Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

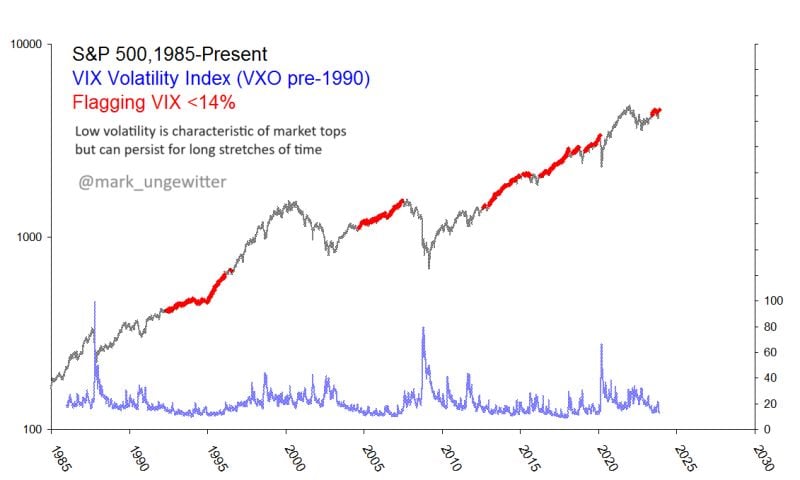

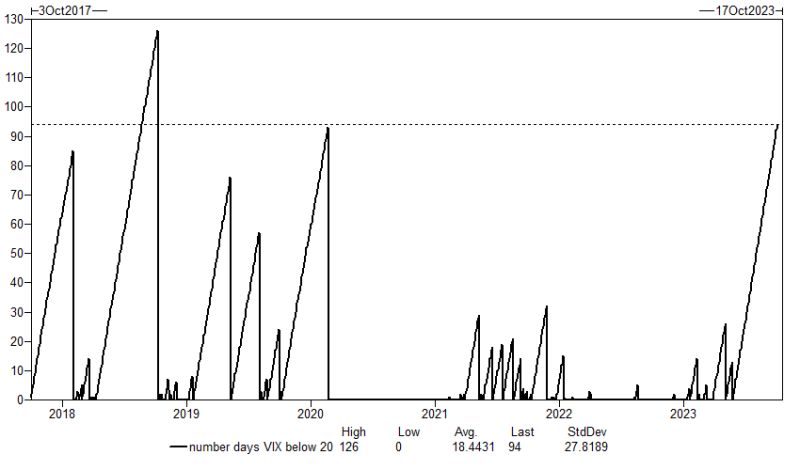

Some investors are worried about VIX index being too low, i.e markets are too complacent

The chart below is a good reminder that a "low VIX" is a normal part of bull markets. Investors seem to always forget this. Source: Mark Ungewitter, Ryan Detrick

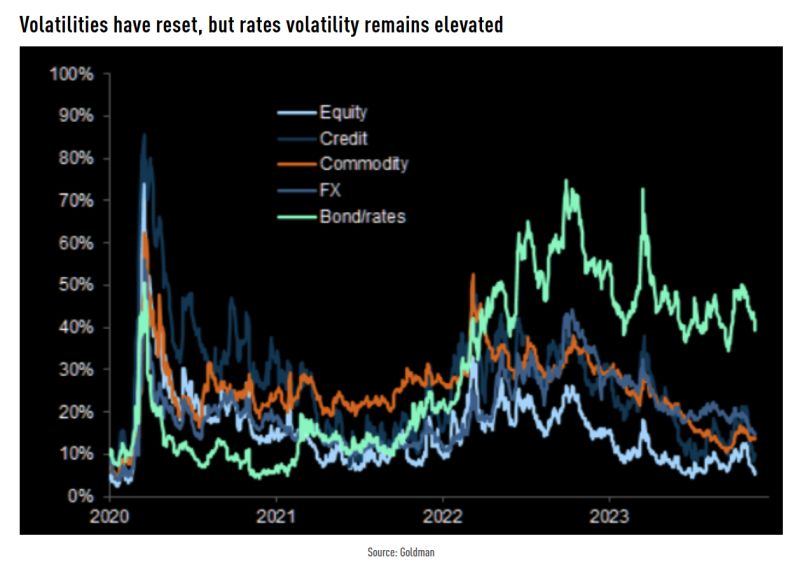

Below the average 3-month ATM implied volatility (max/min range since 2008)

Source: TME, GS

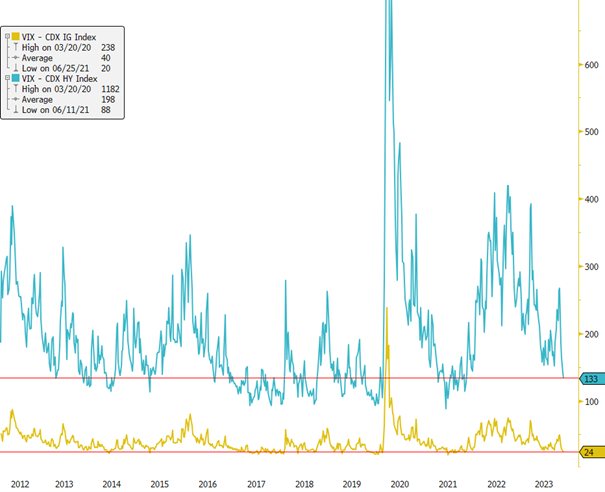

Record-Low Volatility in the US Credit Market! 📉🌐

Amidst ongoing rate volatility (MOVE index) showing a persistent high, albeit with a decreasing trend over the past two months, the volatility in credit markets has taken a different turn. Currently, volatility in US Investment Grade (IG) corporate bonds has reached levels not seen since 2021, hovering close to record lows. Additionally, the volatility in US High Yield (HY) has experienced a significant drop in the past month. With low volatility and tight credit spreads, the question arises: Is there still room to extract excess returns from the US credit market in 2024? 🤔 Source: Bloomberg #CreditMarkets #Volatility #FinanceInsights

Today is the BIG DAY with Nvidia ($NVDA) earnings results after the bell

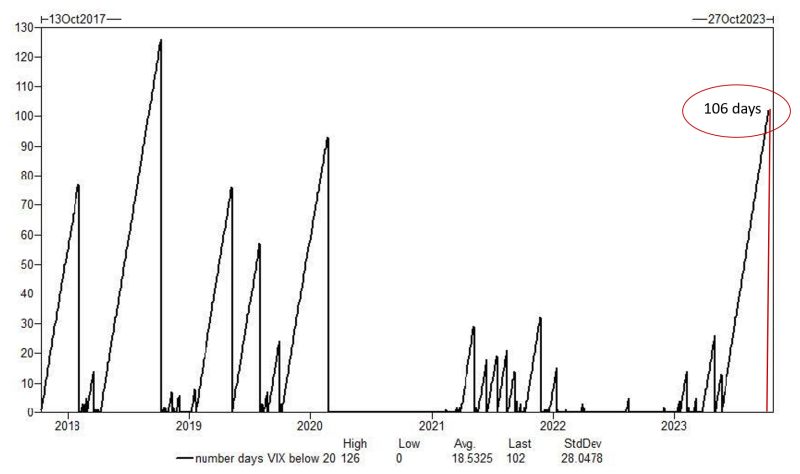

With the Nasdaq up more than 13% from the lows, $NVDA at all-time-high, 95% of sell-side analysts with a BUY rating on $NVDA (!) sentiment of AI probably at record optimistic level after Microsoft "aqui-hire" of openai and the $VIX historically low at 13.5, there is indeed room for a short-term pullback... Source: www.investing.com, kakashiii111

As stocks tumbled, the VIX soared

And after 105 consecutive days of closing below 20, the longest streak since 2019, the VIX index finally closed above 20 - in fact above 21 - breaking the streak on day 106. Source: www.zerohedge.com, Bloomberg

WIth the Vix <17, Brent oil<$90/bbl and S&P 500>4350, do you feel that risk is currently mispriced?

Source: HolgerZ, Bloomberg

Since the VIX has so far failed to break above 20, we are now just shy of 100 sessions in which the VIX has closed below 20

The longest such stretch since October 2018 when, ironically, the market tumbled after the Fed realized it will need to be far more hawkish. Source: www.zerohedge.com

House ousts Kevin McCarthy as speaker, a first in U.S. history

This is likely to add to bond and equity markets volatility. OUR TAKE - This is a big event, at least politically. The House has no Speaker and business can be conducted until a new Speaker is installed. - There is a risk that this is an event for financial markets. The recent rise in bond yields is being driven by a lot of factors and political dysfunction is probably one of them. The US debt servicing cost has hit the inflection point for austerity at the same time basic governing is proving to be impossible. - More bond and equity markets volatility are likely Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks