Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

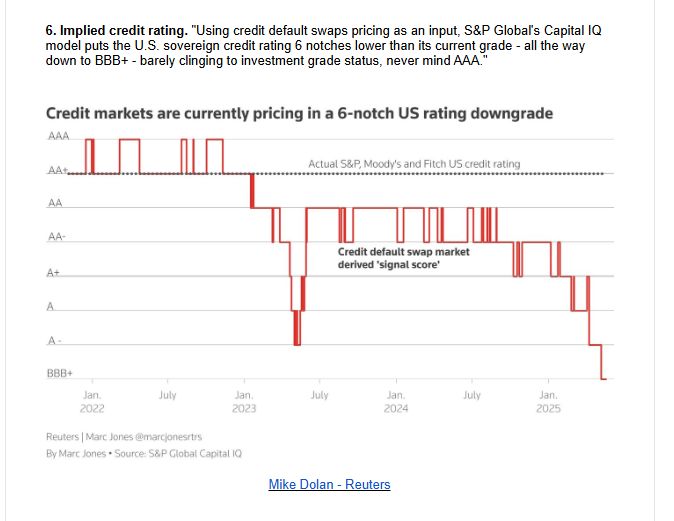

😨 A shocking chart shared by Mike Zaccardi, CFA, CMT, MBA on X

➡️ Credit markets are currently pricing 6 notches of downgrades for US sovereign credit rating ‼️ "Using credit default swaps pricing as an input, S&P Global's Capital IQ model puts the U.S. sovereign credit rating 6 notches lower than its current grade - all the way down to BBB+ - barely clinging to investment grade status, never mind AAA." Source: @dailychartbook, Mike Dolan - Reuter

‼️ Let's be realistic.

Trump 2.0 and the next administrations are never going to become fiscally responsible by cutting spending at the risk of sending the economy into a recession. 🎯 They have no other choice than devaluing the real value of your bonds. Consequence is loss of purchasing power / money debasement for those stuck in cash and bonds. What are the options available to investors / savers? 1) Spend their money now 2) Invest into high quality stocks because they’re the ones receiving all this excess spending 3) Accumulate store of values

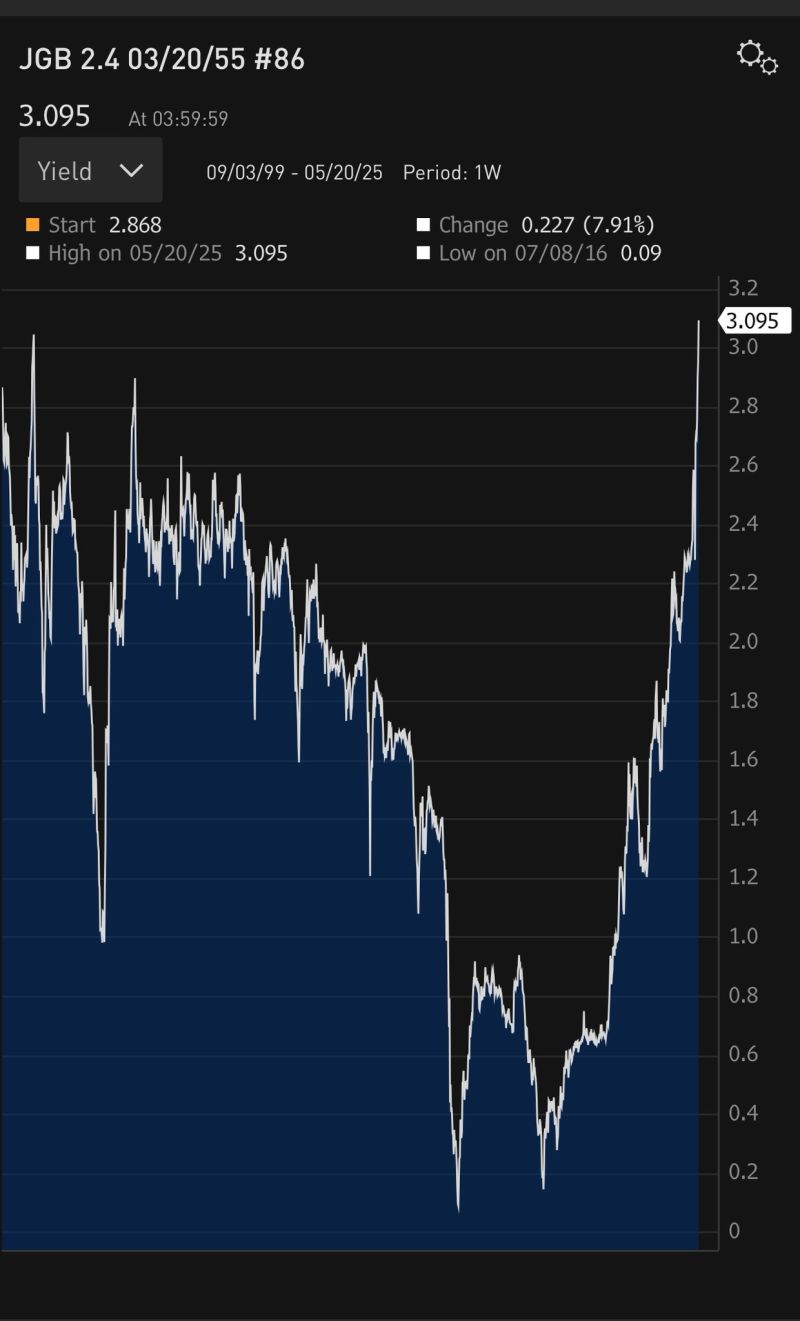

Japan’s 20-Year bond auction gets weakest demand since 2012 – Bloomberg

A slump in Japanese bonds worsened Tuesday after the weakest demand at a government debt auction in more than a decade highlighted worries over the central bank’s retreat from the market. The rout drove up the 20-year yield by about 15 basis points to the highest since 2000, while the yield on 30-year bonds climbed to the most since that maturity was first sold in 1999. Yields on the 40-year tenor rose to a record high in a sign of nervousness ahead of a sale of that debt next week. The surge in yields underscores structural challenges particular to Japan’s debt market, along with the concerns of bond investors globally about the risks posed by rising government spending. Key Japanese buyers like life insurers aren’t stepping in to fill the gap as the central bank scales back its purchases of the nation’s bonds. Meanwhile, the Prime Minister’s comparison of his own nation’s fiscal position to that of Greece this week sharpened the focus on Japan’s huge debt burden. The result is that Japan’s bond curve is the steepest among major economies, even as yields globally are being driven higher, including for US Treasuries.

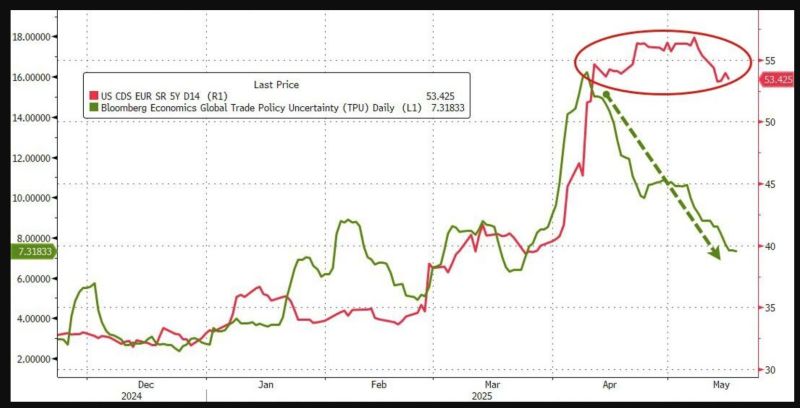

S&P 500 ekes out sixth winning day as investors look past U.S. credit downgrade.

As shown below, US CDS (red line) barely moved on the news. And any way, investors are more focus on the green line (global trade policy uncertainty) than anything else. Source: zerohedge

Is it the end game for US Treasuries?

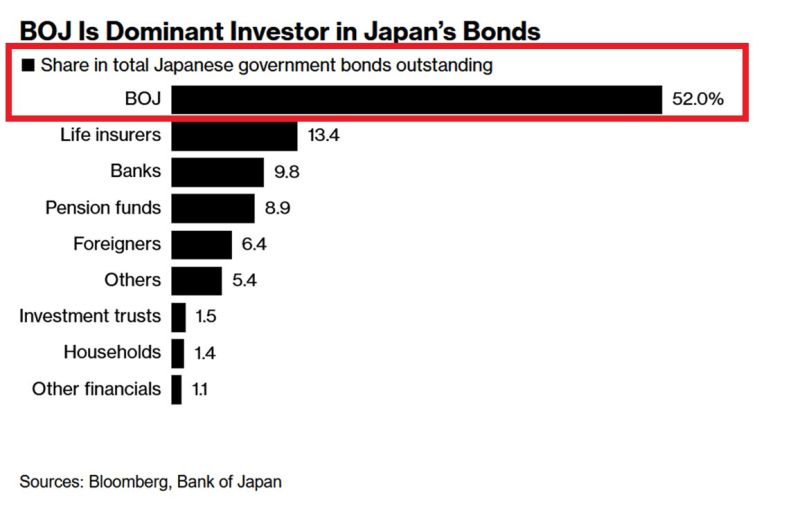

The Bank of Japan owns a whopping 52% of its domestic government bond market. Since July, the BoJ has been gradually reducing the size of its holdings. The estimated value of Japan's government debt market is $7.8 TRILLION, world's 3rd largest. Source: Global Markets Investor, Bloomberg

Thoughts on the Moody's Downgrade of the US sovereign credit rating (inspired by a tweet by Jim Bianco):

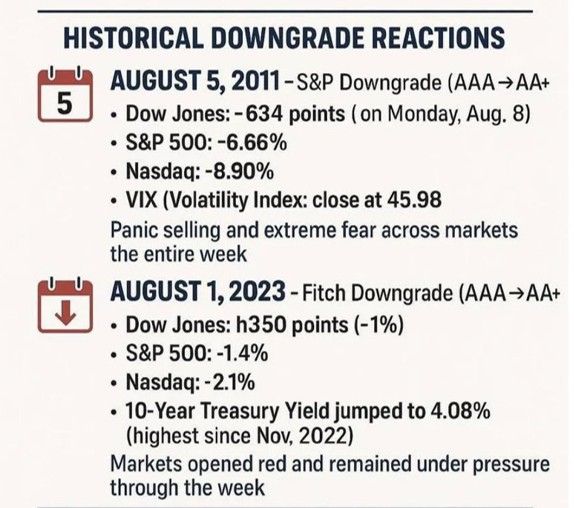

➡️ In August 2011, S&P first downgraded the US from AAA to AA+. Back then, many derivative contracts, loan agreements, investment directives, and similar documents prohibited the use of non-AAA securities. The fear was that a downgrade meant Treasuries were no longer eligible under these rules and would mean forced selling was to follow. ➡️ The 2011 downgrade left the US Split-Rated AAA (Moody's Aaa, Fitch AAA, S&P AA+). So, the US was still an AAA country and NOT in violation of these contracts. But everyone knew it was only a matter of time before the US lost its AAA status. So, in the years after 2011, those contracts were rewritten from "AAA securities" to "government securities," thereby excluding the credit rating qualification.

Global 30-Year Bond Yields from Europe to North America to Asia are all sending the same message

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks