Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- nasdaq

- magnificent-7

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- meta

- microsoft

- bankruptcy

- Healthcare

- Industrial-production

- Turkey

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

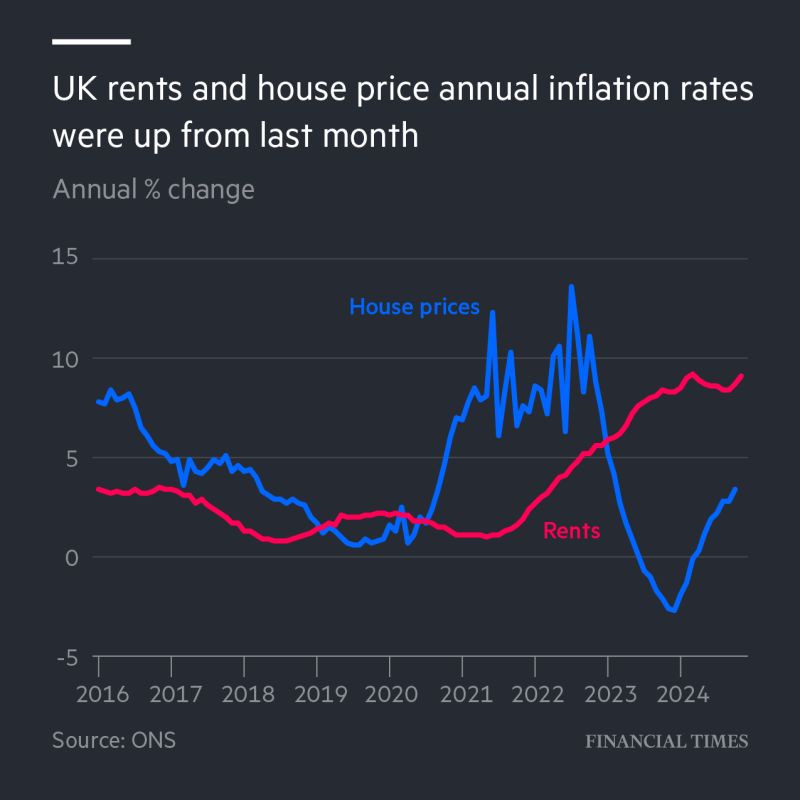

‘Renting is nothing short of brutal. Rents are rising at an astronomical and unsustainable rate.’

Rents in London increased by 11.6% in the 12 months to November 2024. Source: FT

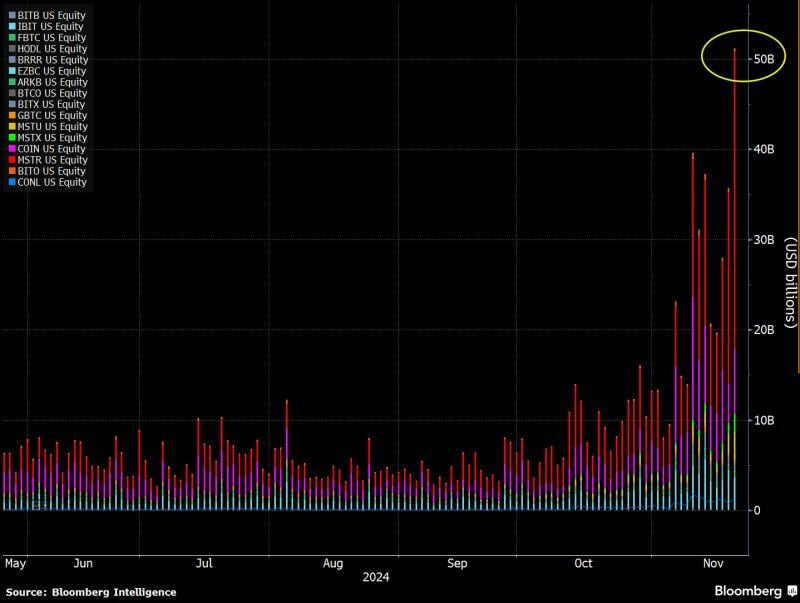

The Bitcoin Industrial Complex crushed their record yesterday with $50b in volume (for context that's same as ADV of entire UK stock market).

$MSTR alone was $32b of it. $MSTU and $MSTX combined for $6b (which is more than all the spot btc ETFs, which were also elevated). What a scene... Source: Eric Balchunas, Bloomberg

UK borrowing costs hit highest level this year as gilt sell-off intensifies.

This should not come as a surprise, Eurizon SLJ Research's Stephen Jen says: When the debt stock is 99% of GDP, and the govt imposes the largest tax hike post-WWII and the largest increase in spending in multi-decades, why should one be surprised that the bond market shows signs of indigestion? Source: HolgerZ, FT

JUST IN : UK'S GOVERNMENT IS CONSIDERING RAISING CAPITAL GAINS TAX TO AS HIGH AS 39% PER THE GUARDIAN

Source: @gurgavin

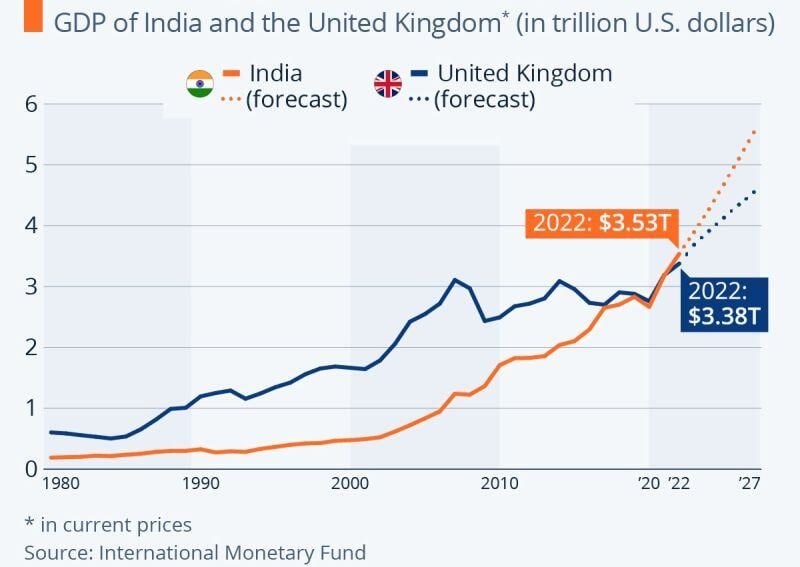

India‘s economy is overtaking UK, the former colonial power.

And this is most likely just a start. Source: The Economist, Michel A.Arouet

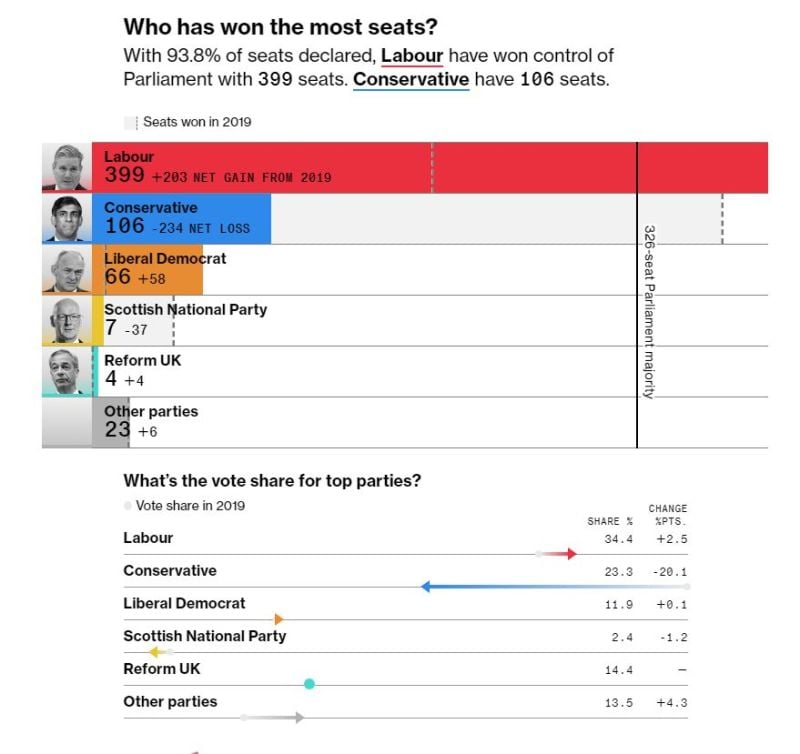

Britain wakes up to a new party in power after 14 years of Conservative rule.

Sir Keir Starmer’s Labour party is headed for a huge majority in the House of Commons after Rishi Sunak conceded defeat in the UK general election. With the final results still streaming in, a national exit poll suggests Starmer will become prime minister more than 400 of 650 Commons seats, with the Tories holding most likely around 110 seats, the party’s worst result in its 190-year history. Sunak, who won his seat of Richmond and Northallerton, said he took “responsibility for the loss”. A victorious Starmer had earlier declared: “The change begins right here. It’s now time for us to deliver.” Source: FT, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks