Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

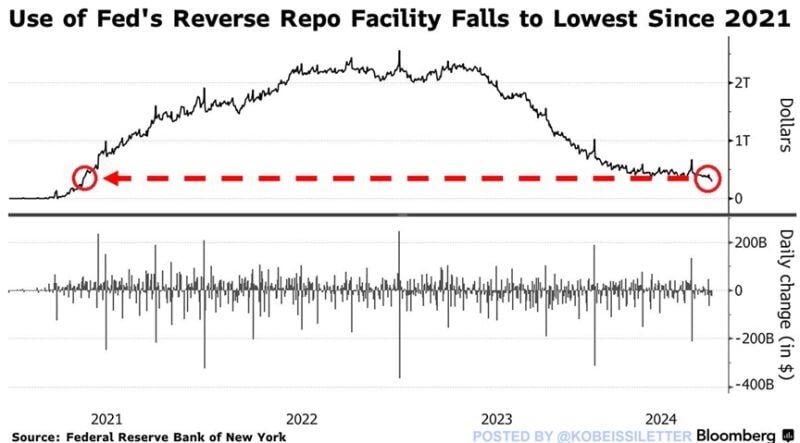

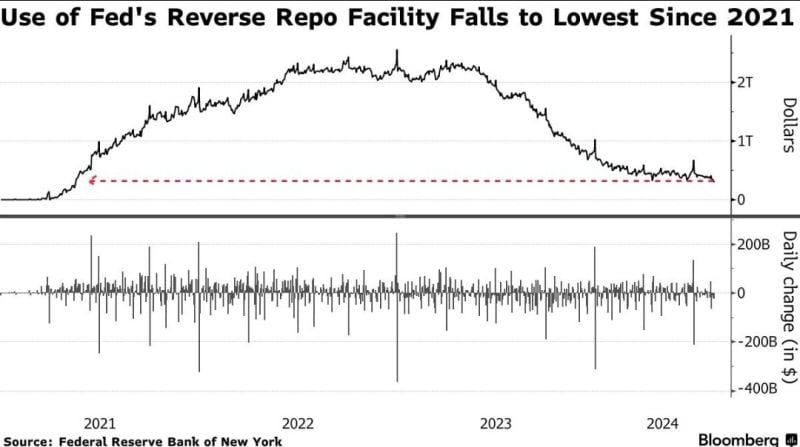

BREAKING: The Fed’s Reverse Repo (RRP) facility has dropped below $300 billion for the first time since 2021

The RRP is one of the financial system's excess liquidity metrics and is widely watched by investors. Large banks, government-sponsored enterprises, and money-market funds put their extra cash into the facility to earn interest on it. RRP usage has plummeted by $2.3 TRILLION since December 2022. Over the last several months, however, the decline has stabilized and the facility usage has been oscillating around $300-$400 billion. Source: www.zerohedge.com, Bloomberg

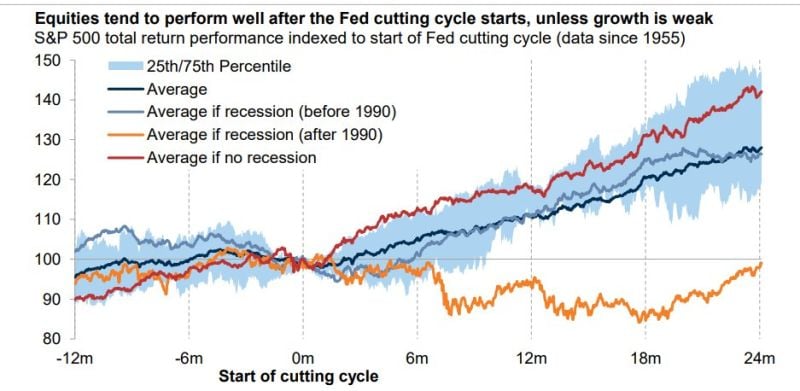

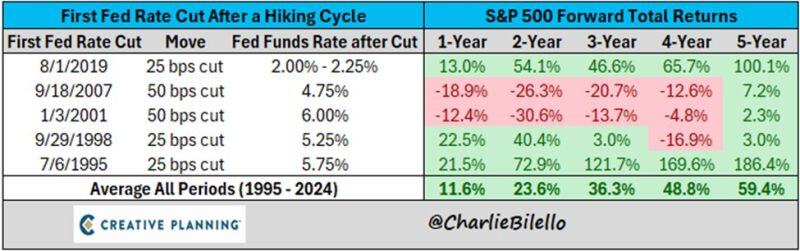

Equities tend to perform well after the Fed cutting cycle starts, unless growth is weak

Source: Goldman Sachs, Mike Z.

Use of Fed's Reverse Repo Facility Falls to Lowest Since 2021

Analysts said investors may have pulled their money from the reverse repo market and placed cash in the overnight repo market, where banks and financial firms such as hedge funds borrow short-term cash using Treasuries or other debt securities as collateral. In addition, a large rise in the supply of Treasury bills on Tuesday and Thursday, is likely to further drain cash from the RRP facility, analysts said. Source: Win Smart, Bloomberg, Yahoo finance

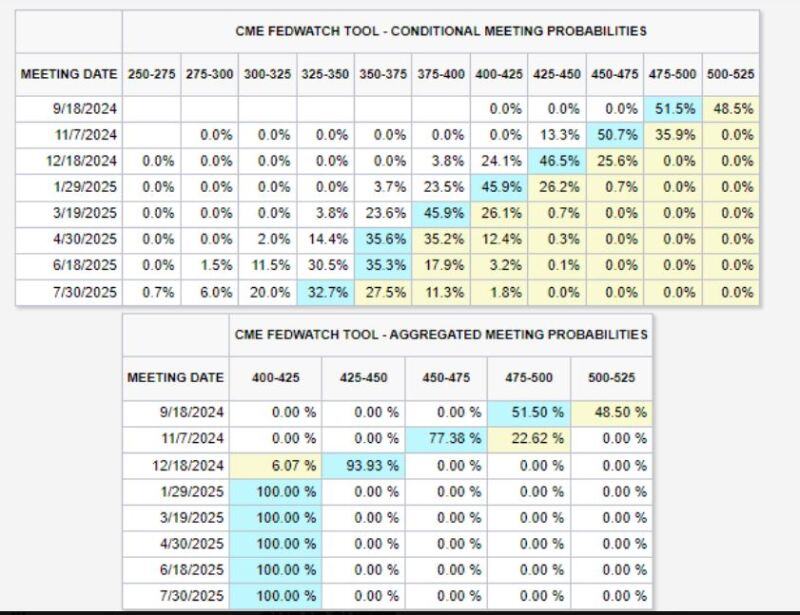

The market is pricing in a 50 basis point rate cut next month.

Market returns following rate cuts have been positive except for periods when the market is generally in crisis. Source: Charlie Bilello, Peter Mallouk

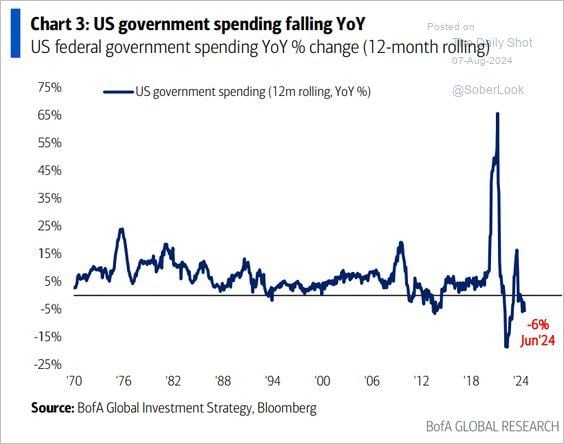

The main reason the economy has been able to avoid a recession over the last 2-years

was due to the massive spending from the inflation reduction and CHIPs Acts. However, the rate of that spending is declining which could potentially weigh on economic growth going forward. Source: BofA, The Daily Shot, Lance Roberts

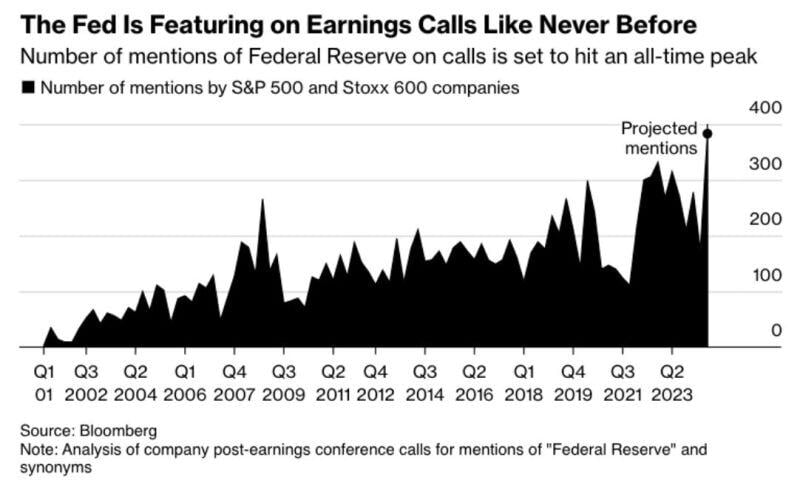

It seems that many companies are in desperate need for rate cuts...

Source: Bloomberg

US 2s/10s yield spread is now flat for the 1st time since 2022 on aggressive repricing of Fed rate cuts

US 2y yields have plunged by 70bps to 3.69% since last Wed while US 10y yields only dropped by 40bps in the same time. Source: Bloomberg, holgerZ

Investing with intelligence

Our latest research, commentary and market outlooks