Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

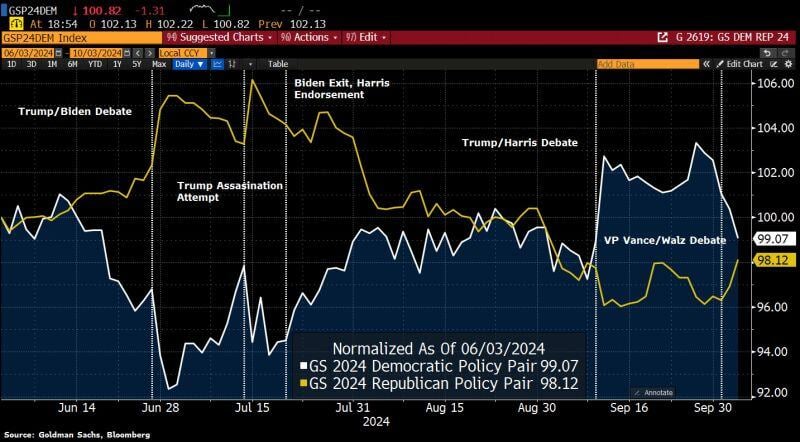

33 days away from election day, it looks like the markets see Republican Vance as the clear winner of the VP debate Vance/Walz.

The GS Republican policy pair depot has risen significantly, while the GS Democrat policy pair depot has fallen recently. Source: HolgerZ, Bloomberg

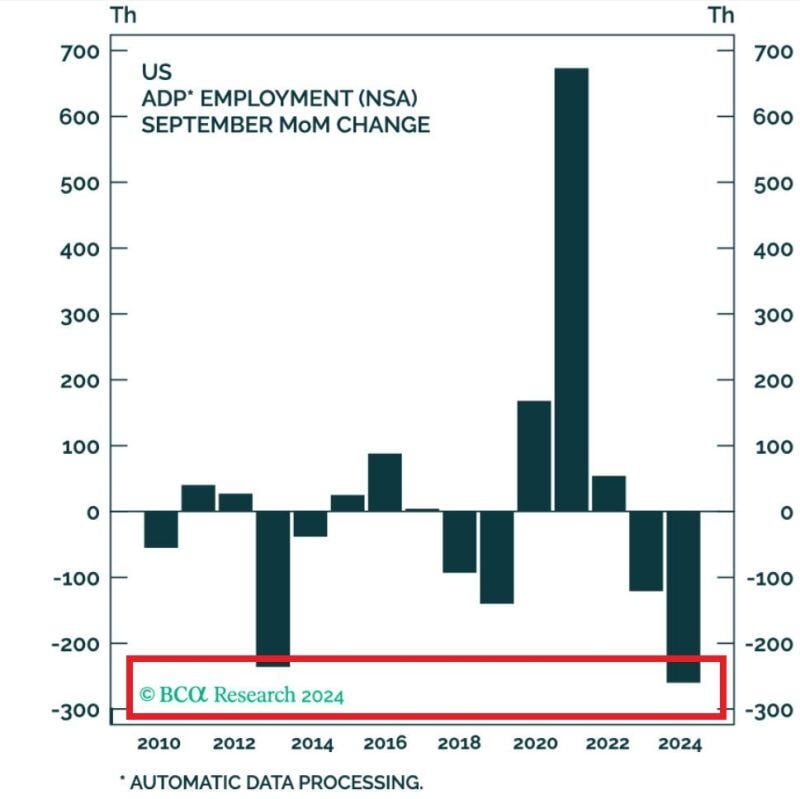

US job market is cooling down...

US Private businesses added 143,000 workers to their payrolls in September. Adjustment was almost 2x prior Septembers elevating the print,!!! On a non-seasonally adjusted basis payrolls FELL 260,000, the worst September in history. Source: Global Markets Investor

🚨 BANK OF AMERICA OUTAGE LEAVES CUSTOMERS UNABLE TO ACCESS ACCOUNTS, SPARKS PANIC🚨

Bank of America customers experienced a major outage on Wednesday, with many unable to access their accounts or seeing $0 balances. The issue, reported on Downdetector, began around 12:45 pm ET. While the bank's app stated accounts were "temporarily unavailable," users flooded social media with concerns. Bank of America has yet to clarify the cause or confirm if funds were at risk. Source: Downdetector thru Mario Nawfal

Michael Burry has had a sensational 2024 so far.

His fund is up 39%. Over the last 8 years he has also managed to provide returns of 345% compared to 110% for the S&P 500...! He only holds 10 companies. Source: @MMMTwealth

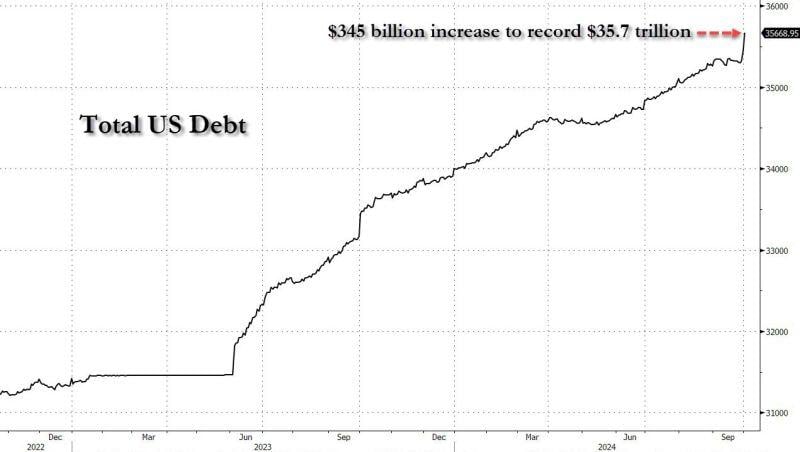

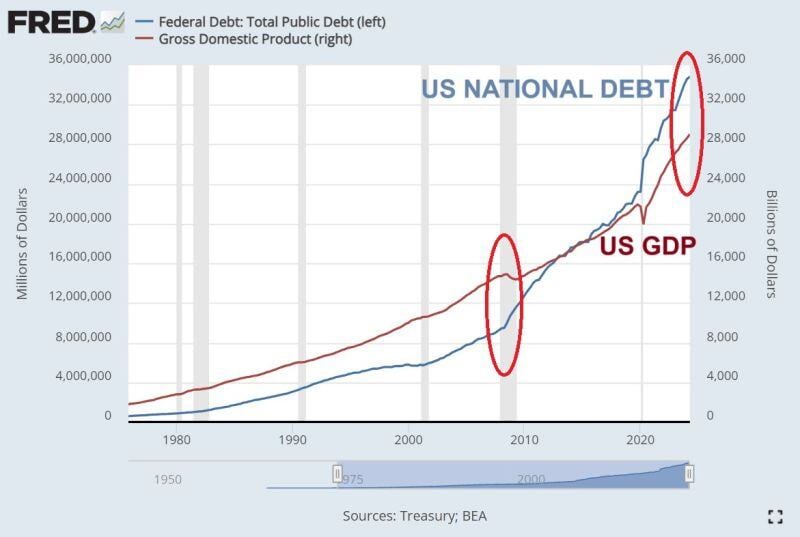

😱 The shocking chart of the day: US PUBLIC DEBT GROWTH HAS BEEN MASSIVE 😱

In 2008, the US federal debt was $9.4 trillion while the US GDP was $14.7T with the debt-to-GDP ratio at 64%. Now, the public debt is $35.7 TRILLION (Total US debt added another $345 billion between Sept 27 and October 1st...) and the US GDP is $29.0 TRILLION with the debt-to-GDP ratio at 122%... What is the pain thresold for the bond market ??? Source: Global Markets Investor, FRED

🔥US STOCK MARKET DOMINANCE KEEPS GROWING🔥

The American stock market accounts for nearly 50% of global market capitalization. It has reached a MASSIVE $55 trillion, or ~200% of US GDP, the most on record. This is almost TRIPLE the value of the Asian and European exchanges. Source: Global Markets Investor, The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks