Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

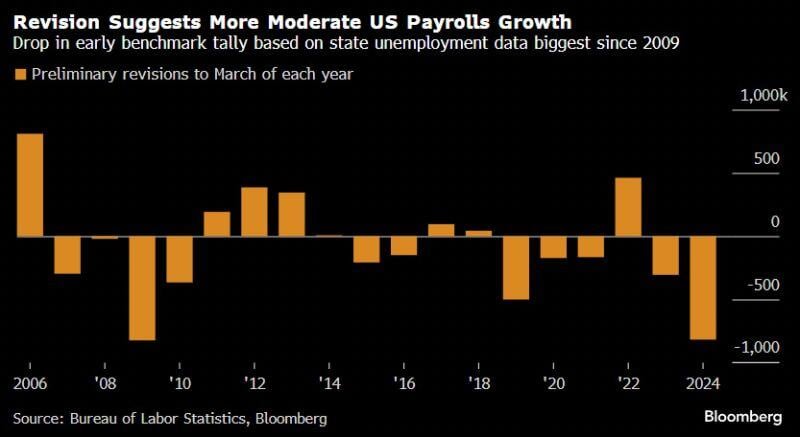

Nonfarm payroll growth revised down by 818,000 for the 12 months through March — or around 68,000 less each month – most since 2009

Before the report, the BLS’s initial payrolls figures indicated employers added 2.9mln total jobs in the period, or an avg of 242k per month. Now the monthly pace is more likely to be ~174k, still a healthy rate of hiring but a moderation from post-pandemic peak At the sector level, the biggest downward revision came in professional and business services, where job growth was 358,000 less than initially reported. => The labor market appears weaker than originally reported. This should allow the Fed to prepare markets for a cut at the September meeting. Source: Bloomberg, HolgerZ, CNBC

BREAKING 🚨 US employment data...

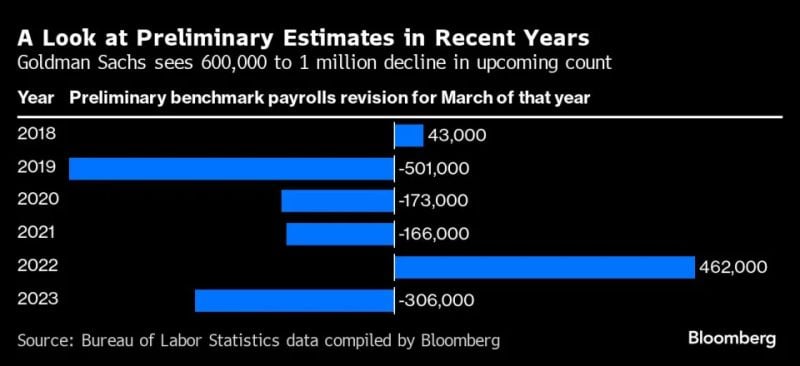

Federal Reserves faces up to 1 million US jobs "vanishing" in potentially the largest downward jobs revision in 15 years, according to Bloomberg Goldman Sachs Group Inc. and Wells Fargo & Co. economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated — about 50,000 a month. While JPMorgan Chase & Co. forecasters see a decline of about 360,000, Goldman Sachs indicates it could be as large as a million. There are a number of caveats in the preliminary figure, but a downward revision to employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer — and perhaps more so — than originally thought. The final numbers are due early next year. Such figures also have the potential of shaping the tone of Fed Chair Jerome Powell’s speech at week’s end in Jackson Hole, Wyoming. Investors are trying to gain insight as to when and how much the central bank will start lowering interest rates as inflation and the job market cool. Source: Yahoo Finance, Bloomberg

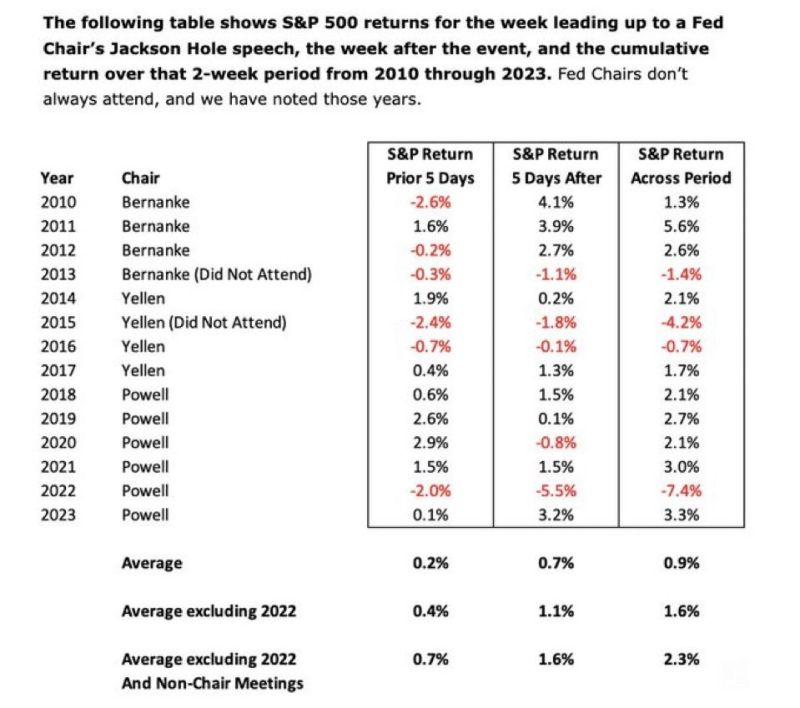

All eyes on Jackson Hole this week

Looking at historical returns, it is rarely a big deal for markets. Will this time be different? Source: The Transcript

Is Powell a super hero?

As highlighted by Genevieve Roch-Decter, CFA in a post, despite interest rates at +20-year highs and QT still ongoing, we have: - the stock market at all-time high - gold at all-time-high - the total value of US real estate at a new record high - bitcoin at $60k. Meanwhile, inflation is cooling down while the US economy seems to be in decent shape with unemployment rate near record low. So far so good for the FED chair. Image by Adam Tooze on X

BREAKING 🚨 Jerome Powell will indicate that the Fed is open to a 50 bps rate cut during his speech at the Jackson Hole, according to analysts from Evercore

BULLS, GET EVEN MORE EXCITED... Source: Stocktwits, www.investing.com

JUST IN 🚨: Odds of a 50 bps interest rate in September has plummeted to less than 25%

Source: Barchart

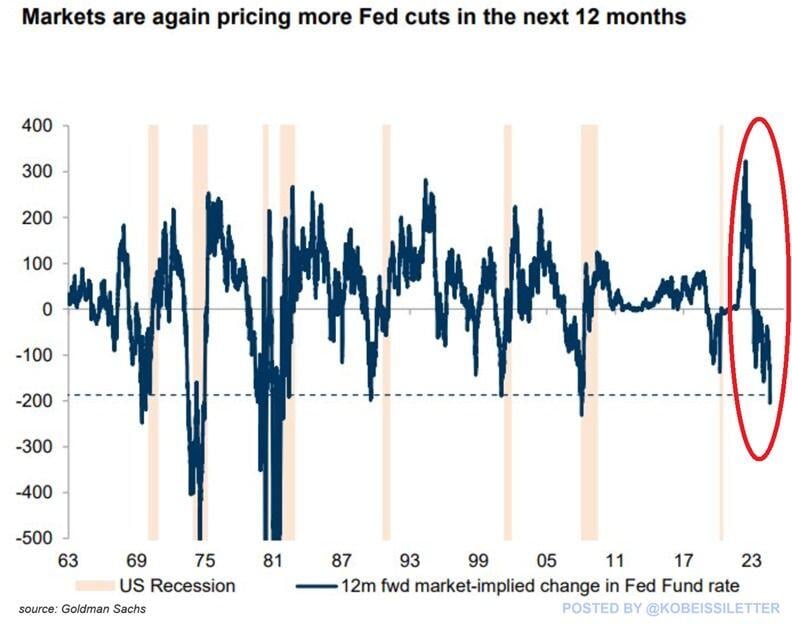

Interest rate futures are now pricing in 8 Fed rate cuts over the next 12 months, the most since the 2008 Financial Crisis.

Market expectations have sharply shifted over the last week toward more cuts in anticipation of economic weakness. Over the last 60 years, every time the market expected 200 basis points of rate cuts, a recession in the US followed within several months. Source: The Kobeissi Letter, Goldman Sachs

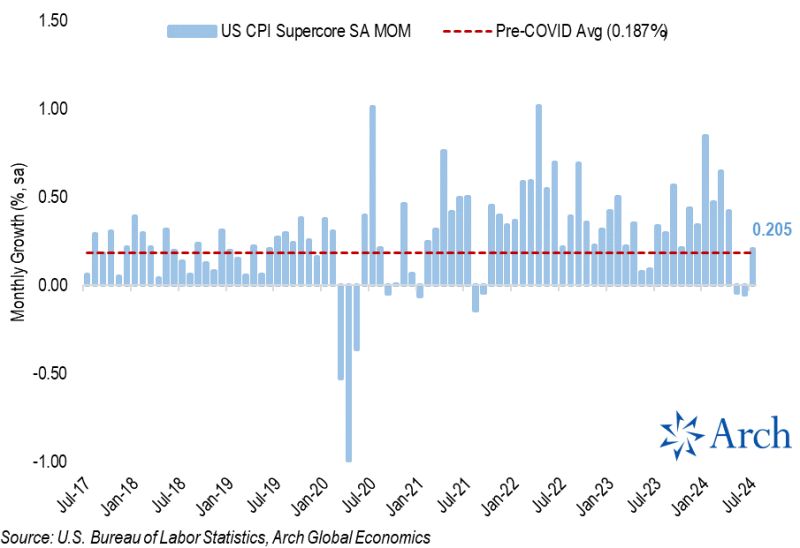

July US CPI fell to 2.9%, below expectations of 3.0%

ore CPI inflation fell to 3.2%, in-line with expectations of 3.2%. This marks the first month with CPI inflation below 3.0% since March 2021. However, Supercore inflation snapped back to just above the pre-COVID average after two months of outright declines. Shelter inflation also surged back to a 0.38% m/m gain after an unusual decline to 0.17% in June. This is not the perfect report the hashtag#Fed would be looking for. However, there is nothing overly concerning from what we've seen thus far. The first rate cut since 2020 is probably coming next month.

Investing with intelligence

Our latest research, commentary and market outlooks