Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

RFK JR. TO BE TAPPED TO “MAKE AMERICA HEALTHY AGAIN” AS HHS SECRETARY

President-elect Donald Trump will nominate Robert F. Kennedy Jr. as secretary of the Health and Human Services Department. RFK Jr., who is a vaccine skeptic and conspiracy theorist, is the son of the late Sen. Robert F. Kennedy, and the nephew of former President John Kennedy. Kennedy, a long time advocate for medical freedom and health, is set to join the administration with a commitment to “shake up” the health system and prioritize Americans’ well-being. Trump’s selection of Kennedy came a day after the Republican president-elect tapped Florida Rep. Matt Gaetz as attorney general.

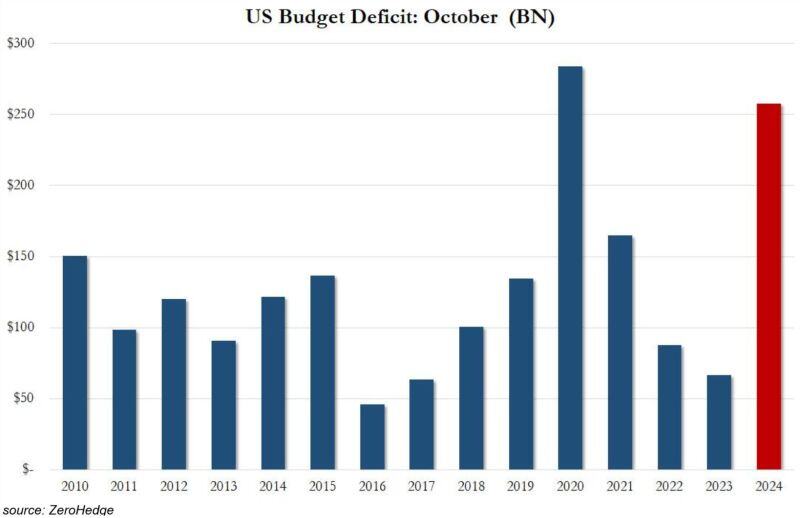

⚠️US GOVERNMENT BORROWING EXPLODED IN OCTOBER⚠️

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire United States history. Mind-blowing numbers. Source: Global Markets Investor, zerohedge

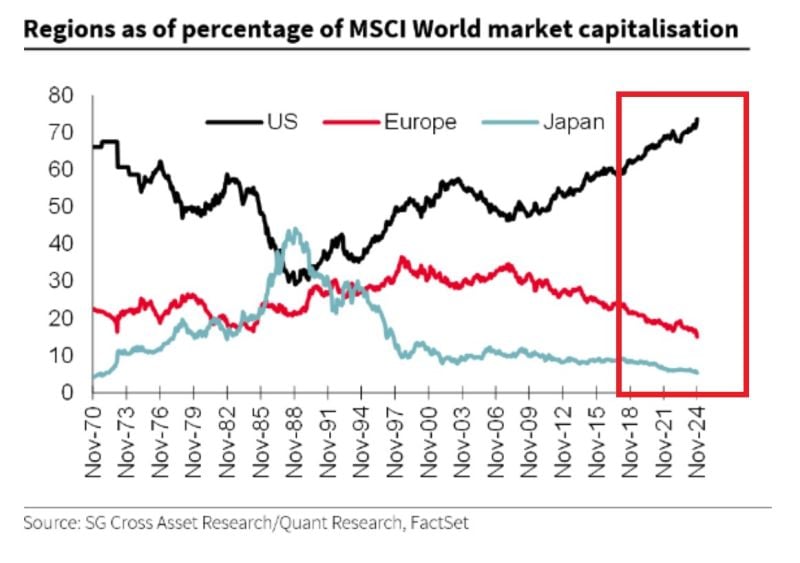

The US accounts for 74% of the MSCI world market capitalization, also a new all-time high.

Source: SG

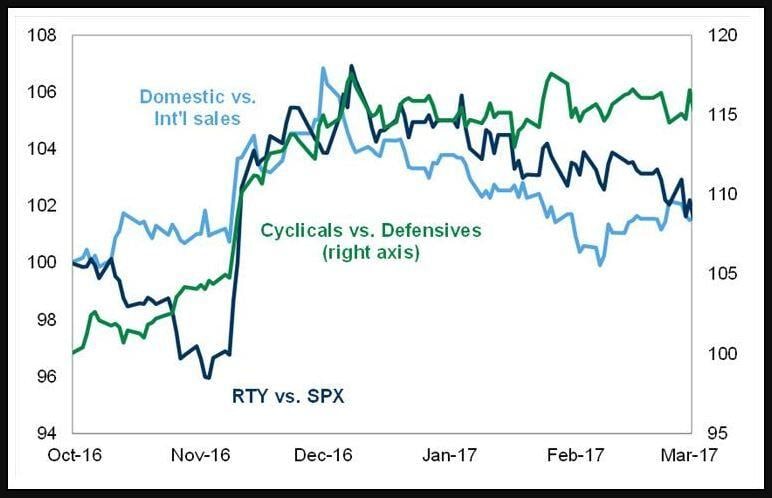

Will the "Trump trade" start top fade in December?

Goldman Sachs' trader John Flood highlighted the 2016 analogs: the 3 trades depicted below (Domestic vs. International sales, Cyclicals vs. Defensives, Small-caps vs. Large-caps) skyrocketed in November 2016 but ALL started to fade in December 2016, going nowhere in Q1 2017. Could we see something similar in December and Q1 2025 ? Source: www.zerohedge.com, Goldman Sachs

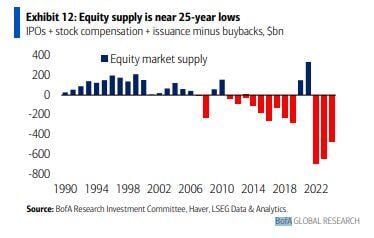

BofA (Woodward):

"the net supply of US equities has shrunk -$473bn. The steady growth of buybacks, a key source of demand, has overwhelmed sources of new supply such as share issuance, IPOs, and stock-based compensation." So basically we have: 1) US stocks: shrinking supply, (ever-) increasing demand 2) US Treasuries: rising supply, decreasing demand Source: Neil Sethi

🔉 President-elect Donald Trump’s choice of Senator Marco Rubio as his secretary of State

He is arguably the world’s most important diplomat, and could change the dial when it comes to the U.S.′ relationship with both its enemies, and its allies. 🚨 Rubio, considered a foreign policy hawk, has been highly critical of China and Iran, which are considered the hashtag#us′ top economic and geopolitical adversaries. 🦅 Trump’s choice for secretary of state, Marco Rubio, was a key sponsor of 2021 Uighur Forced Labour Prevention Act, which bans the import of all goods from Xinjiang unless companies offer verifiable proof that production did not involve such a violation. 🛢️ Marco Rubio, may intensify oil sanctions on Iran & Venezuela! Analysts note potential pushback from China could soften efforts. ❓ The Florida senator has also been ambivalent about ongoing support for Ukraine, echoing Trump’s stance that the war with Russia must come to an end. 👉 Rubio’s appointment as secretary of state and Trump’s focus on Latin America signals a potential shift in U.S. foreign policy priorities. While ‘America First’ often means pulling back globally, Latin America might indeed be an exception due to historic ties and regional security concerns. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks