Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

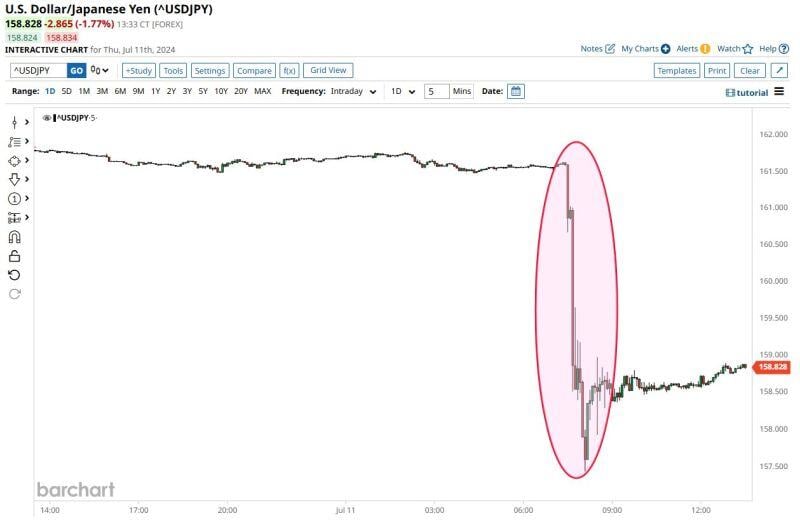

Is the Bank of Japan intervening again trying to prevent the Yen from falling further against the U.S. Dollar?

barchart

🚨 JUST IN: China suspends its largest facilitator of short-selling in order to preserve market stability

Source: barchart

The East-West divide: some evidences of the Saudi/Russia/China emancipation vs. the West

Source: Bloomberg

India increases gold reserves by the most in 2 years

Source: Barchart

How India's rupee went from most to least volatile currency in Asia

Source: Bloomberg

Modi's budget could send India stocks soaring higher

Source: Blomberg

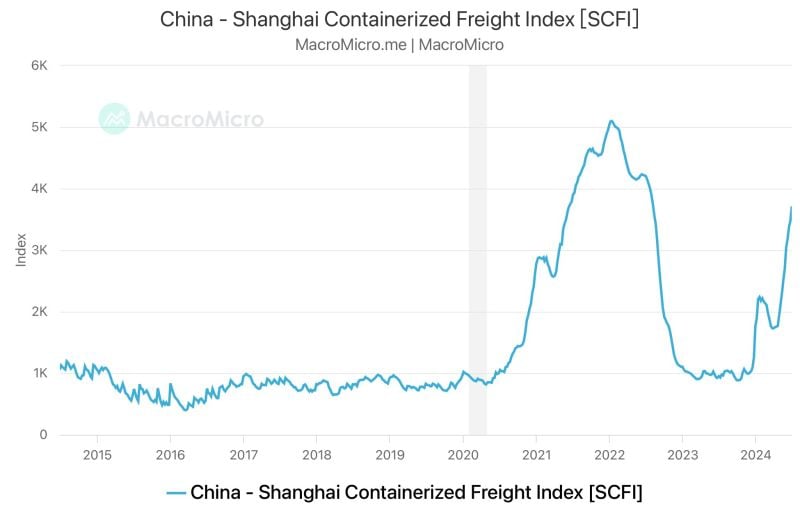

Shanghai Containerized Freight Index (SCFI) keeps climbing, rising another 6.87% to 3714.32 points.

It has now increased for 12 consecutive weeks, reaching its highest level since early 2022. Source: MacroMicro

Investing with intelligence

Our latest research, commentary and market outlooks