Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

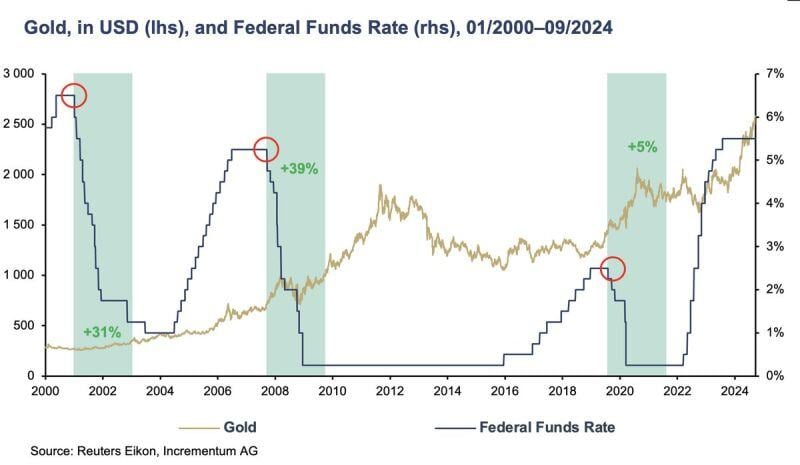

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

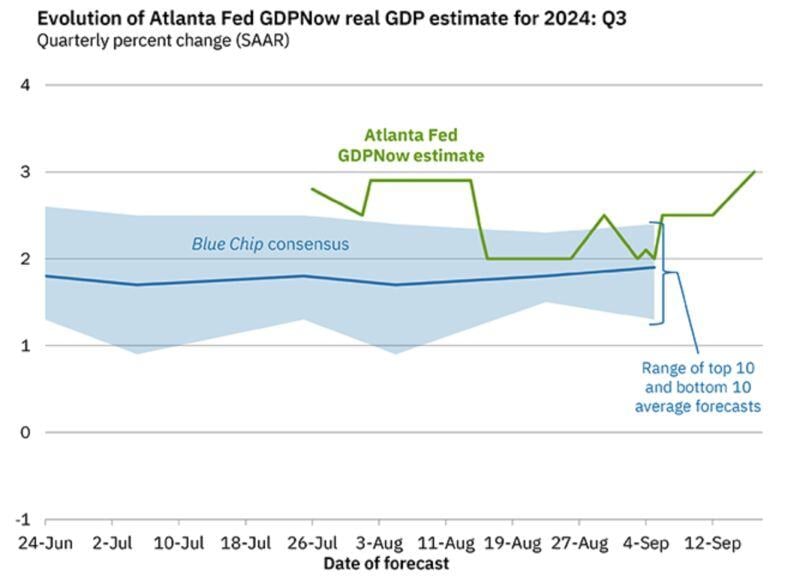

Soft landing? Hard landing? Or no landing?

Atlanta Fed Q3 Real GDP growth Nowcast model just hit 3%...

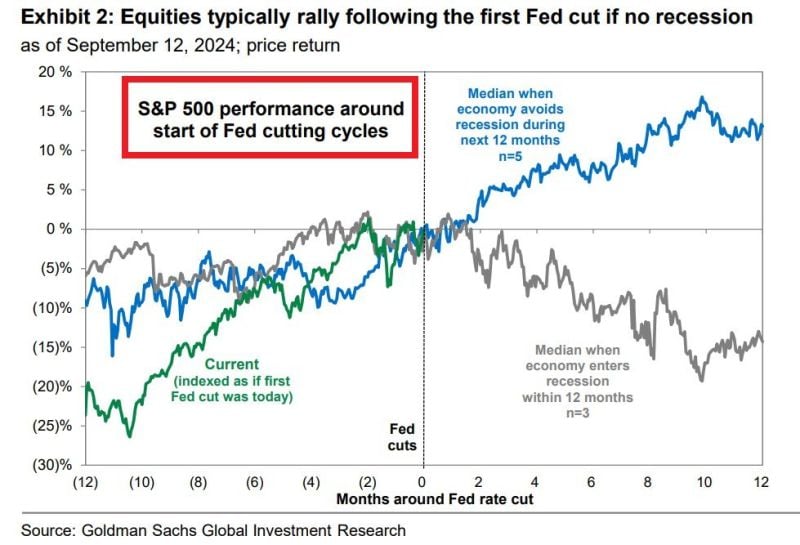

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

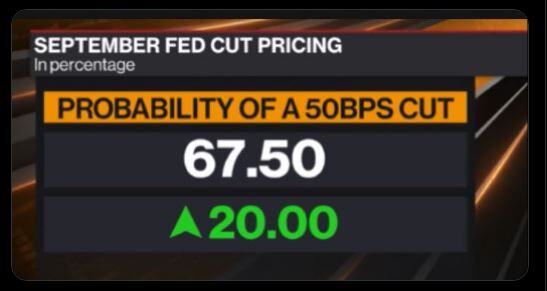

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

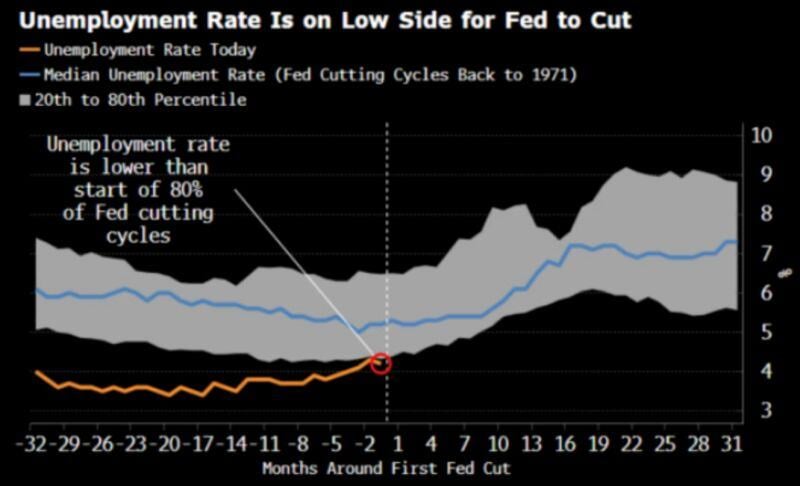

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

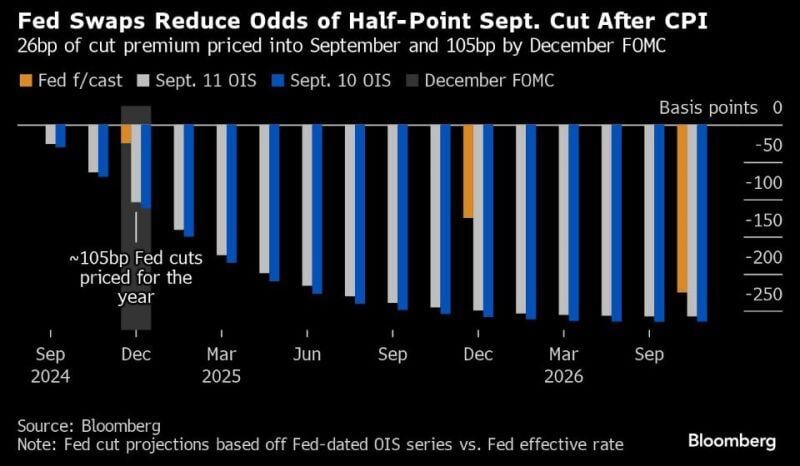

Fed Expected to Cut Rates by 25 Basis Points After Inflation Data; Bitcoin Remains Stable

U.S. inflation came in as expected, increasing the likelihood of a 25 basis point Fed rate cut, with market expectations rising to 83%. A 50 basis point cut is now only 17% likely. The bond market now expects a 25 bps Fed rate cut this month, not 50 bps. The 2-year yield hit 3.69%, and the hashtag#Fed's held rates at 5.25%-5.5% since July 2023. Investors eye 140 bps in cuts by Jan '25. Source: Luc Sternberg, coinoptix, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks