Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

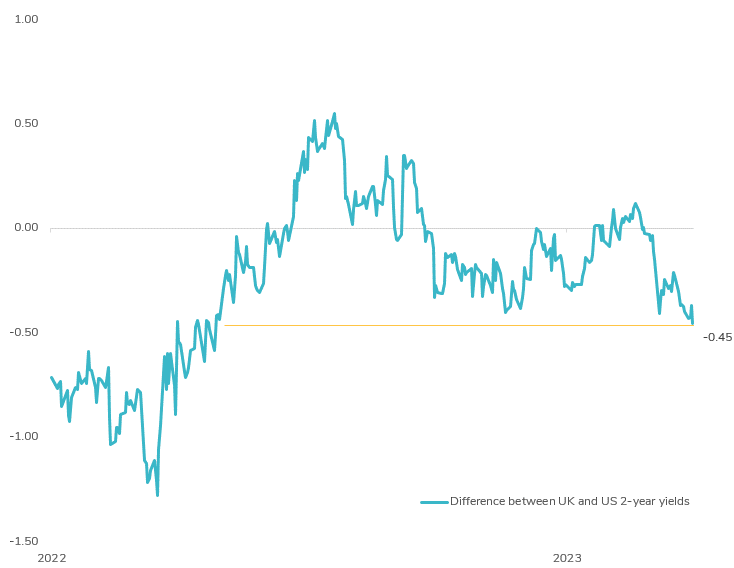

UK Yields Extend Divergence from US Yields Post-BOE Meeting 📊

The Bank of England's today meeting took a more dovish turn than anticipated. Despite holding key rates steady at 5.25%, not a single BOE member voted for a hike for the first time since September 2021. Market sentiment is swiftly adjusting, with expectations shifting from a previously anticipated rate cut in August to now eyeing possibilities in June (70% chance) and even May (15% chance). The news triggered a significant rally in UK government bonds, driving the differential between 2-year UK and US yields to its lowest level in a year! This divergence underscores the evolving dynamics in global markets. Following the surprising interest rate cut by the Swiss National Bank, central banks worldwide appear to be reassessing their strategies. Source: Bloomberg

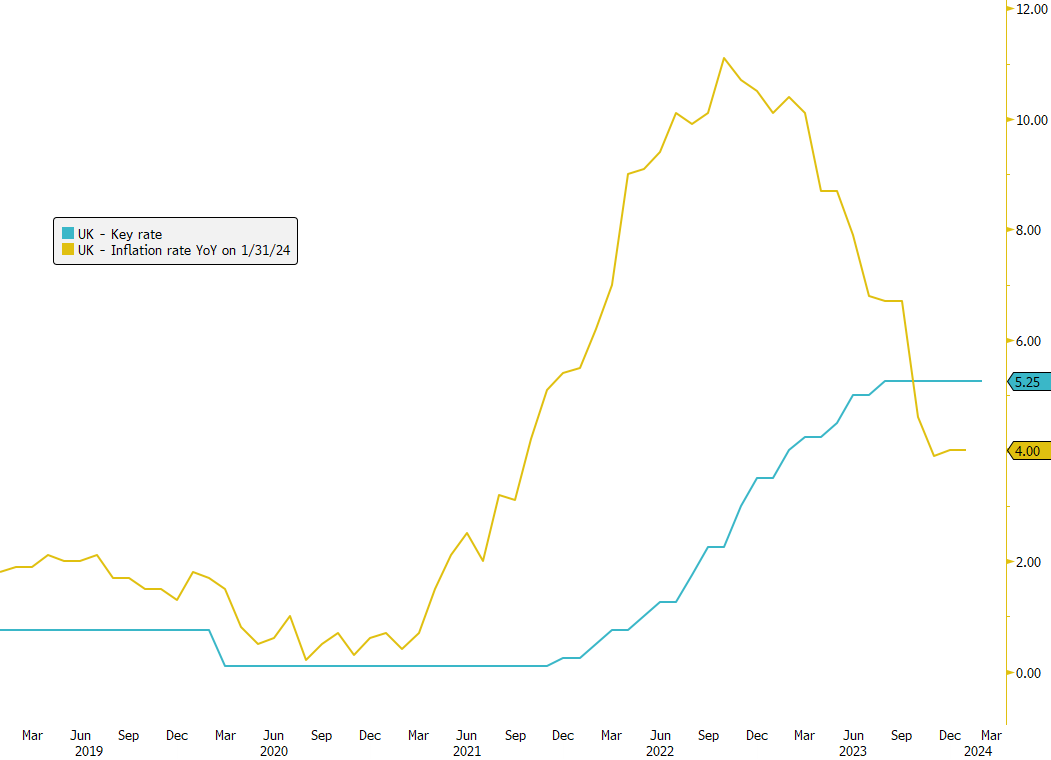

📉 UK Inflation Remains Stable, Easing Pressure on BoE!

UK inflation remained weaker than anticipated in January, holding steady at 4% year-on-year, defying forecasts of a rise to 4.1%. This unexpected outcome suggests reduced pressure on the Bank of England (BoE) from underlying price increases. Notably, services inflation reached 6.5%, slightly below the BoE's projections. Despite the stable headline rates, the BoE remains cautious amidst labor market tightness and signs of economic recovery. As a result, traders have adjusted their expectations for rate cuts, now anticipating two cuts for the year, with the first expected in September. However, amidst this cautious sentiment, the UK bond market could emerge as an attractive opportunity. Expected decreases in the Consumer Price Index (CPI) signal potential inflationary relief, supporting the case for Bank of England rate cuts by mid-2024. Furthermore, appealing yields following recent market pullbacks add to the attractiveness of the UK bond market as an investment avenue. It's worth noting that the market does not anticipate a rate cut until the first half of 2024, providing investors with ample time to position themselves strategically. #UKInflation #BankOfEngland #InvestmentOpportunity #BondMarket #EconomicOutlook

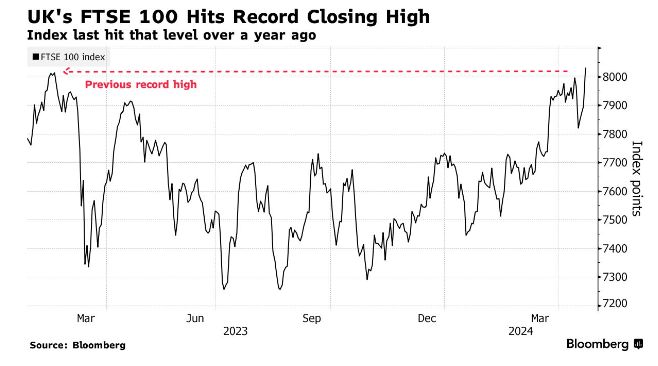

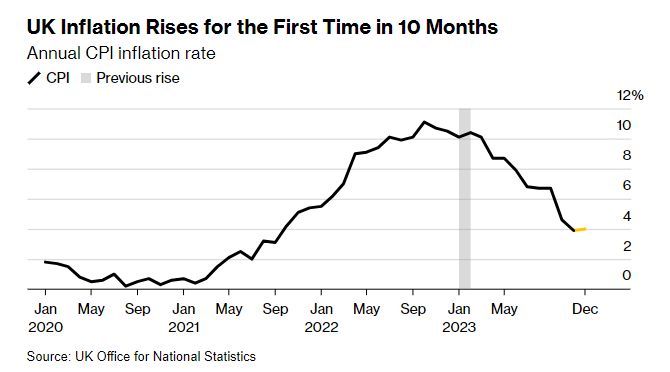

UK Inflation Rises Unexpectedly, Tempering Talk of Rate Cuts

UK inflation disappoints at both the headline and core levels: Headline inflation rose to 4.0% in December, above the consensus forecast looking for it to fall from 3.9% to 3.8%. Core inflation, which was also expected to fall, remained unchanged at 5.1%. Source: Bloomberg

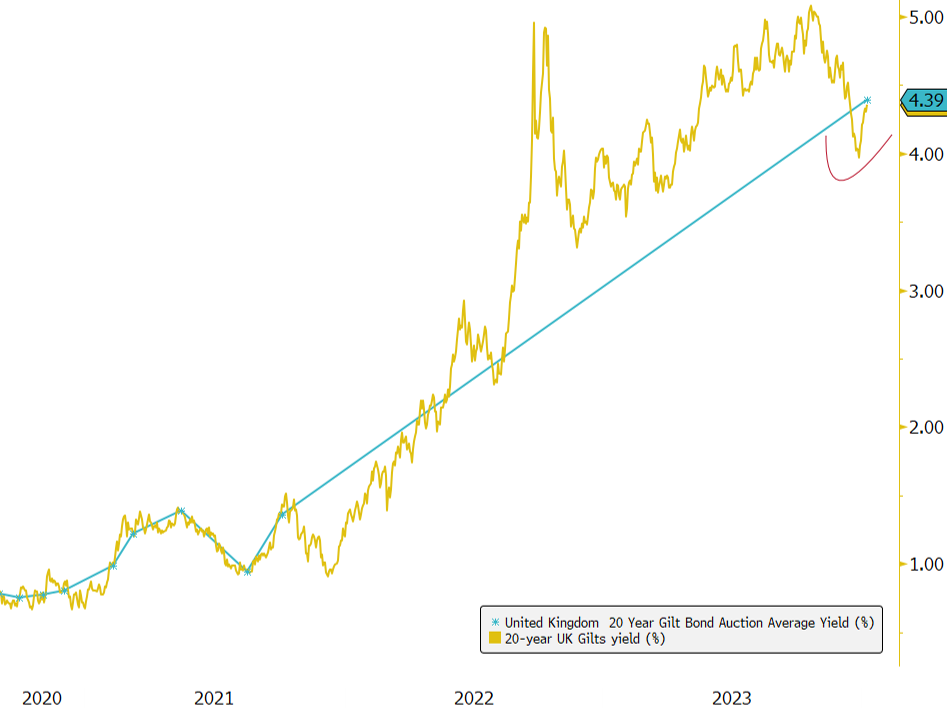

UK 20-Year Bond Auction: A Strong Start to 2024!

Today's successful auction of the UK 4.75% 2043 bonds, raising GBP 2.25 billion at a yield of 4.391%, represents a significant rise from the 1.36% yield in the previous auction in October 2021. 📈 Highlighting investor confidence, the auction achieved a strong bid-to-cover ratio of 3.6. Notably, the 20-year UK Gilt has climbed nearly 40bps from its late 2023 low. 🔍 With core inflation trends showing signs of stabilization, market participants are keenly awaiting signals from upcoming wage and inflation data. We are observing keen interest in how the yield curve will react, particularly with the anticipated new 30Y gilt syndication on the horizon. More steepening could be on the cards. 💷 Considering the estimated £76 billion gilt supply for Q1 2024, a key question emerges: Can today's robust auction mitigate the recent selloff, primarily driven by substantial global duration issuance and reassessment of aggressive rate cut expectations? Source: Bloomberg

BREAKING: UK Metro Bank shares plunge 50% as it tries to urgently raise £600m capital

- Metro Bank is seeking to raise up to £600mn after its share price fell almost 50 per cent in recent weeks, said people with knowledge of the plan. The UK challenger bank is in talks with investors about raising £250mn in equity funding and £350mn in debt to shore up its balance sheet, the people said. - The talks came after regulators last month failed to approve a request from Metro to lower the capital requirements attached to its mortgage business. - Bank Crisis - Round II ? Source: FT

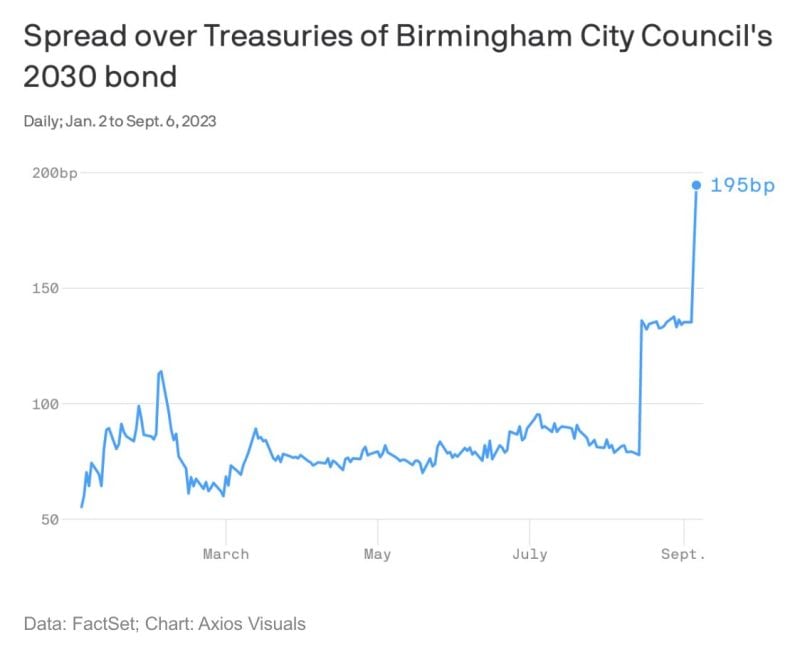

Birmingham City Council 2030 bonds yield roughly 2ppts more than UK govt securities as Britain’s second-biggest city in financial dire straits

Source: HolgerZ, Axios Visuals

The UK's second-largest city is bankrupt

Unable to balance its budget as required by law, Birmingham placed itself under the protection of "section 114" on Tuesday. This means that only essential expenditure is covered. The news had all the more resonance because the city council has a million people under its umbrella - the largest local authority in the country, since London is divided into boroughs. And because this failure has raised fears of a domino effect on other struggling English cities.

Investing with intelligence

Our latest research, commentary and market outlooks