Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

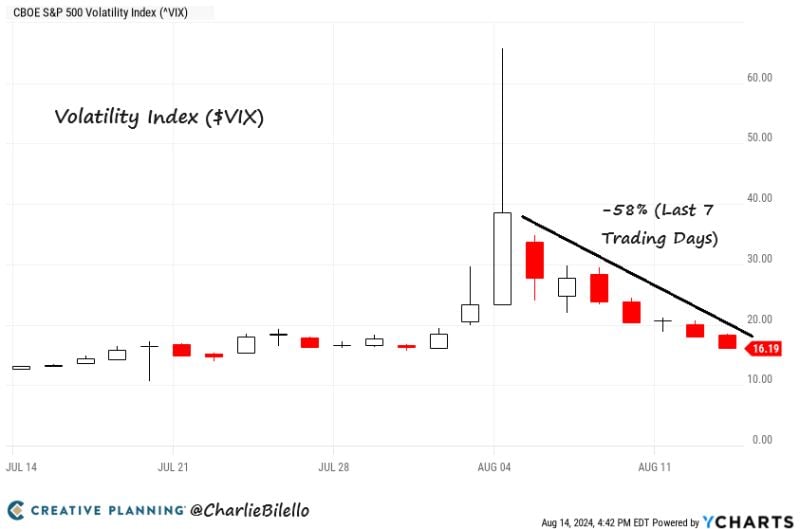

The $VIX has declined 58% (from 38.57 to 16.19) over the last 7 trading days, the biggest 7-day volatility crash in history.

Source: Charlie Bilello

BREAKING: For those who were off the last 2 weeks, nothing happened: the $VIX is back to where it was on August 1...

Source: Stocktwits, Bloomberg

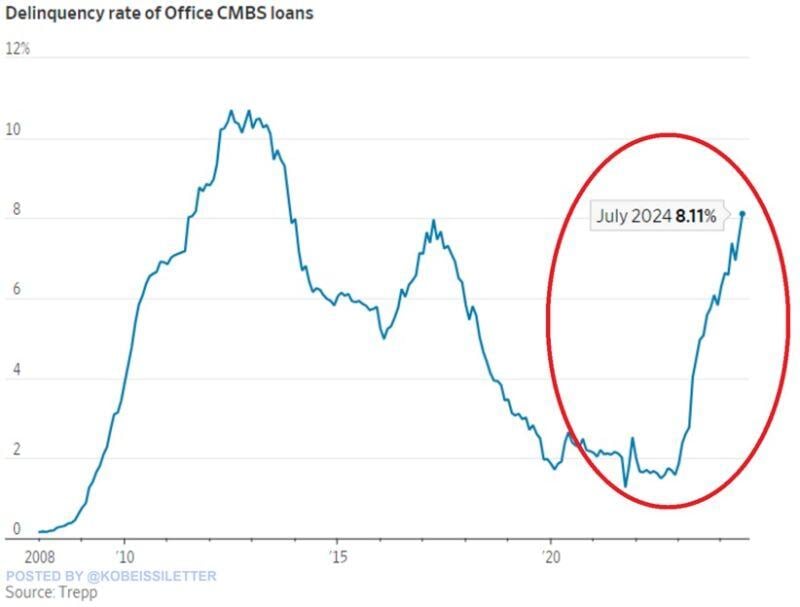

The delinquency rate on commercial mortgage-backed securities (CMBS) for offices spiked to 8.1% in July, the highest in 11 years.

The delinquency rate of office CMBS loans has QUADRUPLED in 1.5 years. Delinquencies are currently rising at a faster pace than during the 2008 Financial Crisis. A top AAA-rated CMBS experienced a $40 million loss in May for the first time since the 2008 Financial Crisis. Source: The Kobeissi Letter

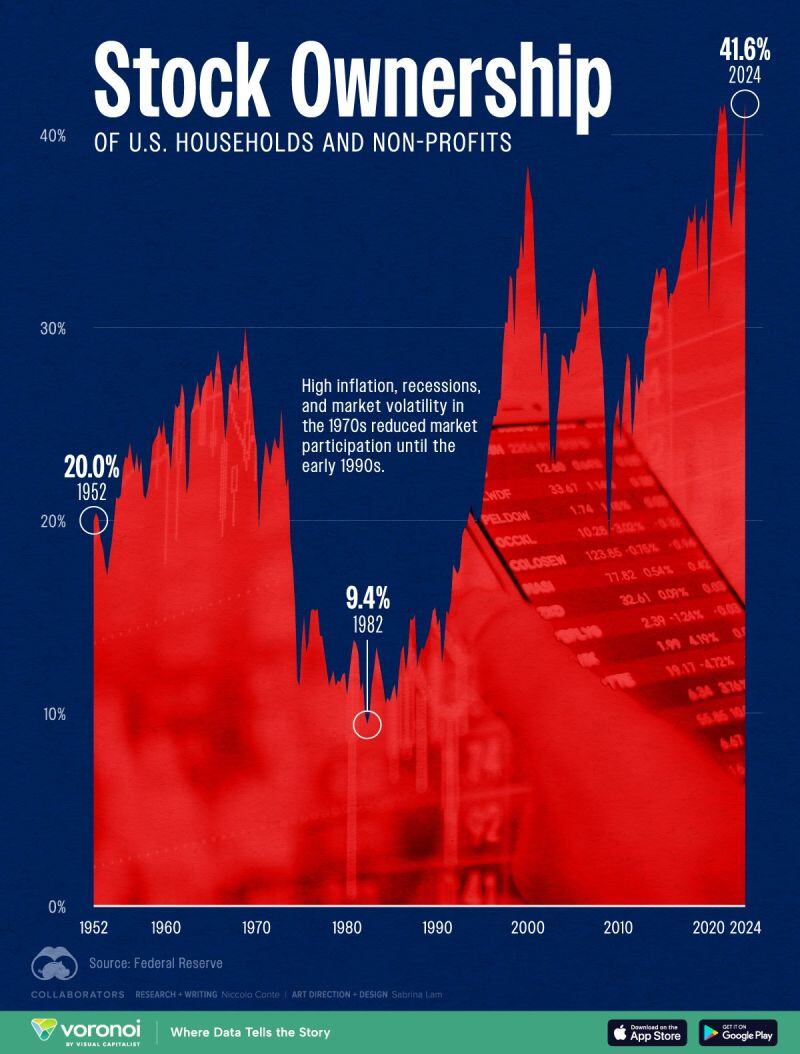

American stock ownership is back at all-time highs

Source: Markets & Mayhem, Visual Capitalist

There is no free lunch in finance

Funds designed to protect investors from volatility failed to protect investors during periods of high volatility Source: FT, Barchart

The Japanese Yen Carry Trade unwinding is only 50% complete warns JP Morgan

Source: Win Smart

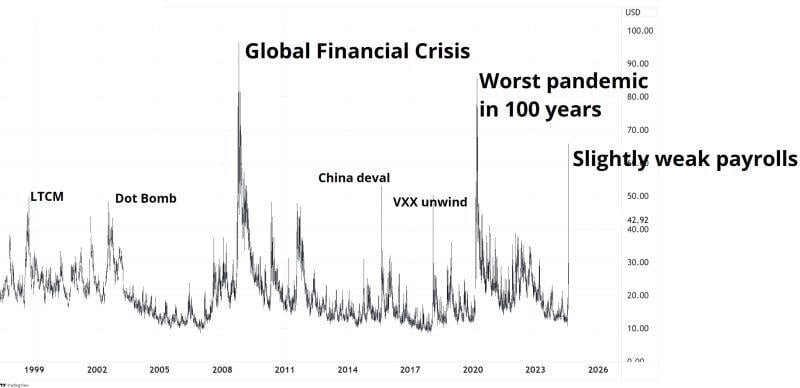

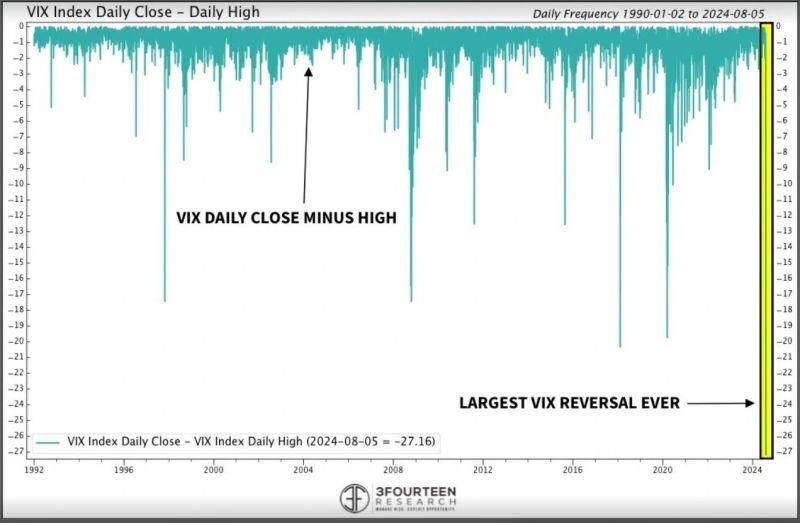

Putting yesterday's VIX intra-day high at 65 into historical perspective...

Source: Bloomberg, RBC

Historic day in volatility

The difference between the VIX's intra-day high (65) and close (38) was the highest EVER. Source: 3Fourteen Research thru Octavian Adrian Tanase

Investing with intelligence

Our latest research, commentary and market outlooks