Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

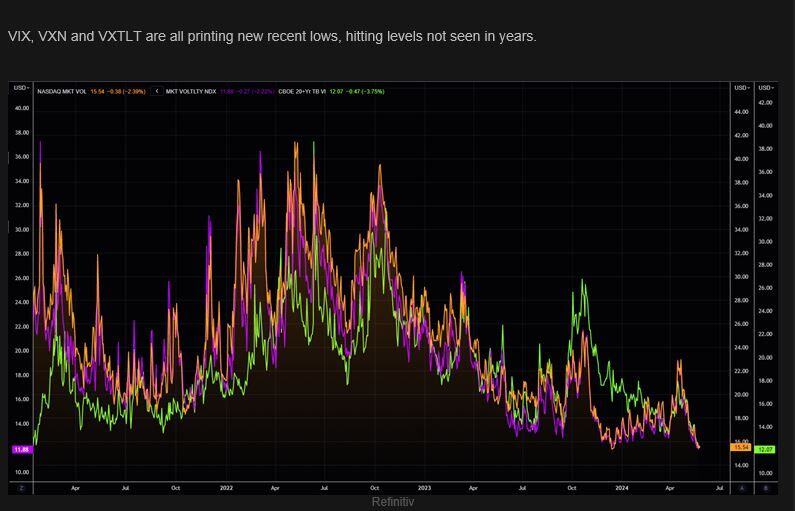

The death of volatility? VIX, VXN and VXTLT are all printing new recent lows, hitting levels not seen in years.

Source: Bloomberg, The Market Ear

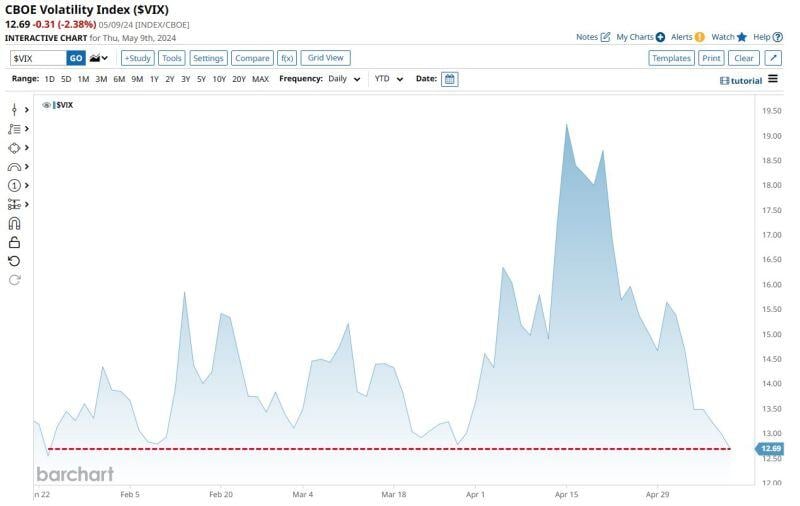

NO FEAR... CBOE Volatility Index $VIX closed at its lowest level since January 23!

Source: barchart

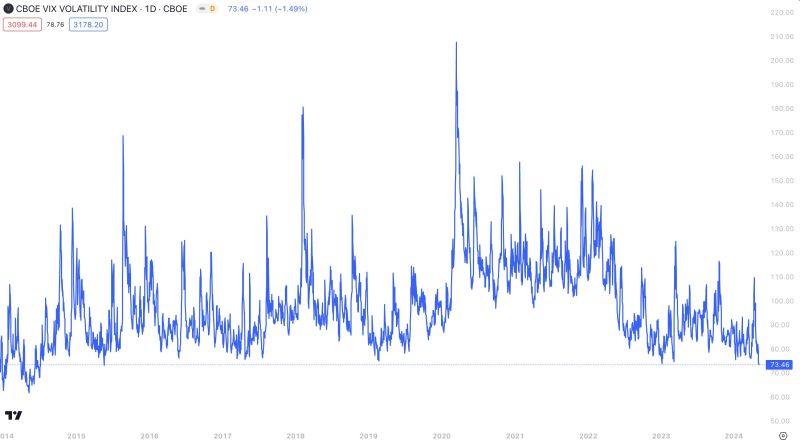

$VVIX just made its lowest close in about 8 years

What is the Cboe VVIX Index? Volatility is often called a new asset class, and every asset class deserves its own volatility index. The Cboe VVIX IndexSM represents the expected volatility of the VIX®. VVIX derives the expected 30-day volatility of VIX by applying the VIX algorithm to VIX options. Source: Swordfishvegetable

As shown by Jeroen Blokland >>> The Ishares 20+ Year Treasury Bond ETF is down 48% since April 2020.

This means investors have realized a negative return of 15% annually on long-duration bonds over the last four years. Moreover, this 'return' was realized with structurally higher volatility and, on average, a positive correlation with stocks. It also means the market for long-duration bonds has to double(!) to erase losses. Source: Jeroen Blokland

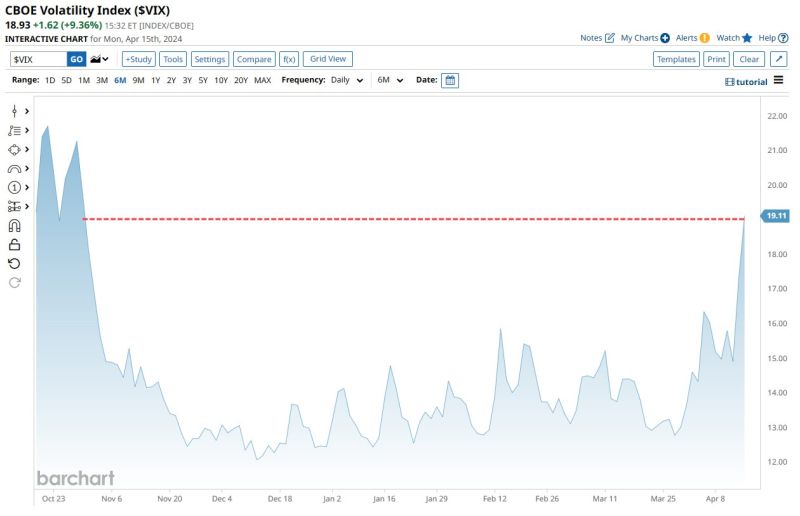

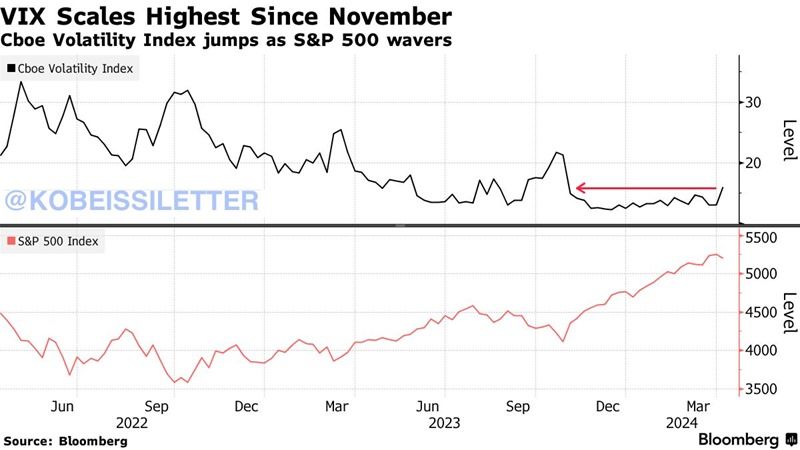

CBOE Volatility Index $VIX surges to highest level of fear since Halloween 👻🎃

Source: Barchart

The volatility index, $VIX, spiked 23% this week, the largest weekly jump since September 2023.

It also marked the highest weekly $VIX close since November 2023. Meanwhile, the Dow posted its worst week of 2024 so far. This week, we will receive crucial inflation data including CPI and PPI inflation. If CPI inflation rises again, it will mark the 3rd straight monthly increase in inflation. Will the VIX continue to increase? Source: Bloomberg, The Kobeissi Letter

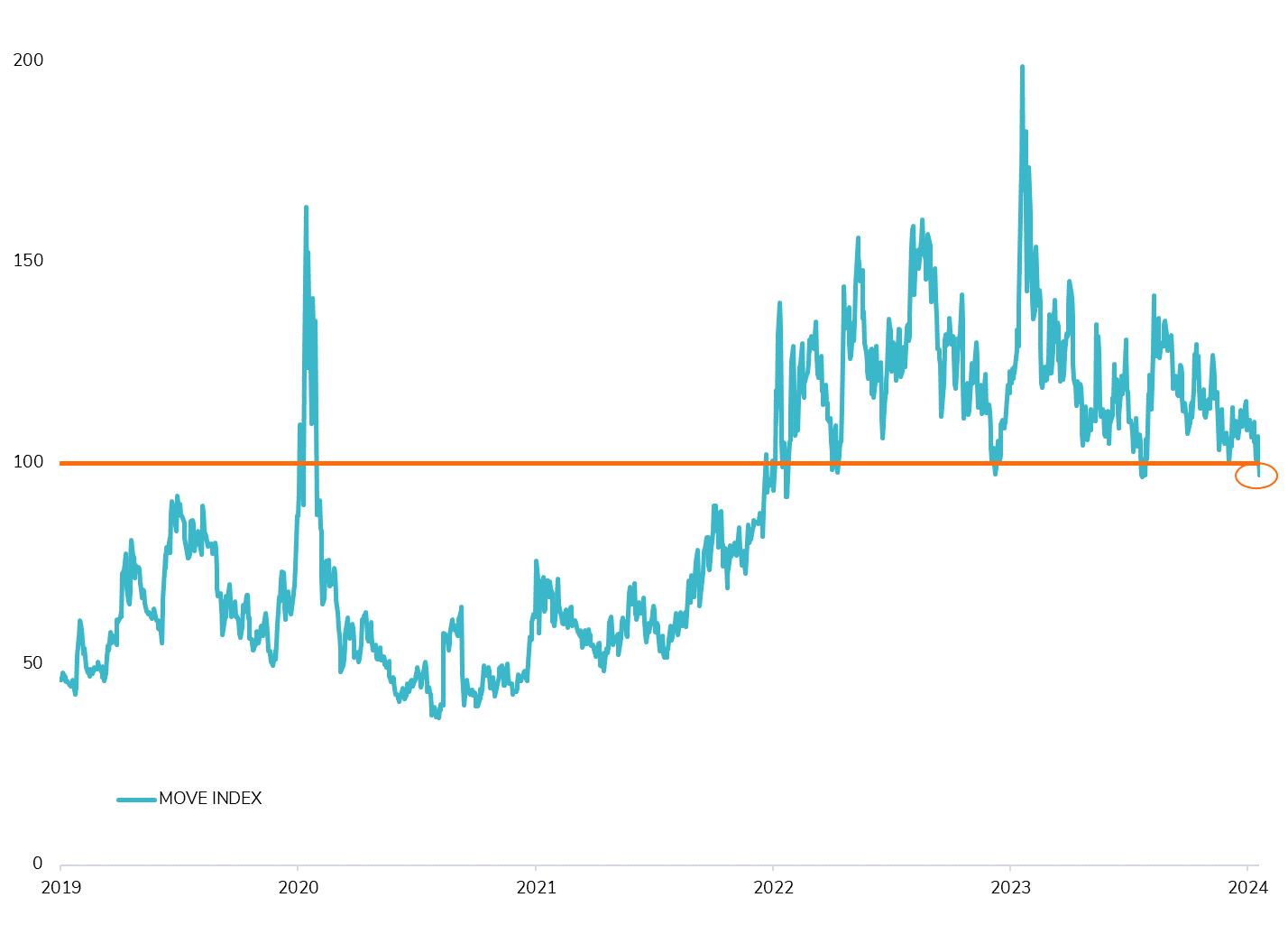

Interest Rate Volatility Drops Below 100 for the First Time in 6 Months!

The #MOVE index, a key measure of US #interestrate #volatility, has dropped below 100 for the first time since September 2023. This marks a significant shift in market dynamics. While attempts to breach this threshold have been made three times since early 2022, they were short-lived, with volatility bouncing back above 100 each time. For the past two years, the #government #bond market has been in a high volatility regime, making investing in long-term US #Treasuries challenging due to relatively low adjusted yield to volatility. The question now is whether this high volatility regime is coming to an end or if it's just another false alarm. Several indicators suggest that this could be another false signal. Growing uncertainty surrounding #inflation in the US may prompt the #Fed to adjust its monetary policy, potentially implementing a reverse operation twist (and thus steepen the yield curve). Additionally, there's still a positive #carry from #shorting bonds. However, signs of improvement are emerging as well. Recent #auctions have shown that the market is absorbing the supply effectively, and the #correlation between bonds and equities is turning negative again. Could this be a pivotal moment in the US Treasuries market? Let's keep a close eye on how things unfold. Source: Bloomberg #fixedincome #bond

There were winners today...

VIX 17 call expiring tomorrow (Wednesday) was basically worthless earlier today... Source: TME, Refinitiv

Investing with intelligence

Our latest research, commentary and market outlooks