Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

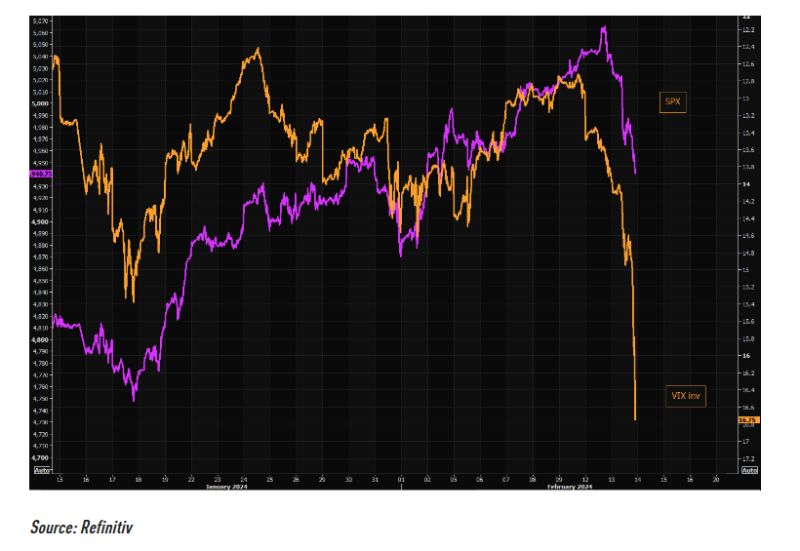

VIX panic kicking in.

VIX has not closed here since the melt up started in late October 2023. You do not compare volatility to trending assets over time, but the shorter term chart shows a clear picture. VIX panic is here. Source: TME, Refinitiv

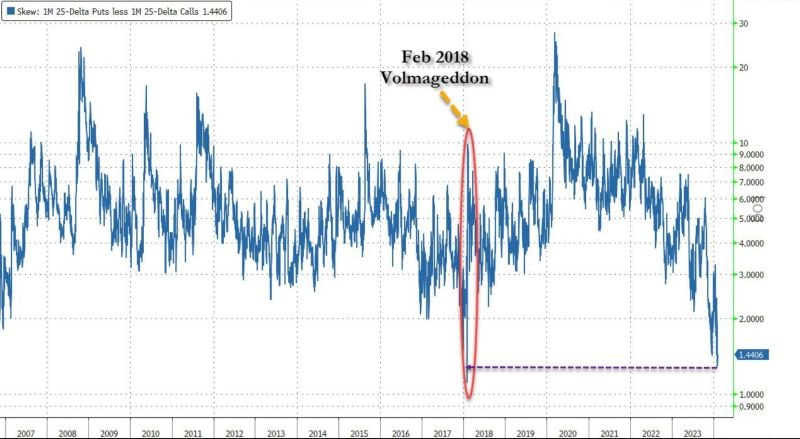

“Volmageddon” is not a Word in the Dictionary.

This term is a blend of "volatility" and "Armageddon," and it refers to a significant and sudden increase in market volatility. It specifically references an event on February 5, 2018, when the stock market experienced a sharp increase in volatility.The previous time the skew reached such a low level was on that exact day, mere hours before Volmageddon caused the VIX to skyrocket, moving it from a serene level of 14 to a heightened state of 40. source : zerohedge

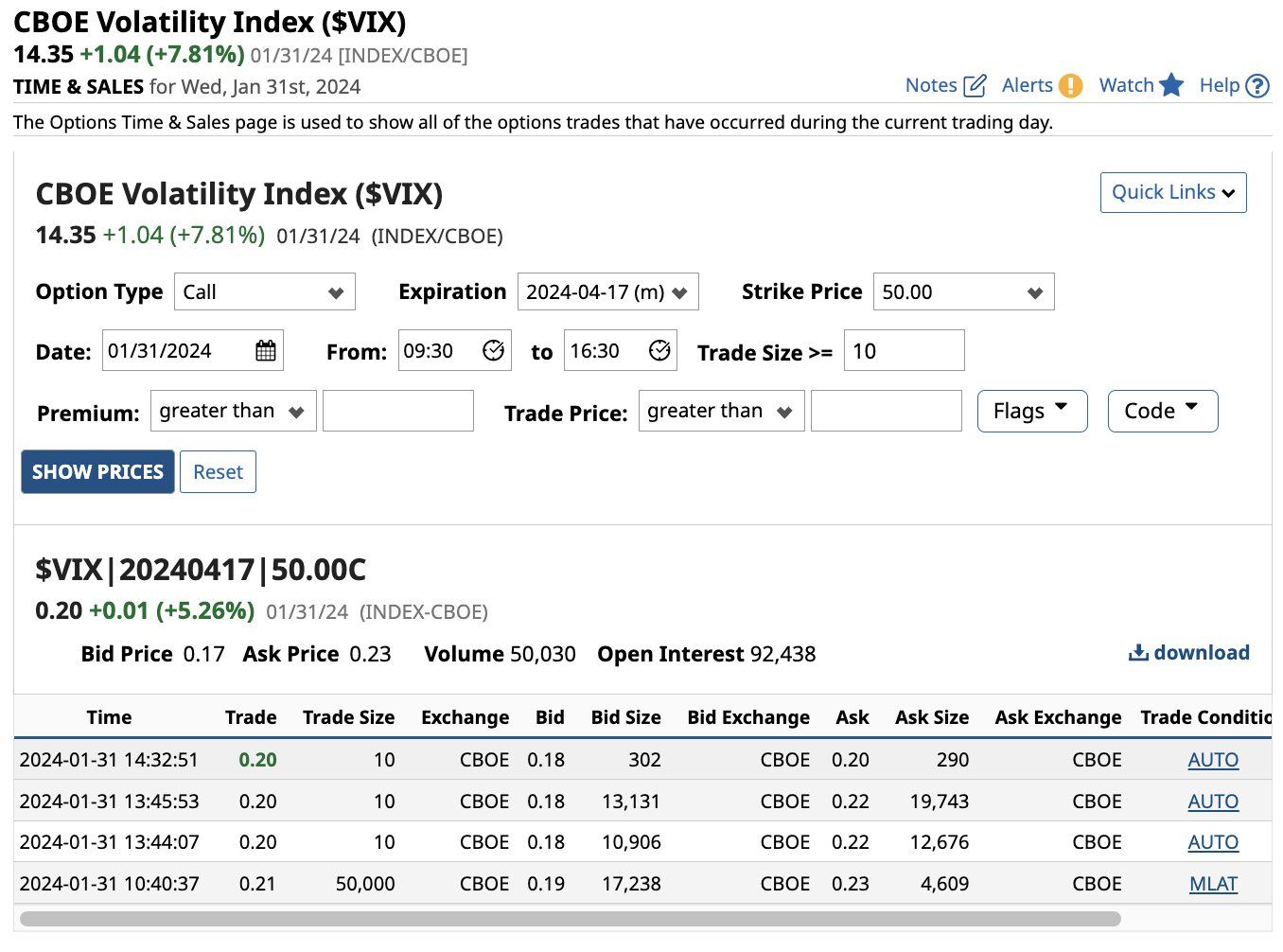

A Trader bought 50,000 CBOE Volatility Index $VIX April expiry 50 strike calls for $0.21 which is a total premium of just over $1 million.

Source: Barchart

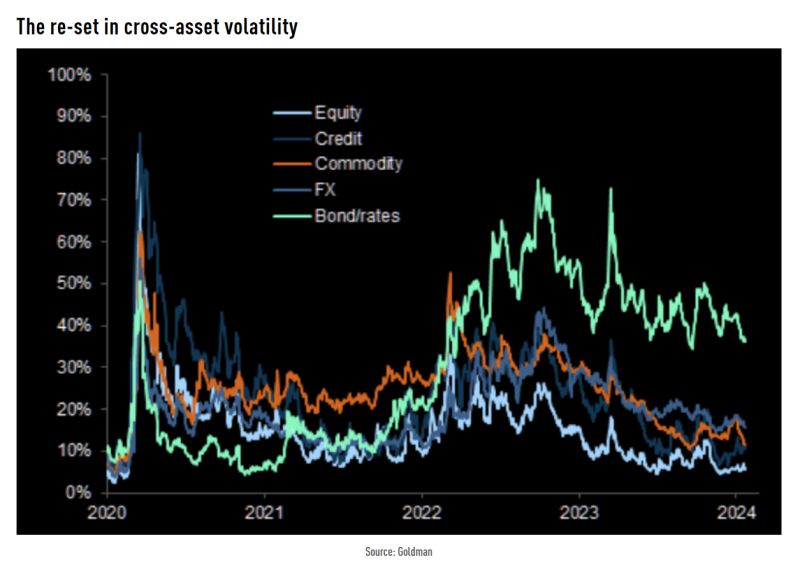

Average 3-month ATM implied volatility (max/min range since 2008)

.

CBOE Volatility Index $VIX jumps to highest level in more than 2 months

Source: Barchart

The volatility index, $VIX, is up 14% to kick off the first trading day of 2024. This puts the $VIX on track for its biggest daily jump since October 13th

Source: The Kobeissi Letter

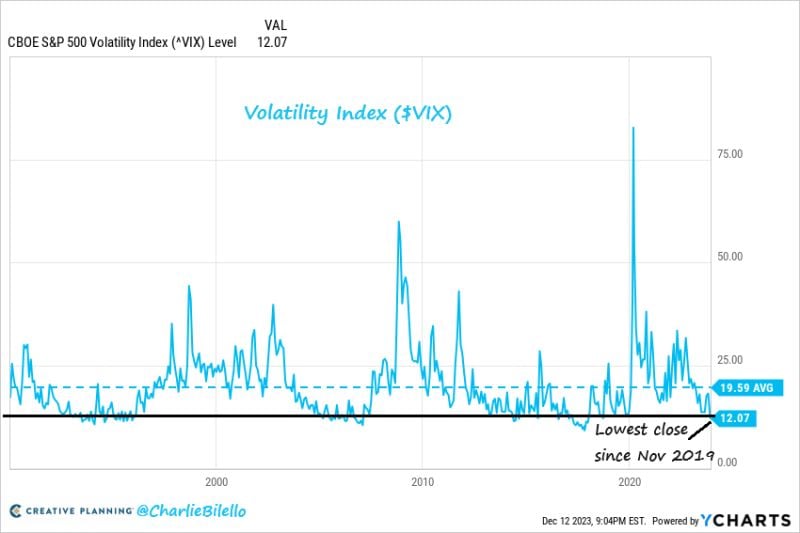

The $VIX currently stands at 12.07, its lowest close since November 2019

Soruce: Charlie Bilello

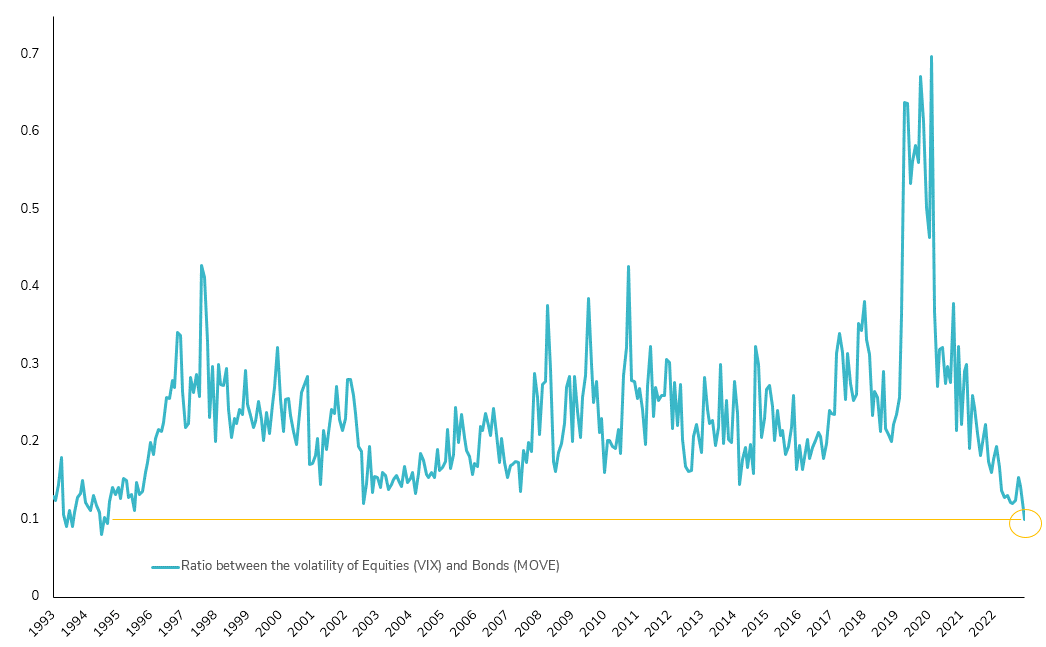

Record Low: Equity/Bonds Volatility Ratio Hits Unprecedented Levels!

The divergence between two widely recognized measures of volatility, the VIX index for Equity and the MOVE index for Rates, continues to be stark. In the U.S., equity volatility has reached new lows for 2023, while volatility in U.S. Treasuries remains persistently high. Calculating the ratio between the VIX and MOVE indexes reveals a significant trend—the lowest point since 1994/1995! Anticipate dynamic shifts in 2024! 📈 #MarketTrends #VolatilityAnalysis #Outlook2024

Investing with intelligence

Our latest research, commentary and market outlooks