Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

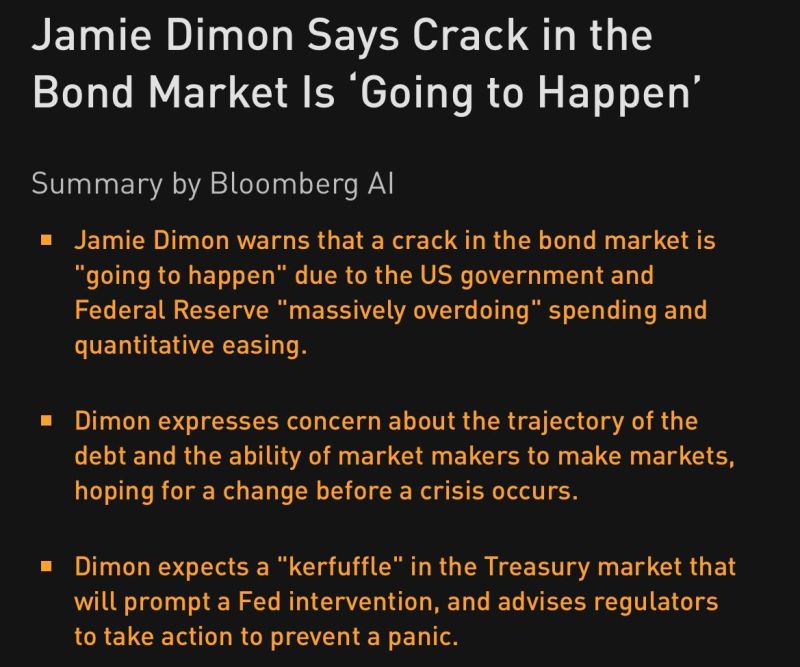

If it is the case, that means the printer is coming

Source: Bloomberg

Gold and JGBs 30y yield...

Wonder why gold was down yesterday? Japanese bond yields tumbled, as according to Reuters, Japan's Ministry of Finance (MOF) will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance... This was enough to fuel some profit taking on the yellow metal Source. The Market Ear

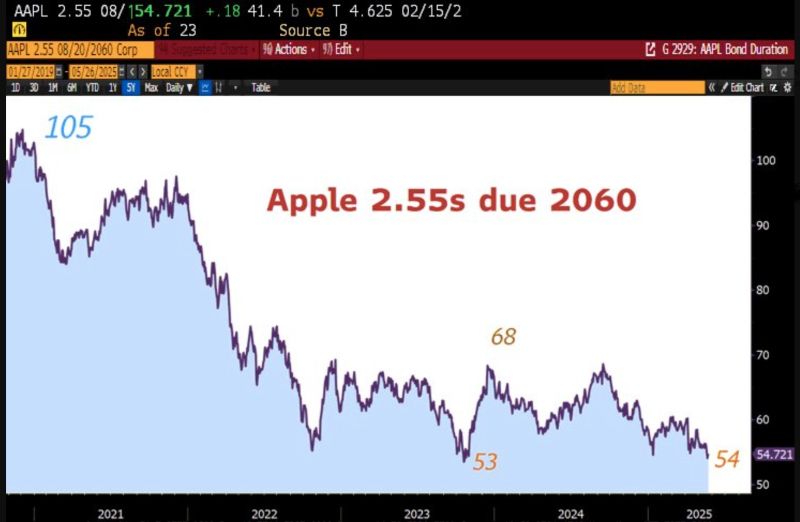

When you think bonds are safe...

This is not a sh*tcoin... This is Apple bond maturity 2060. Drawdown from peak to through is Source chart: Lawrence McDonald, Bloomberg

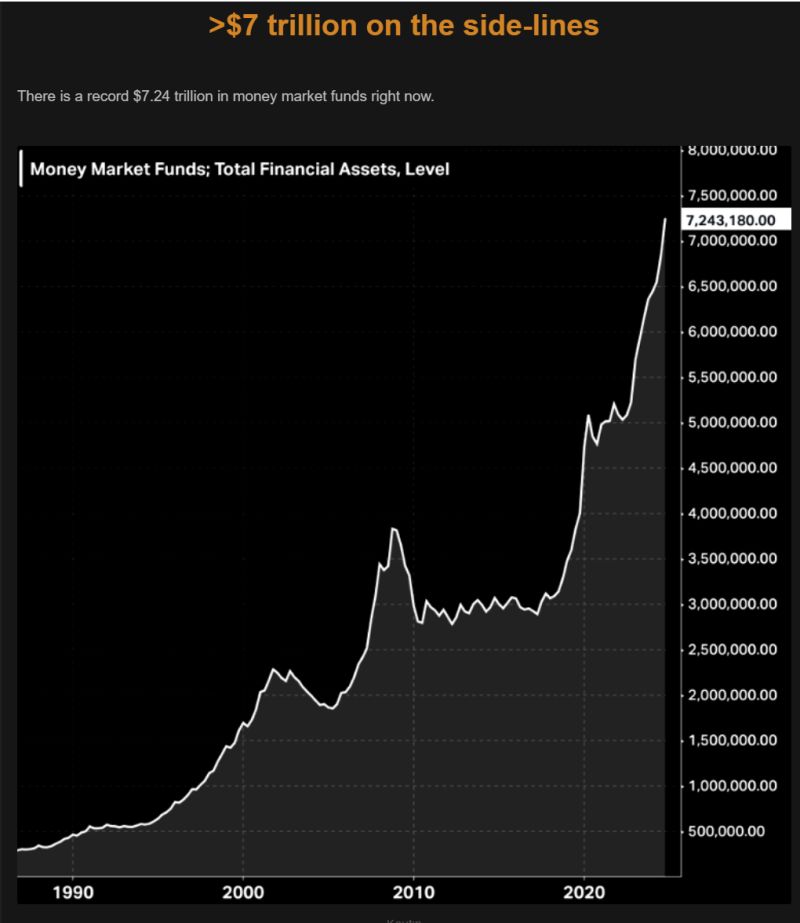

Don't forget... There is more than $7 trillion in money market funds right now.

Fresh dry powder on the side-lines... Source: The Market Ear

It’s time to stop looking at real yields to determine gold price...

Source: Michel A.Arouet

In case you wonder why stocks when down yesterday

BOND AUCTION FOR THE US 20-YEAR TREASURIES WAS UGLY Because of the lack of bidders…it caused the 20-year bond yield to surge to 5.1%. Stock markets didn't like it Source: amit @amitisinvesting

Are rising bond yields the elephant in the room for equities?

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks