Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

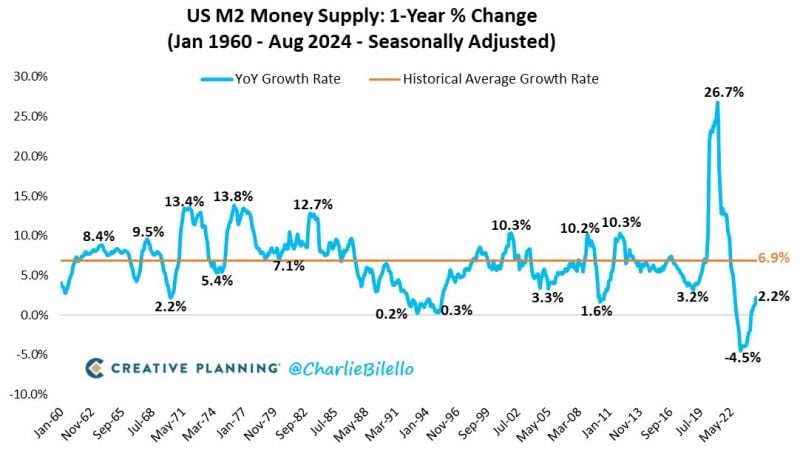

US stocks recorded only small gains yesterday as investors were cold feet by weak consumer confidence numbers

*U.S. SEPTEMBER CB CONSUMER CONFIDENCE SINKS TO 103.0; EST. 105.5; PREV. 108.7 *THIS WAS THE LOWEST LEVEL SINCE MAY 2023 Source: www.investing.com

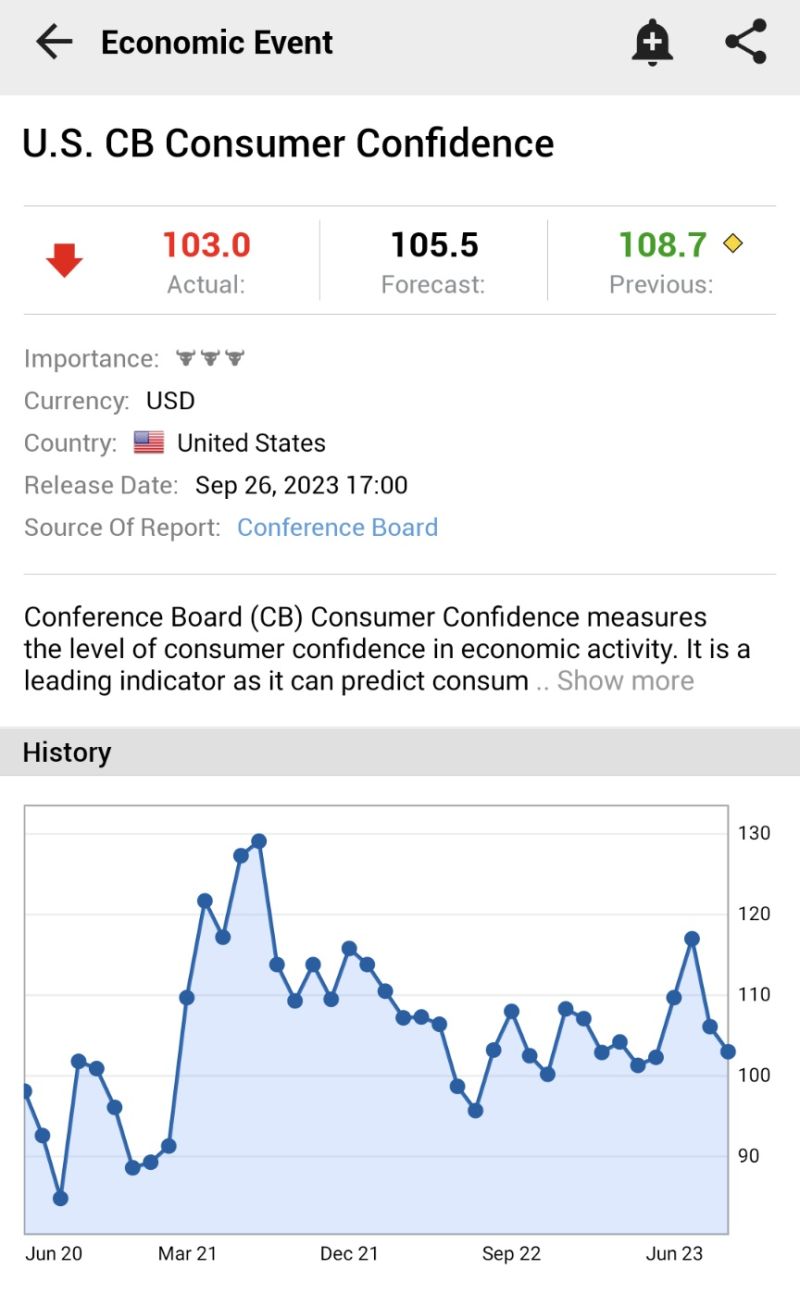

Top Donor Contributions to Donald Trump & Kamala Harris as of September 2024.

Google & Microsoft very disproportionately donate to the Democratic Party. Between them, they control close to 100% of web browsers and search. Any bias? Source: @TheRabbitHole84

AMERICANS CURRENT VALUE OF STOCK MARKET INVESTMENTS IS SKYROCKETING

The median amount of US consumers' stock market investments hit $237,000. The value has DOUBLED in 1 year. Such a spike has never been seen before. Source: Global Markets Investor

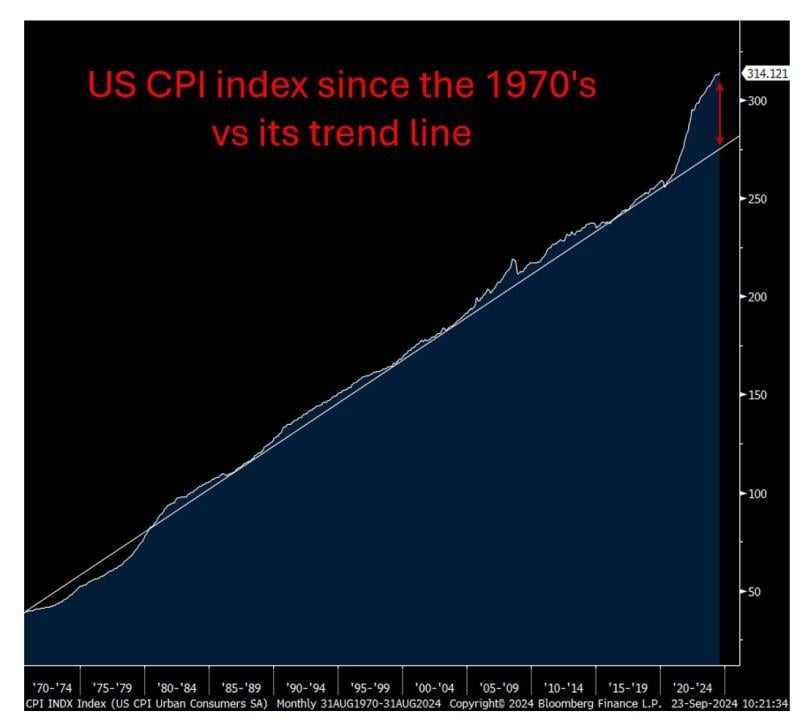

😱 The "shocking chart" of the day !!! 😱 US CPI index since the 1970's vs its trend line.

In order to 'average' out the recent period of high inflation at 2%, the fed would have to tolerate a period of time of deflation. But can they really afford deflation with $33T of debt and persistently high budget deficit? As mentioned by Peter Boockvar on X, once purchasing power is lost, it is lost forever because central bankers won't let you get it back... Last week, Federal Reserve Governor Chris Waller inadvertently made that perfectly clear when he spoke on Friday. He told CNBC in an interview that "What's got me a little more concerned is inflation is running softer than I thought."... Bottom-line: It is very unlikely that inflation will come back to trend line in the foreseeable future. Perhaps the jumbo rate cut was also about making sure that the US economy doesn't fall into a deflationary trap... Welcome to the era of fiscal dominance Source chart: Bloomberg

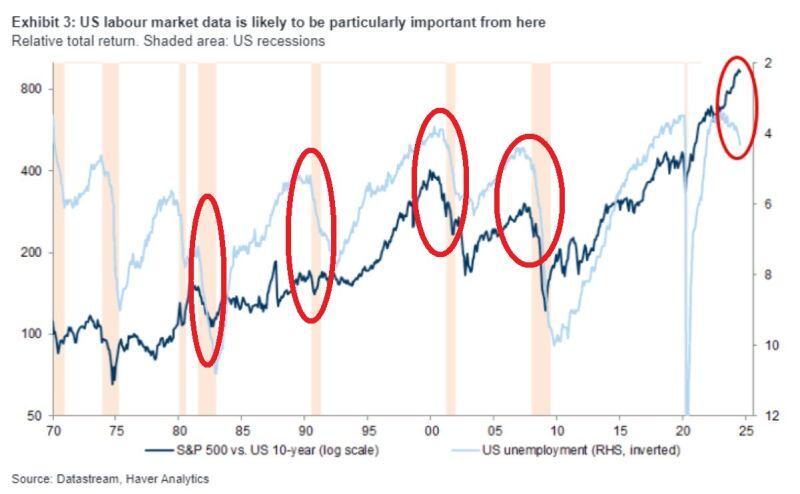

🚨US UNEMPLOYMENT RATE USUALLY RISES BEFORE THE S&P 500 CORRECTION🚨

US jobless rate rose from 3.4% in April 2023 to 4.2% in August near the highest in 3 years. In the past, when the unemployment rate was rising, the S&P 500 index saw significant declines. The us jobs reports in the coming weeks will be key... Source. Global Markets Investor

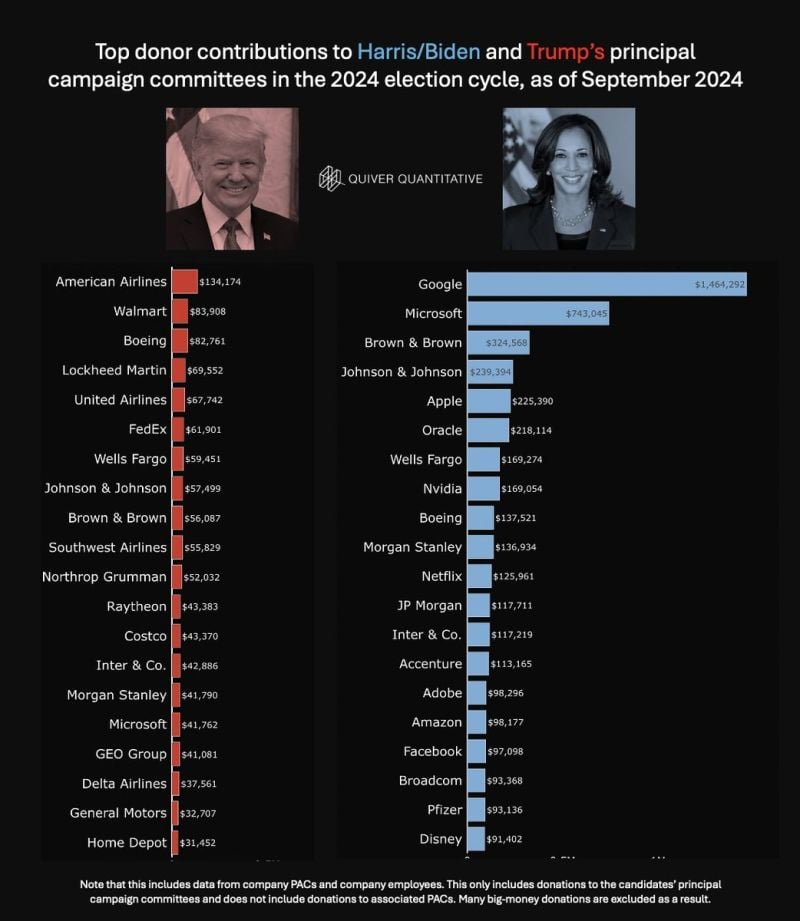

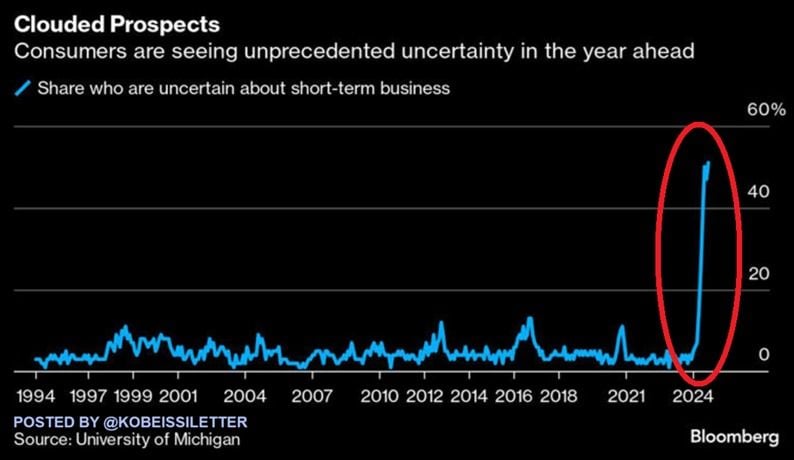

Americans have never been so worried about the year ahead:

The share of consumers uncertain about business conditions over the next year spiked to 51% in September, the most on record. The percentage has DOUBLED in 4 months. Over the last 30 years, the share of consumers concerned about short-term business prospects has never been so high. Americans have been hit by historically high costs of living, elevated borrowing costs, and the deteriorating job market. US households are struggling. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks