Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

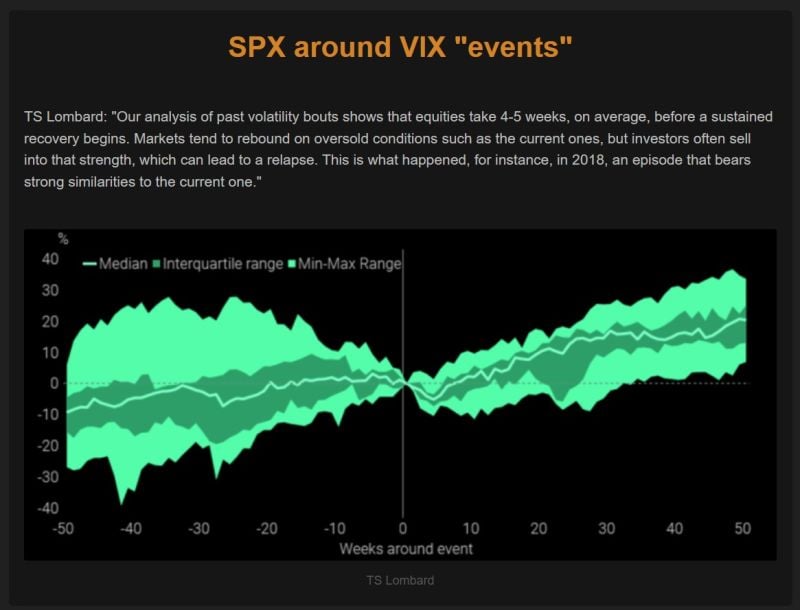

TS Lombard: "Our analysis of past volatility bouts shows that equities take 4-5 weeks, on average, before a sustained recovery begins.

Markets tend to rebound on oversold conditions such as the current ones, but investors often sell into that strength, which can lead to a relapse. This is what happened, for instance, in 2018, an episode that bears strong similarities to the current one." Source: TS Lombard, The Market Ear

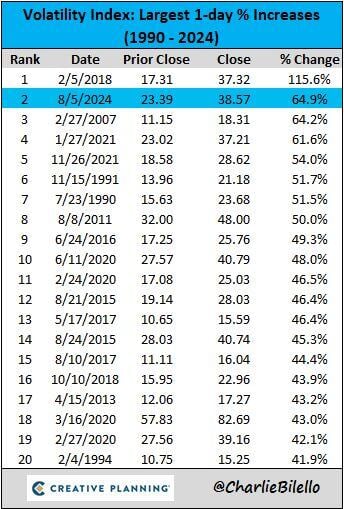

The $VIX spiked 65% higher today, the 2nd largest 1-day % increase in history

(note: $VIX data goes back to 1990). Source: Charlie Bilello

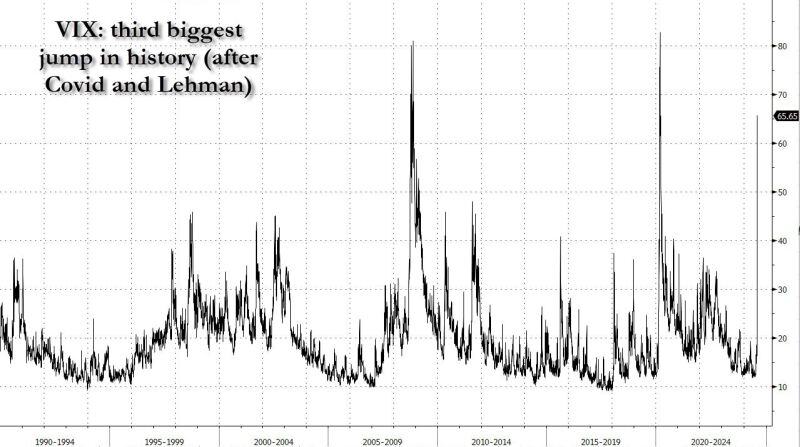

VIX hit 65. To put things in context: this is the 3rd biggest VIX spike in history...

The VIX is now just 15 away from its record high of 80 hit when the global economy shut down and the US market tumbled 30% Source: www.zerohedge.com, Bloomberg

Fed's emergency rate cut never happened when the VIX was below 40.

It seems that we are getting there... Source chart: Yahoo finance

Volatility is back...

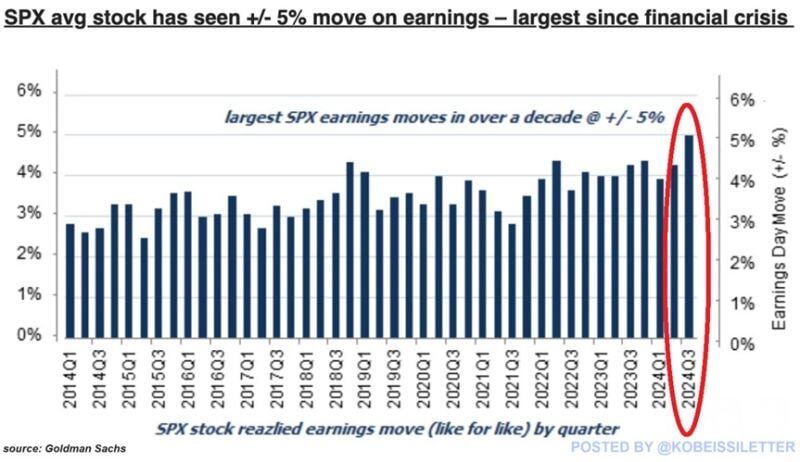

The average S&P 500 stock has seen a 5% one-day move after releasing Q2 2024 earnings. This marks the most volatile earnings season since the 2008 Financial Crisis, according to Goldman Sachs. By comparison, in Q1 2024 and Q4 2023, the average stock moved by ~4% one day after the release. The volatility index, $VIX, is now up ~95% over the last month alone. Volatility is opportunity for traders. Source: The Kobeissi Letter

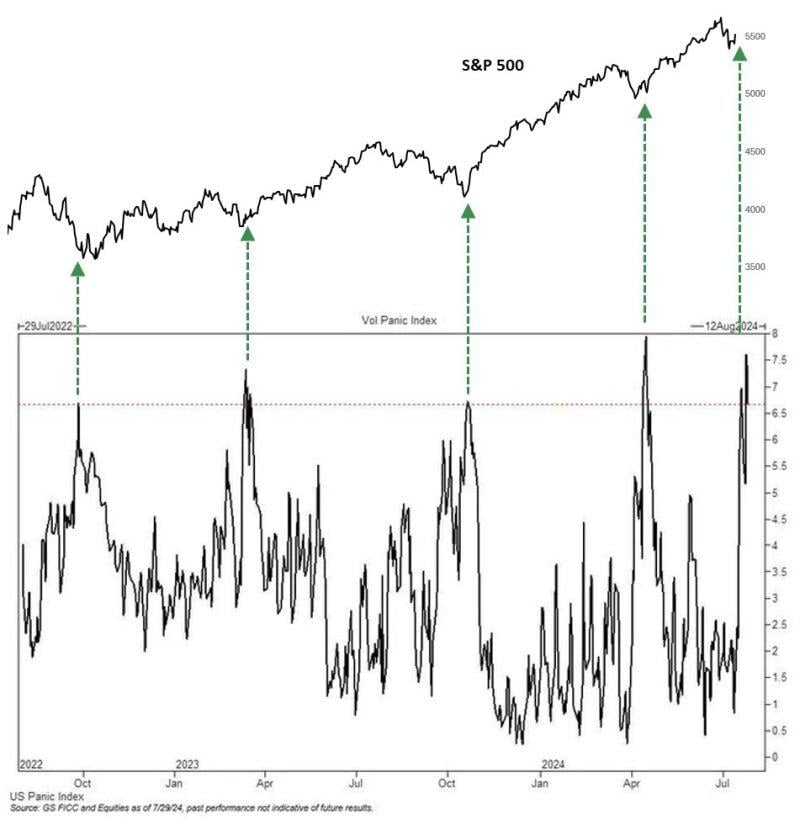

The Goldman US panic index is calculated as a rolling percentile of four equity volatility metrics

It spiked to one of the highest levels in two years in recent sessions... Source: Jason Goepfert on X

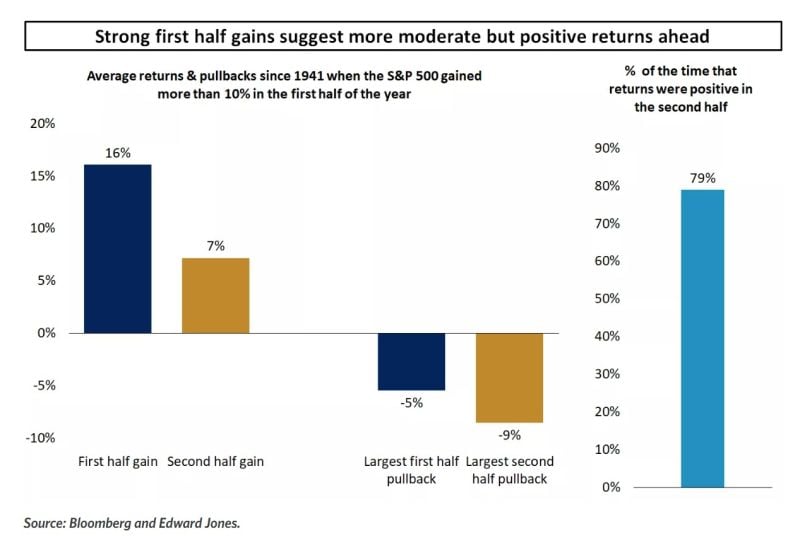

Even as volatility is picking up, the bull market could stay intact.

Going back to 1941, whenever the S&P 500 rose by 10% or more in the first six months of the year, it has risen by 7% on average in the second half. And the percentage of time that returns were positive in the second half of the year was almost 80% vs. 66% for any given period. The one caveat is that pullbacks in the second half tend to be deeper than the first half, averaging 9%. Source: Edward Jones, Bloomberg

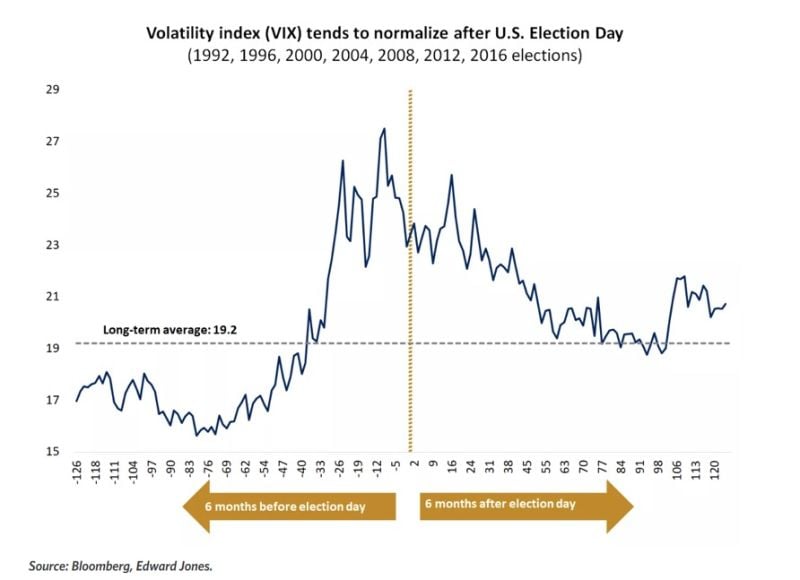

Expect a pickup in volatility as we head towards elections.

History shows us that market volatility tends to increase ahead of election day, and then subside afterwards, regardless of who is in power. This could be in part because some uncertainty is lifted after the election is over, and markets can again focus on opportunities ahead. Source: Edward Jones

Investing with intelligence

Our latest research, commentary and market outlooks