Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Since The Fed cut rates, USA Sovereign risk has exploded higher...

Source: www.zerohedge.com, Bloomberg

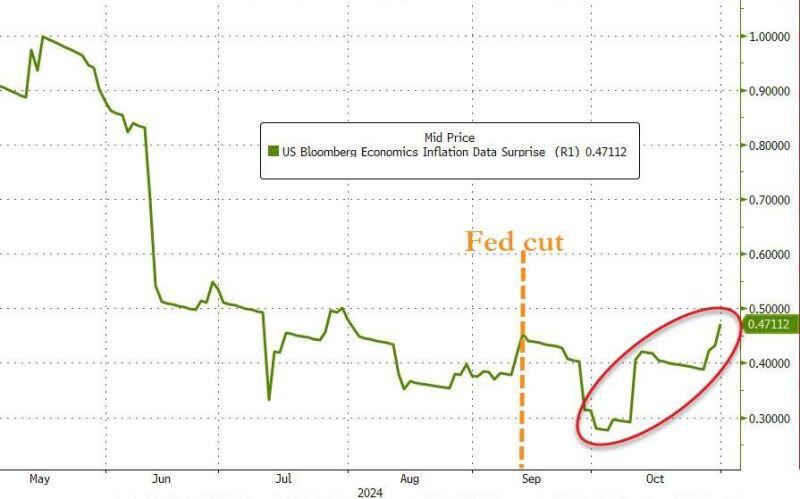

Inflation surprises are picking up since Fed rate cut...

Source: www.zerohedge.com, Bloomberg

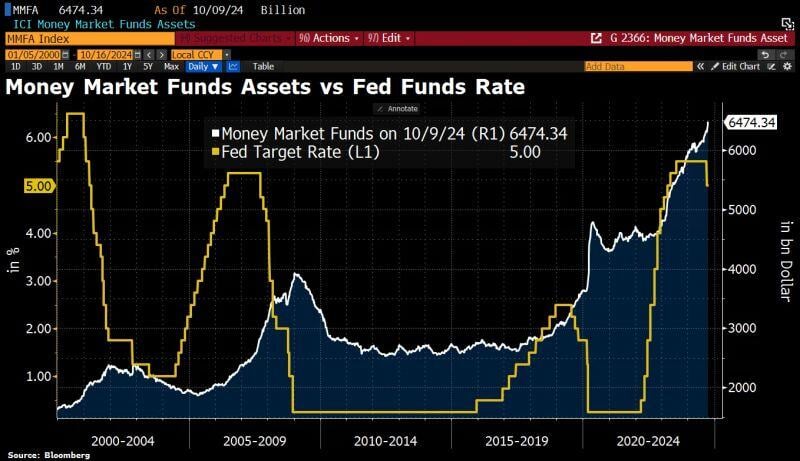

Mind the gap: Assets in US money market funds have hit a fresh ATH at $6.5tn, although the relevant Fed Funds Rates have fallen and are likely to fall further.

Note however that the "relative" figures (i.e money market funds AuMs as a % of total assets AuMs) currently stand at all-time low whereas equities weight is at all-time high... Source. Bloomberg, HolgerZ

Bond market volatility is spiking:

The ICE BofA MOVE Index hit 123.8 points last week, the highest level since January. The MOVE index, also called the “VIX of bonds” is a metric measuring yield volatility of 2-year, 5-year, 10-year, and 30-year Treasuries. The index has skyrocketed 38% in just 3 weeks as yields started rising following the Fed's decision to cut rates by 50 bps. Over this period, the 10-year Treasury yield jumped from 3.64% to 4.10%. At the same time, the popular bond-tracking ETF, $TLT, fell by 6.8%. What happened to the "Fed pivot?" Source: The Kobeissi Letter, The Daily Shot

In case you missed it... Atlanta Fed President Raphael Bostic is okay with skipping rate cut in November 🚨

Source: Barchart

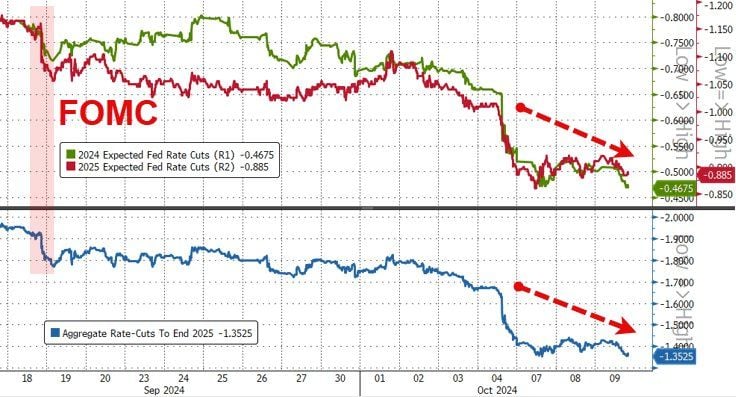

FOMC MINUTES WERE PUBLISHED TODAY, here are the highlights 👇

▪ ‘Substantial majority’ backed half-point rate cut ▪ ‘Some’ officials would have preferred quarter-point cut ▪ ‘Almost all’ officials saw higher risks to labor market ▪ ‘Almost all’ participants saw lower inflation risks The key takeaway >>> FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate Cut While there was only one dissent, the FOMC Minutes show "some" officials preferred a 25bps cut. Despite the apparent dovish pivot, expectations for rate-cuts (this year and next) has plunged dramatically - see chart below Source: Stocktwits, zerohedge

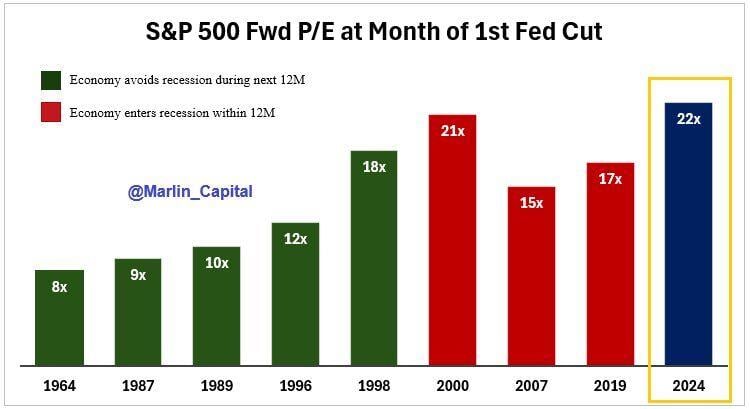

This time is different…

Historically, Fed rate cuts triggered market rallies led by valuation expansion. But this time, it seems that markets front-loaded the Fed by accumulating us stocks AHEAD of the Fed decision. Bottom-line: Current market valuation is now on the high side vs. other instances in history when the Fed cut rates. This should limit the amplitude of the current bull equity Source: David Marlin

Fed Chair Jerome Powell just said the recent 50BPs interest rate cut shouldn’t be interpreted as a sign that future moves will be as aggressive - CNBC

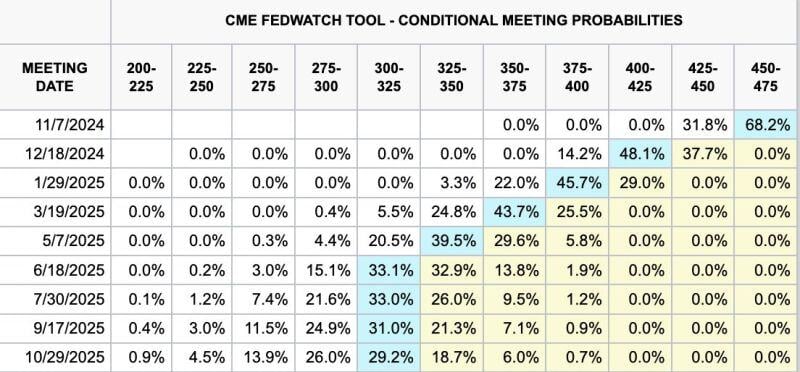

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” he told the National Association for Business Economics in prepared remarks. “The risks are two-sided, and we will continue to make our decisions meeting by meeting” The market currently thinks there's a 68.2% chance Jerome Powell and the Fed cut rates by 25BPs at the next FOMC meeting Source: CME FedWatch Tool

Investing with intelligence

Our latest research, commentary and market outlooks