Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The UK faces the doom loop of rising borrowing costs, growing deficits and a government facing a lot of bad choices to raise revenues

Yields on 30-year gilts have reached their highest levels since 1998. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

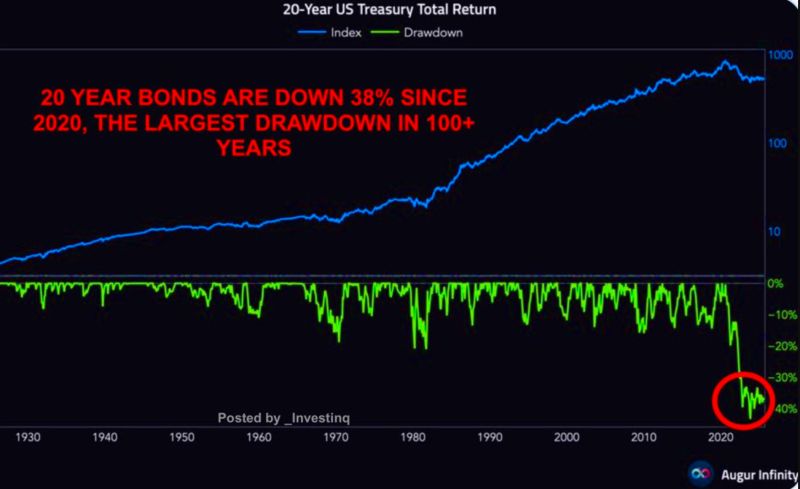

20-year US Treasuries are down ~38% since 2020, the worst drawdown in over a century

What was once seen as the world’s “safest” asset has instead delivered stock-like volatility. Deficits, inflation, and weak demand are forcing long yields higher. Source: stockmarket.news on X

Credit spreads have rarely been this tight.

So why are investors in corporate bonds undeterred despite the significant tightening in risk spreads (chart below)? Two reasons: 1) Higher yields ("risk free" component + spreads 2) More and more investors see corporate bonds as less risky than sovereign bonds Source chart: Bloomberg

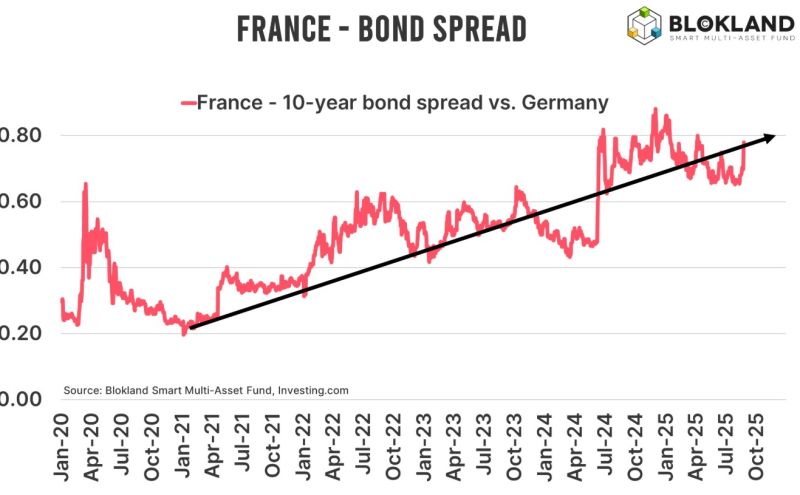

France has done nothing to stabilize its fiscal deficit & debt/GDP.

It already has the highest tax burden in Europe. These higher taxes would throttle growth potential even more. With its political paralysis it won’t cut spending neither. Next confidence vote is coming. And OAT spreads seem to start reflecting that. Source: Michel A.Arouet, INSEE

Prime Minister Bayrou is calling for a confidence vote, risking another collapse of the French government.

OAT-Bund spread keeps widening Source: Blokland Research

The German yield curve is steepening.

The gap between 2-year and 30-year bond yields has widened to its highest level since 2019 — driven by growing concerns over a looming surge in German government debt. Source: Bloomberg, HolgerZ

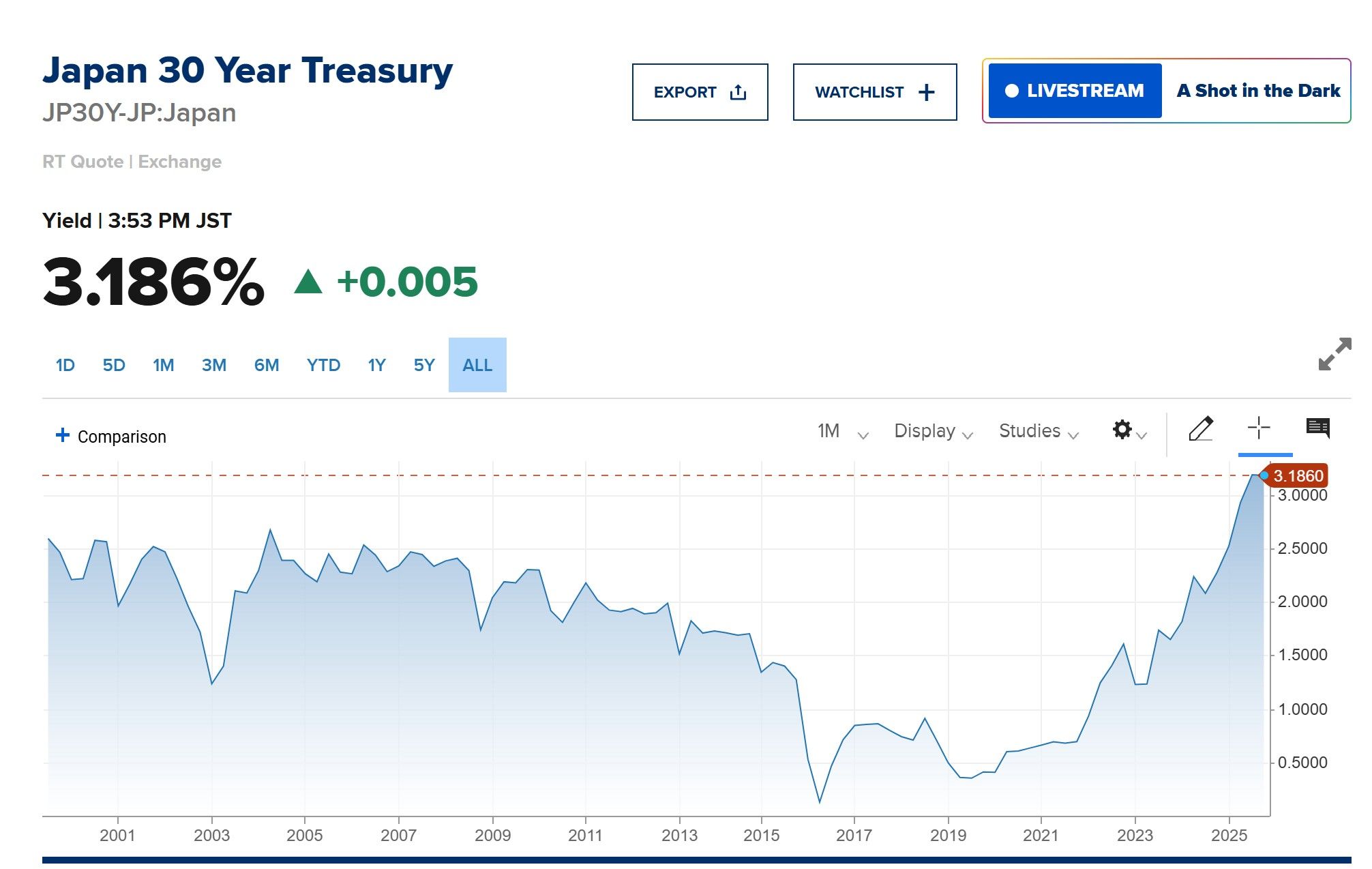

Japan’s 30-year bond yield has spiked to 3.18% - the highest level on record.

A preview of what’s coming for the US if we they don’t get our deficit/debt spiral under control ? Source: CNBC

US Treasury 10y/30y yield curve is at the highest level since September 8, 2021.

Source: Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks