Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

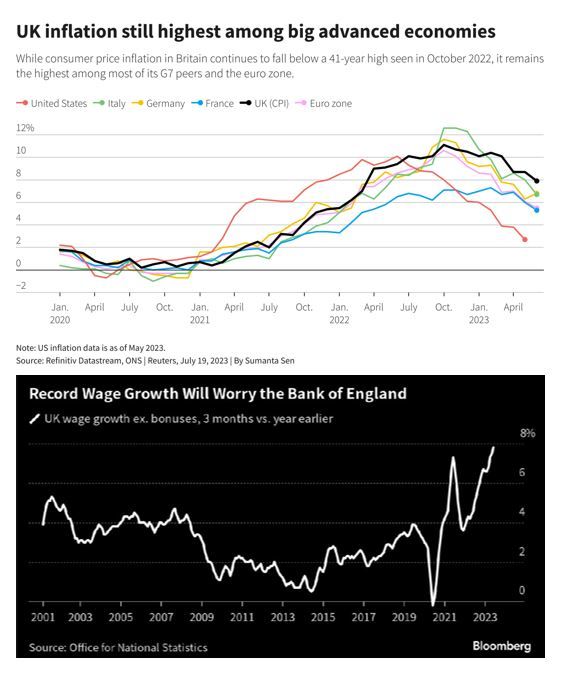

UK headline inflation cooled sharply in July to an annual 6.8%, but the core consumer price index remained unchanged, posing a potential headache for the Bank of England

The headline CPI reading was in line with a consensus forecast among economists polled by Reuters, and follows the cooler-than-expected 7.9% figure of June. Despite the decline, UK inflation is still the highest among "advanced" economies (see upper chart below). On a monthly basis, the headline CPI decreased by 0.4% versus a consensus forecast of -0.5%. However, core inflation — which excludes volatile energy, food, alcohol and tobacco prices — stayed 6.9%, unchanged from June and slightly above a consensus forecast of 6.8%.

U.K. inflation cooled significantly in June, coming in below consensus expectations at 7.9% annually

Economists polled by Reuters had projected an annual rise in the headline consumer price index of 8.2%, following May’s hotter-than-expected 8.7% reading, but annualized price rises continue to run well above the Bank of England’s 2% target. On a monthly basis, headline CPI increased by 0.1%, below a consensus forecast of 0.4%. Core inflation — which excludes volatile energy, food, alcohol and tobacco prices — remained sticky at an annualized 6.9%, but fell from a 31-year high of 7.1% in May. Source: CNBC

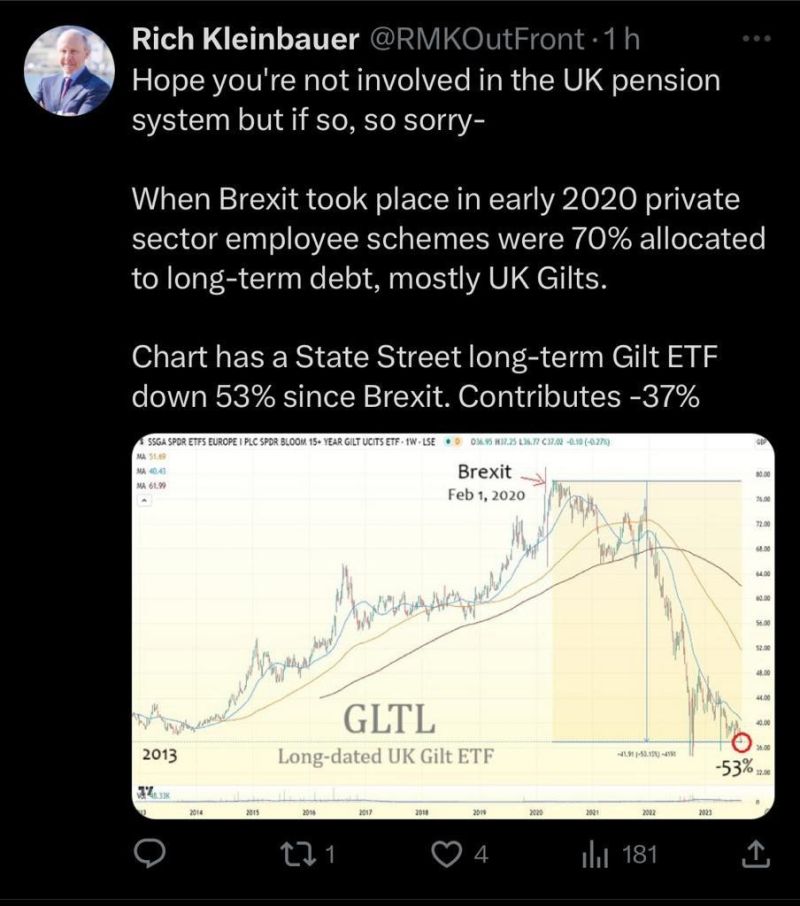

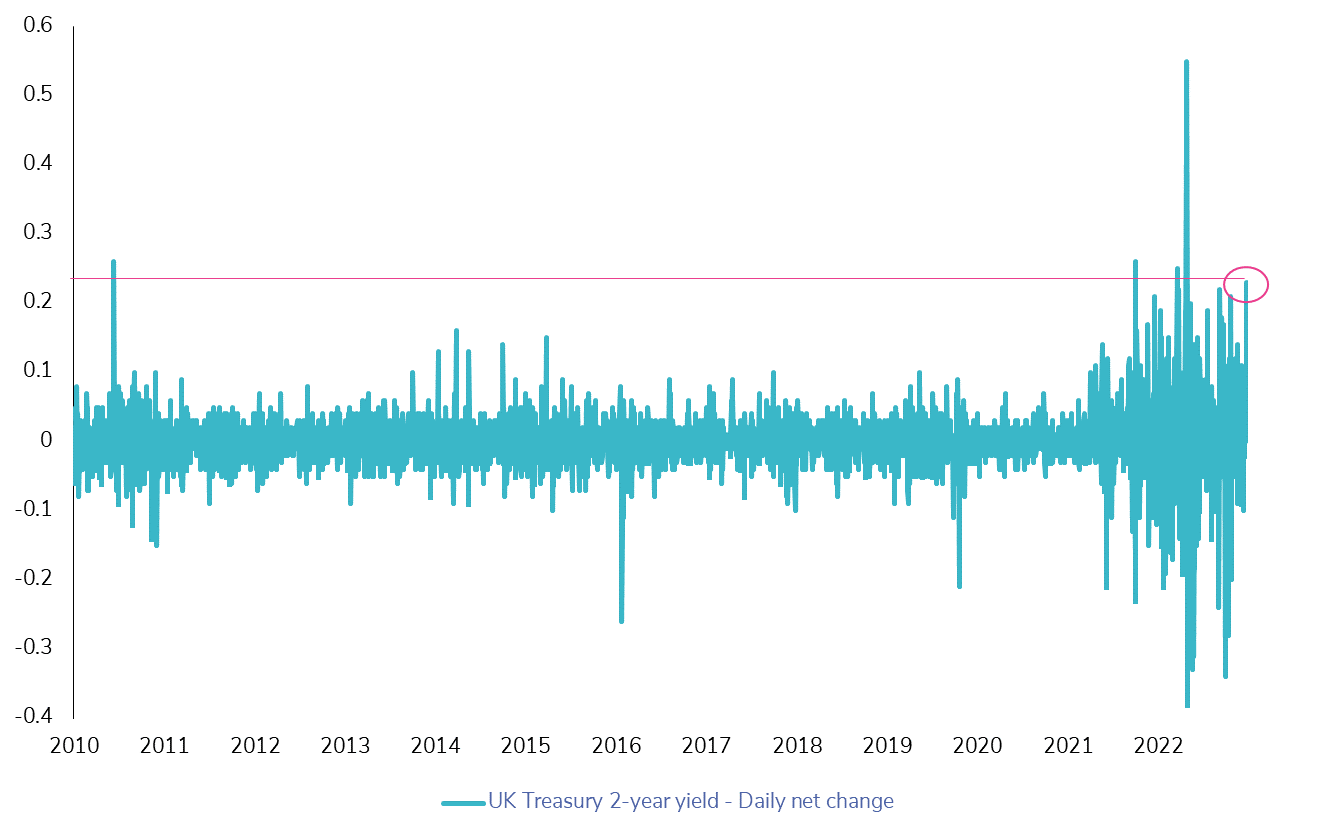

UK Bond Market Suffers Major Blow on Unforeseen Surge in UK CPI!

The UK bond market witnessed a substantial downturn due to an unexpected surge in Britain's core inflation rate, reaching its highest level in over three decades. This surprising release led to a sharp 25bps rise in the two-year UK Treasury yield. Consequently, market sentiment has shifted, with rate hike expectations now fully priced in for June, and projections even suggesting a potential 50bps increase. As a result, the terminal rate, anticipated for December 2023, is now hovering at almost 5.5%, a significant shift from less than 5% merely two days ago. Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks