Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- tech

- nvidia

- earnings

- Forex

- oil

- Real Estate

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- assetmanagement

- Middle East

- UK

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

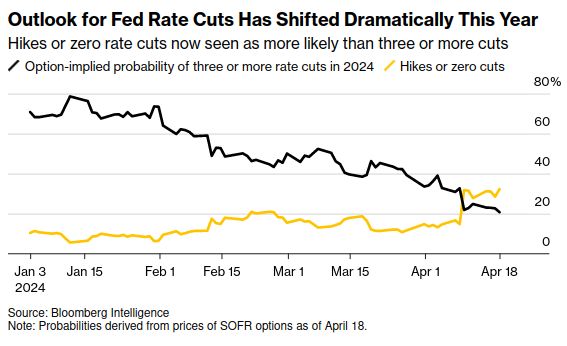

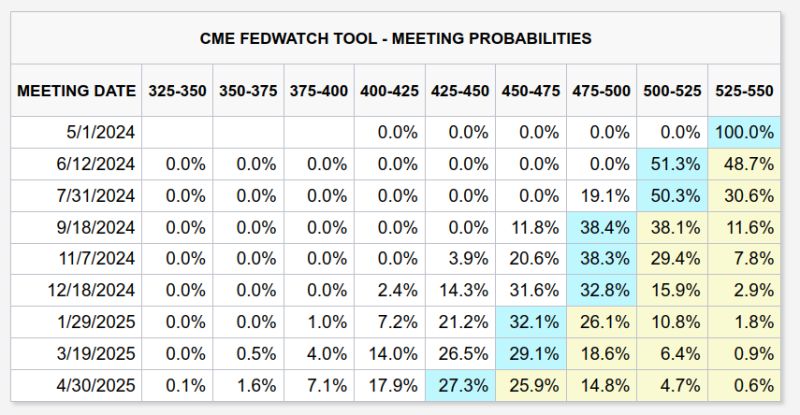

What a difference five months makes for the Fed rate cut outlook. 😉

Source: Bloomberg Intelligence, Markets & Mayhem

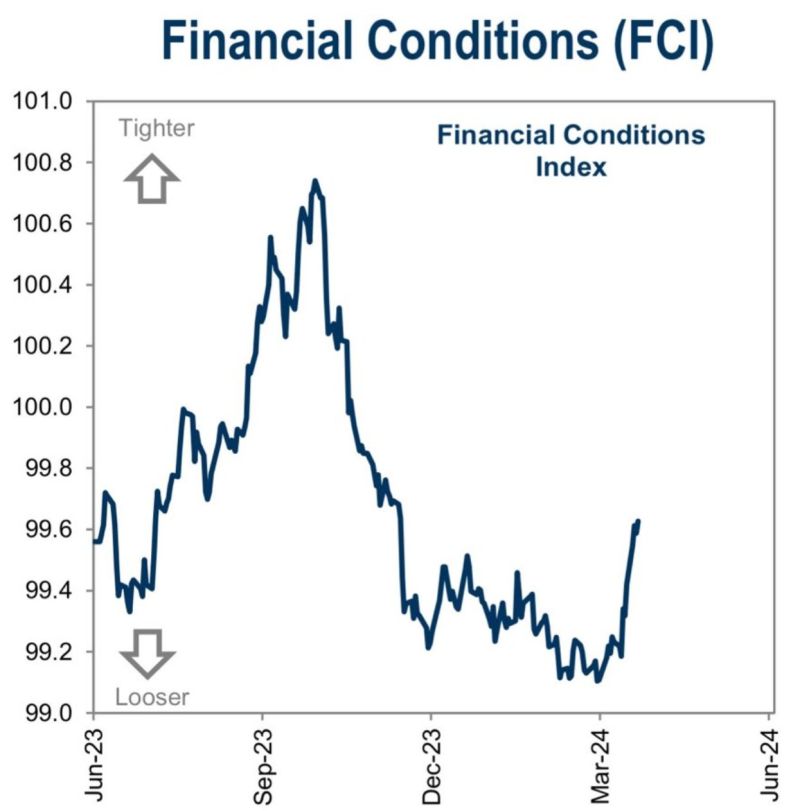

Financial conditions in the US are tightening as rates rise, equities fall and we see liquidity diminishing.

This setup could be set to continue as long as we see: 1) Signs of inflation remaining sticky or re-accelerating 2) The Fed cautious about the timing of cutting 3) Large deficit spending amid rising rates causing interest rate spend to surge (could hit $1.6T by Dec y/y w/o a rate cut) Source: Markets & Mayhem

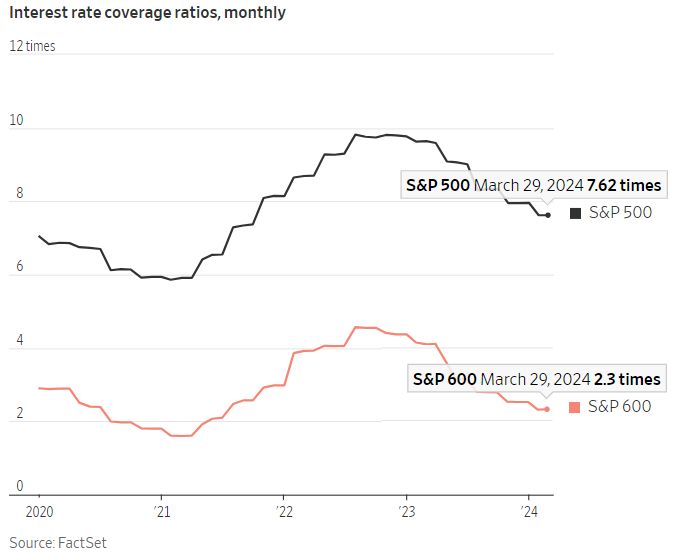

Smaller companies generally spend a much higher % of their income on debt service, making them more sensitive to rising rates.

The interest coverage ratio (operating income / interest expense) for the small cap S&P 600 is 2.3 times vs. 7.6 times for the large cap sp500. Source: Charlie Bilello

BREAKING >>> Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

SUMMARY OF FED CHAIR POWELL'S COMMENTS (4/16/24): 1. Recent data "shows lack of further progress on inflation" 2. Inflation has "introduced new uncertainty" on whether the Fed can cut rates later this year 3. Fed can maintain higher rates for "as long as needed" 4. Recent data has not given greater confidence on inflation 5. Restrictive Fed policy needs more time to work 6. It will likely take longer to "regain confidence" on inflation https://lnkd.in/eMaJZNZZ Source: CNBC, The Kobeissi Letter, Trend Spider

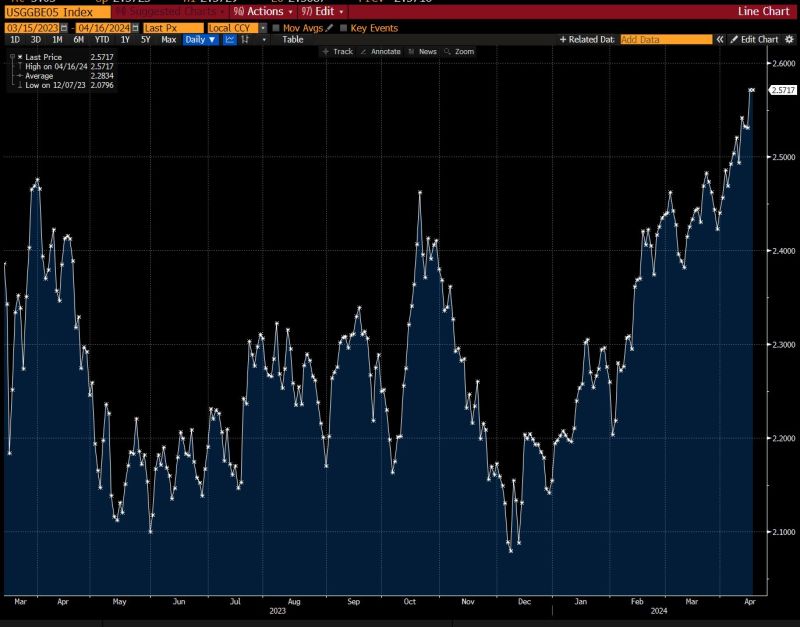

Longer-term inflation expectations are rising again.

The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates. Source: Bloomberg, Lisa Abramowitz

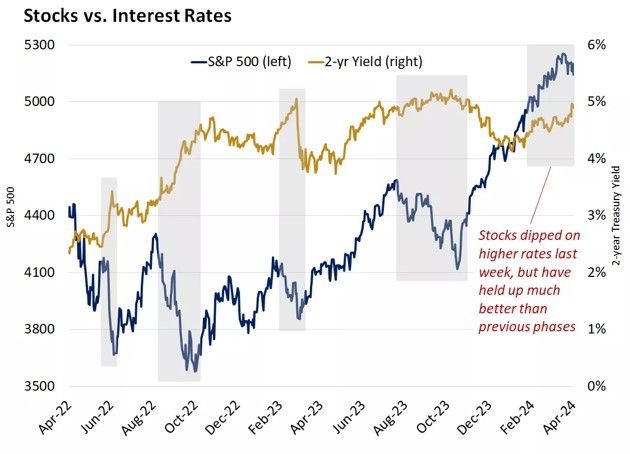

Yes, this week was painful for stocks.

But putting things into perspective, equities have been more resilient to higher rates recently versus previous periods of rising rates. Source: Edward Jones

JUST IN: Federal Reserve will cut interest rates by 50 basis points as soon as June and 150 points by the end of this year, says State Street in call against Wall Street consensus

Source: Bloomberg, radar

From expecting 6 Fed rate cuts to just two in 2024 😉

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks