Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

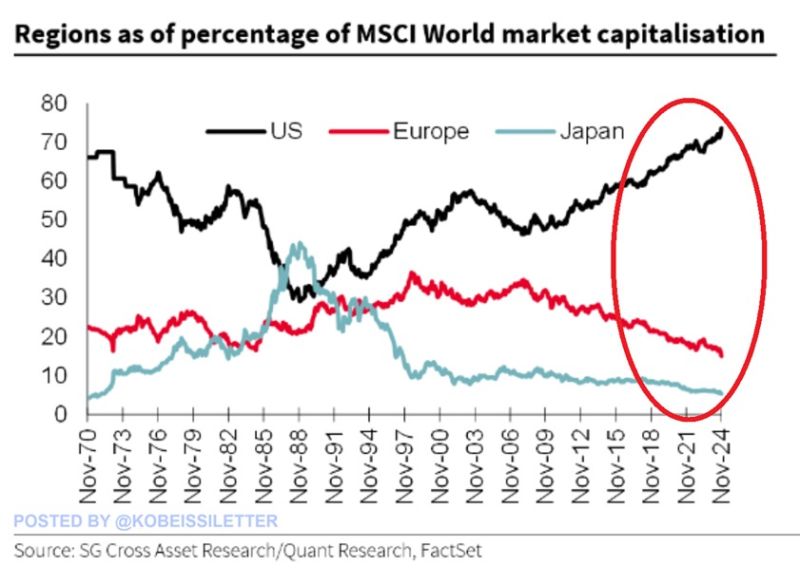

The US stock market is MASSIVE: US stock market capitalization accounts now for 74% of the MSCI World Index, a new all-time high.

Since the end of the 2008 Financial Crisis, this percentage has increased by ~25 points. By comparison, Europe and Japan’s share have dropped by ~15 and ~5 percentage points, respectively. As a result, the US' share of global market cap is now 4 TIMES larger than Europe and Japan COMBINED. This comes as the S&P 500 has rallied 450% over the last 15 years compared to a 70% and 310% gain of the Euro Stoxx 50 and Nikkei 225. The US stock market has never been larger. Source: The Kobeissi Letter, SG Cross Asset Research, Factset

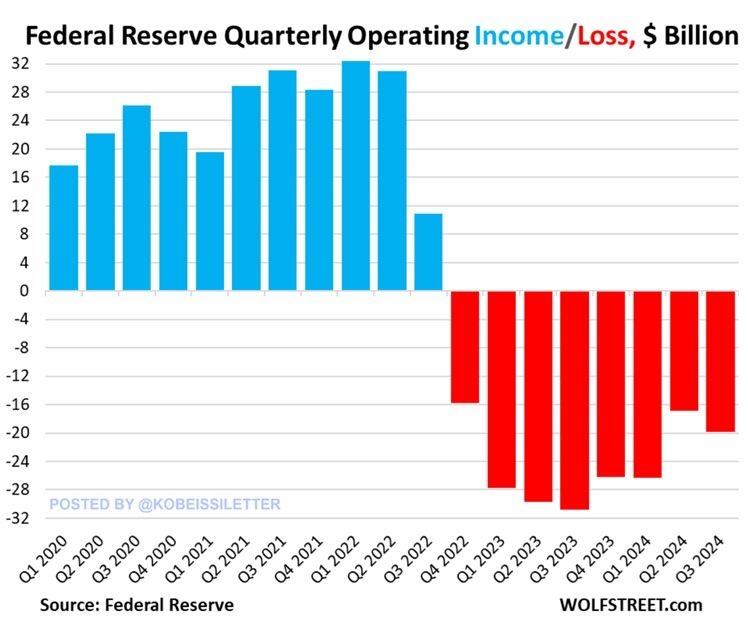

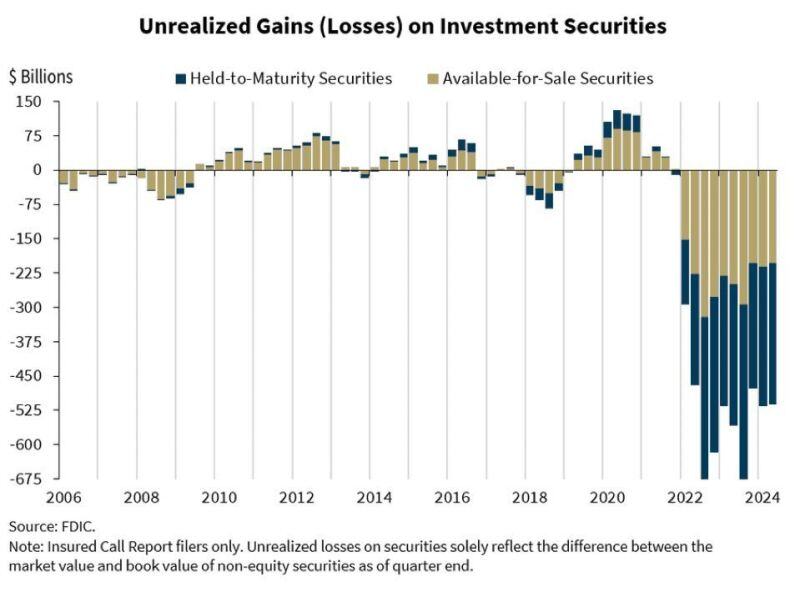

BREAKING: The Federal Reserve just reported a $19.9 BILLION operating loss in Q3 2024 up from $16.9 billion in Q2.

This marks the 8th consecutive quarter of operating losses for the central bank. As a result, cumulative operating losses reached a massive $210 billion over the last 2 years. This comes as the Fed has been paying hundreds of billions in interest to banks and money market funds. At the same time, income the Fed has earned on Treasuries and Mortgage-Backed-Securities has declined. Source: The Kobeissi Letter

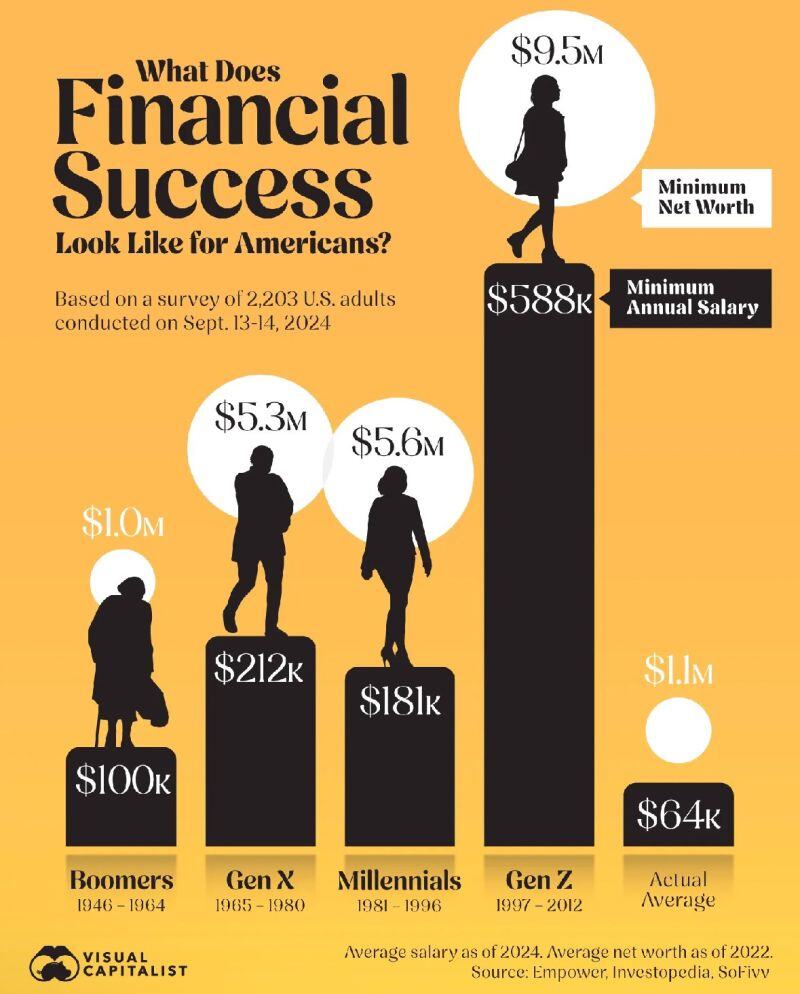

Here’s what different 🇺🇸 generations think financial success looks like

Source: Visual Capitalist

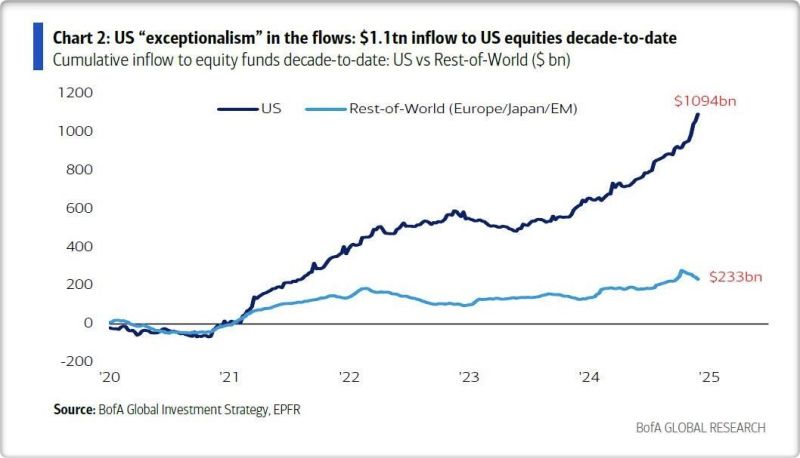

$1.1 trillion into US stocks so far in the roaring 20s.

Source: BofA via @ackmeni via Mike Zaccardi, CFA, CMT, MBA

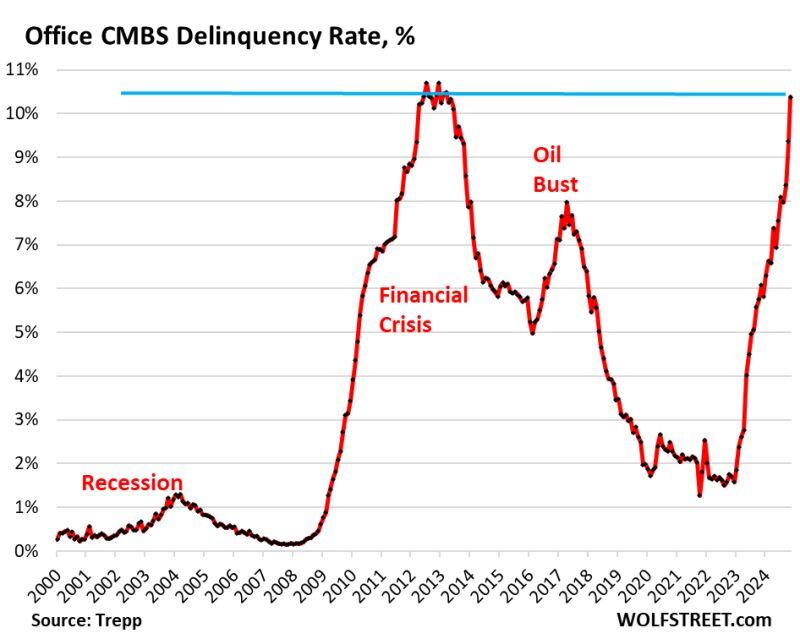

Office CMBS Delinquency Rate Spikes to 10.4%, Just Below Worst of Financial Crisis Meltdown. Fastest 2-Year Spike Ever.

Office-to-residential conversions are growing, but are minuscule because not many towers are suitable for conversion. Source: www,wolfstreet.com, Wolf Richter

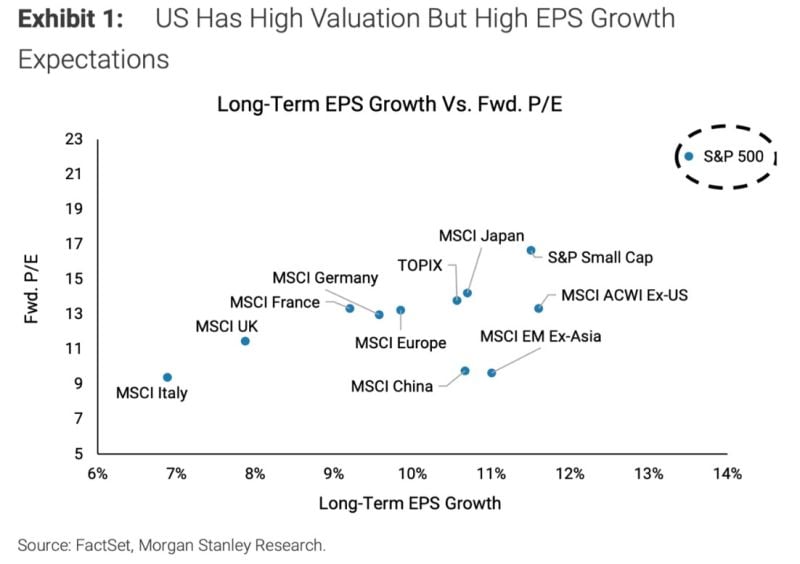

US equities: elevated P/E and high growth expectations.

Better for earnings to deliver in order to keep the PEG at reasonable level Source: Morgan Stanley Research

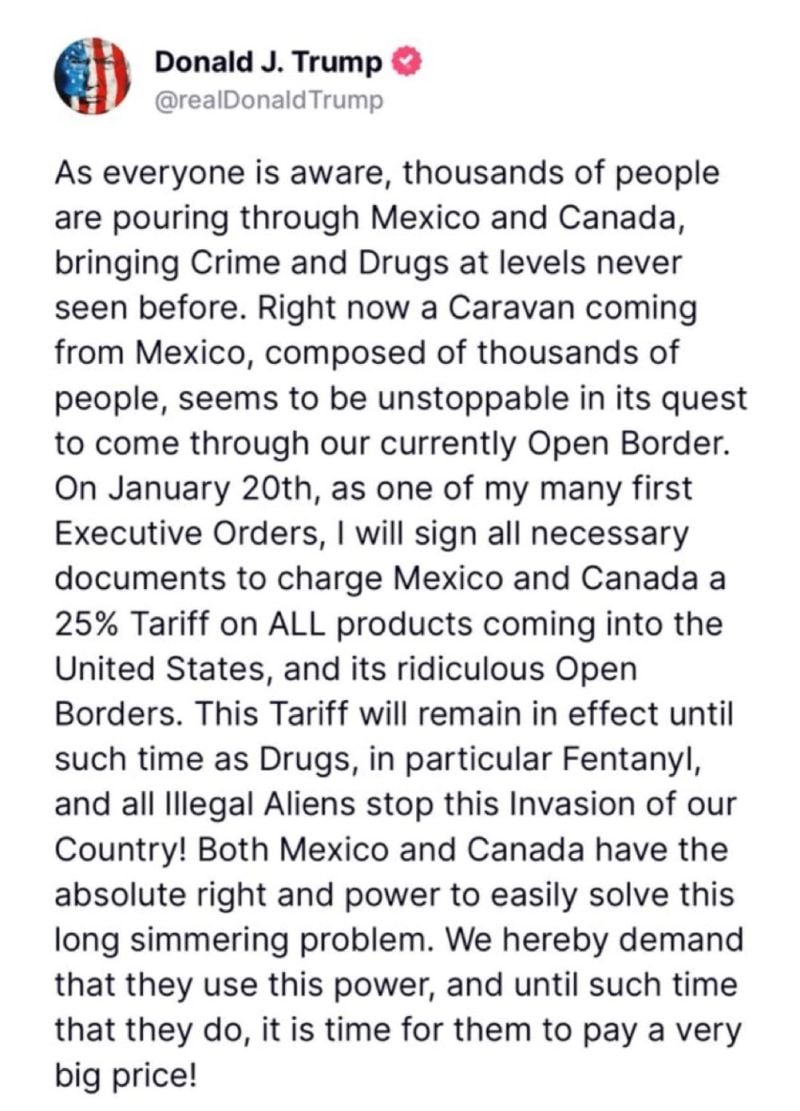

Donald Trump has said he would impose tariffs of 25 per cent on all US imports from Canada and Mexico on his first day in office (and an extra 10 per cent tariff on Chinese goods).

In social media posts, Trump accused the countries of permitting illegal immigration and drug trafficking. Trump said the new China tariffs would come on top of existing levies. He had also threatened on the campaign trial to impose “whatever tariffs are required” to stop Chinese cars from crossing into the US from Mexico. FT >>> The tariffs on the US’s three largest trading partners would increase costs and disrupt business, one expert said, adding that “even the threat of tariffs can have a chilling effect”. A former US trade official agreed the disruption would be significant, especially given the degree of integration in North American manufacturing across sectors such as the automotive industry. He added that “tariffs are inflationary and will drive up prices”.

Investing with intelligence

Our latest research, commentary and market outlooks