Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

JUST IN:

President-elect Trump appoints Elon Musk and Vivek Ramaswamy to lead Department of Government Efficiency (DOGE). #elonmusk #doge

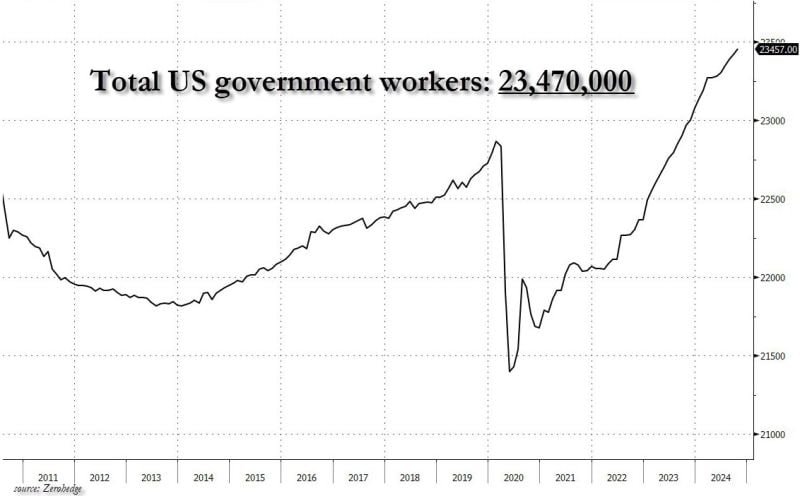

There are a record 23,470,000 government workers

(80% of that is 18,776,000...) #elonmusk #doge Source: www.zerohedge.com

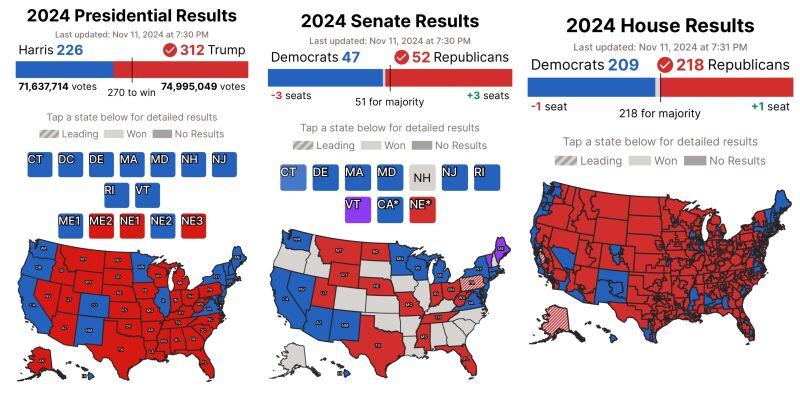

Republicans officially retain control of the U.S. House, giving the GOP a Trifecta; Control of both chambers of Congress and the Presidency.

The Republicans have won control of the U.S. House of Representatives after the party took 218 seats in national elections, according to a Decision Desk HQ projection on NewsNation. Source: @america

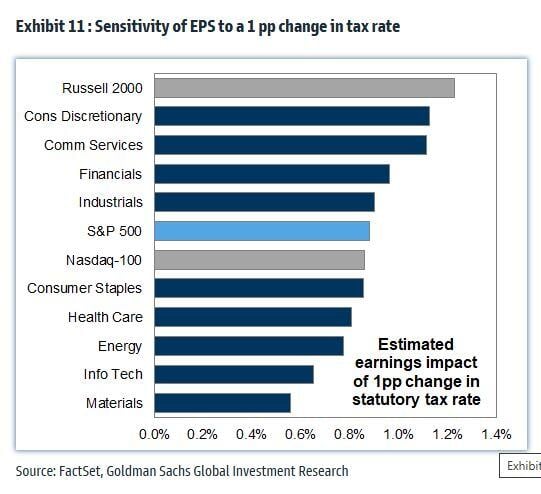

Are you wondering why US smallcaps are surging?

As highlighted by GS: GOP House control could enable corporate tax reform, potentially reducing the tax rate from 21% to 15% and increasing EPS estimates by 4%. Source: Mike Zaccardi, CFA, CMT, MBA, GD

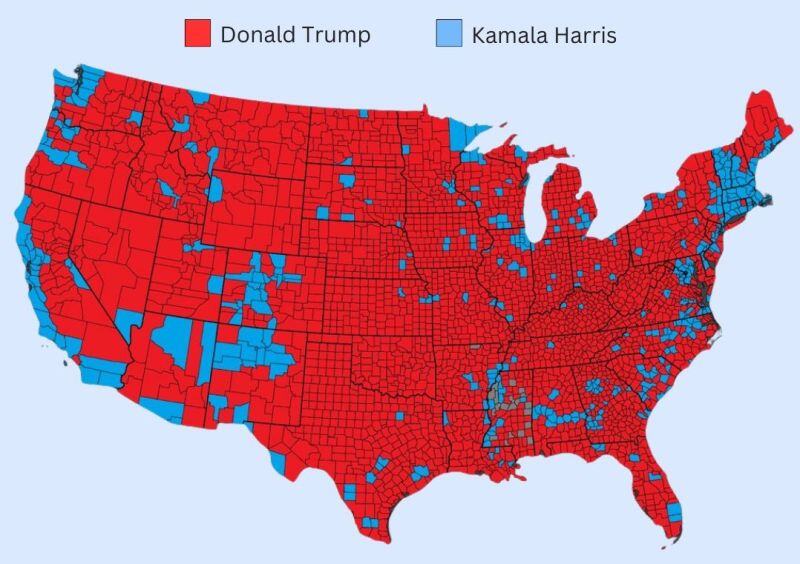

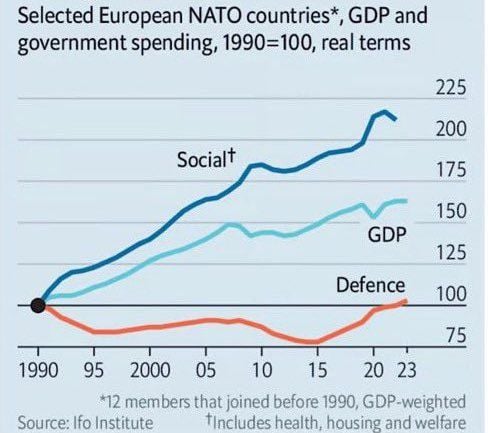

Political risk is in Europe, not in the US

The three-year-old union between Scholz’s Social Democratic Party (SPD), the Greens and Lindner’s Free Democratic Party (FDP) had been on shaky ground for some time. Chancellor Olaf Scholz said he would call for a confidence vote on Jan. 15, raising the possibility of elections earlier than scheduled in March. Source: FT, CNBC

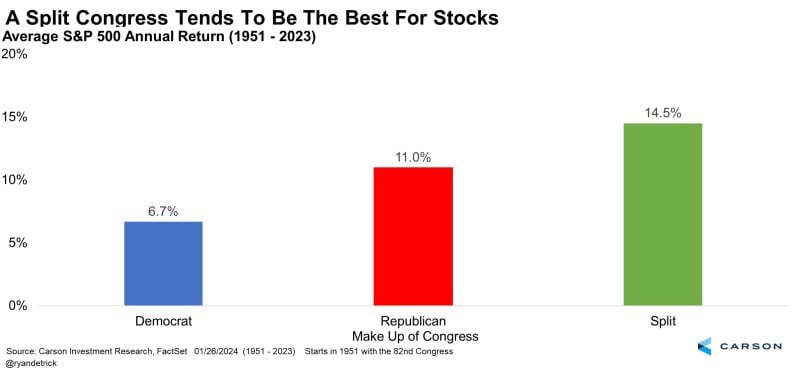

A Split Congress Tends To Be The Best For Stocks

This year will be the 13th year in a row stocks didn't fall when there was a split Congress. Source: Carson, Ryan Detrick, CMT

Investing with intelligence

Our latest research, commentary and market outlooks