Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

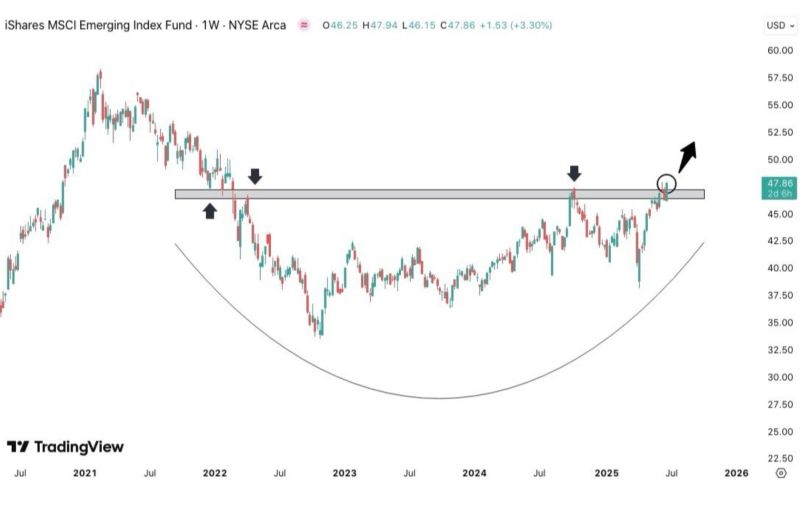

Emerging markets $EEM are breaking out to 3-year highs.

Source: Ross J Brown RJB Financial Direction Limited

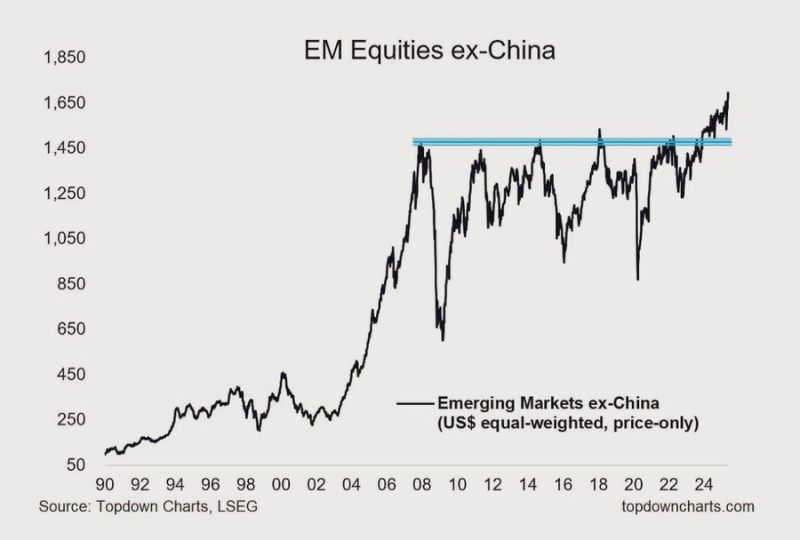

A clean multi decade breakout?

Source: The Long View, @HayekAndKeynes

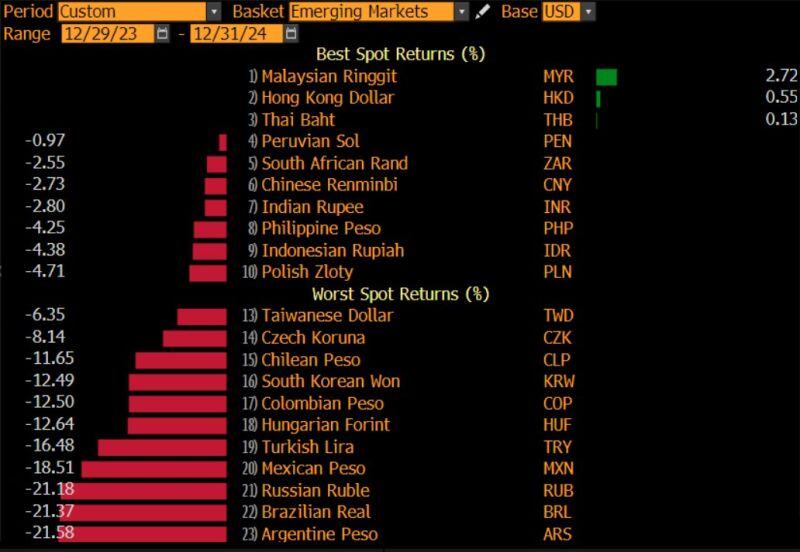

This is EM currency performance versus the Dollar in 2024. The 3 worst performers are: (i) Argentina's Peso; (ii) Brazil's Real; (iii) Russia's Ruble.

Source: Bloomberg, Robin Brooks

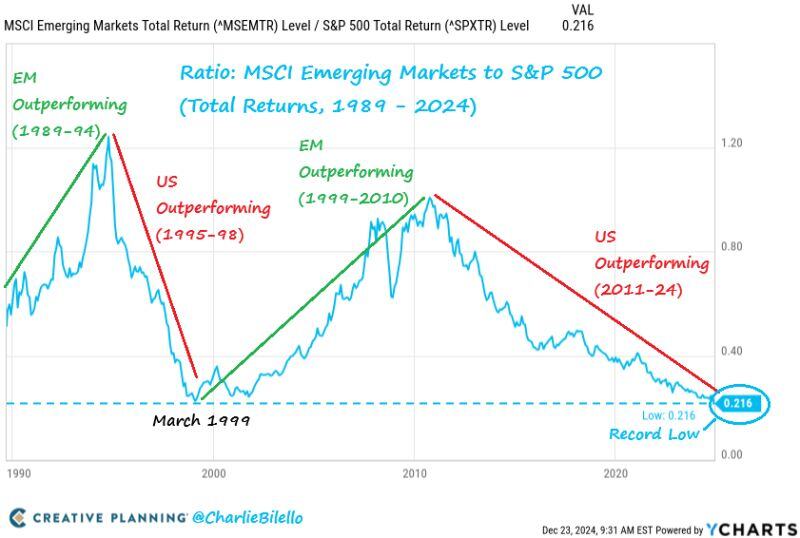

The Ratio of Emerging Markets to US Equities is now at an all-time low, breaking below the prior low from March 1999.

Source: Charlie Bilello

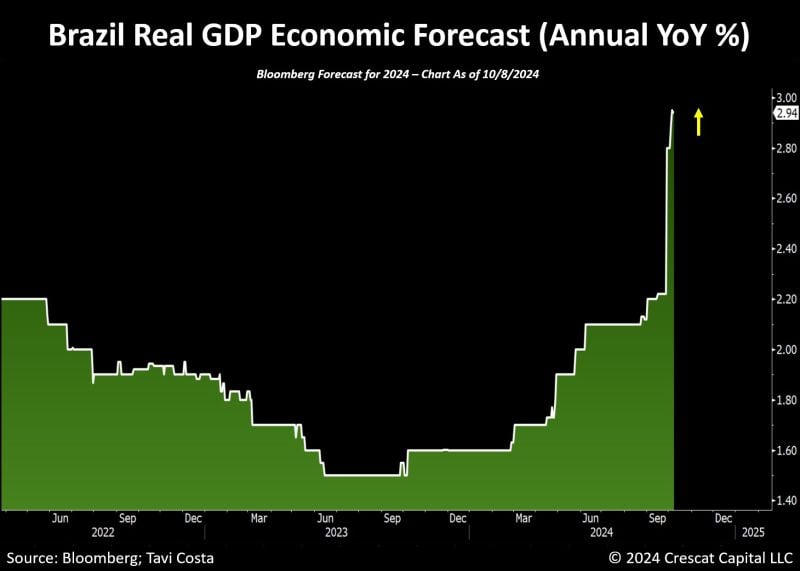

Meanwhile: Very significant upward revision in the real GDP forecast for Brazil this last month.

Source: Tavi Costa, Bloomberg

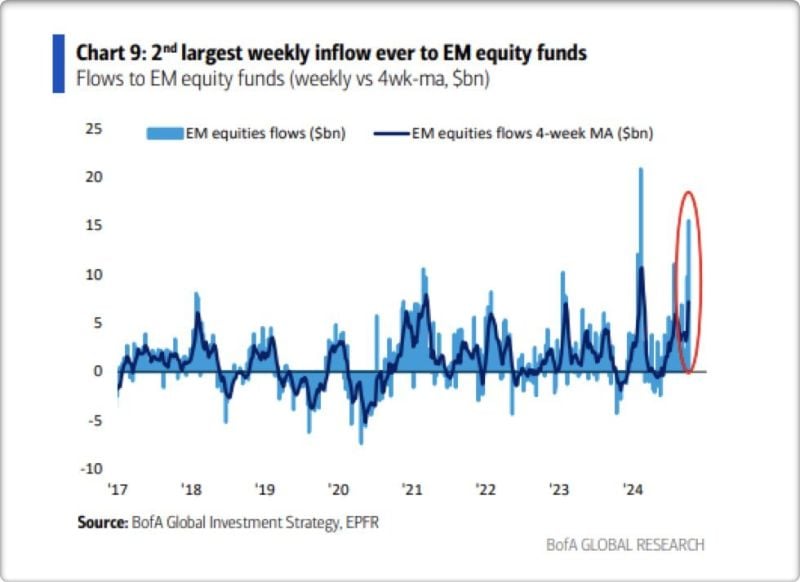

The come-back of emerging markets equities?

We just witnessed the 2nd largest weekly inflow to EM equity funds ever according to BofA / EPFR fund flows data. Among the tailwinds for EM equities: weaker dollar, Fed cutting rates, room for EM central banks to ease monetary policy conditions, China stimulus and cheap valuations. Source: BofA, @ackmeni on X

GS: South Africa, Commodity heavy EMs (Peru, Chile), and North Asian equity markets have the highest sensitivity to China growth

Source: Mike Zaccardi, CFA, CMT 🍖, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks