Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Fed's emergency rate cut never happened when the VIX was below 40.

It seems that we are getting there... Source chart: Yahoo finance

💥 Treasuries surge as traders bet on emergency Fed rate cut 💥

.

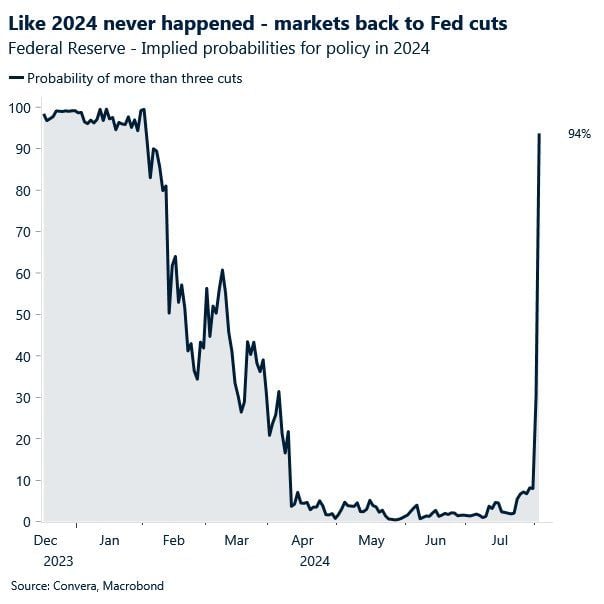

What a chart...

Source. Michel.A Arouet, Ht @MacroKova, Convera, Macrobond

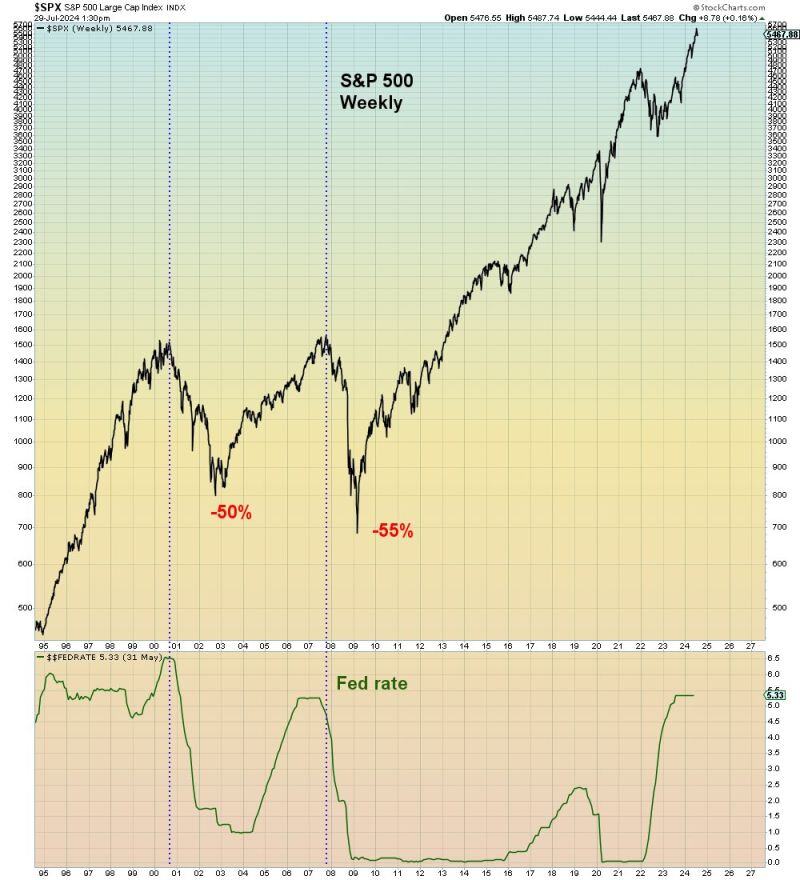

Should the FED wait for a financial accident to happen BEFORE cutting interest rates?

Source chart: Mac10

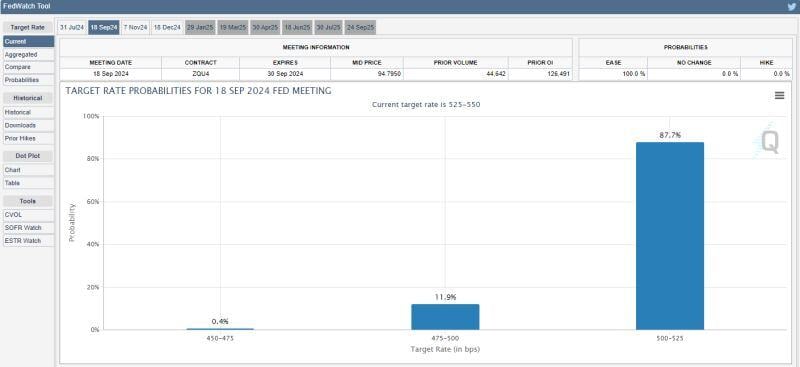

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

Bulls praying to Lord Powell for a rate cut next week

Source; Barchart

Some good news for Wall Street?

Donald Trump will not seek to remove Federal Reserve Chair Jerome Powell before the central banker’s term ends and would consider JPMorgan CEO Jamie Dimon for Treasury secretary if he won the Nov. 5 election, the former president told Bloomberg in an interview published on Tuesday. JPMorgan declined to comment on Trump’s remarks. Powell’s term as chairman runs through January 2026, and his position as a Fed governor continues until 2028. The interview was conducted in late June, according to Bloomberg.

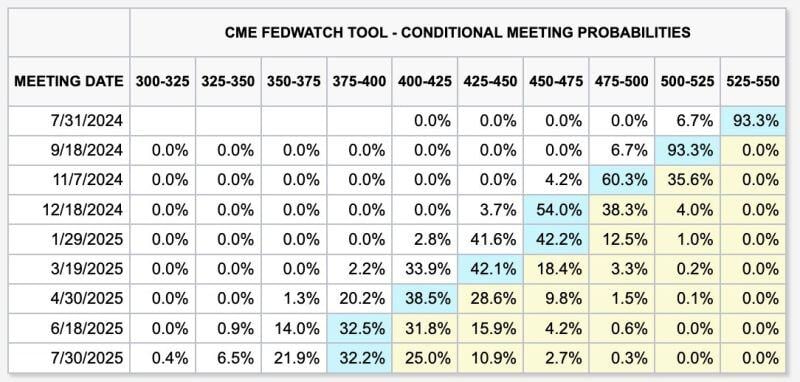

Markets now have a BASE CASE of 6 FED interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September. Discussions of a 50 basis point interest rate cut have even begun to emerge. This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks. Source: The Kobeissi Letter, CME

Investing with intelligence

Our latest research, commentary and market outlooks