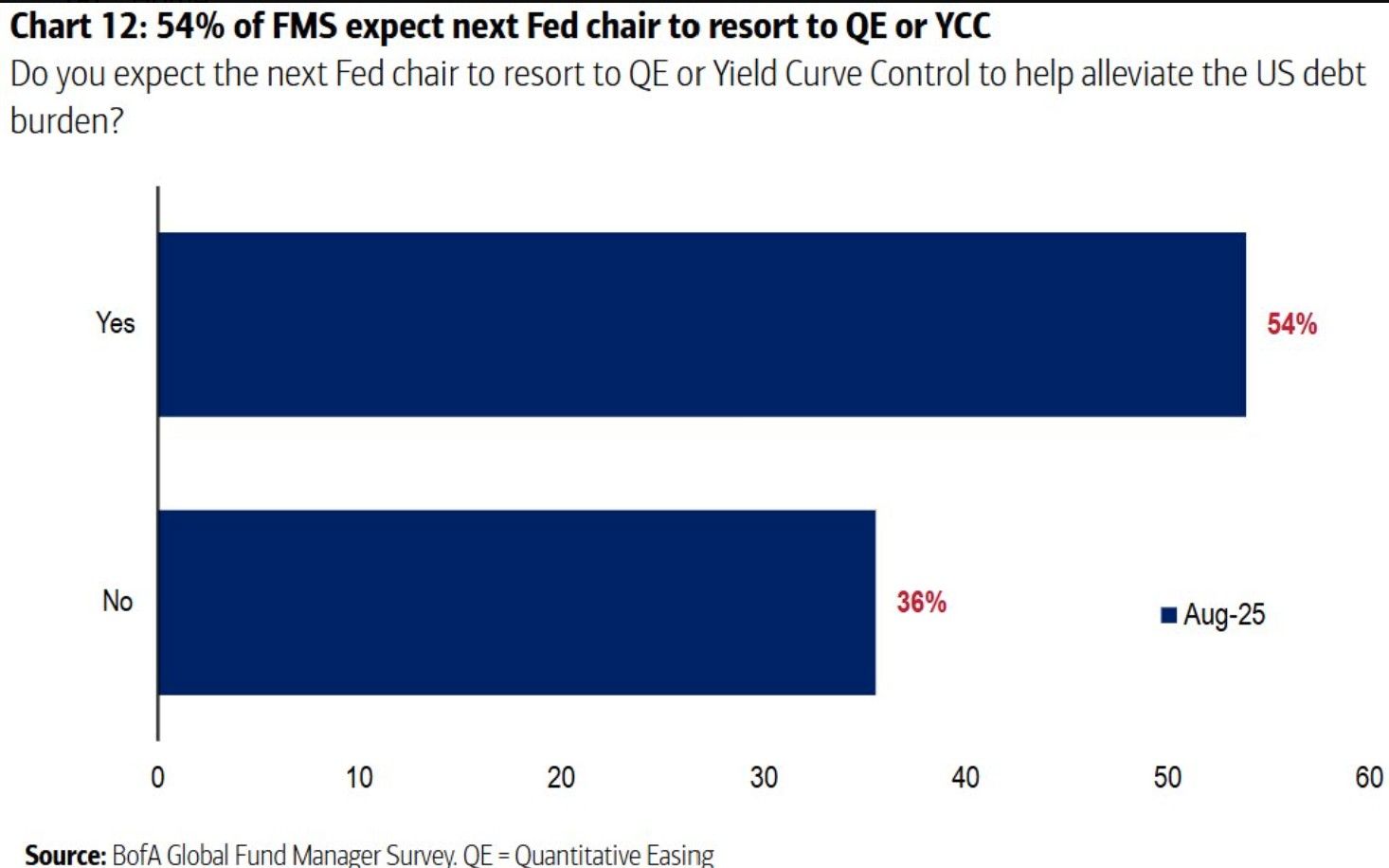

The majority of managers (via the BoA survey) see a return to QE or YCC to deal with the super-sized fiscal deficit.

This will be CPI inflationary, but with 10y bond yields pinned to (say) 4% maybe stocks might like that outcome for a while, before reality hits home. Source: Albert Edwards, H/T @johnauthers, BofA

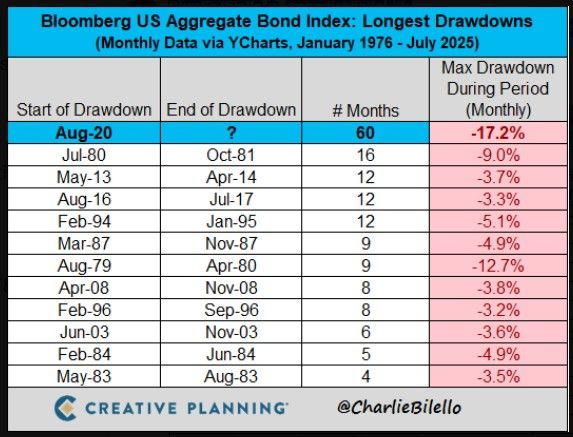

The US Bond Market has now been in a drawdown for over 5 years, by far the longest in history.

Source: Charlie Bilello

In case you missed it...

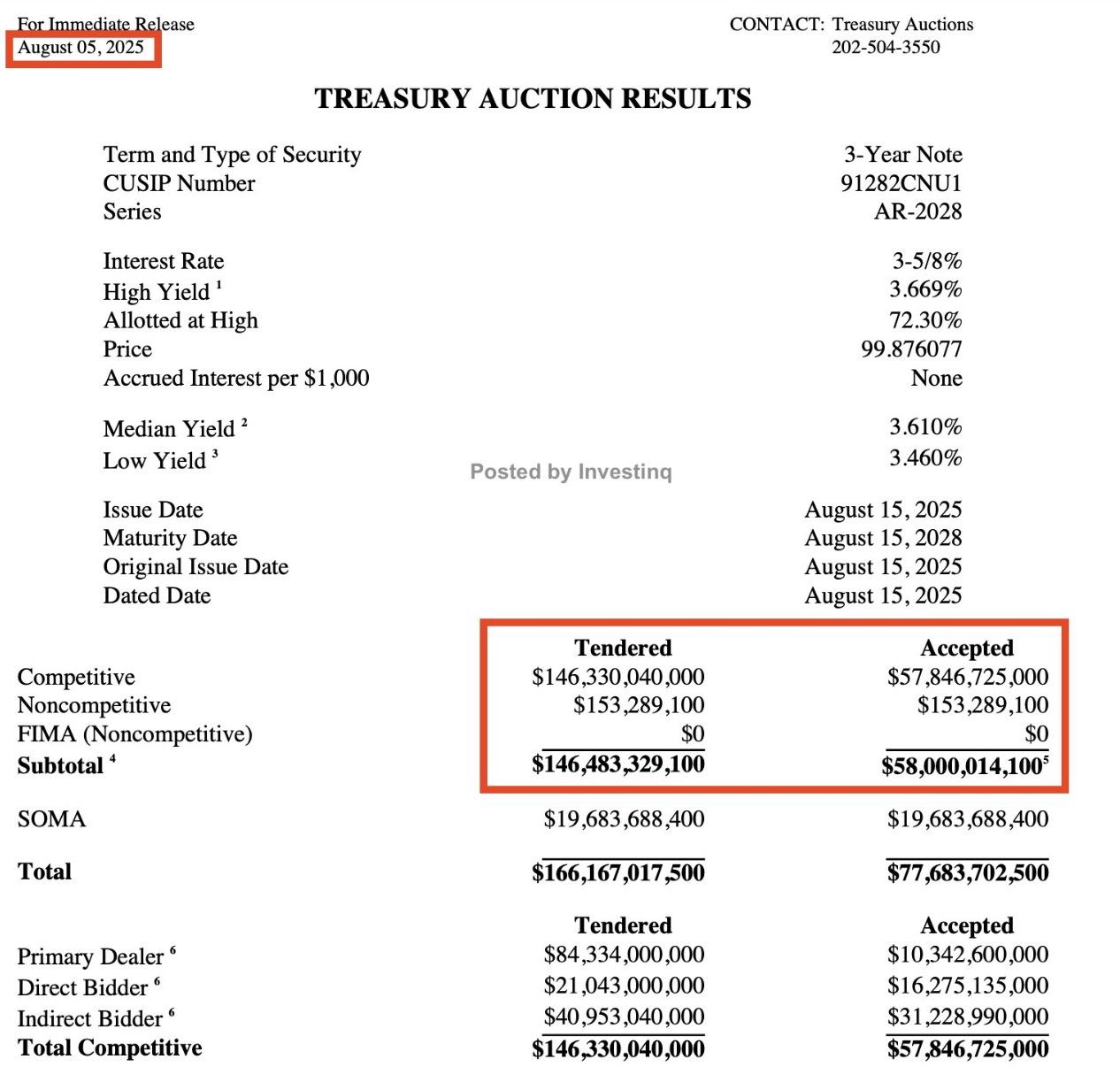

🚨 The U.S. tried to raise $58 billion and demand came in cold. Foreign demand hit a low, and big banks had to step up. This auction’s bid-to-cover ratio was 2.53. That means: for every $1 the government wanted to borrow, $2.53 was offered. Sounds healthy but what matters is who’s bidding, not just how much. Indeed, foreign buyers took 54%, their lowest share in over a year. So if foreigners are stepping back… who’s stepping in? U.S. investors (directs) who took 28% near record high. That means that US Pensions, insurance companies, and hedge funds are the ones who filled the gap. Big banks got stuck with 18%, which is not great. Despite the weak 3-year demand, the 10-year yield didn’t move much staying around 4.20%. Why? Because the market already expected this weak auction. And everyone’s watching the Federal Reserve instead. But if auctions continue to be on the weak side, things might start to become more difficult for the US Treasury, especially on longer maturities. Source: StockMarket.News on X

It is hard to see gold and other store of values as a bad long-term investment with Money Supply exploding all across the world!

Source: Andrea Lisi

Investing with intelligence

Our latest research, commentary and market outlooks