Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

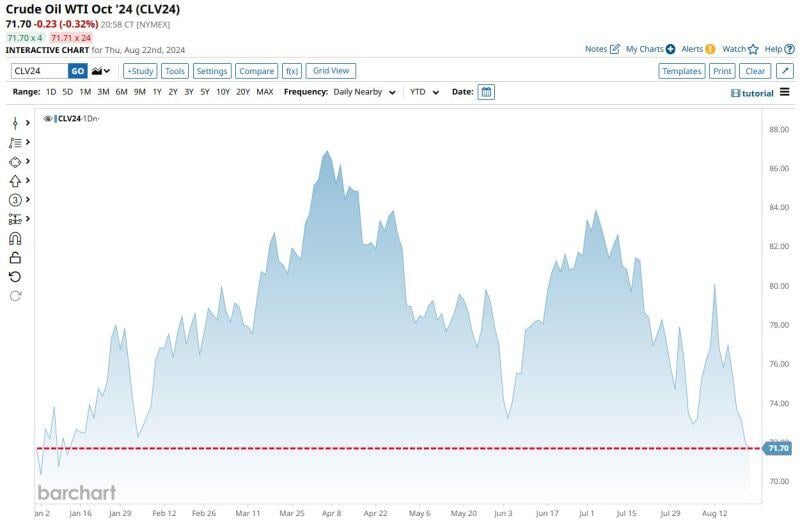

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is buying the dip still the best strategy? The average return when buying the dip in the S&P 500 varies based on timeframe.

Within 6 months of buying a -10% decline, the average return has been +13% compared to a +4% return when holding stocks through the pullback and recovery. Within 12 months, the "buy the dip" strategy has returned a +22% gain, beating a +5% return with the buy and hold strategy. On the other hand, buying dips over a 5-year period has returned +33%, well below a +75% from simply holding. In other words, buying the dip has been a successful strategy during periods of market volatility.

An important chart by J-C Parets >>> High Beta outperforming Low Volatility stocks is usually something we see in healthy market environments.

This year, however, High Beta has been struggling to make any progress vs their Low Volatility counterparts. "Beta" is essentially how volatile a stock is relative to its benchmark. So High Beta think $SMCI, $NVDA, $AMD, etc.. You have half the S&P500 High Beta Index in Technology and another 17% in Consumer Discretionary. In contrast, for Low Volatility think Berkshire Hathaway, Coca-Cola, Visa, Procter & Gamble. You'll find a lot of Financials, Consumer Staples, Utilities and Industrials in this group. Source: J-C Parets

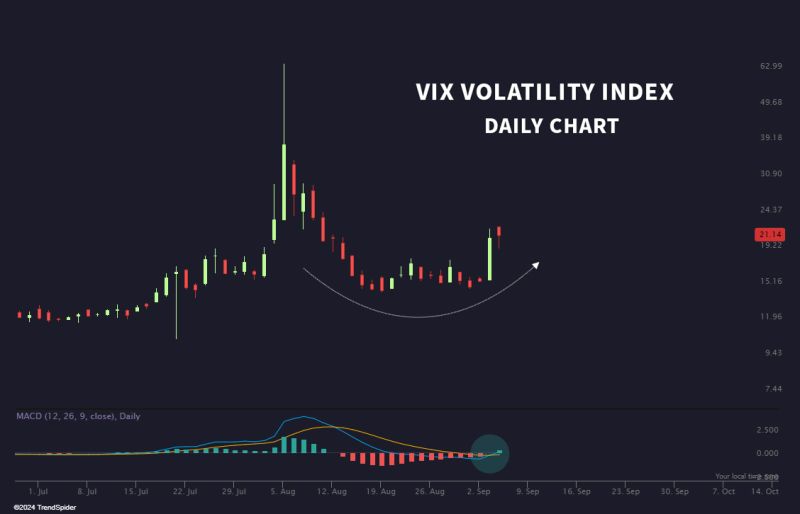

Is the VIX preparing for another pop?

$VIX During an election year, it is the norm for volatility to pick up in September. Source: Trend Spider

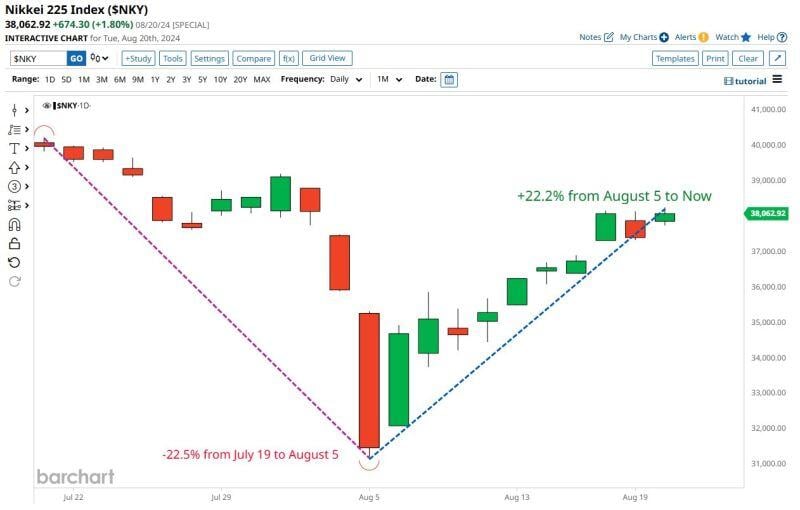

Japanese Stocks have both fallen and risen more than 20% in the last month

Source: barchart

Short Volatility etf $SVIX Assets Under Management are surging

Aug 2024: $600M Q1 2024: $140M Q1 2023: $88M Q1 2022: $22m Source: Bloomberg, Lawrence McDonald

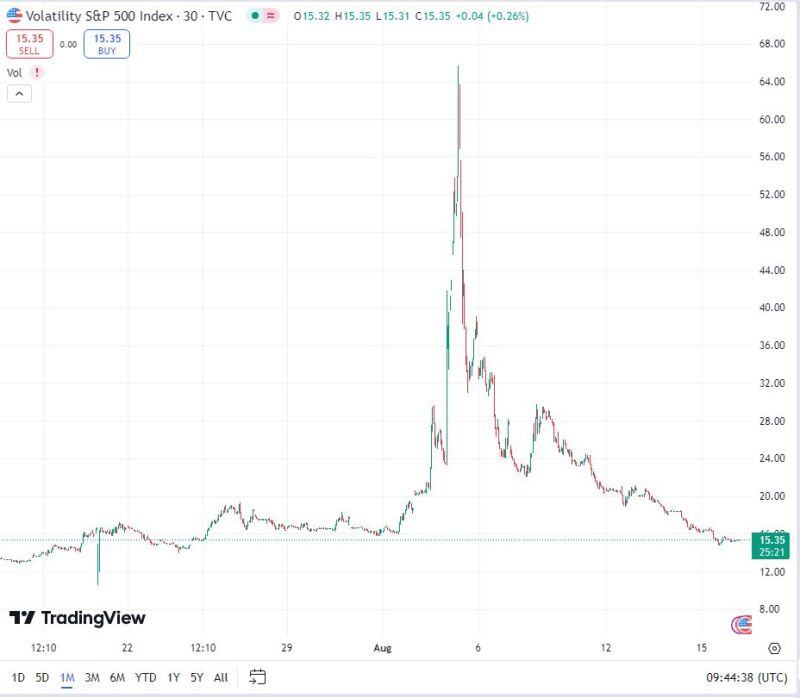

Fear Index Vix dropped 27.3% this week, most since Nov 2023 as recession fears have faded and bulls are firmly back in control of the narrative.

Source: Bloomberg, HolgerZ

The VIX is now LOWER than it was before August 1st.... what a round trip...

Source: TradingView

Investing with intelligence

Our latest research, commentary and market outlooks