Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

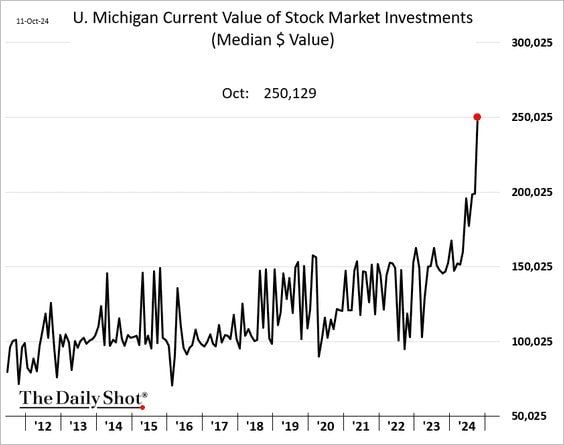

😱 The shocking chart of the day >>> The median value of US households’ stock portfolios has surged to $250k this month... 😱

This is twice as much as in early 2023... Middle to high income households enjoy a very strong "wealth effect" as both real estate and stock prices hit all time highs... Source: Stocktwits

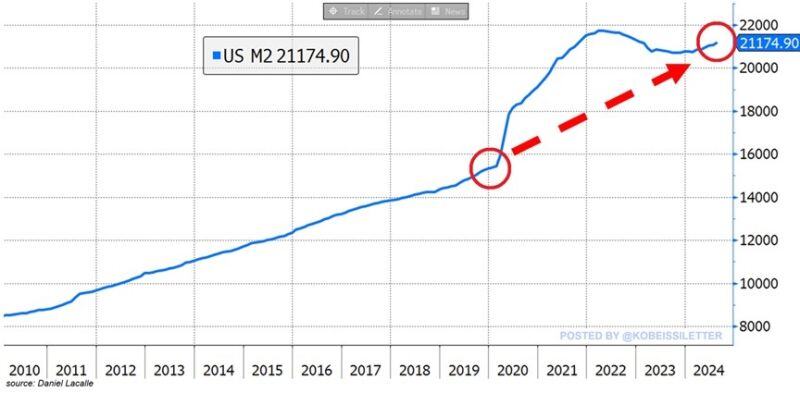

BREAKING: The US money supply hit $21.17 trillion in August, the highest level since January 2023.

This also marks a fifth consecutive monthly increase for the US money supply. Over the last 10 months, the amount of US Dollars in circulation has jumped by a MASSIVE $484 billion. In effect, the money supply is now just $548 billion below a new all-time high. After a brief decline, the quantity of money in the financial system is surging again raising concerns about another inflation wave. Source: The Kobeissi Letter

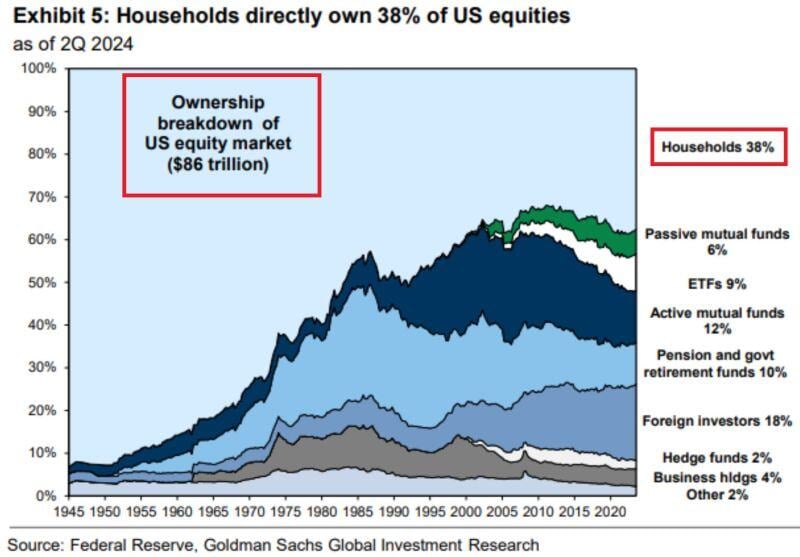

⁉️WHO OWNS THE MOST SHARE OF THE US STOCK MARKET⁉️

US households own 38% of the total equity market, the most among other participants. This equals to roughly $33 trillion. This is followed by foreign investors and active mutual funds with 18% and 12% shares respectively. Source: The Kobeissi Letter

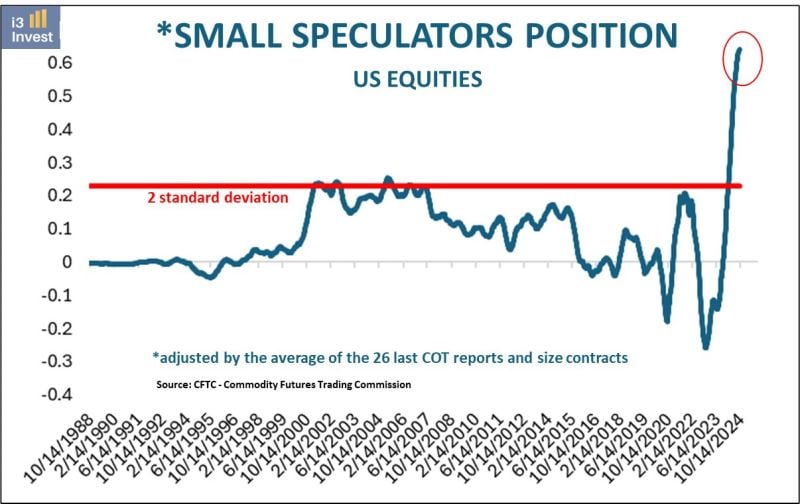

Small traders are extremely long in US equities.

Source: Guilherme Tavares i3 invest on X

BREAKING: The number of people working MULTIPLE jobs in the US hit 8.66 million in September, a new record.

This is ~300,000 above the peak seen before the pandemic and ~600,000 above the 2008 peak. Furthermore, the number of part-time jobs has jumped by ~3 million over the last 3 years to a near-record 28.2 million. Concerningly, full-time employment has declined by 1 million since November 2023. Multiple jobholders have been rapidly rising over the last few years as Americans are fighting record-high prices. Millions of Americans are working multiple jobs to afford basic necessities. Source: The Kobeissi Letter

Top 10 largest US Stocks vs the rest of the S&P 500 so far in 2024

Source: www.econovisuals.net

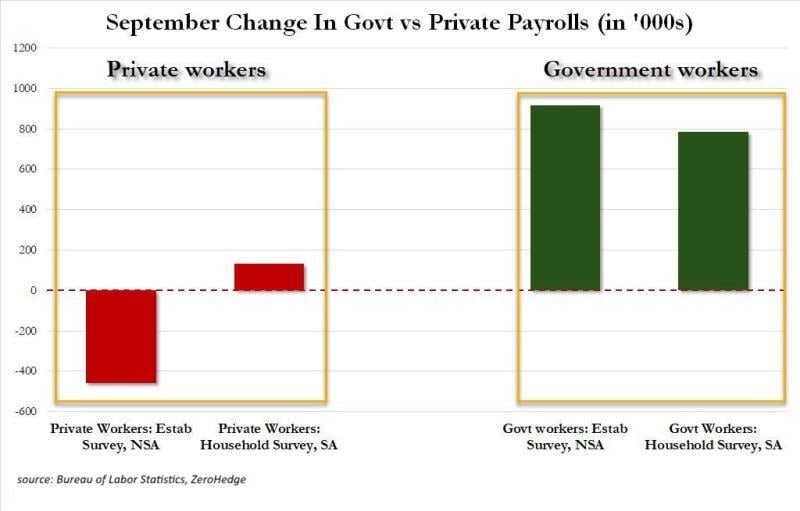

‼️IN REALITY US JOB MARKET SHED 458,000 PRIVATE JOBS IN SEPTEMBER‼️

Not seasonally adjusted private sector workers FELL by 458,000 in Sep. Government jobs SPIKED 918,000 This largely came as young people left summer jobs and returned to school while teachers went back to work. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks