Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The 69% decline in the $VIX over the last 20 weeks is the biggest volatility crash in history.

Source: Charlie Bilello

Isn't this the time of year when volatility typically picks up?

Source: Lance Roberts

U.S. Treasury volatility falls to its lowest level since January 2022

No Fear left in the market! Source: Barchart

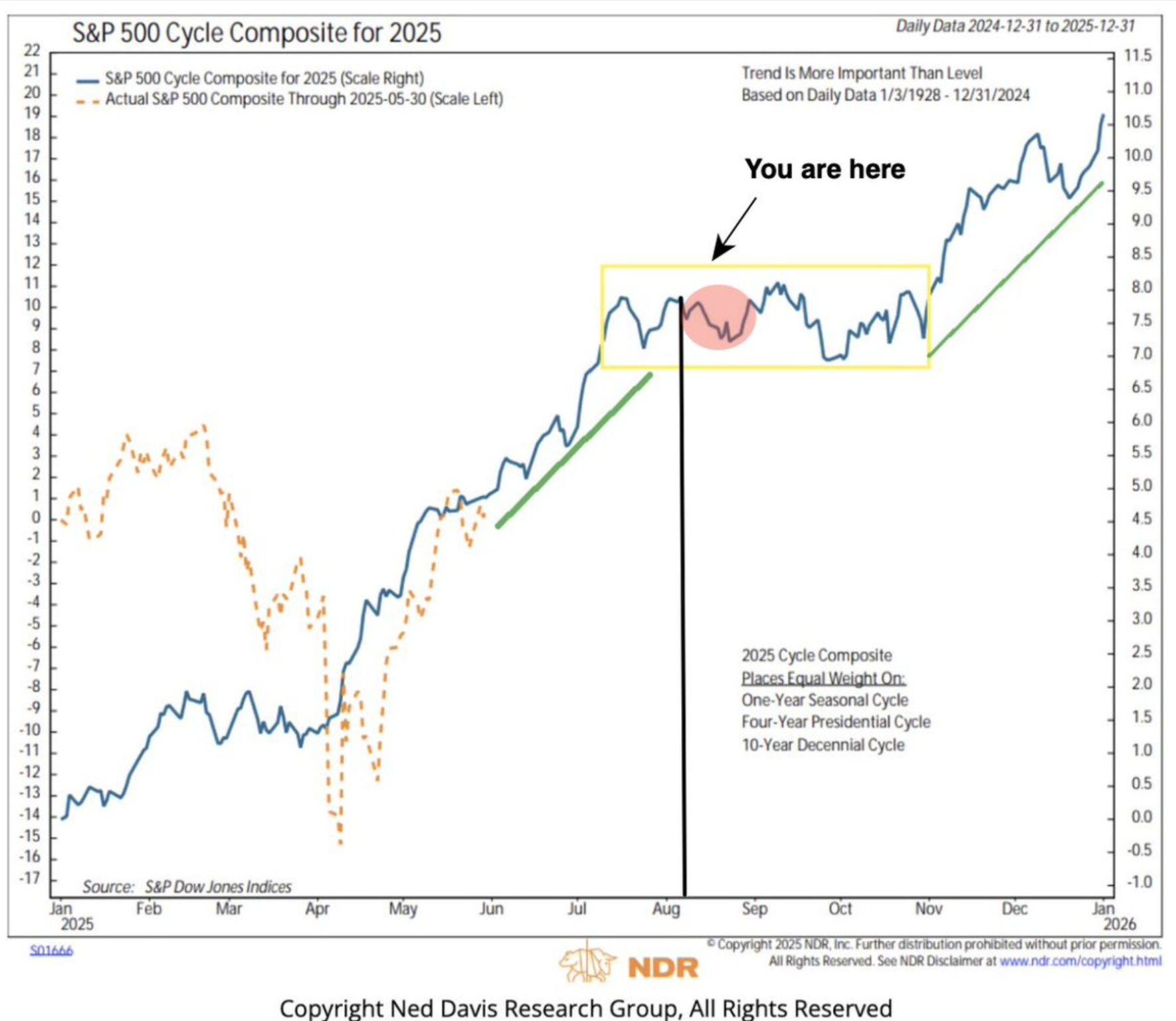

After getting off course in Q1, $SPX has been trending well with the Cycle Composite since.

Will we see a pick up in volatility in the week ahead, in-line with historical cycle? Source: NDR thru Seth Golden

$VIX seasonality last 20 years.

If we are to see a spike, should be any day now. Just simply basing off seasonality. Source: Heisenberg @Mr_Derivatives

Treasury Rate Volatility $MOVE falls to lowest level since January 2022

Source: Barchart

The lowest close since February 2020 for the VIX index

Source: Charlie Bilello

CBOE Volatility Index $VIX falls to lowest level since February

No Fear Left in the Market Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks