Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

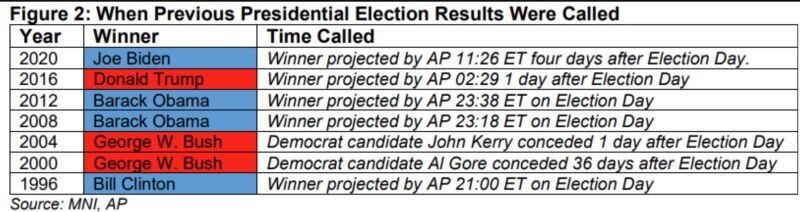

When Previous Presidential Election Results Were Called

Source: DeItaone (@*Walter Bloomberg)

New York Post Cover

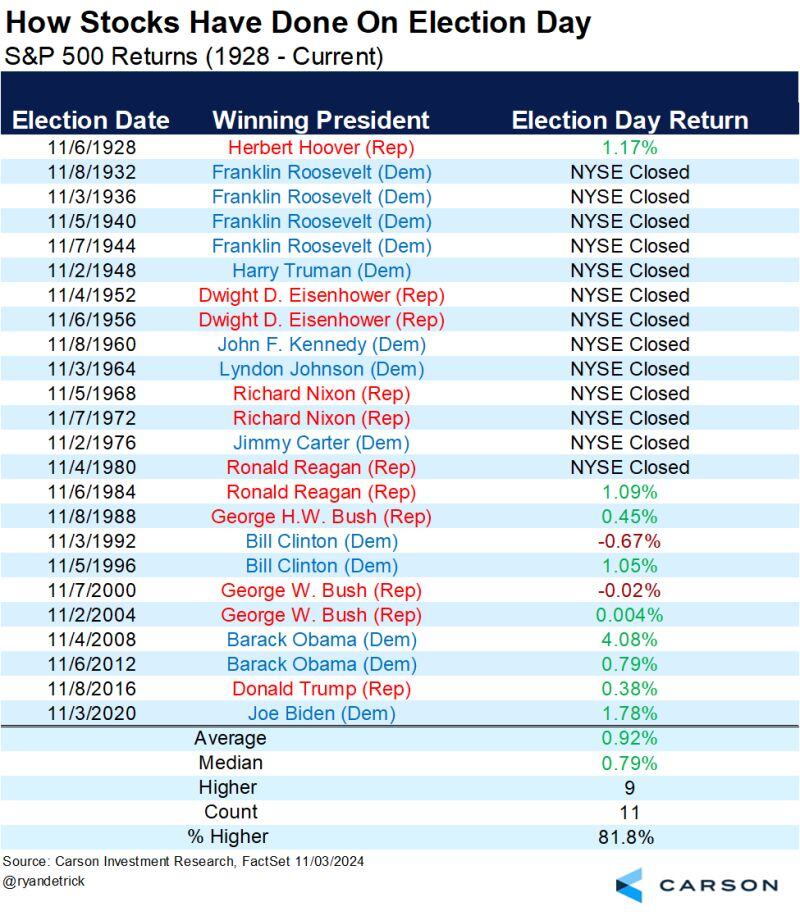

Pretty well overall, but also up the past five elections. Source: Carson, Mike Zaccardi, CFA, CMT, MBA

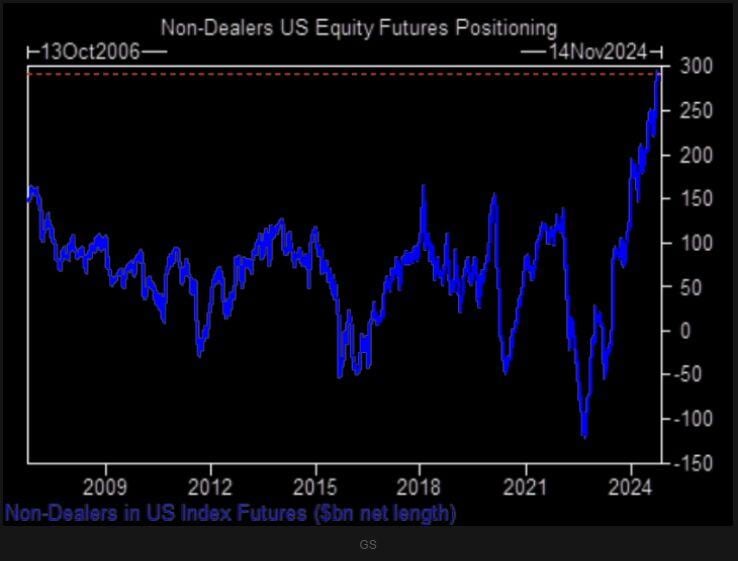

Traders have built the largest long US Equity Futures position in history, now worth more than $300 Billion

Source: Stocktwits

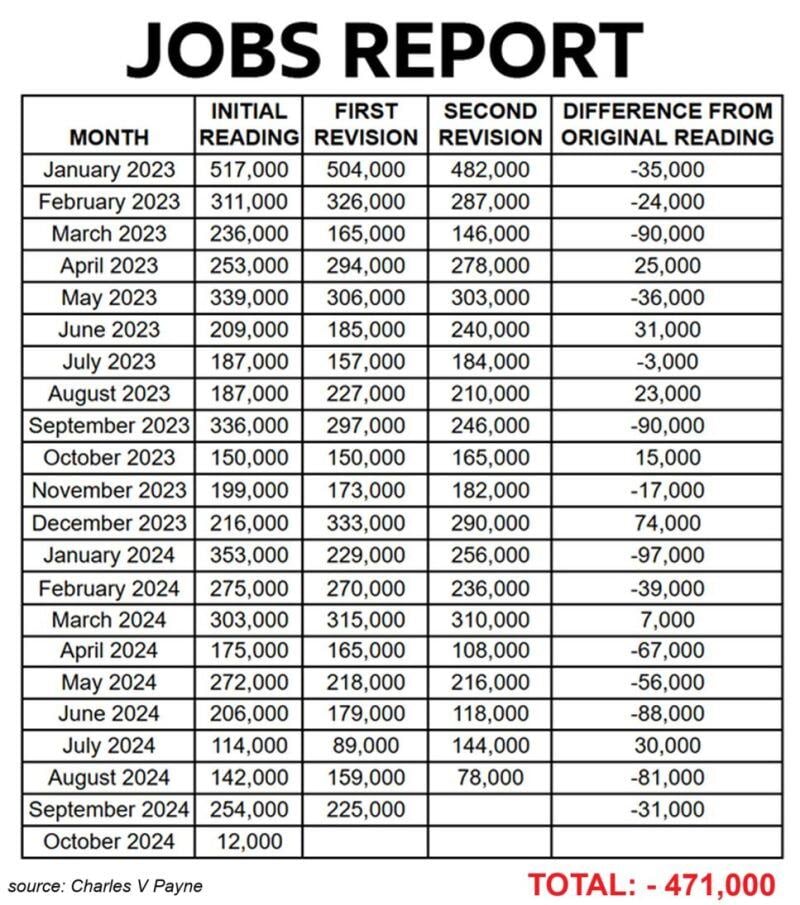

😱 US JOB MARKET IS MUCH WEAKER THAN IT SEEMS 😱

Since January 2023, the number of jobs have been revised DOWN by A MASSIVE 471,000, the most since the 2008 Financial Crisis. Monthly nonfarm payrolls have been revised DOWNWARD in 14 out of the last 21 months. Source: Global Markets Investor

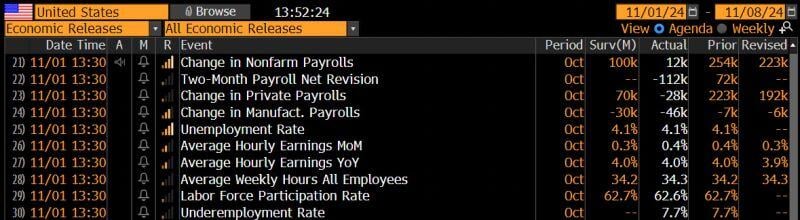

US employment numbers are out... and what a miss... 😱

🚨 It is indeed a confusing US jobs report with ugly headline numbers. US economy added just 12k jobs, according to Establishment Survey, far below consensus forecast of +100k and down from +223k in September. 🚨 Private payrolls were negative 28k, below the Street’s +70k forecast and down from +192k in September. 🌪 August was revised down by 81,000, from +159,000 to +78,000, 🌪 September was revised down by 31,000, from +254,000 to +223,000 👉 Odds of a 25 bps Fed cut next week increase per SOFR. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks