Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

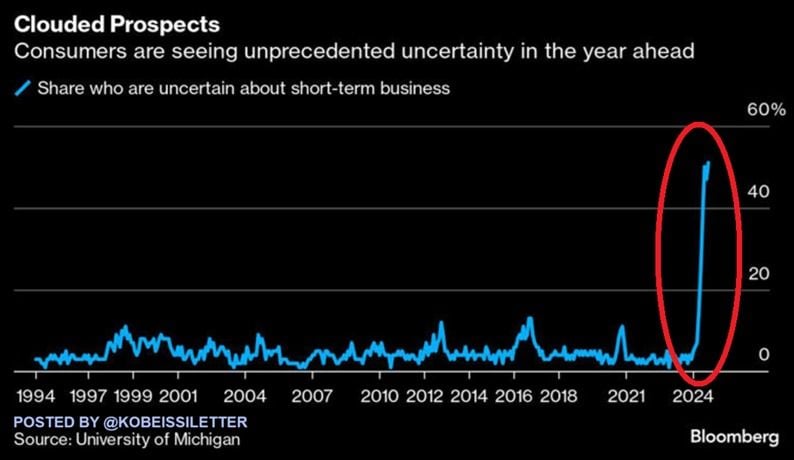

Americans have never been so worried about the year ahead:

The share of consumers uncertain about business conditions over the next year spiked to 51% in September, the most on record. The percentage has DOUBLED in 4 months. Over the last 30 years, the share of consumers concerned about short-term business prospects has never been so high. Americans have been hit by historically high costs of living, elevated borrowing costs, and the deteriorating job market. US households are struggling. Source: The Kobeissi Letter

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

BREAKING: Multiple shots were fired in the vicinity of Donald Trump as he was golfing at the Trump National Golf Club in West Palm Beach

.

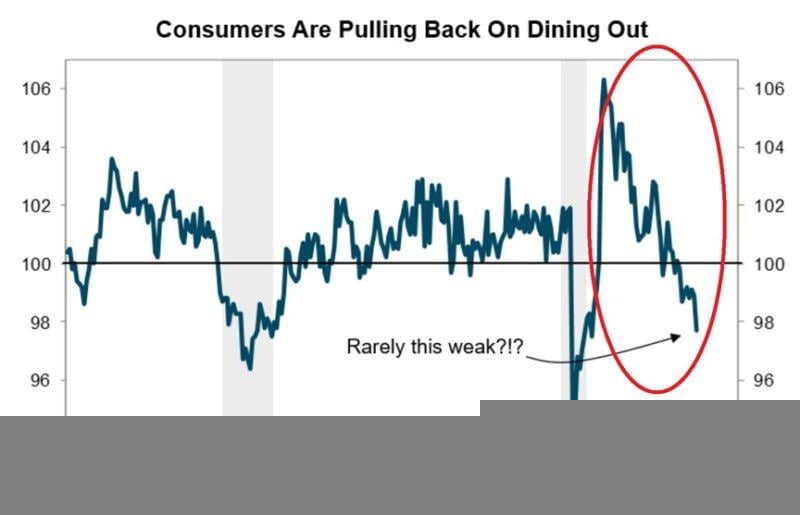

BREAKING: The Restaurant Performance Index (RPI) fell -1.3% in July to 97.7 points, the lowest level since the 2020 lockdowns

This index tracks the health of the restaurant industry in the US by measuring sales, customer traffic, labor, and overall business conditions. Since 2021, this metric has fallen by ~8.0%, marking the largest drop since it was launched in 2002. Such a low level in the index has only been seen during recessions. Americans are pulling back on dining out as prices have been sharply rising and recently hit new all-time highs. Since 2020, food prices away from home have increased by 27.0%, and fast food prices have jumped by 31.0%. Eating out is becoming a luxury... Source: The Kobeissi Letter, Trahan Macro Research

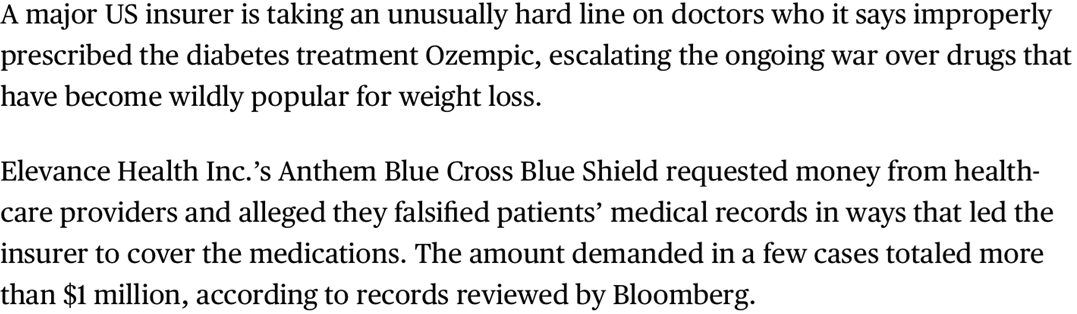

Ozempic is selling so well that an insurer requests USD 1 bn in payments back

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks