Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

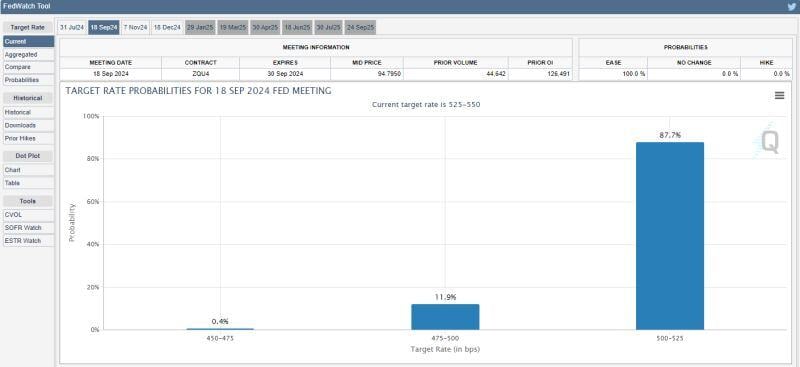

JUST IN 🚨: There is now a 100% chance of a 25 bps interest rate cut by September, according to CME FedWatch

Source: Barchart

Bulls praying to Lord Powell for a rate cut next week

Source; Barchart

This is not a Trump trade but rather a "soft landing trade" => Stocks have rallied on the prospects of a soft landing for the economy

Source: Edward Jones

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

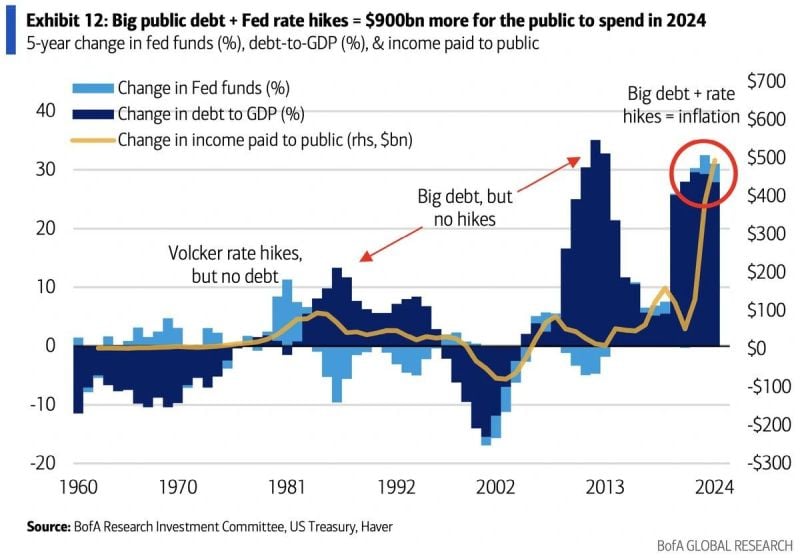

Interesting point of view by BofA:

"Fewer investors have focused on the inflationary effects of higher income. No other Fed hiking cycle in history occurred while government debt was so large ... interest payments flow to holders of Treasury securities and some portion will be spent." Source: BofA, Octavian Adrian Tanase

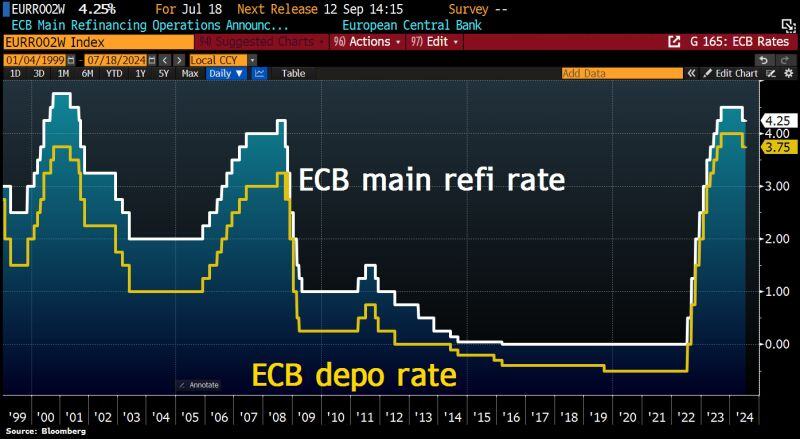

ECB leaves all rates unchanged as expected.

Main Refi at 4.25%, deposit rate at 3.75%. Guidance on interest rates also stays unchanged: Not pre-committing to particular path. ECB to follow data-dependent, meeting-by-meeting approach. Source: Bloomberg, HolgerZ

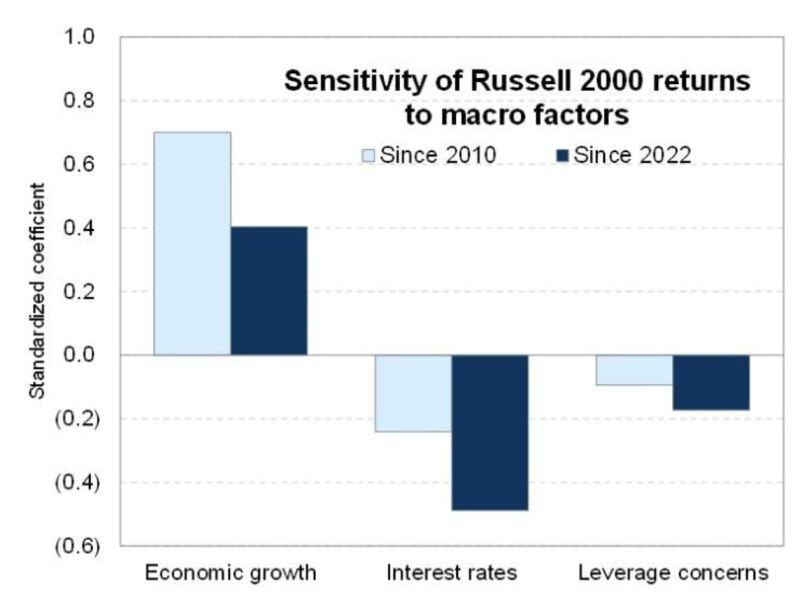

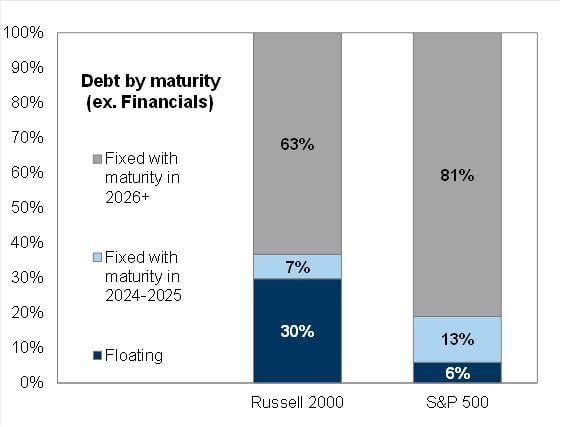

For US small caps, rates just as important as growth since 2022.

And as we know, March of 2022 is when the hiking cycle began... Source: GS, RBC

A large portion of Russell 2000 debt load is floating

It thus makes a lot of sense that small-caps were the most hot by monetary policy tightening / higher interest rates. Now the Street is anticipating rate cuts, small-caps underperformance might be coming to an end... Source: GS

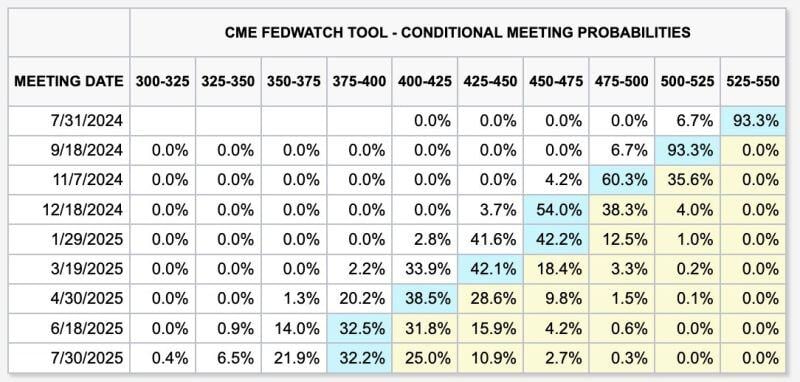

Markets now have a BASE CASE of 6 FED interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September. Discussions of a 50 basis point interest rate cut have even begun to emerge. This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks. Source: The Kobeissi Letter, CME

Investing with intelligence

Our latest research, commentary and market outlooks