Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

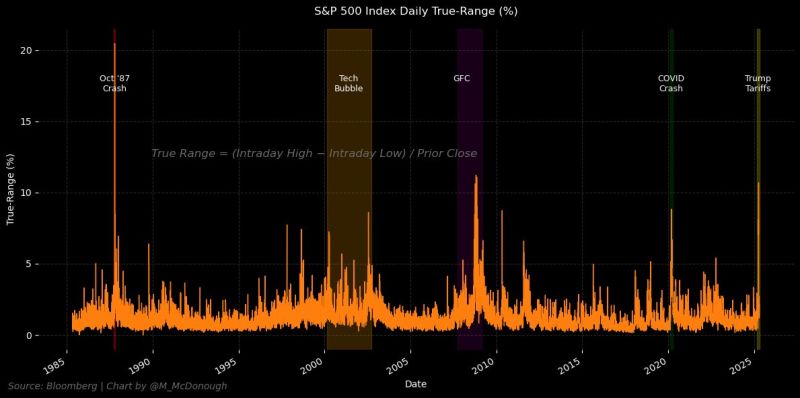

S&P 500 Index Size of Intraday Swings Since 1985

Source: Michael McDonough @M_McDonough, Bloomberg

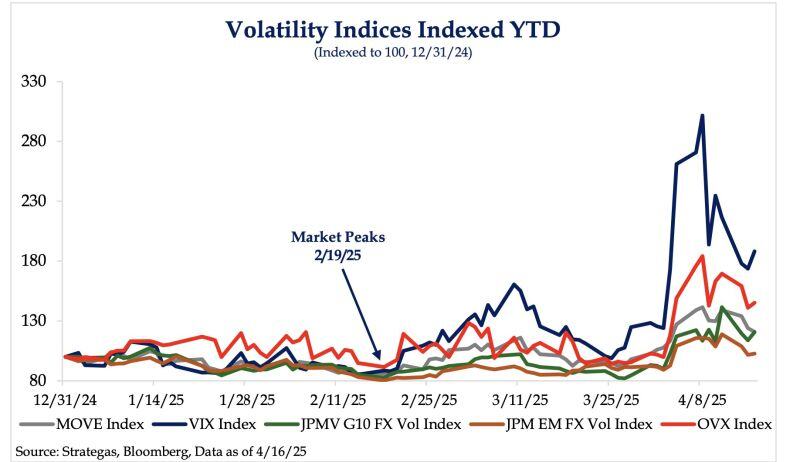

This chart shows how much uncertainty driven by Trump affects all major asset classes — including stocks, bonds, currencies and oil

Stock market volatility is still leading the way, but what's more concerning is that volatility is rising across the board. All the major volatility indices are climbing at the same time, which reflects the growing global uncertainty caused by US trade policy coming out of DC. (via SRP) Source: HolgerZ

CBOE Volatility Index $VIX drops by more than 35%, its largest decline in history

Source: Barchart

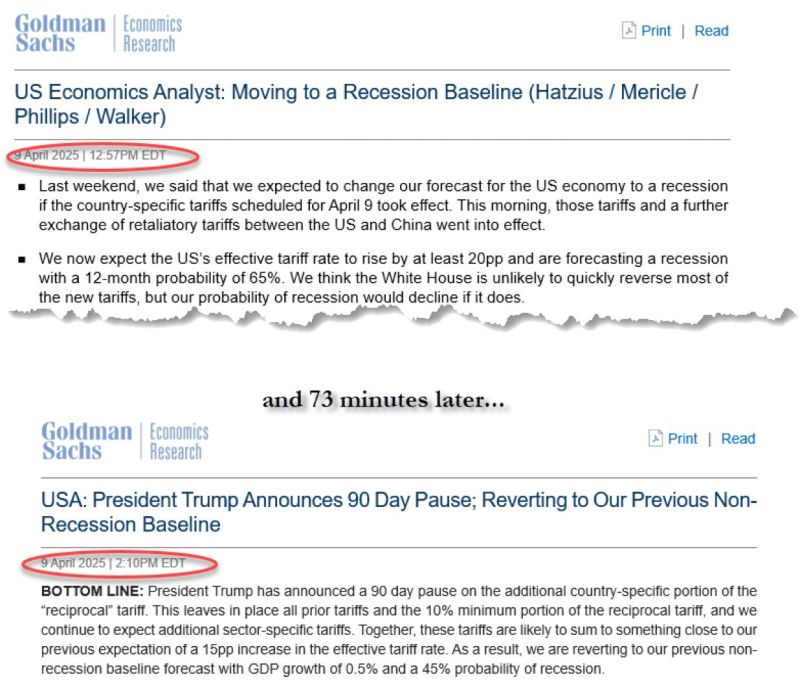

Macro volatility, market volatility and... sell-side volatility...

Goldman Sachs’ research department publishing these two headlines 73 minutes apart. Source. litquidity @litcapital

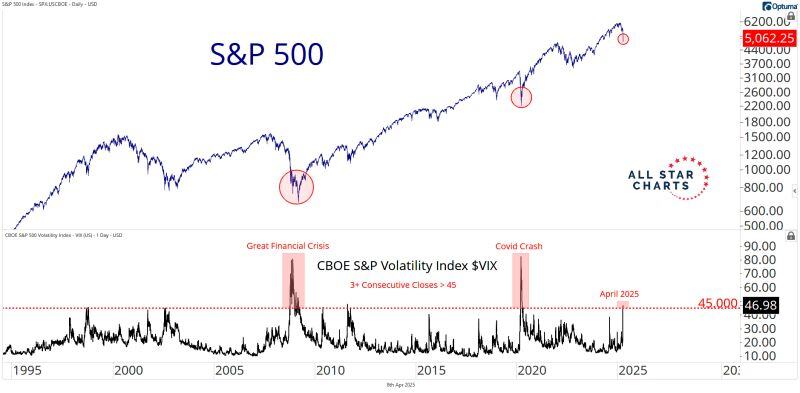

Third consecutive close of the $VIX > 45.

That’s only happened in three bear cycles: 🔻 2008 🔻 2020 🔻 2025 Source: Alfonso De Pablos, CMT, Alfcharts

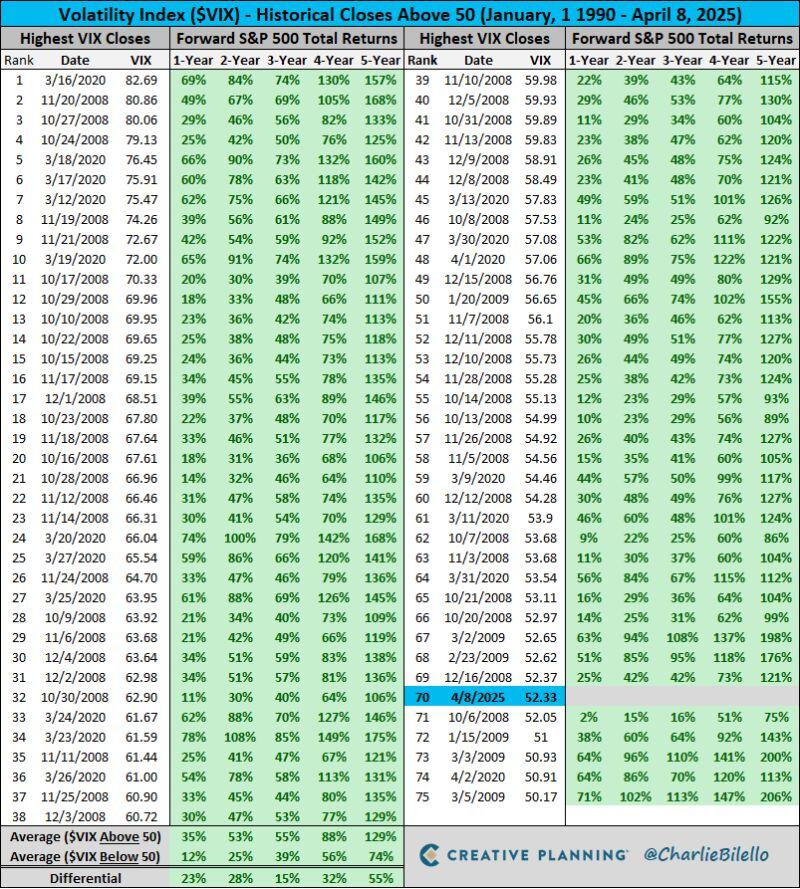

The $VIX closed above 50 today which is in the top 1% of historical readings.

What has happened in the past following closes above 50? S&P 500 gains over the next 1, 2, 3, 4, 5 years every time with above-average returns overall. Source: Charlie Bilello

The vix (S&P 500 implied volatility) is now back above 50 (extreme fear).

The move index (30Y Treasuries implied volatility) is also skyrocketing... What's going on here? If volatility and market stress stay too high for too long, the risk of a financial accident is real. Source: TradingView

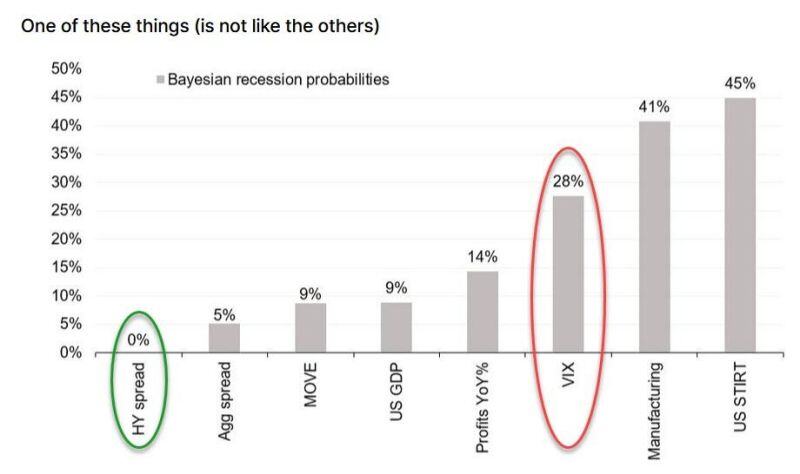

🔴 The VIX Is Pricing In A Recession, While Junk (Still) Sees Zero Risk

➡️ SocGen's Jitesh Kumar writes that high yields spreads remain below 4%, and "we have never been in recession with high yield spreads below 4.5% (data going back to 1987)." In other words, US HY credit spreads are pricing in 0% recession probability. ➡️ However while credit remains complacent, one asset is starting blast a recession warning siren: according to UBS trader Antonya Allen, the VIX is now pricing in a recession. Which one will be correct? Source: SocGen, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks