Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

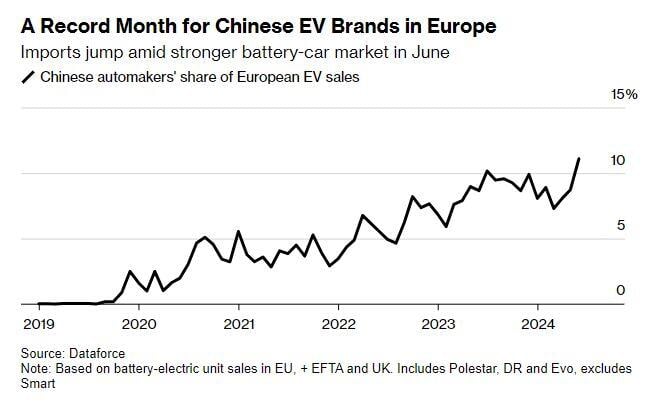

Chinese EVs Seize Record 11% Share in Europe Ahead of Tariffs - Bloomberg

Chinese brands captured 11% of the European electric-car market in June, notching record registrations as manufacturers raced to beat stiff European Union tariffs that took effect early this month.

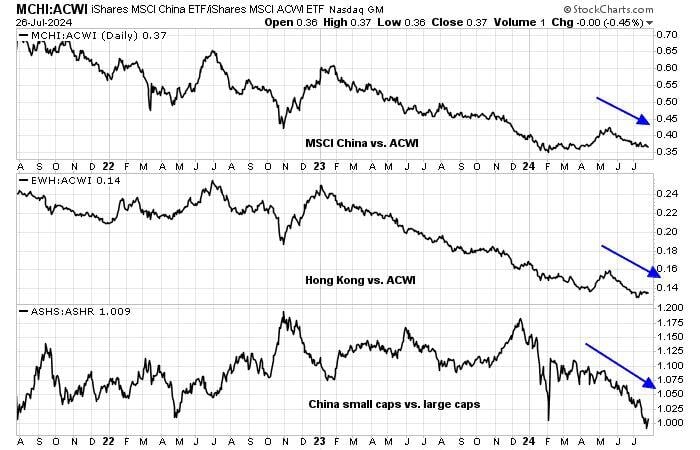

Remember when China had a huge rally in April and May?

Nice chart from @HumbleStudent showing relative strength rolling over again. Source: Ryan Detrick on X

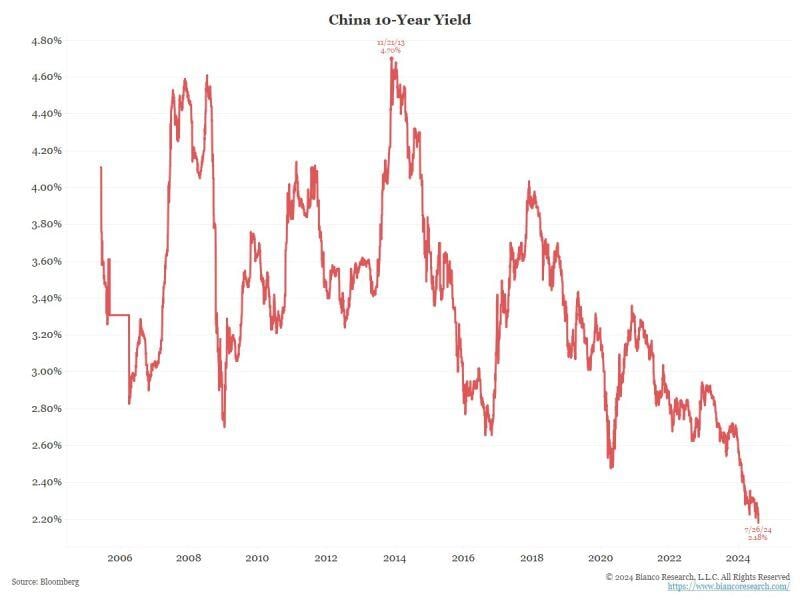

CHINA 10-YEAR YIELD FALLS TO A FRESH RECORD LOW

So, what is the Chinese bond market signaling about the Chinese economy? Source: Bianco research

India quickly catches up to China as the world’s largest emerging market.

Indian stocks comprise nearly 20% of the MSCI Emerging Markets index, while China has dropped to a quarter from 40% in 2020. The narrowing gap has become one of the biggest issues for investors in emerging markets this year as they debate whether to put capital into an already red-hot Indian market, or into Chinese stocks that are relatively cheap, but are being hit by an econ slowdown. https://lnkd.in/ddkSqFy5 Source: FT, Charlie Bilello

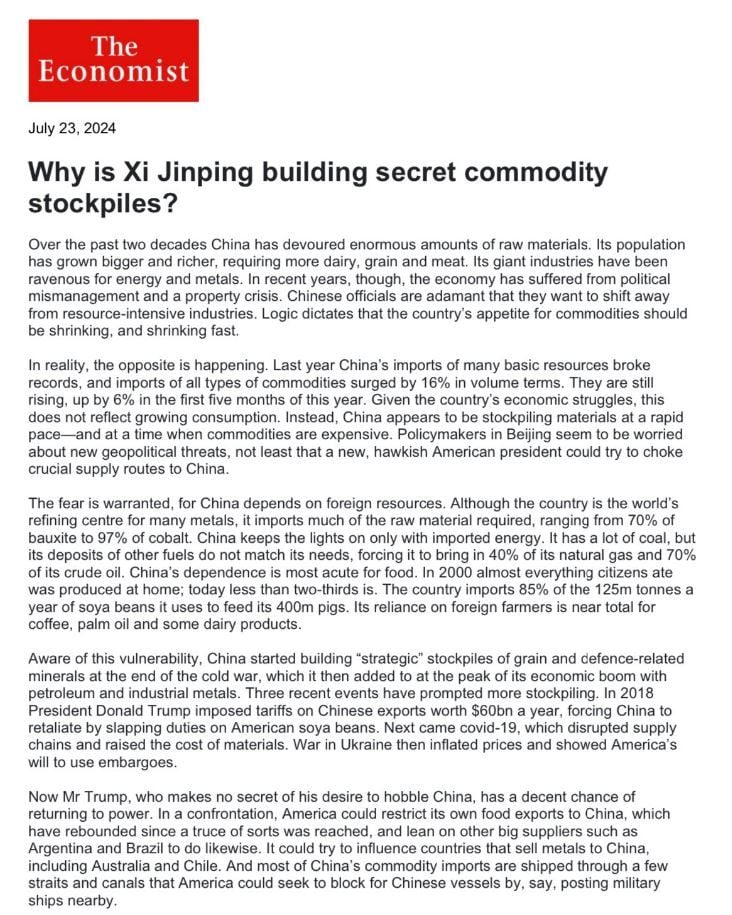

China commodity stockpiles

Source: Robert Friedland on X, The Economist

India’s dependence on Chinese imports keeps growing:

• In 2023-24 financial year China edged past the US to reclaim its position as India’s top trading partner • India’s imports from China rose by 56% since 2020, fuelling a 75% rise in country's trade deficit with China Source: Agathe Demarais, The Economist

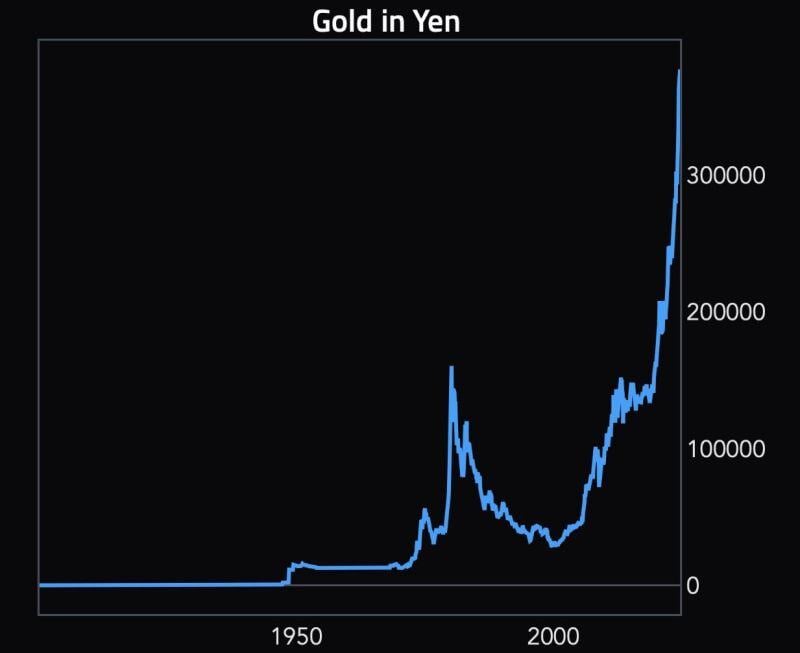

Remarkable chart: gold in yen.

No further comments necessary. Source: Michel A.Arouet, Ht @AugurInfinity

Forward P/E Ratios of Key Global Stock Markets - Clad Bastion research on X

India: 24 Denmark: 23 United States: 21 Taiwan: 18 Switzerland: 17 Netherlands: 17 Australia: 17 Saudi Arabia: 16 Sweden: 16 Japan: 15 Canada: 14 France: 14 Germany: 12 Mexico: 12 United Kingdom: 12 Spain: 11 South Korea: 10 Hong Kong: 10 South Africa: 9 Italy: 9 Brazil: 7 China: 6 Turkey: 5

Investing with intelligence

Our latest research, commentary and market outlooks