Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

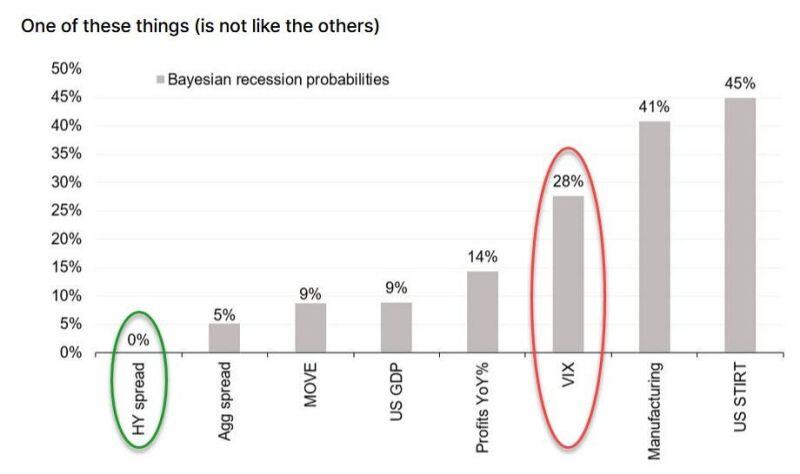

The VIX Is Pricing In A Recession, While Junk (Still) Sees Zero Risk

➡️ SocGen's Jitesh Kumar writes that high yields spreads remain below 4%, and "we have never been in recession with high yield spreads below 4.5% (data going back to 1987)." In other words, US HY credit spreads are pricing in 0% recession probability. ➡️ However while credit remains complacent, one asset is starting blast a recession warning siren: according to UBS trader Antonya Allen, the VIX is now pricing in a recession. Which one will be correct? Source: SocGen, www.zerohedge.com

🚨Market volatility is skyrocketing as if there is A FINANCIAL CRISIS

The Volatility Index, $VIX, spiked to 59 points, the 4th highest level EVER. There were only three times when the VIX traded higher: - Great Financial Crisis - 2020 Crisis - August 2024 Flash Crash Meanwhile, the S&P 500 futures are crashing 5% in the session and are trading 22% below the peak (which means it is now in BEAR MARKET territory). Source: Global Markets Investor

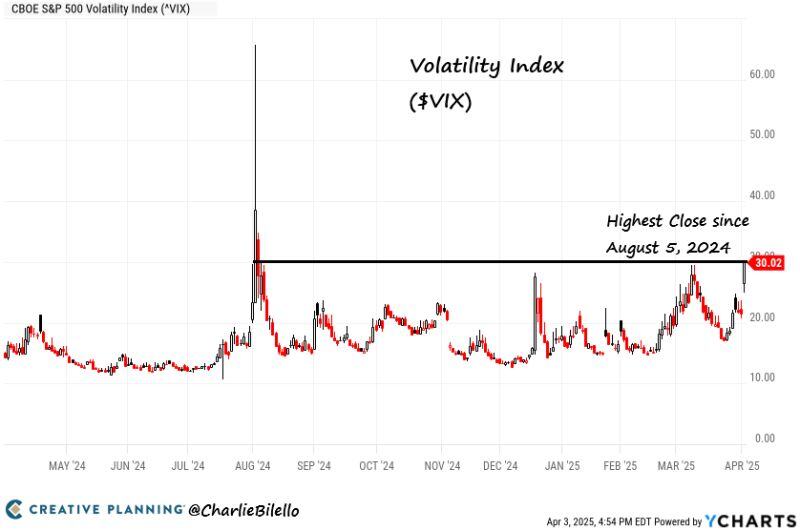

The $VIX ended the day at 30, its highest close since August 5, 2024

Fear is on the rise and stocks are on sale, providing more opportunities for long-term investors. Source: Charlie Bilello

Behold your new volatility regime...

VIX curve is now inverted: Source: Bloomberg, Tracy Alloway @tracyalloway

Market VOLATILITY is back:

The S&P 500 has seen a move of more than 1% in either direction for 6 straight trading sessions, the longest streak since November 2020. Source: Bloomberg

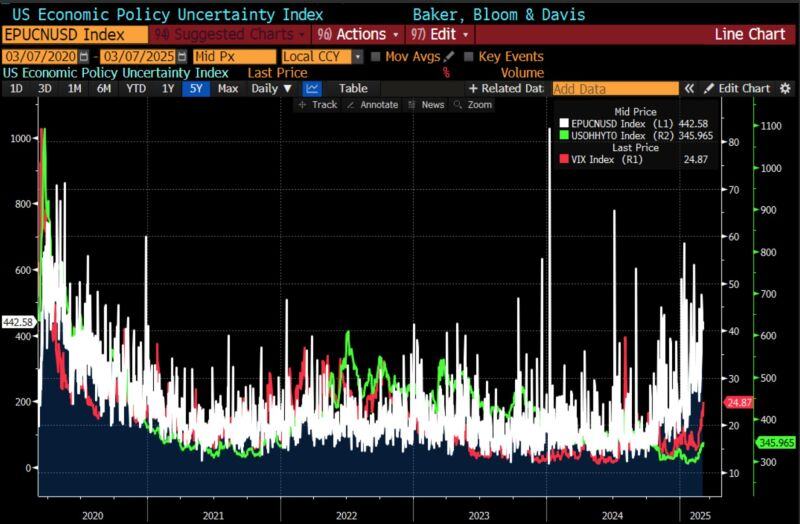

WATCH CREDIT SPREADS‼️

US high yield spreads (in green) are starting to tick up, but not to the extent of the Economic Uncertainty Index nor the Vix (in red). If credit weakens, then we know we are in trouble... Source: Bloomberg, RBC

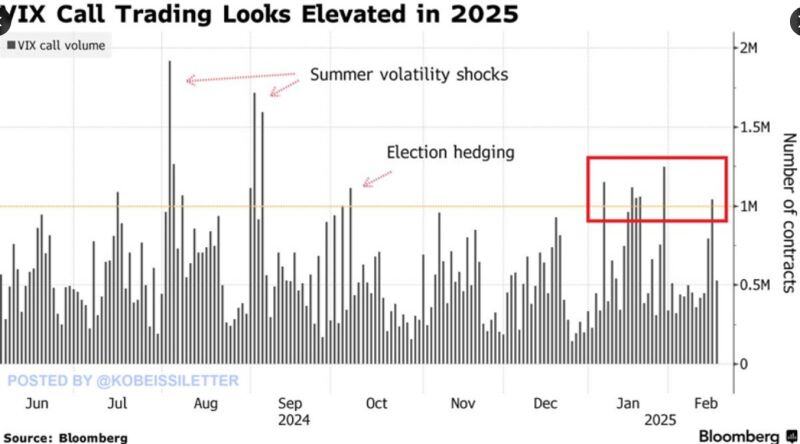

Call options volume on the volatility index, VIX, jumped above 1 million contracts on Tuesday for the 6th time this year.

Source : bloomberg

CBOE Volatility Index $VIX dropped to its lowest level this year, even with stocks declining on Friday

No fear left in the market except by Bears. Today might be another story… Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks