Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

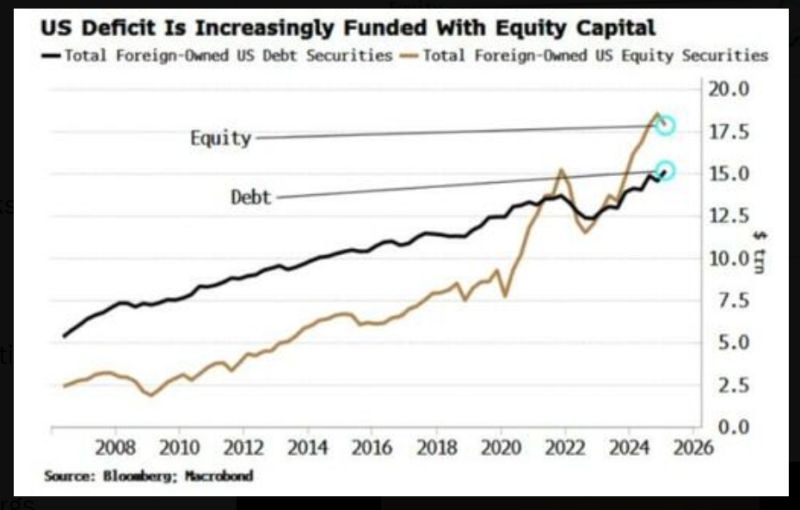

Foreign Investors now own $2.5 Trillion more in U.S. Stocks than U.S. Debt, the widest gap ever

Source. Barchart, BofA

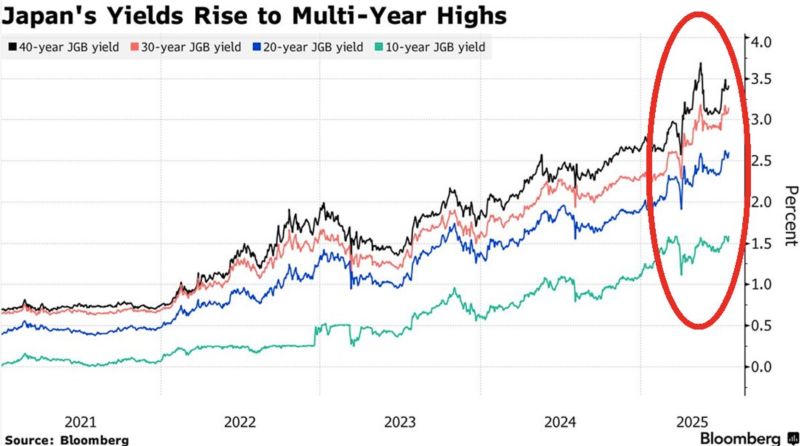

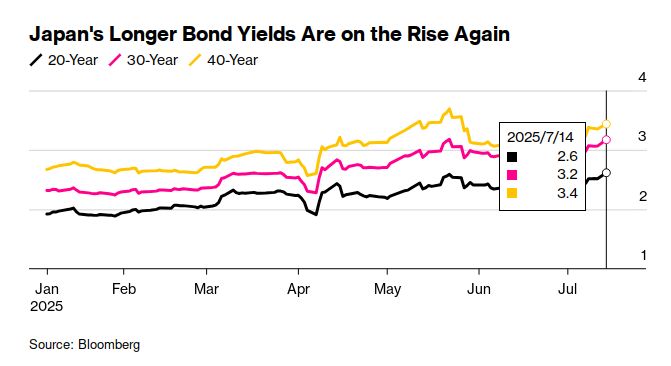

This is a GLOBAL DEBT CRISIS: Japan’s 40-year bond auction just saw its weakest demand since 2011.

The bid-to-cover ratio fell to 2.127. Yield surged to a record 3.375%. Cracks are forming in the world’s 3rd-largest bond market. Source: Bloomberg, Global Markets Investor

Japan’s 10y bond yields have jumped to their highest level since 2008, driven by growing fiscal concerns.

The spike came after President Trump announced a trade deal w/Japan. It appears Japan may be covering part of the cost of US car tariffs by using its own investment funds–essentially a partial bailout to smooth the deal. Source: Bloomberg, HolgerZ

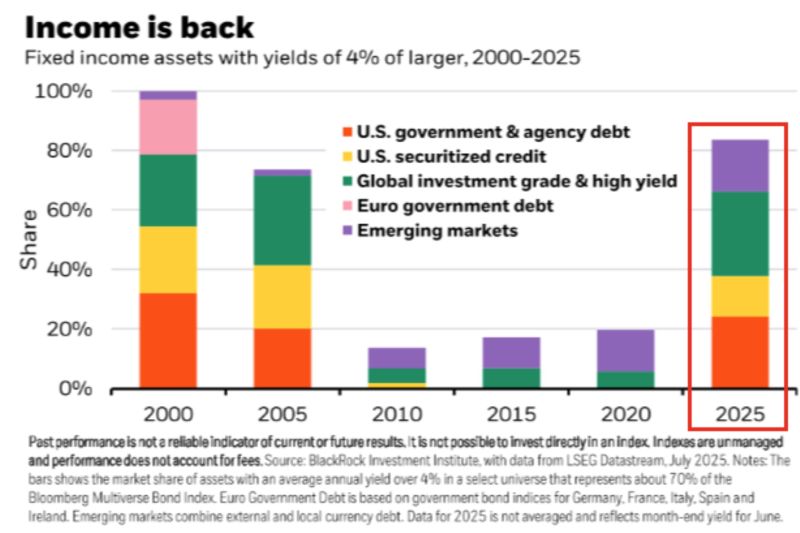

More than 80% of fixedincome assets yield above 4%.. income is back.

Source: BlackRock thru Mike Zaccardi, CFA, CMT, MBA

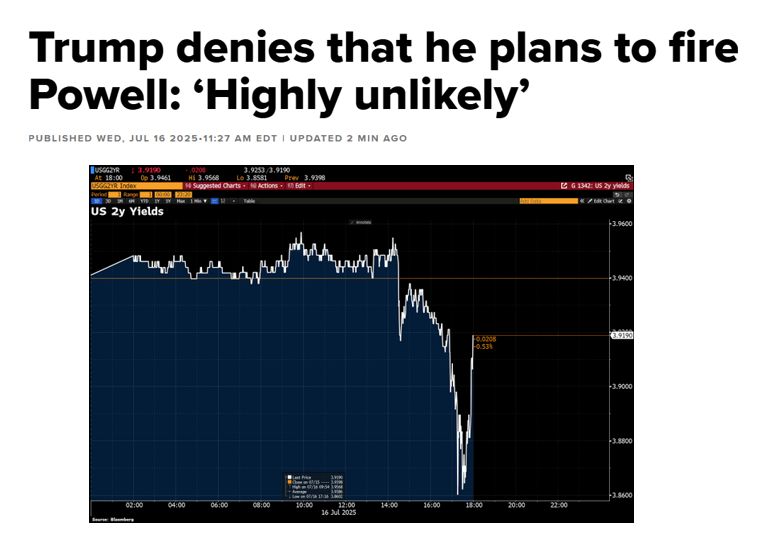

What a mess... 🤡

*TRUMP ON FED CHAIR POWELL: WE ARE NOT PLANNING ON DOING ANYTHING *TRUMP ON POWELL: WE GET TO MAKE A CHANGE IN 8 MONTHS US 2-year hashtag#yields bounced back after President Trump says his administration is “very concerned”, but “not planning on doing anything” about Fed Chair Jerome Powell. Source: CNBC, Bloomberg, HolgerZ

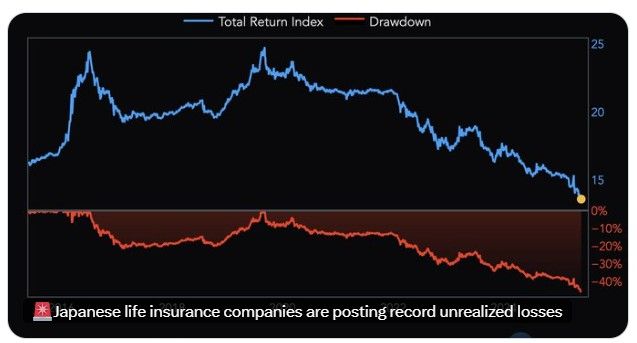

🔴 Japanese insurers' unrealized LOSSES are HUGE

▶️ The biggest insurers’ paper losses on their domestic bond holdings hit a record ¥8.5 TRILLION ($60BN) in Q1. 💥 Nippon Life, the largest insurer and the world’s 6th-largest saw ¥3.6TN ($25BN) LOSS. Source: Global Markets Investor

Yield on Japanese government hashtag#bonds are back to the highs they reached in May.

Japan was always held up by the MMT (Modern Monetary Theory) crowd as an example for how debt doesn't matter because governments can always cap yields. That view needs to be retired along with MMT. Fiscal space seems to be finite. Not infinite. Source: Robin Brooks, Bloomberg

Treasury Rate Volatility $MOVE falls to lowest level since January 2022

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks