Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

India is set to welcome billions of dollars of foreign inflows when JPMorgan adds the country’s sovereign debt to its emerging markets index on Friday

A move that some analysts say will leave it more vulnerable to fickle flows of hot money. The inclusion of India marks the first time the bonds of the world’s fastest-growing large economy have been included in a major benchmark and is the latest move to open up a once closed-off market. It was only in 2020 that India removed foreign ownership restrictions on some rupee-denominated debt. The inclusion of 28 government bonds worth more than $400bn will give India a 10 per cent share of the widely tracked measure, according to JPMorgan. About $11bn has flowed into Indian bonds as investors position themselves ahead of the formal inclusion, according to Goldman Sachs. The bank expects a further $30bn to arrive as the bonds are gradually incorporated into the index over the next 10 months, raising foreign ownership from around 2 per cent to about 5 per cent. Source: FT Link to the article >>>

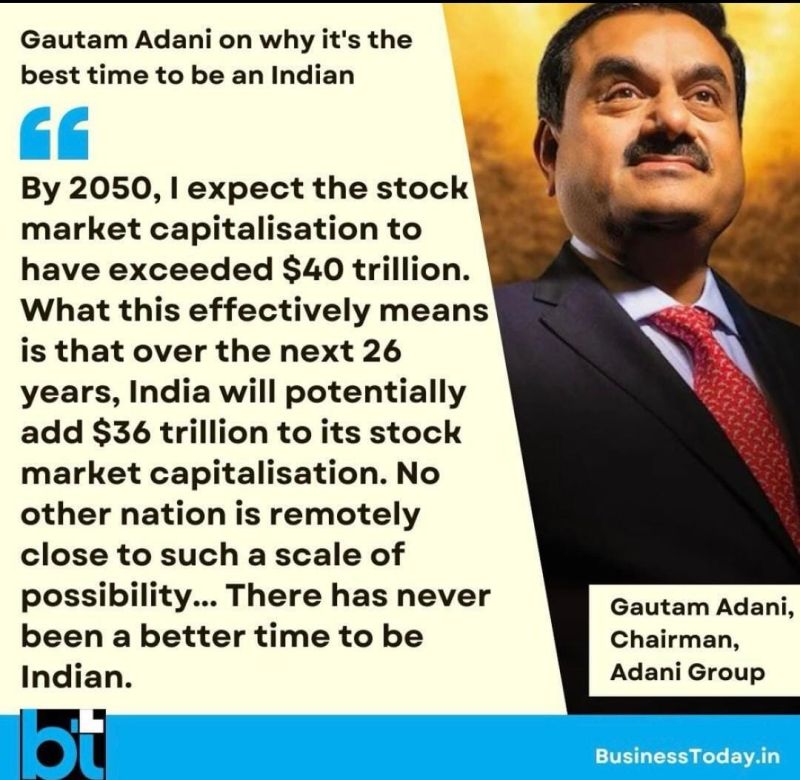

Gautam Adani is uber-bullish on indian equities "There has never been a better time to be Indian"

Source: Nikhil Oswal

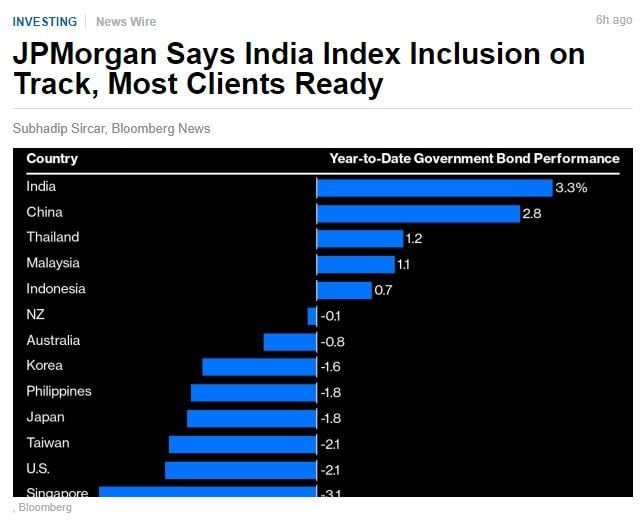

JP Morgan Says India Index Inclusion on Track, Clients Ready.

Firm expects $20 billion to $25 billion of foreign inflows JPMorgan Chase & Co. is on track to include India in its emerging market debt index from June with most of its clients ready to trade despite some “teething issues,” according to the firm’s global head of index research. The difficulty in setting up to trade in India due to an elaborate documentation process has been one reason why foreign investors have been apprehensive about the nation’s entry into global indexes. Last September, JPMorgan said it would include India in its emerging market bond index, where it will have a maximum weight of 10%. JPMorgan estimates foreign inflows will be between $20 billion and $25 billion, assuming an index-neutral position, Kim said. The firm estimates its emerging-market bond gauge currently has $216 billion of assets under management, she added. India’s entry into global bond indexes will open up an insular market where foreigners own just over 2%, helping develop another investor base. It also adds to the growing heft of the nation and its financial markets, which are seen as the next driver of global growth amid China’s economic woes. Indian sovereign bonds have seen about $8 billion of inflows into the so-called Fully Accessible Route securities since the JPMorgan announcement, though there were some outflows in April amid a global debt selloff. A Bloomberg gauge of the bonds has outperformed major peers this year. Source: BNN

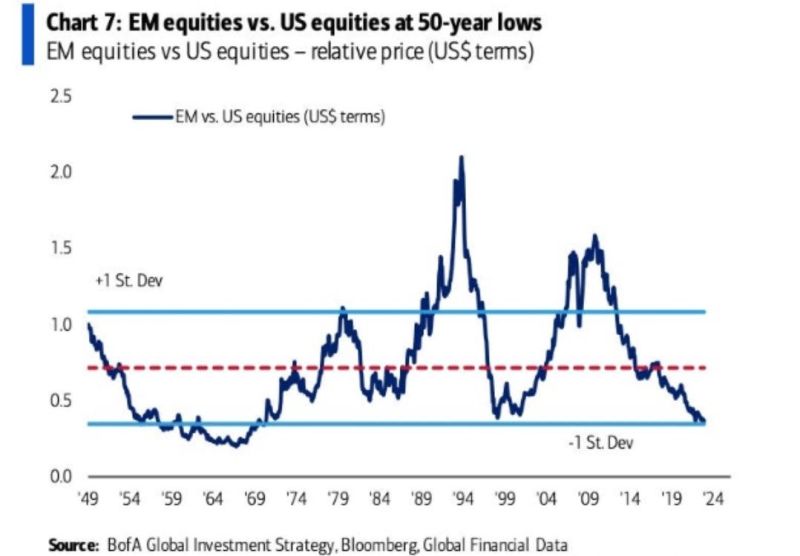

US big tech revolution steamrolling emerging markets equities in one chart.

What would make this trend reverse? Source: BofA, Michel A. Arouet

The Imminent Inclusion of Indian Sovereign Bonds in EM Bond Indices is Attracting Huge Foreign Inflows👇

Source: Neha Sahni, JP Morgan

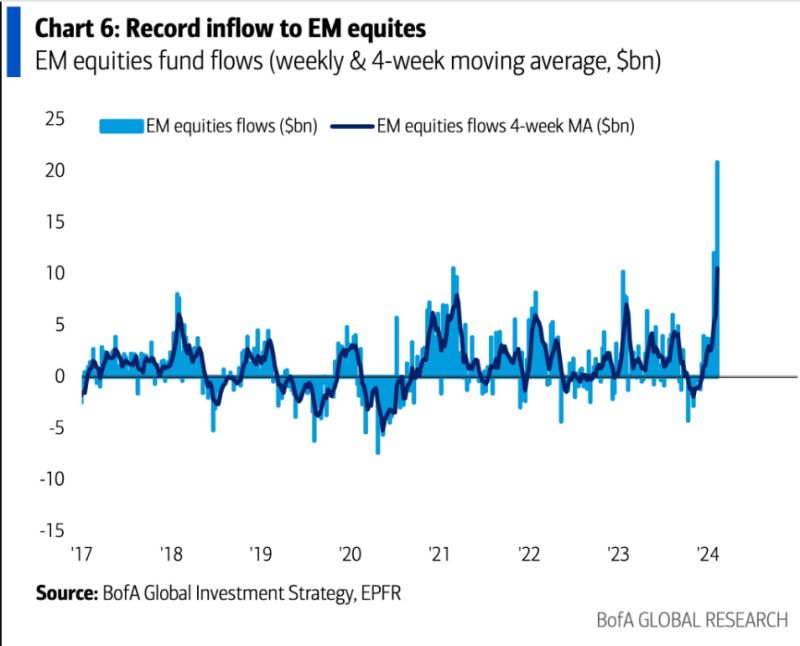

Record inflow to EM equities

Emerging Market Stocks see a weekly inflow of $20.8 billion, the most in history source : BofA, barchart

Egypt: The currency is in free-fall

Black market rate: 1 dollar = 70 pounds Official rate: 1 dollar = 30.9 pounds The pounds has weakened by nearly 24% in the market in 2024. Egyptian billionaire Naguib Sawiris criticized delays in enacting a long-awaited devaluation of the pound, suggesting authorities match the spiraling black market rate to end the nation’s chronic foreign-currency shortage. Postponing reforms is “a disaster that will increase the extent of the critical situation we are in,” Sawiris said in an Arabic-language post on social media platform X. Egypt’s pound has plunged on the parallel market to 68-70 per dollar in recent days, leaving it more than 50% weaker than the official rate of about 30.9. Source: Bloomberg, Ziad M Daoud

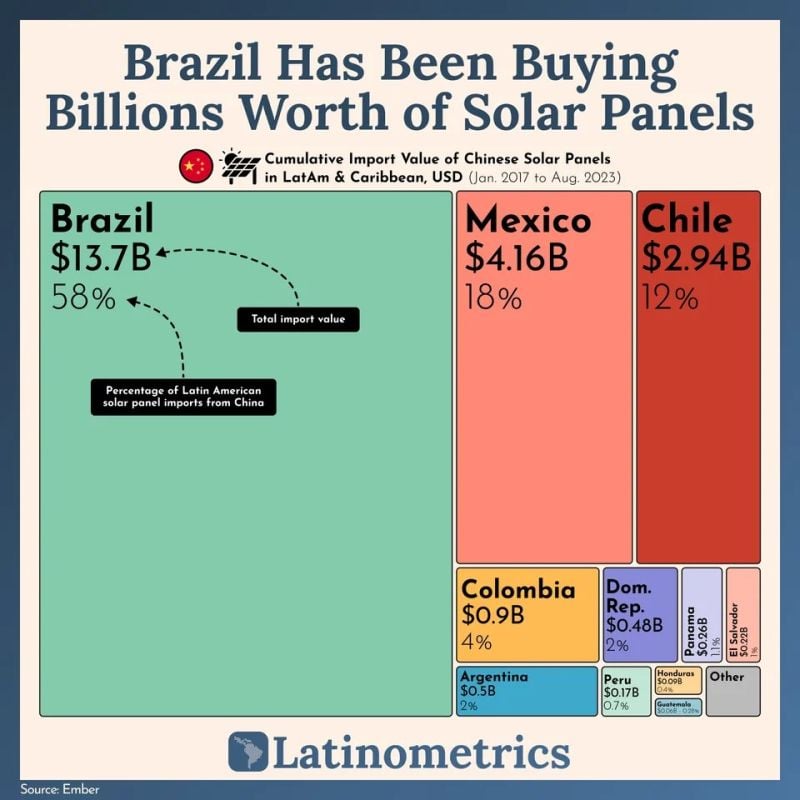

Did you know that Brazil has been leading Latin America in solar panel purchases? 🤔

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks