Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

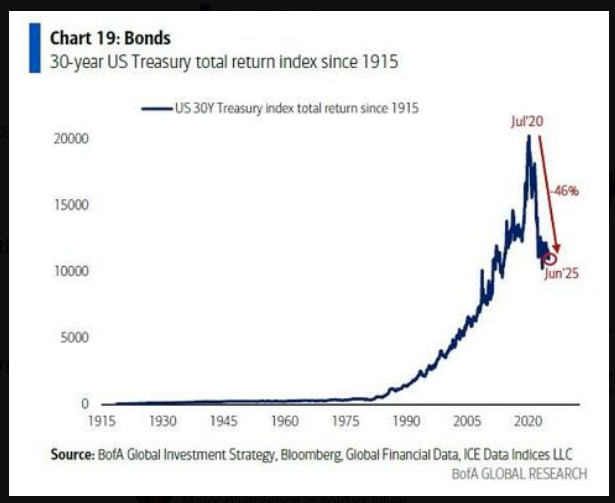

30-Year Treasury Bonds have now lost almost half their value over the last 5 years 📉

Source: Barchart

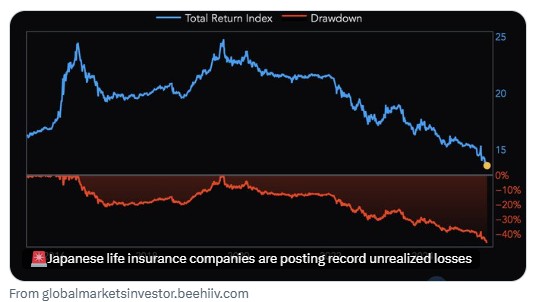

⚠️Japanese insurers' unrealized LOSSES are HUGE: Biggest 📷 insurers’ paper losses on their domestic bond holdings hit a record ¥8.5 TRILLION ($60B) in Q1. Nippon Life, the largest 📷 👇

Source: @GlobalMktObserv

Love it...

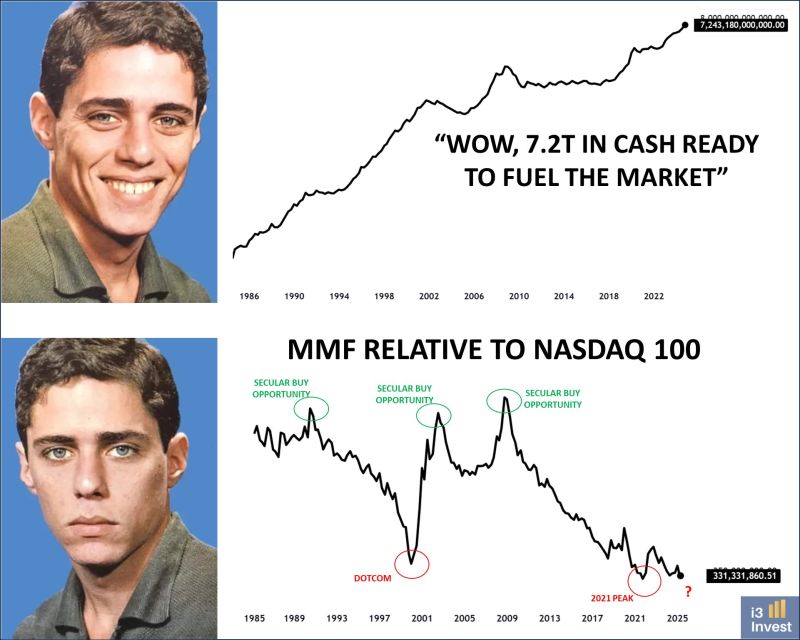

yes indeed at lots of cash in money market fund but the most important number is on the lower chart. It is a secular low relative to total assets Source: i3 invest

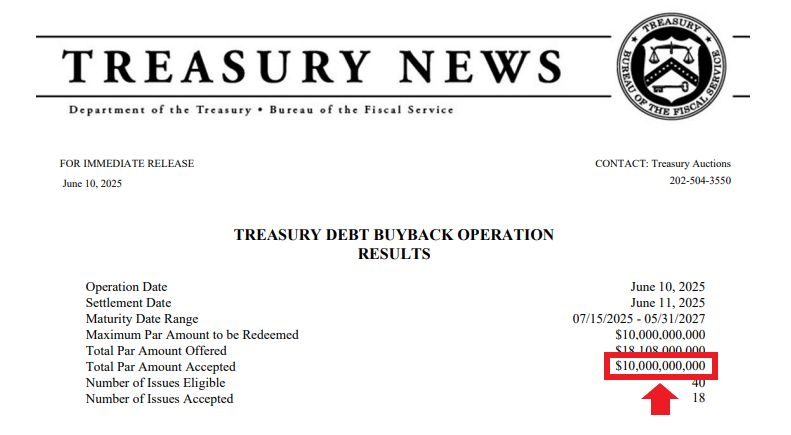

BREAKING 🚨: United States Treasury - THEY DID IT AGAIN! Japan 2.0 ???

U.S. Treasury just bought back another $10 Billion of its own debt, matching the largest Treasury buyback in history (and that was from last week)! Source: Barchart

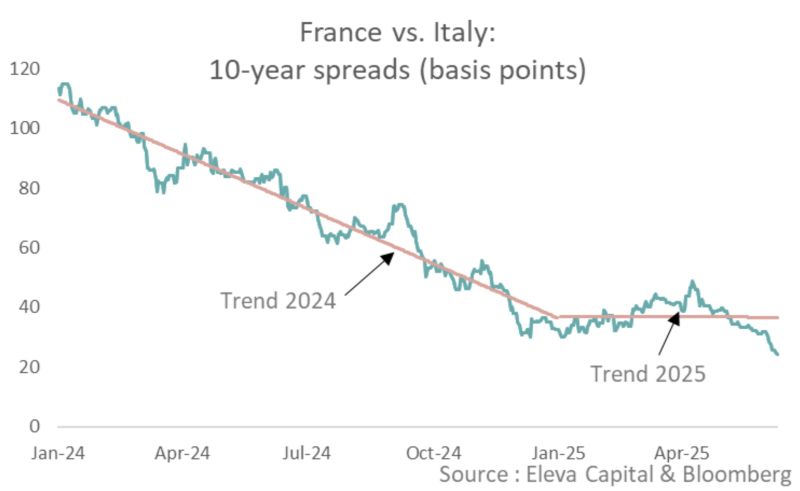

French-Italian 10y spread dropped below 25 bp this morning.

It was 115 bp at the start of last year… En route to zero? Source: Stephane Deo on X, Eleva Capital, Bloomberg

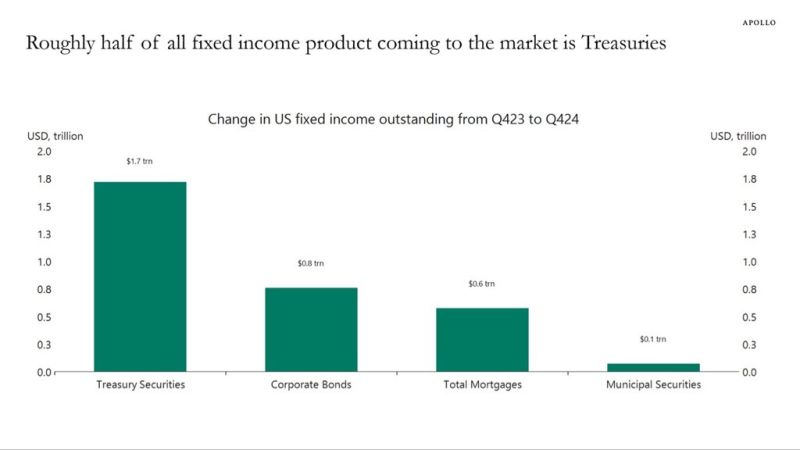

Apollo’s take on the treasury market and its implications:

👉 Over the past 12 months, roughly half of all fixed income product coming to the market has been Treasuries, see chart below. 👉 This is not healthy. Half of credit issued in the economy should not be going to the government. ➡️ The consequence is that investors need to allocate more and more dollars to finance the government rather than financing growth in the economy through loans to firms and consumers. Source: Peter Mallouk

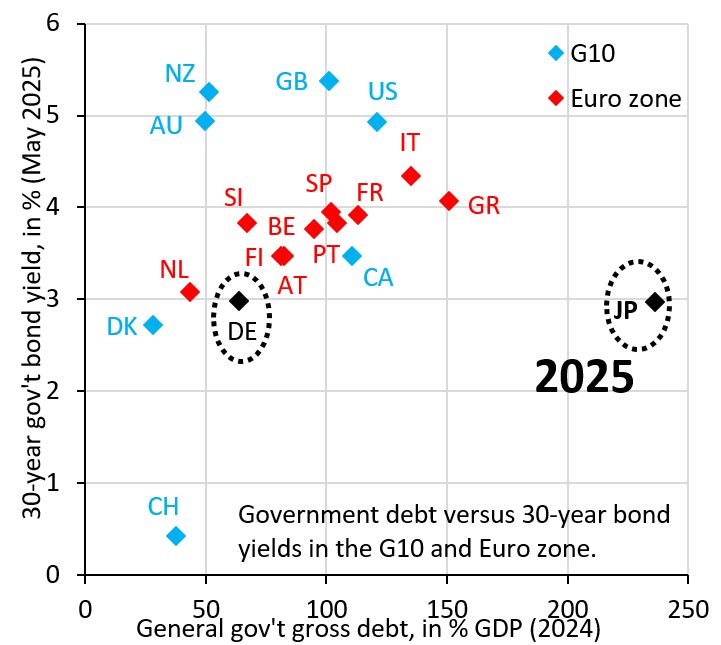

Japan's 30-year government bond yield has risen sharply in recent months and is now 3%.

That's the same yield level as Germany, but German government debt is 60% versus Japan's 240%. Japanese yields are still way too low given Japan's astronomically high level of government debt. Source: Robin Brooks @robin_j_brooks on X

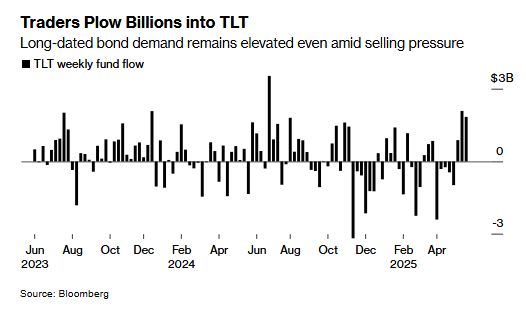

$TLT just saw a weekly inflow of $1.8 Billion, the highest inflow among all ETFs 🚨

Source: Bloomberg, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks