Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

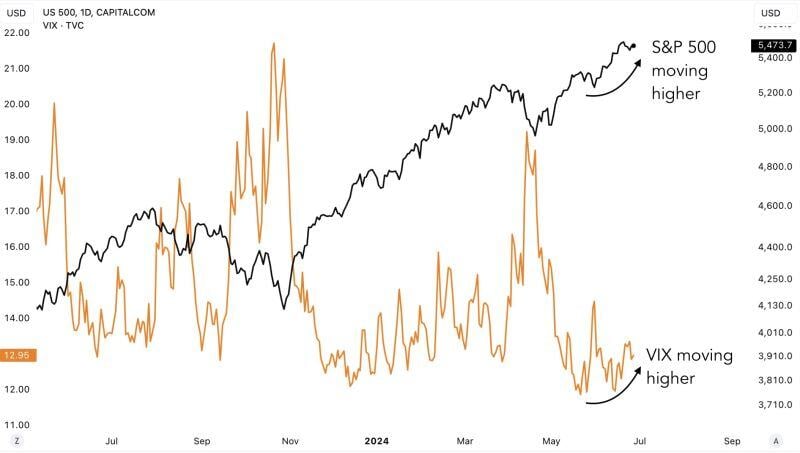

The end of complacency? Fear Index Vix has jumped 32.6% last week, the biggest weekly increase since March 2023.

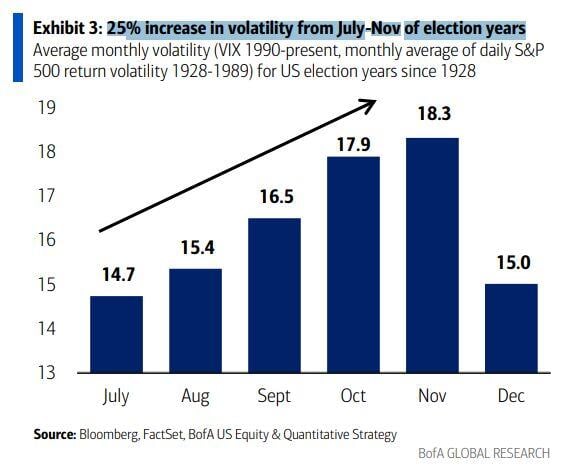

But at 16.5, the Vix level is still below the long-term average of 19.8. And remember that during election years, volatility tends to increase by 25% between July and November... Source: HolgerZ, Bloomberg

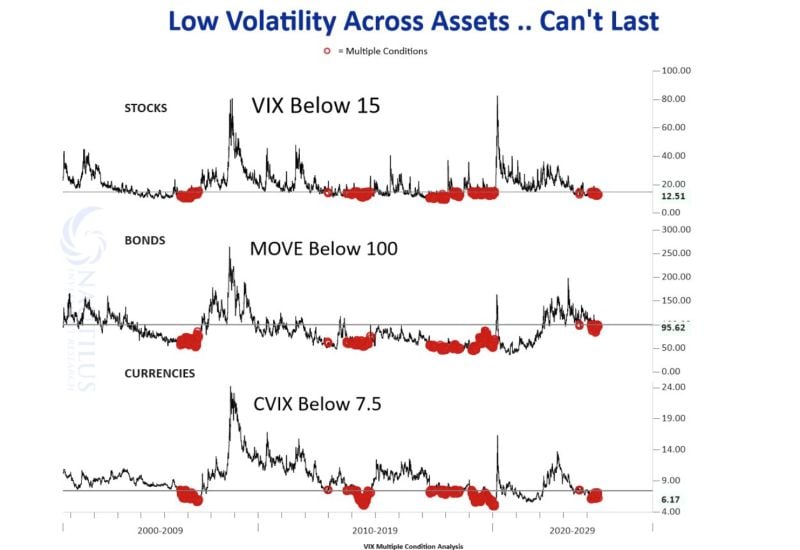

There is low volatility across asset classes.

Can it last? Source: Nautilus Research

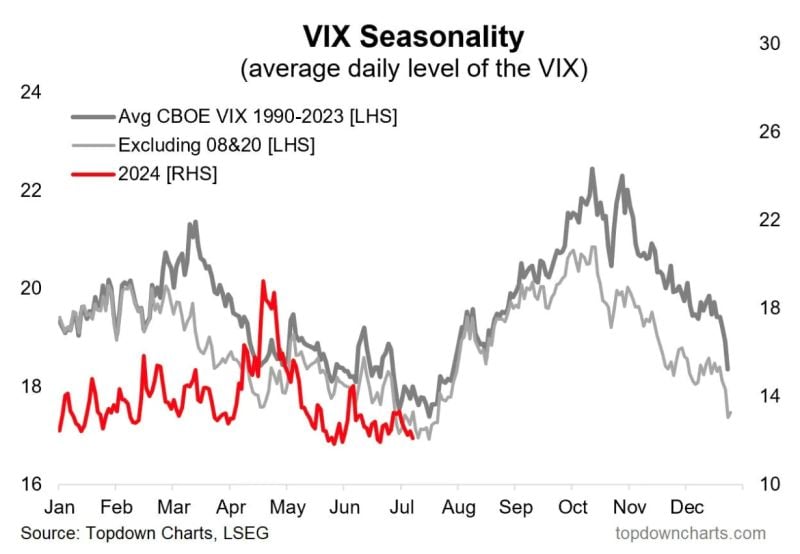

During Presidential election years, volatility tend to pick up EXACTLY at this time of the year

Source: Topdown Charts

Major divergence spotted:

The VIX has been trending higher since mid-May. But even the SP500 has been moving higher. This is an anomaly. Source: Game of Trades

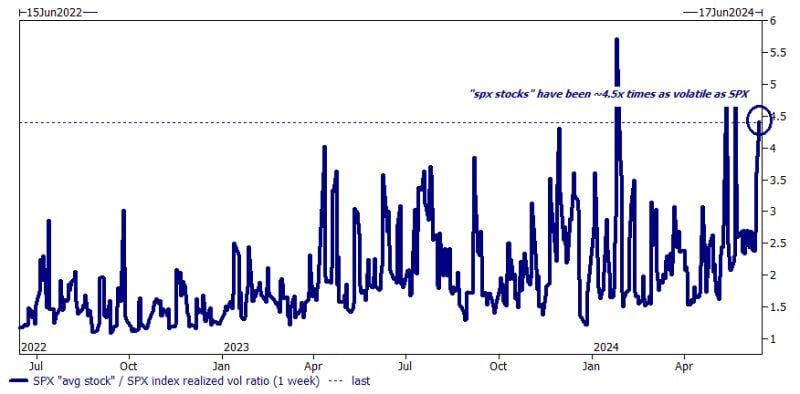

Wow. The average S&P500 stock has been on average 4.5x as volatile as the broader index!

Chart: Goldman Sachs Source: Markets & Mayhem

History shows an average 25% increase in volatility from July-Nov of election years...

Mike Zaccardi, CFA, CMT, BofA

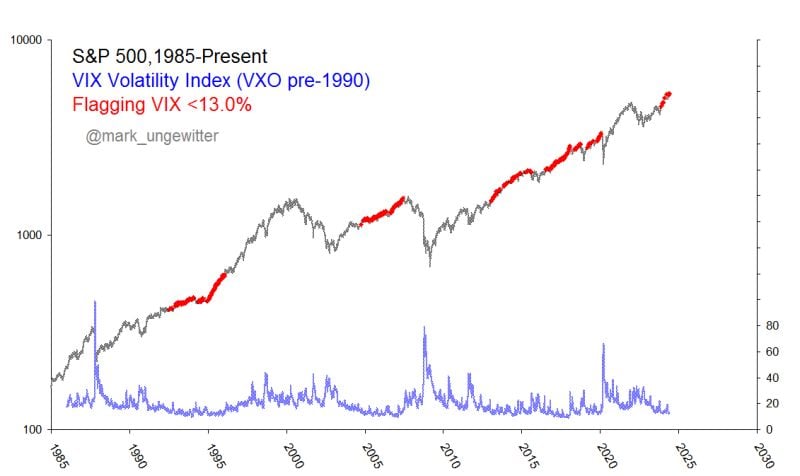

Low-volatility regimes can last longer than you think.

Source: Mark Ungewitter

Investing with intelligence

Our latest research, commentary and market outlooks